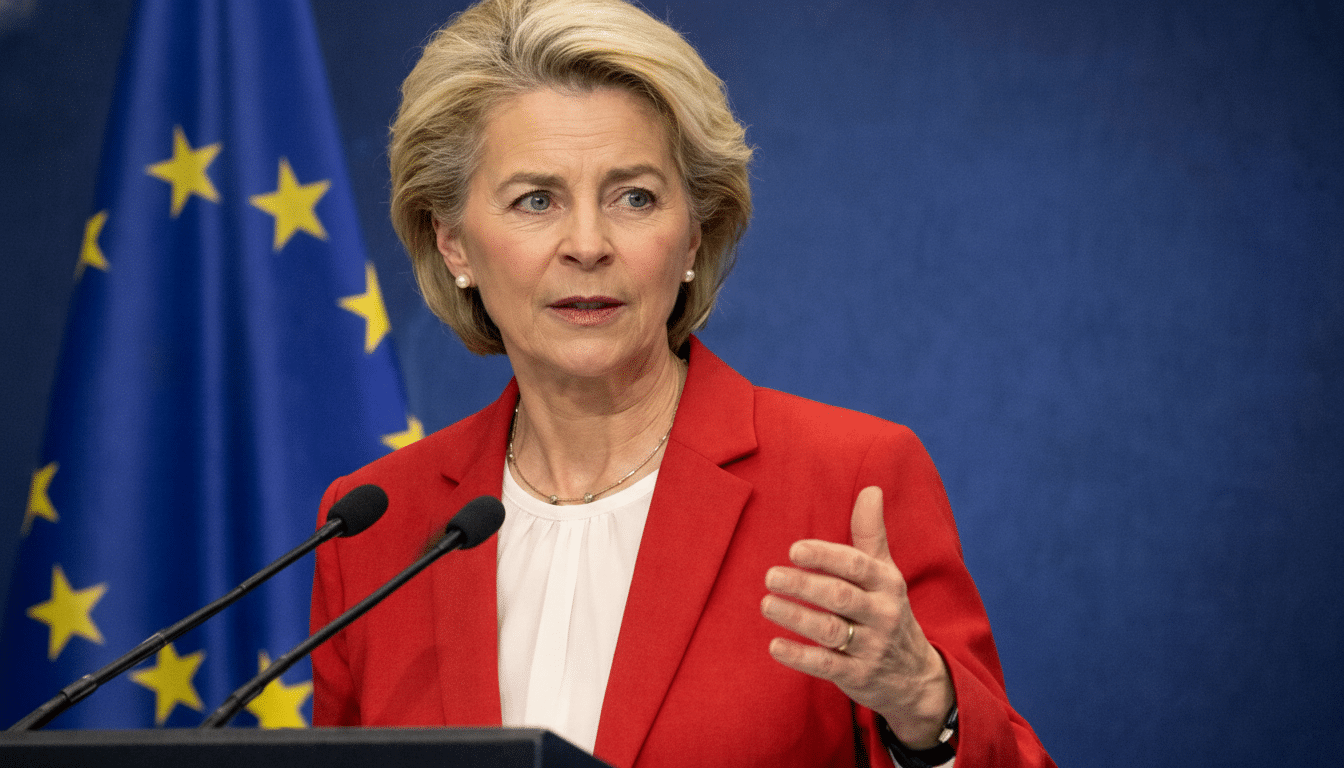

European policymakers are accelerating plans to reduce dependence on U.S. technology as sanctions and combative rhetoric from Washington expose the risks of relying on American platforms, clouds, and payment rails. The message from Brussels and national capitals is increasingly blunt: digital sovereignty is no longer a slogan, it is a contingency plan.

The trigger is not only geopolitics but lived experience. Recent U.S. sanctions that swept up non-Americans and the threat of sudden deplatforming have underscored how easily access to cloud services, developer tools, ads infrastructure, app stores, and even credit card networks can be severed. For European officials and executives, that vulnerability is now a boardroom and cabinet-level risk.

