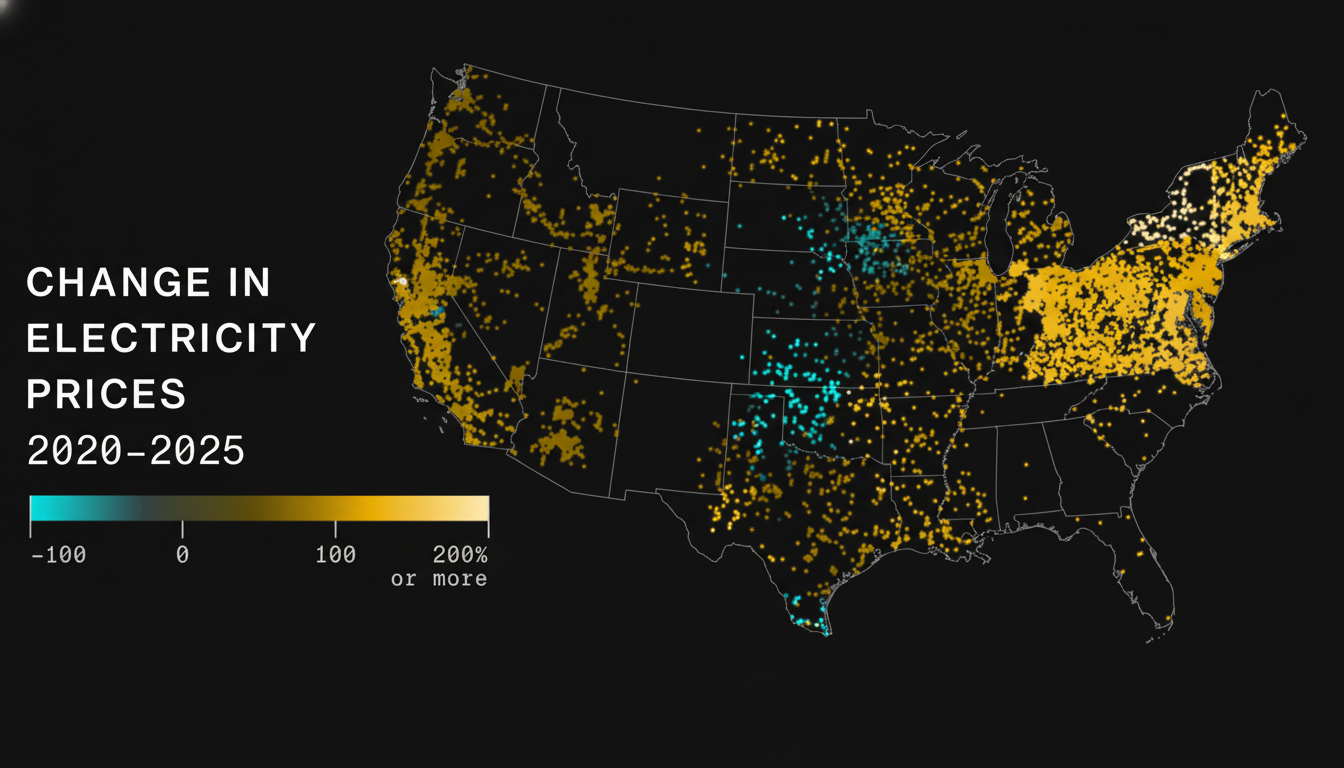

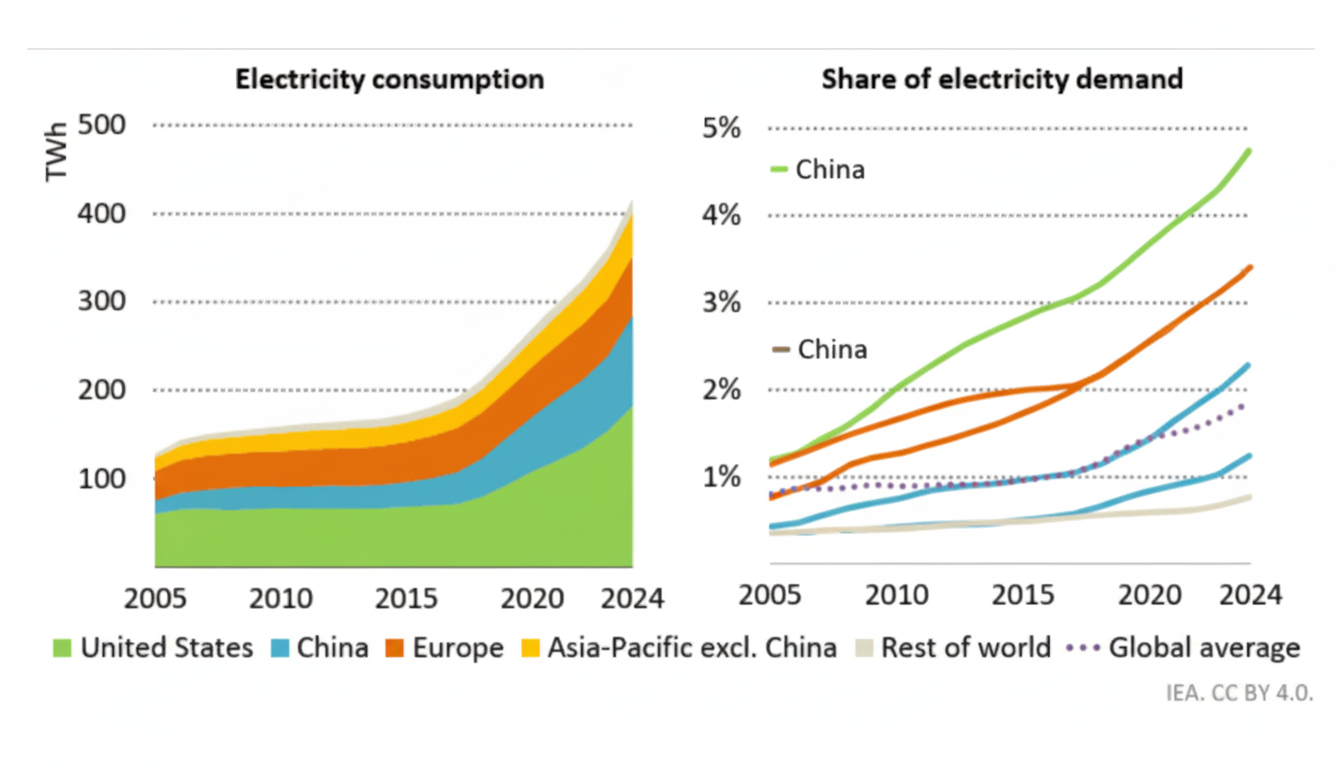

Rising electricity costs are colliding with the breakneck buildout of AI infrastructure, putting data centers squarely in the public and policy spotlight. A new national survey commissioned by Sunrun shows that 80% of consumers fear the AI boom could boost their power bills—a view that is rapidly evolving into a political and regulatory hot potato for the industry. The problem is acute. Researchers at Lawrence Berkeley National Laboratory estimate U.S. data centers are on track to consume around 4% of the nation’s electricity, more than double their share in 2018, and could grow to 6.7%–12% by 2028. That projection unfolds simultaneously with the prospect of more upward pressure on wholesale market prices from fuel prices, extreme weather, and grid congestion.

Why wholesale power prices are climbing across regions

Fuel dynamics are a substantial factor. U.S. Energy Information Administration data indicate gas-fired power burn is about 20% above the 2019 level, while liquefied natural gas exports are up almost 140%, tightening the market and boosting generator costs. And thousands of heat waves are increasingly contributing to higher peak values and capacity-stress rates across multiple regions.

