The U.S. Department of Energy agreed to lend Constellation Energy $1 billion to restart the long-idled nuclear reactor Three Mile Island Unit 1, whose power is being bought by Microsoft under a long-term agreement.

The move merges federal clean energy finance with skyrocketing AI-era power demand, making it one of the first big U.S. nuclear reboots directly connected to data center growth.

What the DOE Loan Programs Office Is Funding Here

The loan is from the Department of Energy’s Loan Programs Office, which was established under the 2005 Energy Policy Act to help advance clean energy and other advanced technologies into the marketplace faster. The office is best known for early bets that helped spur U.S. EV manufacturing, and it has a post-recovery default rate of around 3.3%, according to DOE summaries—a low figure by project finance standards for first-of-a-kind or complex assets.

The latest LPO action comes in the context of a sweeping effort to promote grid reliability: last month it closed on a $1.6 billion loan to American Electric Power, which will use the funds to expand nearly 5,000 miles of its transmission network. For TMI, DOE is using authorities designed to modernize existing energy infrastructure for the benefit of reducing emissions and strengthening reliability—an objective it meets if a nuclear unit is recommissioned and on hand as firm, zero-emission generation.

Microsoft’s 24/7 power strategy for firm zero-carbon energy

Microsoft has committed to purchase the plant’s output for 20 years, which brings Constellation the certainty of revenue necessary to finance a complicated restart. Analysts at Jefferies estimate that the price could end up somewhere between $110–$115 per megawatt-hour for the duration of the contract—higher than wholesale averages, but in line with the premium big tech buyers are paying for 24/7 carbon-free power that can directly match data center load profiles.

The deal comes after a wider wave of nuclear-linked procurement from hyperscalers. Meta this year reached a deal with Constellation to buy clean energy credits from a 1.1 gigawatt nuclear station in Illinois. Though attributes also differ from physical offtake, both signify an evolution: major cloud players are increasingly valuing firm sources of emissions-free power to hedge against price variability and to support around-the-clock decarbonization targets.

Cost context and market reality for nuclear restarts today

Lazard’s most recent levelized cost analysis, for example, shows new-build nuclear as more expensive than wind, solar, and geothermal, to say nothing of some renewables paired with utility-scale storage. But the market is bifurcating. For always-on loads (like AI training clusters), firm clean power can be worth the premium, particularly if it secures long-term hedges and utilizes existing sites and grid interconnections rather than developing greenfield.

According to Energy Information Administration data, the U.S. nuclear fleet has an average capacity factor of more than 90%, making it one of the most reliable zero-emission resources on the grid. Restarting an existing unit would also escape a good deal of the cost and schedule risk that has plagued new nuclear construction, while maintaining skilled regional jobs and tax bases centered on legacy plants.

