Dubai-based Eat App is sharpening its focus on India’s restaurant reservation market with a three-pronged push: a fresh funding extension, the acquisition of ReserveGo, and a commercial partnership with Swiggy designed to put its software in front of thousands of dining rooms nationwide.

The company closed a $10 million Series B extension led by PSG Equity via its portfolio company Zenchef SAS, lifting total funding to more than $23 million. Eat App says it now serves over 5,000 restaurants across 92 countries, reports $12 million in ARR, and has scaled past 2,000 restaurants in India within the past year—facilitating more than 8 million covers via multiple channels.

Why India’s restaurant reservation stack is ripe for change

India’s food service market is large, fast-evolving, and fragmented. Analysts at RedSeer and the National Restaurant Association of India expect the sector to top $85 billion by 2028, with dine-in accounting for well over half of spend. Yet reservation demand and guest data remain scattered across platforms such as Zomato, Swiggy, and EazyDiner, while many venues still rely heavily on walk-ins and manual books.

The top tier of restaurants operates almost entirely on reservations, but the next several thousand venues wrestle with capacity balancing across multiple discovery channels. Consolidating those streams into a single system that can forecast covers, reduce no-shows, and capture guest preferences is the operational prize—and the opening Eat App is targeting.

The Deal Playbook: Acquisition Plus Distribution

Eat App’s purchase of ReserveGo brings in a founder with deep category know-how. ReserveGo’s creator, Vijayan Parthasarathy, previously built inResto in 2014, which was acquired by Dineout the following year. Dineout itself became part of Swiggy in 2022. That lineage gives Eat App local product intuition and relationships—a crucial advantage in a market where regional nuances often decide software adoption.

On the distribution side, Eat App has struck a partnership with newly listed Swiggy to co-market its solution to restaurants. The tie-up has already helped drive the company past 2,000 Indian restaurant clients, while Swiggy’s Dineout handled 23.8 million covers in 2025, underscoring the size of the demand funnel. For a B2B platform, this pairing of acquisition-led product depth and marketplace-led reach is a classic route to efficient scale.

