Ford and General Motors have changed their minds about plans to exploit a leasing loophole in order to continue providing the $7,500 federal electric-vehicle incentive after its consumer tax credit elapses. The auto manufacturers “confirmed that they would no longer claim the commercial credit for vehicles leased through their financing arms, although they want to keep monthly payments low,” according to statements reported by Reuters and The Wall Street Journal.

Why the EV lease loophole mattered for affordability

It would have allowed a vehicle to be treated as a commercial sale and exempted from the tax when it was originally leased by a consumer, but considered as a business transaction if the lender bought the car and then leased it to the driver. That structure let automakers sidestep the retail tax credit’s stringent sourcing and assembly stipulations, and pass through as much as $7,500 as a capitalized cost reduction on a lease.

For shoppers, the effect was relatively simple: On a typical 36-month lease, $7,500 works out to about $208 a month before interest and taxes. That one mechanism helped keep many models affordable and supported demand for electric cars at a time of higher borrowing costs and increasing insurance premiums.

Industry data reveal the importance of leasing. Cox Automotive projected that leases represented a majority of new EV transactions in the U.S., simply because commercial credit could be used across a wider range of models compared to retail credit.

How political pressure shut the door on EV lease credits

The backflip by Ford and GM followed a request from Republican Senators Bernie Moreno of Ohio and John Barrasso of Wyoming to the U.S. Treasury to prevent captive finance units from using the commercial credit on consumer leases. In a letter to Treasury Secretary Scott Bessent, they said the practice violated congressional intent by granting incentives for vehicles that would not be eligible under the retail rules.

Within days, GM said it would stop taking the credit on leases but would continue to give $7,500 lease incentives for a limited period using its own money.

Ford announced in a similar vein that it would not take the credit but would work to maintain competitive lease offers in the market.

The Treasury Department and the I.R.S. may still choose to issue formal guidance on how the disabled commercial credits are applied when leasing takes place. But moves by two of the biggest American automakers effectively reset the near-term playbook for EV affordability and dealer advertising.

What shoppers will see now as EV lease credits change

Without the commercial credit, advertised lease rates could increase on models that had previously used the $7,500 pass-through.

Automakers can soften the impact with subvented money factors, increased dealer cash, or longer terms, but these are tactics with limits and exceptions depending on region and inventory.

State and utility incentives are still a hodgepodge, and corporate or fleet programs may in some cases still technically be eligible for commercial credits as the law originally envisioned. Customers shopping offers need to look beyond the headline monthly payment to factors like the amount of capitalized cost reductions, residual value assumptions, and any manufacturer cash that may be used to substitute for the federal incentive.

EV Sales Context And Impact On The Market

The decision comes as the demand picture is mixed. Rho Motion says global sales of electric vehicles were up 21 percent year on year between July 2024 and 2025, hitting the big figure of 10.7 million in the first seven months of that time frame. North America was a laggard, as sales increased by roughly 2 percent to approximately 1.0 million units on affordability headwinds and uneven charging buildout.

There appeared to be buyers rushing into the market before incentives were gone, and then a risk of a softer patch as pricing resets. If the lease credit went away, that could add even more downward pressure on entry-level models, and perhaps have a mellowing effect on mainstream customers who had been brought to showrooms by the promise of sub-$300 monthly payments.

