The first full agenda for Disrupt 2025’s new Going Public Stage is live, and it reads like a masterclass for founders charting a course from late-stage growth to IPO readiness to strategic exits. The list includes Zoom founder and CEO Eric Yuan, Emergence general partner Santi Subotovsky, Andreessen Horowitz general partner David George, CapitalG partner Jane Alexander, Premise co-founder Vanessa Larco, Nextdoor CEO Nirav Tolia, Chime co-founder and CEO Chris Britt, Sapphire Ventures co-founder Jai Das and Renegade Partners co-founder Roseanne Wincek. The attention is practical: actual metrics, investor expectations and what it takes to creating a second act when you haven’t lost the first.

Why a “Going Public” track now

Two rough years later, the public markets are tentatively reviving for high-quality issuers. Renaissance Capital and EY’s Global IPO Trends have both pinpointed a significant uptick in 2024 with deal sizes consolidating around profitable or near-profitable tech names and a tighter bar on governance. The result: companies can remain private longer, but the journey to becoming a public company requires greater discipline and a clearer path to durable cash flow.

That’s the very terrain that this stage takes on — how to overcome smaller windows, how to leverage secondary markets effectively, how to prepare for scrutiny around unit economics, and how to avoid common pitfalls in S-1 storytelling, accounting controls, and investor relations. Your hosts will hear what’s changed, what hasn’t and where the next set of opportunities is likely to appear.

Sessions to watch

David George, a general partner at Andreessen Horowitz, jumps in with a candid view of late-stage capital in a time of tighter money and loftier expectations. Look for a breakdown of how growth investors are underwriting risk right now, from Rule of 40 thresholds to payback periods and gross-margin profiles, plus actionable insight on how to use tender offers, structured secondaries and the like to balance your employees’ need for liquid reserves against your startup’s long-term health.

