Firefly Aerospace is making a bold leap up the defense value chain with an acquisition of Princeton, New Jersey-based SciTec in a deal valued at about $855 million in stock and cash. The deal provides Firefly with an instant foothold in software for missile warning, tracking and space domain awareness — capabilities that the Pentagon is increasingly emphasizing — and it epitomizes the company’s aim of transitioning from a launch-and-spacecraft maker into a vertically integrated provider of national security services.

Why Firefly Is Betting on Defense and Mission Software

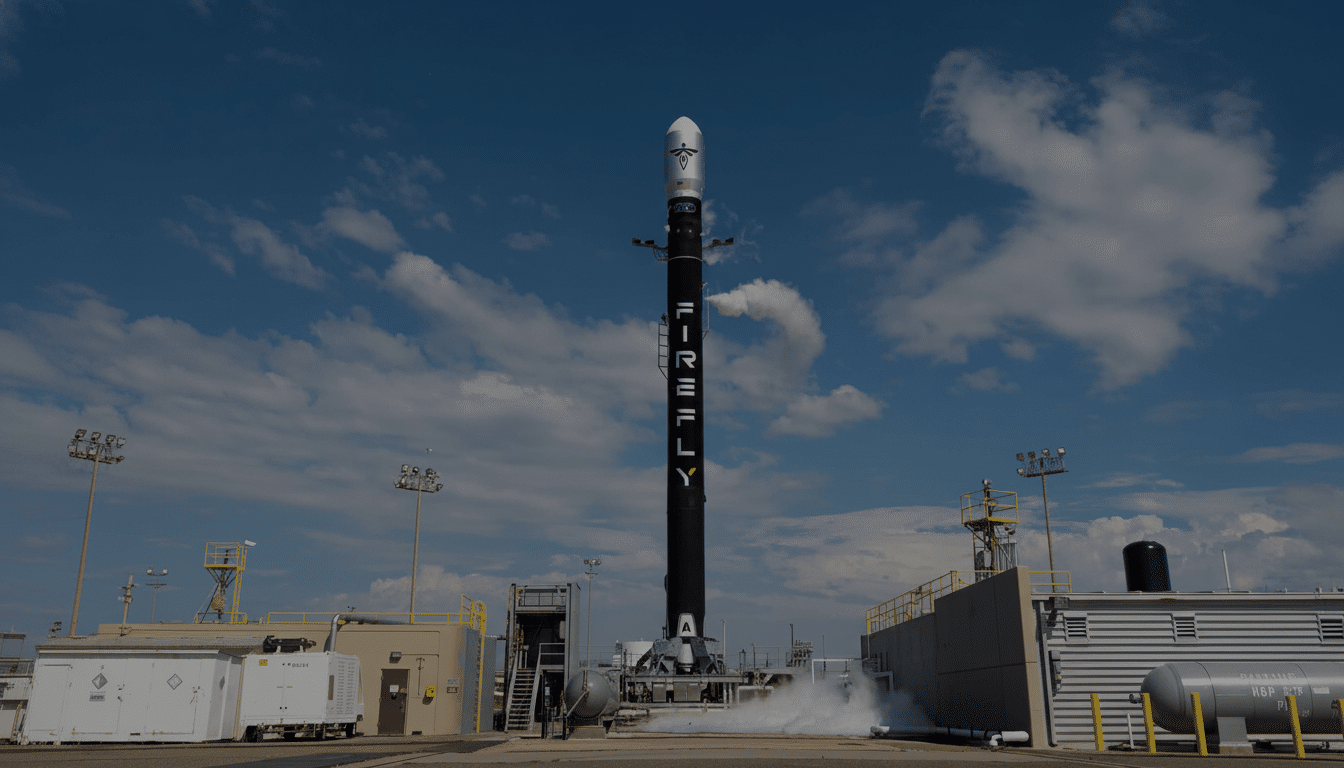

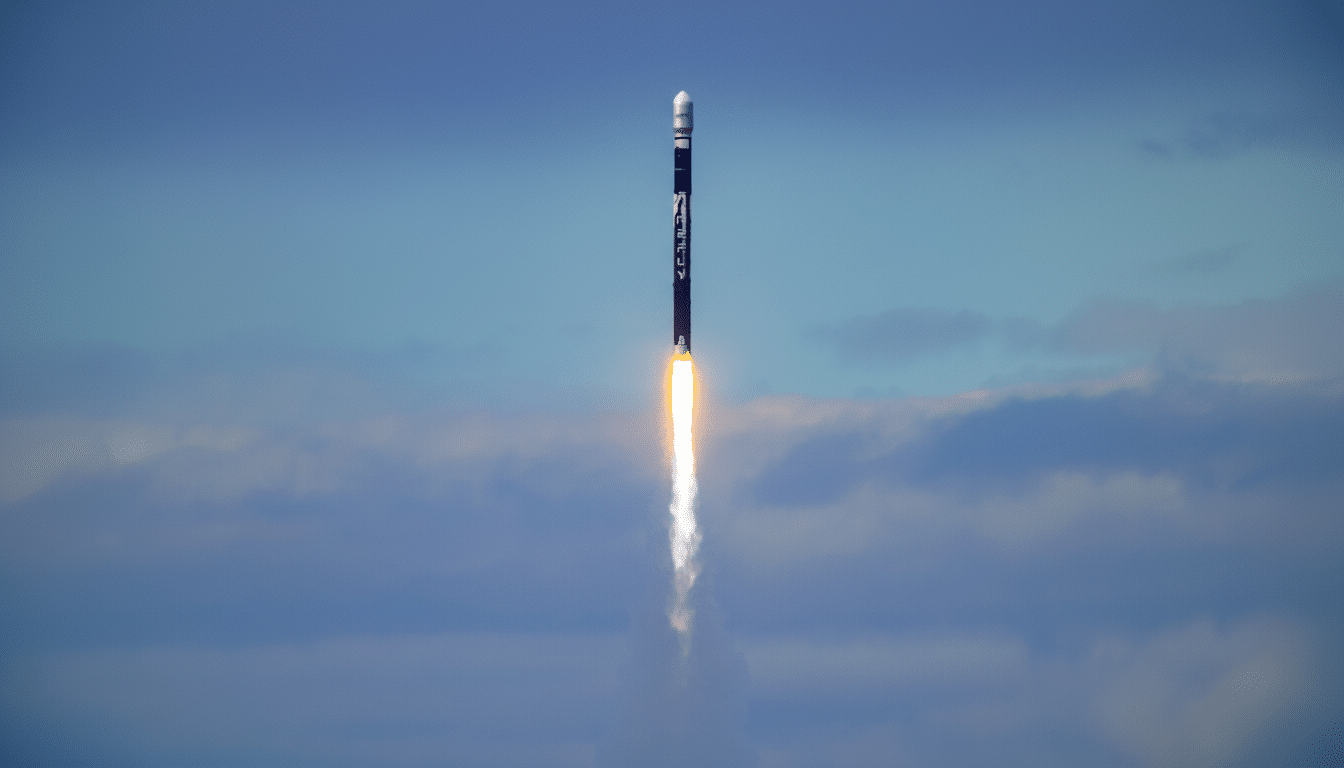

For the last two years, Firefly has been proving it can serve the U.S. national security community. Its fast-response Alpha mission that rode — on hours’ notice — under the Space Force’s tactically responsive space program was a convincing commercial: Yes, the company can design, integrate and fly on military timelines. By combining with SciTec’s data fusion and analytics software — based on launch, spacecraft buses, and on-orbit services — Firefly aims to offer a full-stack offering similar to how the Department of Defense is purchasing space capabilities now.

What SciTec Brings to Firefly’s Full-Stack Strategy

SciTec provides mission software, ground systems and analytics for missile-warning and missile-tracking programs, as well as space domain awareness and sensor exploitation tools. The company’s competence is at the decisive intersection of OPIR data, advanced multi-sensor processing and A2/AD operations.

Earlier this year, the U.S. Space Force awarded SciTec a roughly $259 million contract to develop a ground system for missile-detection satellites, reflecting that confidence in the company’s mission software.

As of midyear, SciTec had annual revenue of around $164 million and a customer base that included the Space Systems Command, the Space Development Agency, the Missile Defense Agency, and parts of the intelligence community. Linking that portfolio with Firefly provides instant and direct cross-sell opportunities for vehicles, payloads, and operations.

Deal Structure and the Valuation Signal from Firefly

The acquisition is to be financed with about $300 million in cash and $555 million in new equity, according to Firefly. To use stock as currency so quickly after its IPO suggests management is confident in the company’s trajectory and that SciTec is a strategic add-on. The purchase implies a multiple a hair above five times trailing revenue—within the range paid for profitable, cleared software-and-services assets that support high-priority defense missions.

Upon closing of the transaction after customary approvals, SciTec will become a Firefly subsidiary with its current chief executive, Jim Lisowski, continuing to lead it.

Maintaining leadership will, in theory, preserve momentum on programs, as well as clearances and customer relationships, while the integration takes place.

