The Department of Energy is rolling back 321 awards worth $7.56 billion and rescinding funding from a broad range of clean energy projects and demonstrations. The cancellations fall disproportionately on Democratic-leaning states, according to public statements and lists of recipients, and include marquee efforts like hydrogen hubs and direct air capture pilots.

The decision immediately scrambles schedules for states and companies, who had timed permitting, hiring, and private financing around federal cost-share commitments. Several recipients said they are planning to appeal.

- Scope of DOE clean energy award cancellations

- Hydrogen hubs and DAC projects hit hardest in cuts

- Programs affected and timing of DOE cancellations

- Partisan optics and messaging around the decision

- Legal challenges and market fallout from reversals

- Jobs and climate stakes tied to hubs and DAC cuts

- What to watch next as appeals and reviews unfold

Scope of DOE clean energy award cancellations

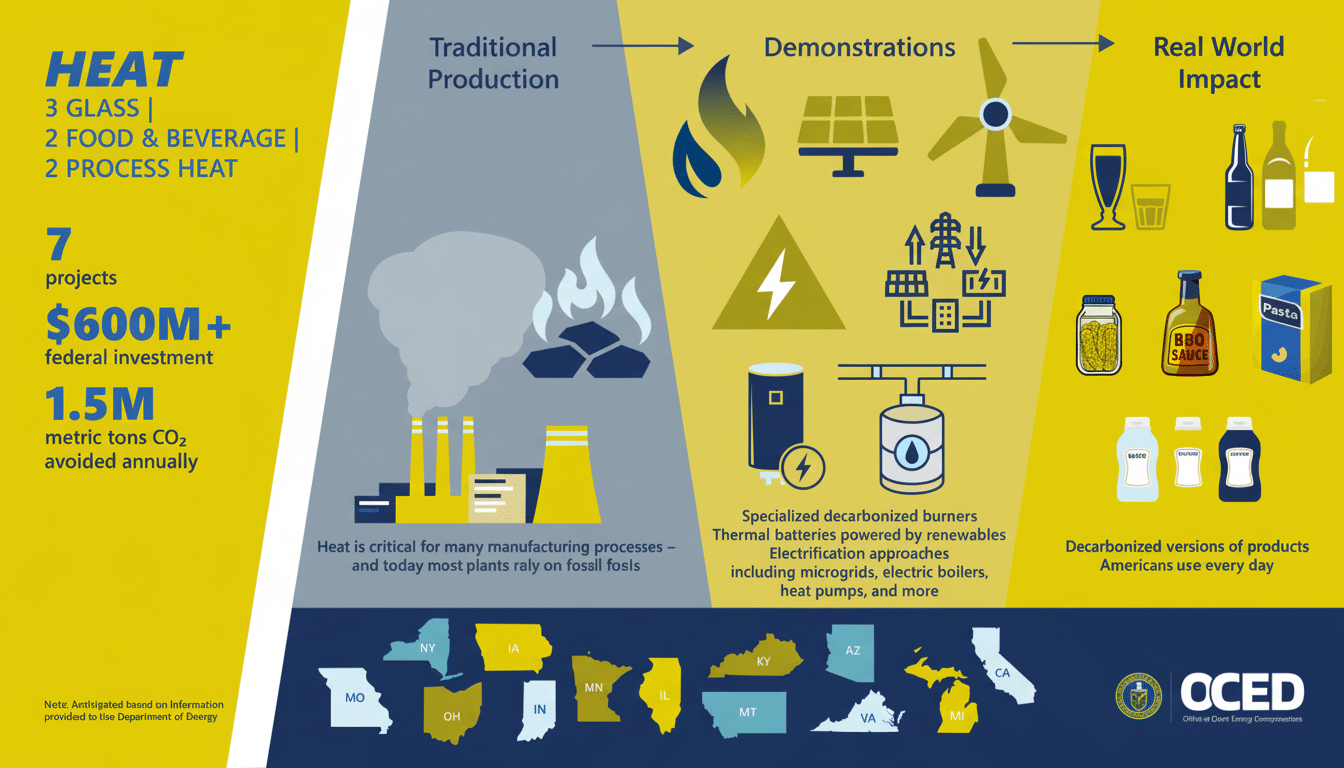

The awards were issued from the DOE’s innovation and deployment portfolio of offices, including ARPA‑E, Office of Clean Energy Demonstrations, Office of Energy Efficiency and Renewable Energy, Office of Fossil Energy and Carbon Management, Grid Deployment Office and Manufacturing and Energy Supply Chains. Taken together, the canceled projects span power, industrial decarbonization and manufacturing supply chains.