What GroMax Promises Restaurants in India Today

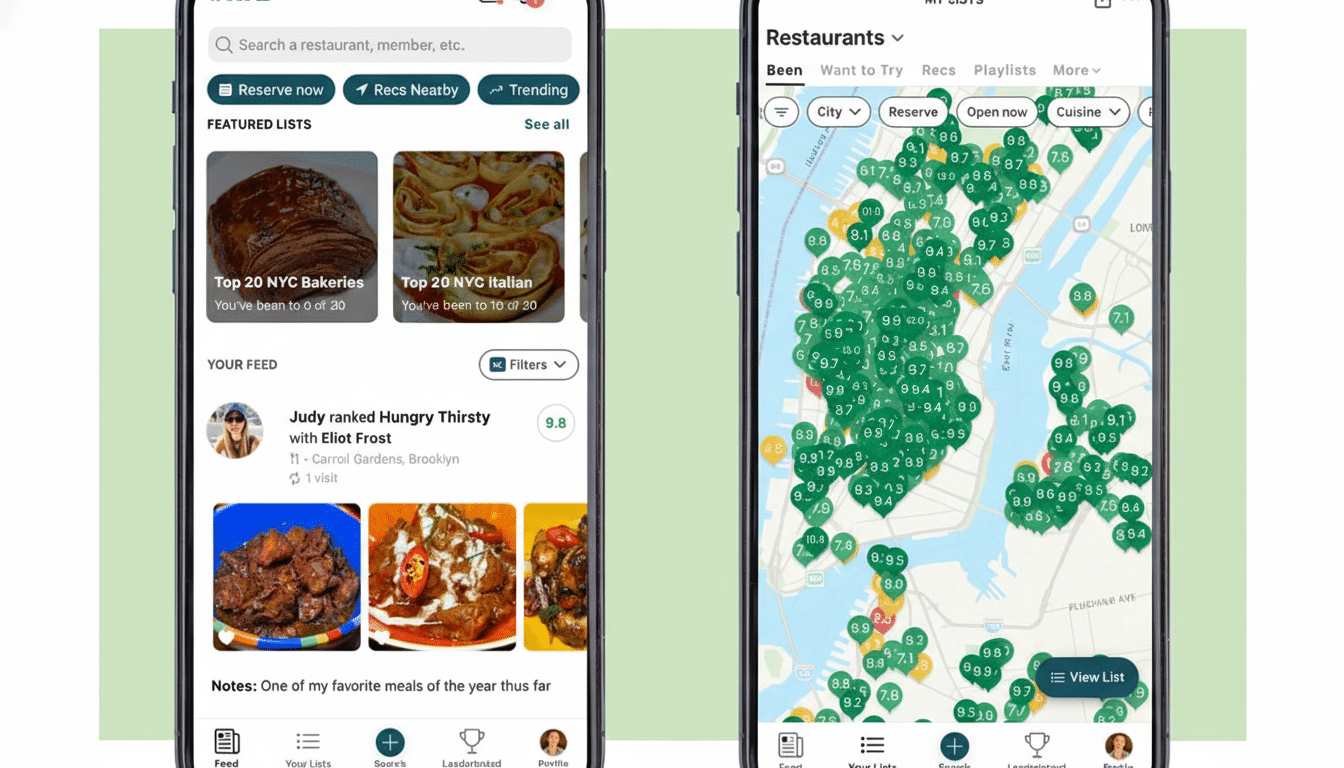

In India, Eat App and Swiggy are packaging the offering as GroMax, a stack that blends reservation management with marketing add-ons. Beyond aggregating bookings from multiple sources, GroMax includes tools to drive visibility on Swiggy and paid promotions on Meta, coupled with AI-assisted features aimed at optimizing table turns, predicting demand spikes, and nudging repeat visits.

Consider a mid-market, multi-outlet brand that gets inquiries from Swiggy, Zomato, its own website, and phone calls. Without aggregation, managers spend hours reconciling lists, risking overbooking during peak slots while underutilizing shoulder hours. Eat App’s pitch is a unified guest ledger with cover forecasting and yield controls—think automated hold times, targeted reminders, and segmented offers—that convert idle inventory into seated covers with lower no-show rates.

Swiggy’s strategy team has framed the collaboration as a way to bring global-grade, AI-driven tooling to Indian dining rooms, arguing that better reservation visibility and marketing automation translate to higher guest satisfaction and steadier revenue. While Swiggy provides market feedback and sales reach, Eat App leads product development, keeping the roadmap aligned to on-the-ground operator needs.

Competitive Landscape and Adoption Hurdles

The field is hardly uncontested. International players like SevenRooms, TableCheck, and OpenTable are active in premium segments, while local restaurant tech ecosystems such as Petpooja and Posist anchor point-of-sale and operations for tens of thousands of venues. Vendors that integrate cleanly with these systems—and with discovery platforms—will enjoy a distribution edge.

Two frictions persist. First, many operators remain comfortable relying on walk-ins during high-traffic periods, dampening urgency for software adoption. Second, budget sensitivity can slow rollouts unless vendors clearly prove ROI: fewer no-shows, better seat utilization, higher repeat rates. Data control and compliance under India’s evolving privacy framework are additional table stakes that enterprise accounts will scrutinize.

What to Watch Next as Eat App Expands Across India

Key signals over the next year will be the pace of restaurant onboarding, the share of covers routed through GroMax, and churn across different city tiers. Deep integrations with major POS providers, richer diner profiles, and automated marketing that ties to attributable revenue will determine whether Eat App becomes a default operating layer rather than just another channel manager.

With fresh capital, a founder-led acquisition, and Swiggy’s distribution muscle, Eat App has engineered a credible wedge into India’s reservation stack. If it can convert fragmented demand into measurable revenue lifts for operators—while outpacing well-funded rivals—it stands to become one of the few cross-border SaaS stories to win share in a notoriously complex, high-growth market.