A Match For Pentagon Procurement Priorities

Missile warning and tracking is moving to proliferated low Earth orbit architectures, resilient ground systems, and software that can ingest and exploit data from hundreds of sensors, all according to the Defense Department. Those are all values that the Space Development Agency’s Tracking Layer and the Space Force’s next-generation OPIR efforts stress heavily — commercial integration, iterative software deliverables, rapid refresh.

Firefly’s new footprint puts it in a position to be in the running for that spend: launch capabilities for rapid replenishment; satellite bus and on-orbit offerings for payload hosting; and now a ground-and-analytics layer that converts raw data into actionable intel. It reflects a wider industry trend: Space companies like, say, SpaceX with Starshield or Rocket Lab with space systems and defense programs are moving to be systems integrators rather than just component providers.

Risks To Execution And Competitive Landscape

The upside is obvious, but so are the obstacles. Bringing a software-cleared contractor into a hardware-focused organization requires careful consideration of culture, cost structure and program execution. Firefly will have to defend SciTec’s autonomous credibility with its government clients, while extracting synergies across bidding and delivery. Portability of clearances, the retention of talent and the avoidance of actual or perceived conflicts with prime contractors will also be front and center.

Competition is intensifying. Incumbents and newcomers are seeking missile warning and tracking work aimed at everything from SDA satellites and ground systems to OPIR exploitation to command-and-control modernization. Success will be quantified with tangible milestones: backlog growth, book-to-bill above one, on-time space vehicle deliveries and re-awards from Space Systems Command, the Missile Defense Agency and SDA. If Firefly can spool up combined wins — launch, bus and ground software — this acquisition will seem prescient.

What to Watch Next as Firefly Integrates SciTec

These include regulatory clearance, customer novation approvals (where applicable), and early joint bids using SciTec software and hardware from Firefly. One near-term indicator will be whether SciTec’s $259 million ground program reaches delivery gates while integration is ongoing. Over the longer term, watch to see if Firefly scores roles in expanded missile-tracking constellations and responsive launch taskings that cite integrated analytics as a selling point.

Bottom line: marrying SciTec’s mission software with Firefly’s launcher and spacecraft products provides a cleaner line of sight to defense-scale revenue. If it can execute as well as it is ambitious, Firefly just made itself a go-to commercial partner for the Pentagon’s next generation of space-based missile warning and tracking.