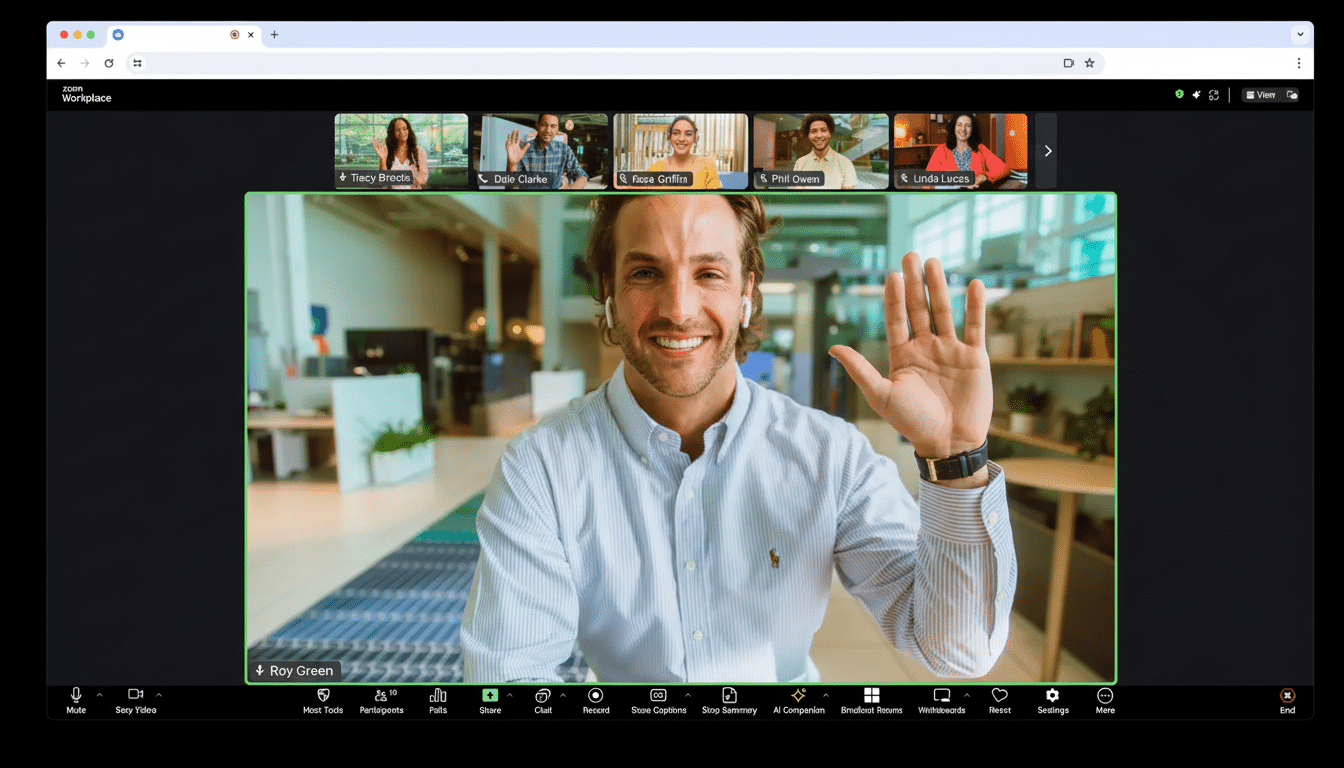

Eric Yuan (Zoom) joins Santi Subotovsky (Emergence) to unpack what comes after the breakout moment. Zoom’s own growth — into Phone, Contact Center and AI-measured productivity, from mere meetings— provides a blueprint to not become a one-hit wonder. They will go deep on when to diversify product lines, how to maintain velocity at scale, and what investors look for in a “second act,” like net dollar retention, attach rates, and enterprise penetration.

The way companies sell is being rewritten by AI, and a panel of Jane Alexander (CapitalG), Vanessa Larco (Premise) and Nirav Tolia (Nextdoor) are digging into what’s working versus hype.

Anticipate tough examples I’ve heard from you on: AI assisted prospecting that speeds sales cycle LLM enabled support that lifts CSAT without eroding trust Measurement frameworks to see the lift (pipeline quality, conversion rates and fully loaded CAC) McKinsey and BCG studies have shown double-digit productivity gains from AI in sales and service — this session is about operationalizing those gains while keeping data security and model governance stringent.

Chime CEO and founder Chris Britt, a fintech veteran, brings a playbook for scaling with discipline in a regulated category. Discussion on deck: how to maintain growth while reining in risk controls, creating durable revenue streams that transcend rate cycles, and bracing for public-market scrutiny of interchange economics and fraud loss rates. Think war stories, the kind of operating detail that doesn’t make into glossy pitch decks.

On exits, Jai Das (Sapphire Ventures) and Roseanne Wincek (Renegade Partners) weigh paths: IPO, M&A or stay private longer. The panel will map on to decision criteria founders actually use like revenue scale and durability (often $200M+ ARR for IPO candidates), GAAP vs non-GAAP profitability, customer concentration, and internal-readiness markers such as audit cadence and SOX preparedness. They will also talk about the increasingly active role of strategic acquirers and how to prepare an M&A-ready data room long before you need one.

What founders get to keep

Attendees will hopefully walk away with a list of things to do over the next 6–18 months: tightening unit economics and cohort visibility; establishing a repeatable GTM engine with productivity baselines; building a provable AI advantage that reduces cost to serve or increases lifetime value; and upgrading financial discipline — having a financial leader and a monthly close process, forecasting accuracy and audit readiness matter as much as growth rate once the window narrows.

Equally important is investor education. Seasoned CFOs will typically begin non-deal roadshows a year before they file, pressure-testing the narrative with crossover funds and long-only institutions. PitchBook and Morgan Stanley have each stressed the importance of building relationships early, in order to ensure that price discovery is eased and listing volatility is minimised.

The bigger picture

The Going Public Stage is not just about ringing the bell — it’s about creating strong, compounding companies that work under the public eye. It is an agenda that mixes candor with playbooks that executives and investors can take to Monday morning and thrive — or at least survive. This is as close to a field guide as you’ll get for founders thinking about when and how they should step out on the public stage.