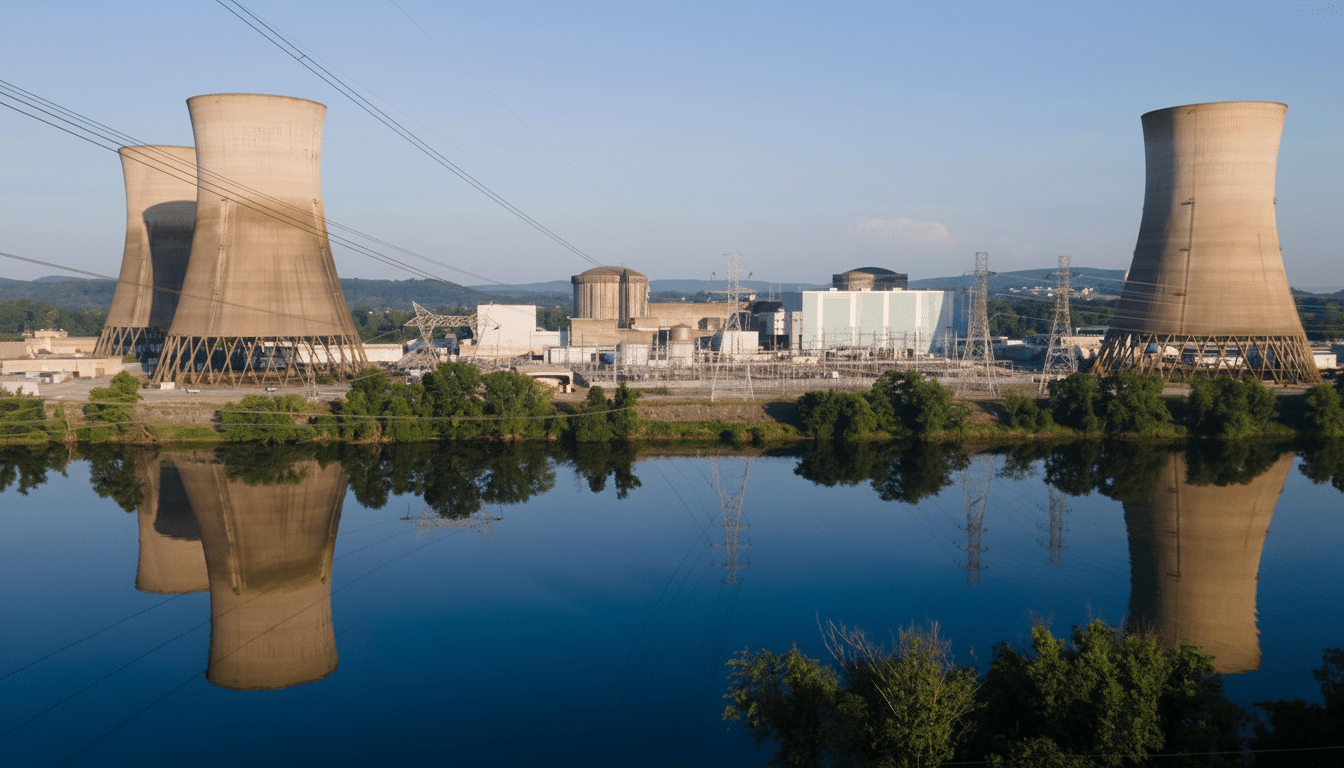

Safety history and unit information for Three Mile Island

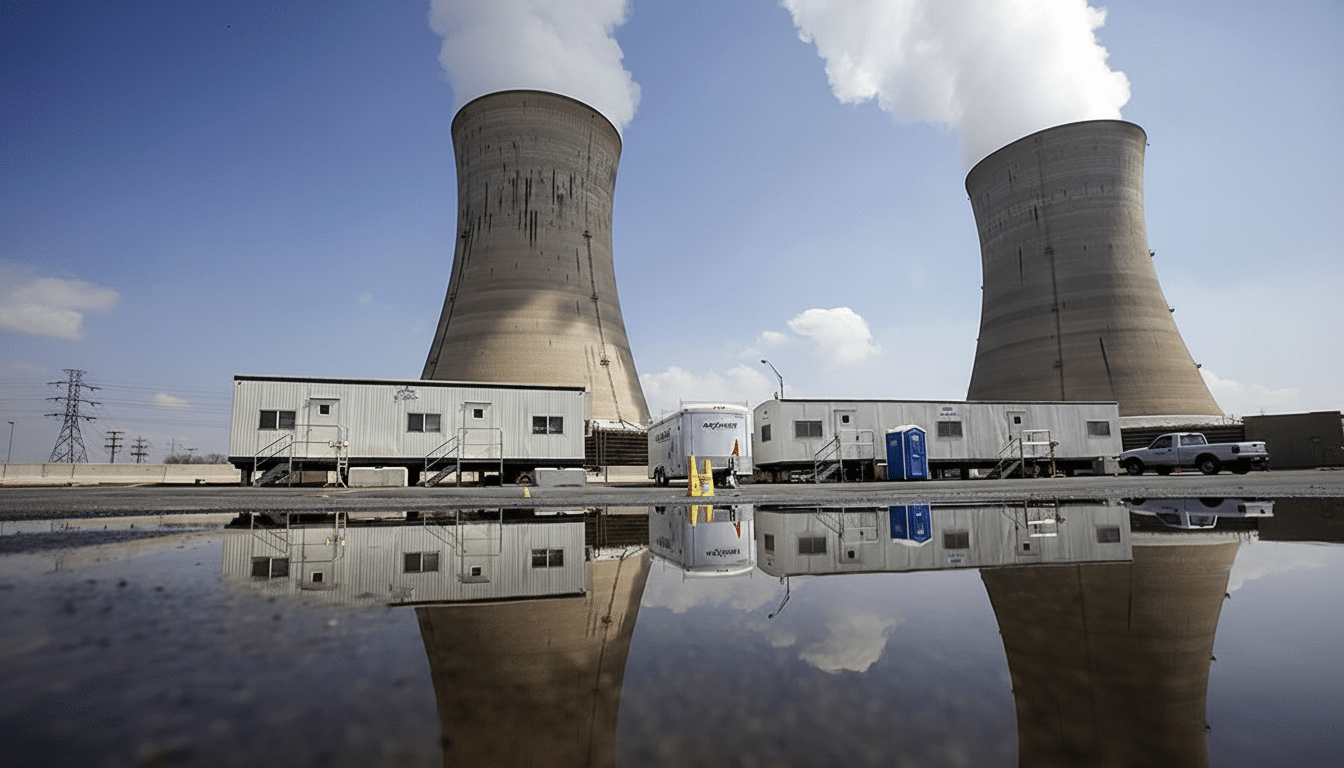

The unit scheduled to be restarted is Three Mile Island Unit 1, not the Unit 2 reactor on which the 1979 accident occurred. Unit 1 was commissioned in the 1970s and was retired in 2019 as competition from inexpensive natural gas squeezed its profit margins. Constellation’s approach would focus on inspections, component replacements, and refueling combined with modern control upgrades, followed by aggressive testing before returning and synchronizing with the PJM grid.

The safety steps are to be overseen by the Nuclear Regulatory Commission, including checks on equipment qualifications and operational readiness assessments. Supply chain readiness—especially for nuclear-grade components and fuel—coupled with the retention of experienced operators, will be key execution risks to track as the project progresses.

What to watch next as financing and NRC milestones arrive

Key events include financial close under DOE conditions, significant equipment upgrades, and NRC approvals and initial grid synchronization. Market watchers will be monitoring to see what impact this large corporate resource has on PJM capacity prices, congestion, and emissions over time, and whether more life extensions or restarts follow as tech demand grows.

If it works, Three Mile Island could serve as a model: federal credit support mitigates capital costs, a hyperscaler swaps 20 years of demand certainty, and a utility operator resuscitates an existing zero-carbon asset. For a grid straining from AI growth and electrification, it’s the pragmatic—if premium-priced—way to add reliable clean megawatts fast.