Elon Musk has spent years making a plaything of cars, rockets, tunnels and social media platforms — and just as regularly of the patience of regulators. The friction isn’t incidental. It originates in a strategy that values moving fast, iterating with software first, and public brashness over slow consensus. Those tactics led to blockbuster products and valuations, but have also set off an ever-widening web of investigations, consent decrees, compliance orders from across a range of agencies.

The result is a Mexican standoff with high stakes not just for the future of Tesla’s driver-assistance technology roadmap, SpaceX’s launch cadence, The Boring Company’s urban ambitions, or privacy requirements at X. Investors and customers are left to parse whether oversight will calcify into headwinds or impose long-needed guardrails which in turn strengthen the products.

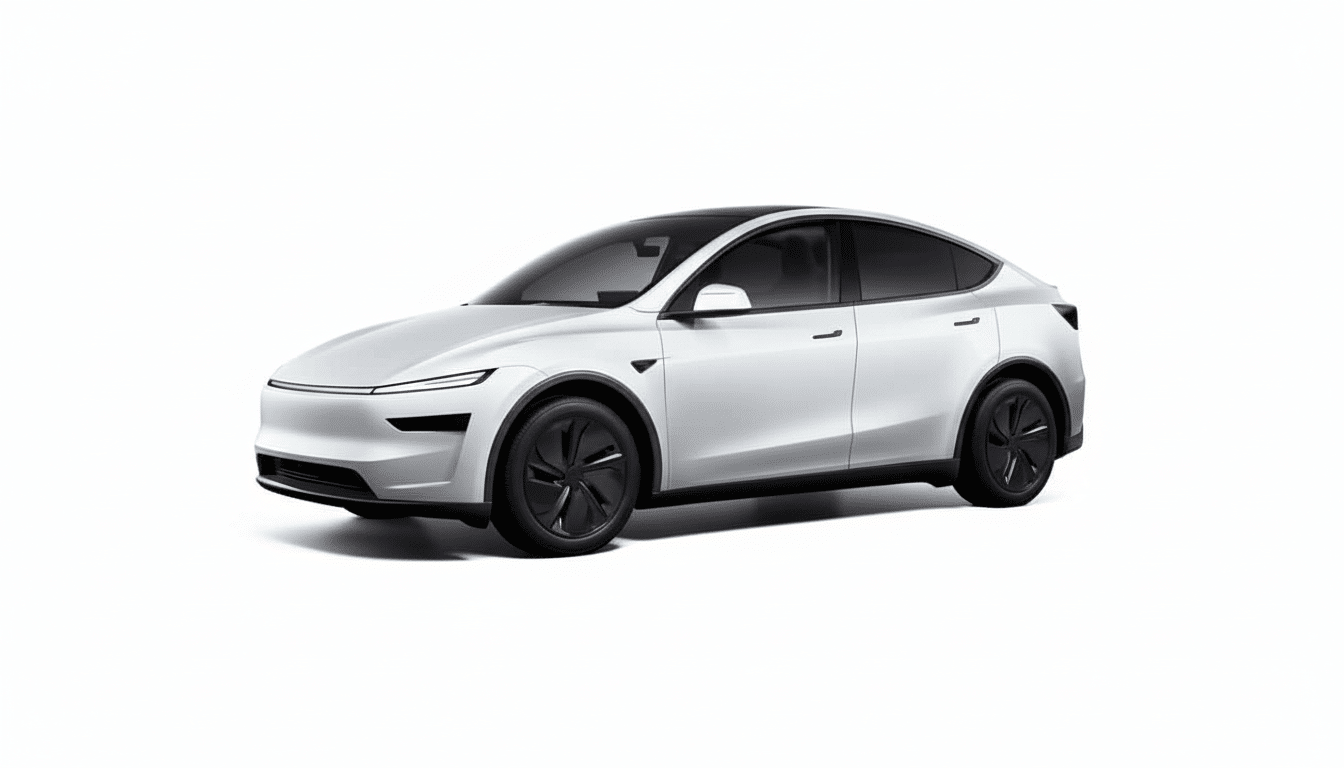

Tesla under the safety microscope for Autopilot and FSD

Tesla has faced continued scrutiny from the National Highway Traffic Safety Administration over the operation of Autopilot and Full Self-Driving, advanced driver-assistance features that the company offers. Following a multiyear investigation, Tesla issued a widespread software recall that affected over 2 million vehicles to install new safety features around driver engagement. Later, NHTSA indicated that it was not convinced the changes were sufficient, keeping pressure on Tesla to continue hardening the system’s defenses against misuse.