The states with impacted projects are spread across both coasts and the Midwest. Officials in California said their programs were affected, and reporting indicated cancellations likewise reached initiatives in New York, Massachusetts, Washington, New Jersey and other places. Though the Eastern time zone still has more than a dozen projects, many are in battleground states that can swing either left or right.

Hydrogen hubs and DAC projects hit hardest in cuts

Hydrogen hubs, which the DOE had once touted as a keystone to decarbonize heavy industry and long-haul transport, are among the biggest casualties. California officials said the state’s alliance for renewable clean hydrogen energy systems — initially up for some $1.2 billion — was killed off. Cancellations for hub projects in Texas and Louisiana were also reported to energy trade press.

At least 10 projects licensing direct air capture, valued at about $47.3 million together, were deleted from the list. A few DAC efforts in Alaska, Kentucky, Louisiana and North Dakota remain on the books. Oil and gas companies had supported a handful of DAC pilots because the captured CO₂ can be injected for enhanced oil recovery, in a niche that mixes climate technology with fossil operations.

Programs affected and timing of DOE cancellations

Officials with the DOE said more than a quarter of the impacted awards — 26% — were officially completed in the window from Election Day to Inauguration Day. That timing is allowed under federal law, but it is frequently subject to extra scrutiny during transitions. The department has notified all recipients that they have 30 days to appeal.

Viewed alongside previous moves, the decision suggests a sweeping reordering of federal climate and manufacturing investments. In an earlier round, the Department of Energy canceled $3.7 billion in clean energy and industrial awards, while the Environmental Protection Agency quickly suspended contracts worth roughly $20 billion, agency statements and court filings said.

Partisan optics and messaging around the decision

Russell Vought, the director of the Office of Management and Budget, called particular attention to the cancellations in a post on Twitter and emphasized projects in 16 states that supported Kamala Harris for president in 2020. His post cast the decision as a reversal of what he described as the Left’s focus on climate. Of particular interest to analysts were the Republican-leaning states that his list left out but which have nevertheless been found to be impacted — reinforcing a sense among some that blue states are being whacked.

The political motivation behind that backdrop is hard to miss — minority whip Steny Hoyer all but accused the House leadership of crafting this bill as a way to score cheap political points, rather than make good policy decisions.

That politicized background has been clear in other ways too: An internal DOE guidance document obtained by multiple news outlets reportedly instructed department staffers last month not to use terms like “climate change” and “emissions” when they were corresponding with the White House. The change in tone came as the administration also began reversing its predecessor’s funding for cutting-edge climate science monitoring programs through networks such as NASA and NOAA.

Legal challenges and market fallout from reversals

Expect litigation. Recipients of similar reversals at other agencies have already challenged those actions in court. In at least one high-profile case, a federal district court called EPA cancellations “arbitrary and capricious,” and on appeal the courts ultimately stood on the side of the government, finding that terminations had been within accepted practice for contract and grants management. That divided record suggests outcomes could turn on program-specific language and each award.

For businesses, the immediate threat is funding. Most of these projects are counting on federal dollars to trigger private capital, lower the risk in first-of-a-kind deployments or satisfy a lender’s demands. The cancellations will send shock waves through supply chains, from manufacturers of electrolyzers and heat pumps to engineering firms and building trades.

Jobs and climate stakes tied to hubs and DAC cuts

DOE has previously estimated that the hydrogen hubs themselves could produce tens of thousands of jobs in both construction and operations, as well as add demand for steel, concrete and pipelines. Pilots of direct air capture were meant to demonstrate at a commercial scale and prove how much it costs to operate the systems while establishing monitoring and storage protocols regulated federally or by the states.

Taking these awards away also risks taking the wind from the sails of a growing momentum toward net‑zero targets established by many states and large corporates.

It also prolongs grid modernization and industrial retrofits that could reduce emissions from cement, chemicals, power generation and heavy transport — sectors that are the most difficult to decarbonize without public support for pioneering efforts.

What to watch next as appeals and reviews unfold

In the short term, keep an eye on the 30‑day window for appeal and whether DOE carves out exceptions or re‑competes projects following this next round under modified criteria. State energy offices could try to backfill some funding with bonds or climate trust mechanisms, but many megaprojects were scoped around federal cost shares that are hard to replace.

Congressional oversight, potential rescissions and any project-by-project renegotiations will influence the final total. For now, markets are getting a clear signal: the federal government is reassessing how it spends money on clean energy and blue-state projects, to a large degree hydrogen hubs and carbon removal pilots — are in the crosshairs.