- Why wholesale power prices are climbing across regions

- Renewables help but policy delays and load growth loom

- AI training clusters are reshaping data center demand

- Public sentiment may slow projects amid bill concerns

- Regulators weigh limits on large new digital loads

- How builders are battling the rising energy cost curve

- What could shape the next chapter for AI power costs

New supply is in short supply. The International Energy Agency notes that combined-cycle gas plants normally take about four years to build, and manufacturers are now encountering a critical shortage of one-of-a-kind turbines, with quoted deliveries extended out as far as seven years. While the interconnection queue for fresh generation and storage is still congested, it is frustrating the development of projects that might alleviate specific local price volatility.

Renewables help but policy delays and load growth loom

Renewables’ continued growth has been the price mitigator of the last decade in many markets. EIA reports that solar, wind, and grid-scale batteries will continue to lead new U.S. capacity additions in the shorter term. However, with additional long-duration tax incentives still undecided by H1 2023, this may retain barriers to accelerated growth as load outmaneuvers supply.

AI training clusters are reshaping data center demand

AI training clusters have upended the scale of data center power demands. Developers are now planning campuses on the order of 100 MW or more, with individual buildings geared for unprecedented rack densities to keep racks of GPUs and specialized accelerators humming. Utilities from Virginia to Texas report multi-gigawatt pipelines anchored by digital infrastructure customers, and grid planners in PJM, ERCOT, and the Midcontinent region have already revised load forecasts upwards.

While efficiency helps, it does not entirely mitigate the demand. The Uptime Institute reports that the average data center PUE is around 1.58, a constructive development over the last decade. However, overall consumption has continued to rise given the growth of AI workloads. Additional water and thermal management—warm-water liquid cooling and heat reuse—are eliminating waste at the margins of historical cooling; the underlying demand for compute remains.

Public sentiment may slow projects amid bill concerns

Public discernment will act as a brake. Pew Research Center reports many more Americans are concerned than positive about AI writ large. Higher electric bills—due to fuel pass-throughs, capacity costs, and native congestion—will be associated with the most-seen new fringes of power consumption: AI and hyperscale data centers.

Regulators weigh limits on large new digital loads

Policymakers are on it. State commissions are re-examining long-term utility contracts and rate designs applied to large digital loads. European experience indicates what to anticipate: Ireland’s grid manager has banned new data center connections around Dublin, and Dutch cities have put the permits on hold temporarily for mega-sites. U.S. city utilities have also indicated capacity constraints, and some require that high-load connections await transmission upgrades.

How builders are battling the rising energy cost curve

Hyperscalers are racing to secure stable energy. Power purchase agreements for long-term utility solar and wind remain the initial line of protection, trusted for cost clarity and accelerating the market. Many operations are situated next to existing nuclear plants or have signed groundbreaking contracts such as next-generation geothermal and provisional fusion to safeguard the impact and sharpen the carbon triple.

Storage is advancing from the pilot to the portfolio. Grid batteries are helping to reduce the highest prices and sustain renewable output, specifically when paired with flexible AI workloads that shift training to off-peak sessions. Liquid refrigeration, superior power delivery, and reuse of waste energy are decreasing operating costs and easing local grid pressure in compute land expenditure. However, when regional capacity is tight, none of that eliminates the exposure.

What could shape the next chapter for AI power costs

For data center operators, the choice is getting harder: secure firm power at a premium, delay projects, or redesign workloads to be more grid-interactive. For households and small businesses, the question is easier. Whatever is done, it should not involve another line item creeping charges on monthly statements. It is difficult to do it without rapid low-cost generation, storage, and transmission buildouts.

Three signals will decide the next chapter:

- the pace of interconnection reforms dismantling renewable and storage backlogs;

- the behavior of gas prices and LNG exports heading into peak seasons;

- whether AI companies commit to aligning consumption with automated calls for flexible consumption.

If any of these trends break favorably, the AI power-price overhang will probably lessen. If not, simply wait for stricter siting rules, tougher contracts, and louder ratepayer pushback.