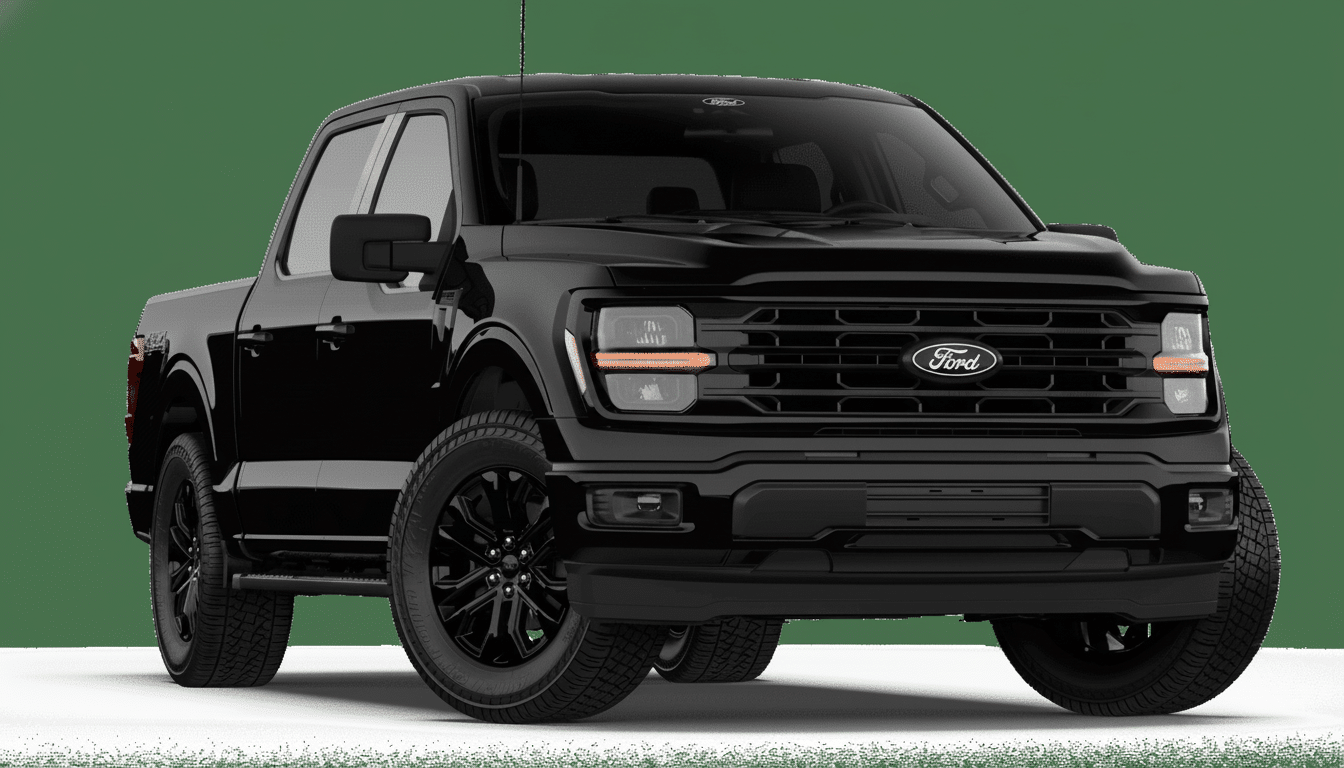

Automakers are hastening with low-cost nameplates and revamped lineups. Ford has sketched out a “universal” EV program, which includes a midsize electric pickup it envisions selling for roughly $30,000. GM teased the next Chevrolet Bolt, whose starting price will come in at under $30,000 and have a sped-up timeline. The approach is clear: Balance incentive uncertainty with simpler architectures, less expensive batteries and scale economics.

What’s next for policy and industry after lease credit

Anticipate the industry’s push for regulatory clarity. The Alliance for Automotive Innovation and other trade groups repeatedly have sought stable, long-term rules on who is eligible; what the content requirements are; and how credits can be transferred among companies. Clear advice aids finance units in the construction of deals and avoids mid-quarter whiplash for dealers.

In the meantime, manufacturers will rely on established levers: sharper pricing, targeted captive financing subsidies and cost reductions in materials and manufacturing. Closing the loop on the leasing workaround may bring policy closer to the legislative goal but also ratchet up standards for product-and-market fit—particularly in segments where shoppers cross-shop competitively priced hybrids.

The lesson is a simple one: With Ford and GM retreating from the lease-credit game, the market needs to find a new equilibrium. Shoppers will continue to see deals, but the straightforward $7,500 lever is gone, and competitiveness will be predicated primarily on actual cost reductions and appealing EVs — not accounting legerdemain.