The agency’s Standing General Order, which mandates crash reporting for Level 2 driver-assistance reports, reveals that Tesla is a big share of the reported incidents — a function of both its large on-road fleet and of its telemetry pipeline. Safety researchers at groups like the Insurance Institute for Highway Safety have consistently warned that naming and marketing can produce an overconfidence in driver-assist systems, a shared theme in Tesla’s case as it works to scale toward robotaxis.

And Tesla’s marketing claims have also been criticized, in addition to its safety performance. The California Department of Motor Vehicles had earlier accused the carmaker of overestimating what Autopilot and FSD can do, a case that highlights how voice can be a regulatory albatross when combined with real-world crashes and near misses.

Insurance and consumer protection oversight

Tesla’s move into insurance has drawn scrutiny from state regulators that oversee claims handling and pricing. The California Department of Insurance said it had taken an enforcement action accusing the company of stalling or rejecting legitimate claims despite previous warnings. For a company that pitches safety as much as it does software, the optics of fight-heavy claims management can be as damaging as any fine — especially when state regulators have the authority to yank underwriting or require restitution.

That’s no small flak. When responsibly integrated, insurance data can strengthen safer driving and more accurate risk pricing. But to the degree that customers find the program opaque or punishing, that would make it yet another flashpoint for consumer advocates and attorneys general who have been increasingly vocal about telematics, algorithmic fairness and transparency of rates.

SpaceX and the balancing act of the F.A.A.

SpaceX’s test-fast culture has upended launch economics, but every high-profile Starship flight still depends on Federal Aviation Administration oversight. After test failures, the FAA would open and close “mishap investigations” based on corrective actions taken by SpaceX, while the U.S. Fish and Wildlife Service looked at environmental impacts near the Boca Chica site. Each step reflects a pragmatic compromise: Regulators allow for aggressive iteration, but only along with documented mitigations and community safeguards.

That overall botched cadence has increased in the last few years as corrective actions have piled up — new flight-termination systems put in place, pad hardening developed, debris containment made better, and improved stage separation mechanics perfected. The company’s ability to check the appropriate FAA lists has also become, however unfortunately, as material a consideration in its Mars story as is engine performance or manufacturing scale.

The Boring Company meets state pushback in Nevada

Musk’s tunneling project has faced some of its own compliance issues. A ProPublica investigation found almost 800 violations claimed by Nevada regulators, allegations that include digging without proper permits and insufficient stormwater controls. While The Boring Company has promised a cheap, quick-to-deploy mobility solution, the real nitty-gritty of construction — permits, environmental concerns and roadway hygiene — is overseen by state and local rules that rarely bow to startup calendars.

If the company is going to move beyond trying out demonstration loops to operating city-spanning networks, it will need not only engineering skills but also consistent, auditable proof that construction and environmental standards are being met.

The S.E.C. shadow on Musk’s speech and disclosures

The fallout from Musk’s 2018 “funding secured” episode has not gone away. The settlement by the Securities and Exchange Commission — a $20 million fine and an obligation to get some communications approved — nonetheless continues to shape his public statements about Tesla. Musk fought those limitations, but the Supreme Court refused to hear his appeal, effectively upholding the consent decree. For a C.E.O. who uses social media as a product channel and policy platform, the limits imposed by securities law continue to be a friction point with actual risk attached.

For its part, X is subject to a long-standing privacy order imposed by the Federal Trade Commission. The agency has requested details about its product changes and data access under Musk’s ownership, showing how changes in the executive suite can spur fresh scrutiny of compliance programs dating back to before the acquisition.

What This Says About Musk’s Path Forward

The immediate consequences — recalls, fines, delayed launches and enforcement actions — are manageable for companies of this size. The deeper risk is strategic: Regulators are making Tesla have to show autonomy is safer in production, not just demos; pushing SpaceX toward industrializing compliance alongside rockets; and reminding every Musk-led venture that velocity without process invites expensive resets.

There is something positive to read here. Firms respond when oversight is clear and data-based. The biggest signal to investors and the public will be fewer safety interventions, cleaner audits and fewer enforcement headlines. If Musk’s teams can transform today’s frictions into more durable systems — from driver-monitoring rigor to launch-site protections and claims handling — the “versus the regulators” storyline could look less like a confrontation closer to home and develop into something rarer in tech: a competition that ended up raising the bar for everyone.