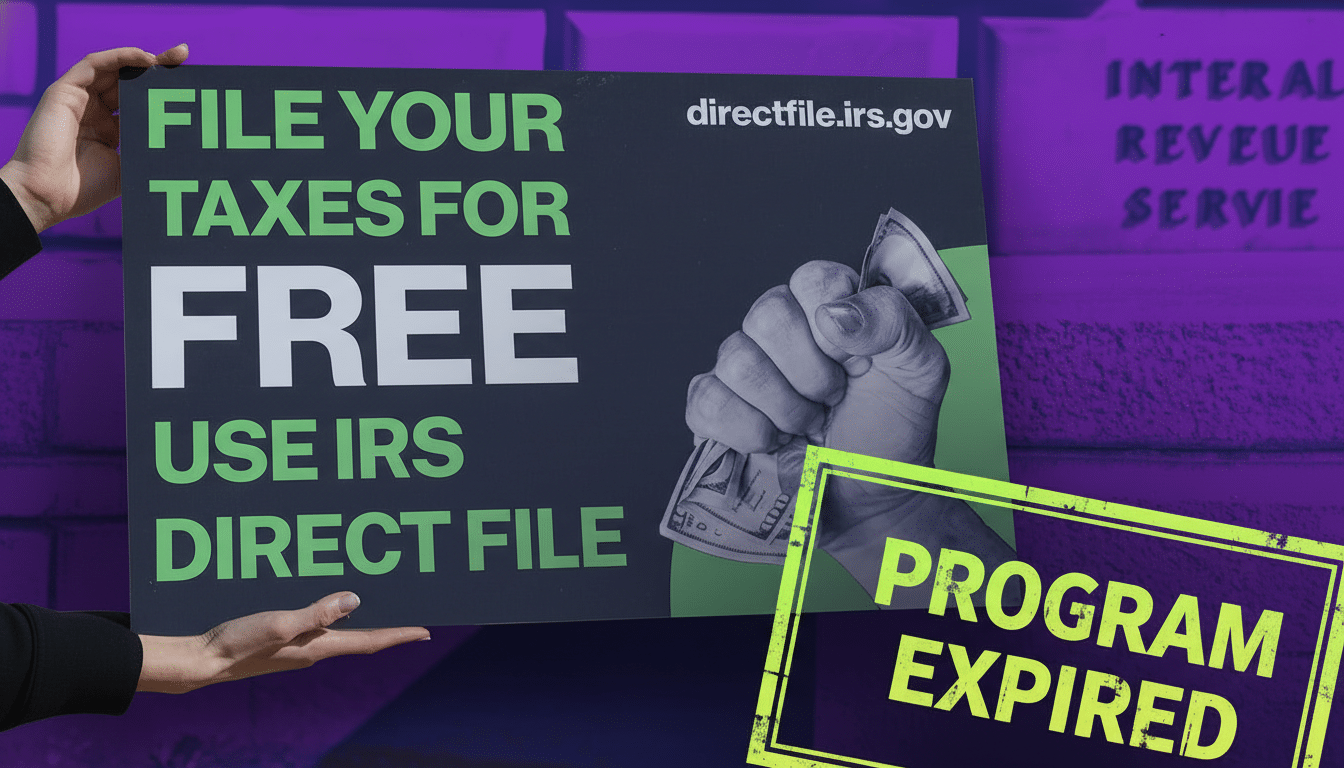

With the IRS shuttering its Direct File pilot, filing for $0 might sound harder this season. It isn’t. Four proven pathways still let most people prepare and e-file a complete federal return for free, and in many cases a state return, too. Despite low uptake of Direct File last year—fewer than 300,000 users—there’s ample no-cost capacity if you know where to look and how to qualify.

IRS Free File Still Covers Most Taxpayers

About 70% of taxpayers qualify for IRS Free File, which routes you to one of several vetted software partners at no cost. Eligibility hinges on adjusted gross income, with the program typically targeting low-to-moderate incomes; this season’s threshold is expected to mirror the IRS’s published cutoff tied to partner offers. Critically, you must start from the IRS Free File portal to unlock the free version—going directly to a provider’s homepage can drop you into a paid product.

Free File isn’t just for simple W-2 returns. Many partner offers support itemized deductions, common credits, and Schedules 1–3. State filing varies by provider: some include it, others charge, and a few don’t support every state. The National Taxpayer Advocate has long noted confusion around the word “free,” so read each offer’s eligibility rules before you begin. If you itemize, have student loan interest, gig income, or an HSA, Free File can still be your best $0 option.

VITA and TCE Provide Human Help At No Cost

Prefer a person over software? The IRS’s Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs offer in-person preparation by IRS-trained and certified volunteers. VITA primarily serves those with incomes at or below program limits, people with disabilities, and taxpayers who speak limited English. TCE focuses on taxpayers age 60 and older and specializes in retirement issues like pensions, Social Security, and required minimum distributions.

Sites are typically hosted at community centers, libraries, and nonprofits. Bring a photo ID, Social Security cards or ITINs for everyone on the return, income documents (W-2, 1099-NEC/INT/DIV, 1099-R), health coverage forms, and last year’s return. Many locations accept walk-ins; some require appointments. Accuracy rates are strong because returns are reviewed before e-filing, and both federal and state returns are usually handled on-site.

Cash App Taxes And FreeTaxUSA Offer Robust $0 Software

If you earn too much for Free File or want a streamlined online experience, two third-party platforms consistently deliver full-featured filing at little or no cost. Cash App Taxes charges $0 for both federal and state and supports a broad array of situations: W-2s, many 1099s, HSAs, itemizing, and common credits. FreeTaxUSA offers a $0 federal return with low-cost state filing and similarly wide coverage, including many self-employment scenarios.

The trade-off versus premium brands is lighter hand-holding and fewer “guardrails.” If you have a partnership K-1, multi-state moves, foreign income, or complex depreciation, paid software or a pro may be safer. But for a typical mix—say a W-2 plus side-gig 1099-NEC, student loan interest, and a home mortgage—these tools can produce the same refund or balance due as pricier options. Many seasoned filers even run a comparison in both before choosing where to e-file.

IRS Free Fillable Forms For Confident DIY Filers

Comfortable reading IRS instructions and doing your own math? IRS Free Fillable Forms replicate the paper forms in a browser and let nearly anyone e-file a federal return for $0. There’s no interview, no step-by-step guidance, and no state filing—this is “you and the forms.” It’s best for straightforward returns when you already know which schedules you need, or for experienced filers who want total control without software upsells.

Before diving in, download the latest versions of IRS Publication 17 and the instructions for Form 1040 and any schedules you expect to file. Double-check arithmetic, credit phaseouts, and e-filing signatures (AGI or PIN). Keep a clean PDF copy of everything for your records and for next year’s identity verification.

How To Choose The Right Free Route For You

Use IRS Free File if your AGI fits and you want a guided experience that can handle itemizing and common schedules; it’s the closest analog to Direct File’s simplicity. Choose VITA/TCE if you want human help at no cost or have retirement-specific questions. Pick Cash App Taxes or FreeTaxUSA if you want to file both federal and state quickly, especially with a mix of W-2 and 1099 income. Opt for Free Fillable Forms if you’re a confident DIYer with a straightforward federal return.

One last safeguard: the IRS does not initiate contact by text or email about your refund, balance, or filing status. The Treasury Inspector General for Tax Administration reports recurring phishing spikes each filing season. Stick to official channels, start Free File from the IRS portal, and you can keep your tax prep bill at $0 while avoiding scams and surprise upsells.