Why Sanctions Are Driving a Tech Rethink

Sanctions have become a precision instrument of U.S. policy, but their effects can feel blunt for those caught in the blast radius. Being placed on a U.S. blacklist can mean losing access to dollar clearing, major card schemes, and the U.S.-centric cloud and productivity ecosystem. Even those not directly sanctioned fear overcompliance by companies that preemptively cut ties to avoid penalties.

European officials also point to extraterritorial laws such as the U.S. CLOUD Act and legacy surveillance powers that continue to worry regulators, despite the rebooted EU-U.S. Data Privacy Framework. The lesson many governments draw is simple: if the switch for your critical digital services sits in another jurisdiction, you do not control the light.

The Scale of Europe’s Dependency on Foreign Tech Suppliers

Lawmakers in the European Parliament recently backed a push to identify where the bloc relies on foreign suppliers, noting that well over 80% of its digital stack comes from outside the EU. In cloud infrastructure, U.S. hyperscalers account for roughly 70%+ of the European market, according to Synergy Research, placing core enterprise workloads under non-EU legal and commercial control.

Belgium’s top cybersecurity official, Miguel De Bruycker, has warned that Europe “lost the internet” to U.S. platforms and that keeping data fully in-region remains difficult given the dominance of American infrastructure. That imbalance extends to payments, where Visa and Mastercard remain central, and to mobile app distribution, where U.S.-based app stores gate access to consumers.

Steps Toward a Sovereign Tech Stack across Europe

Brussels is responding with a mix of regulation and industrial policy. The Data Act mandates cloud switching and limits on punitive egress fees, aiming to make it feasible for companies to move workloads to EU providers. ENISA’s draft EUCS cloud cybersecurity scheme, under negotiation, is expected to formalize technical and organizational requirements for “sovereign” clouds operated under EU jurisdiction.

At the national level, France is replacing foreign video-conferencing tools across public administration with a domestically developed platform and is expanding the SecNumCloud certification that favors providers anchored in French and EU law. Germany continues to grow its state cloud offerings, while Italy’s Polo Strategico Nazionale pursues a government cloud under local control. Gaia-X, though slower than hoped, has seeded reference architectures and interoperability projects among European vendors.

Cloud Compute AI And Chips Under EU Control

Compute has become the new oil of AI, and Europe is trying to secure supply. The EuroHPC Joint Undertaking is opening access to top-tier supercomputers for startups and researchers, while member states fund “AI factories” that pair GPUs with sovereign data and tooling. On the hardware front, the European Chips Act targets a 20% global share by 2030, with investments spanning advanced nodes, specialty semiconductors, and emerging RISC-V ecosystems to reduce lock-in.

In payments, the European Payments Initiative is piloting a unified wallet and instant payments layer branded “wero,” conceived to cut reliance on non-European schemes for everyday transactions. Together, these efforts sketch a stack—from compute and cloud to data and payments—less exposed to geopolitical whiplash.

What It Means for Companies and Everyday Users

For enterprises, the calculus shifts from pure price-performance to risk-adjusted resilience. Many are adopting multi-cloud strategies that include at least one EU-based provider or a “trusted cloud” operated under EU law, often via partnerships between U.S. tech and European firms that ring-fence data access. The Data Act’s switching rules aim to lower migration friction, a longstanding barrier to diversification.

Consumers and public-sector workers will increasingly encounter European alternatives—whether messaging tools built to EU security standards or productivity suites hosted in-region. Open-source vendors like Nextcloud, and privacy-focused services from European providers, are gaining ground as governments write procurement rules that favor local control and transparent codebases.

The Roadblocks Ahead for Europe’s Digital Autonomy

Europe’s challenge is scale. Matching the pace and capital intensity of U.S. hyperscalers and platform companies requires sustained funding, unified standards, and demand aggregation across 27 markets. Fragmentation—different national certifications and procurement preferences—risks diluting impact unless frameworks like EUCS deliver genuine harmonization.

Still, the direction of travel is clear. With sanctions and abrupt policy shifts now part of the operating environment, the EU is moving from theoretical debates to practical rewiring of its digital base. If the next year sees final EUCS rules, active enforcement of cloud switching rights, and visible wins in sovereign AI and payments, Europe’s reliance on U.S. tech could start to bend—slowly, but decisively—toward autonomy.