The full Disrupt 2025 breakout agenda is now live, and it’s the most operator-heavy roster we’ve ever hosted. Over 200 intimate sessions, founders and builders will receive hands-on playbooks for AI agents in production, capital-efficient growth, M&A readiness, deep tech translation, and energy systems powering AI’s scale. Unlike the mainstage talks, these rooms are here to solve very specific problems — ranging from trimming cycle time in the SDLC to packaging an acquisition offer that actually closes.

AI and Engineering at the Helm of Disrupt 2025

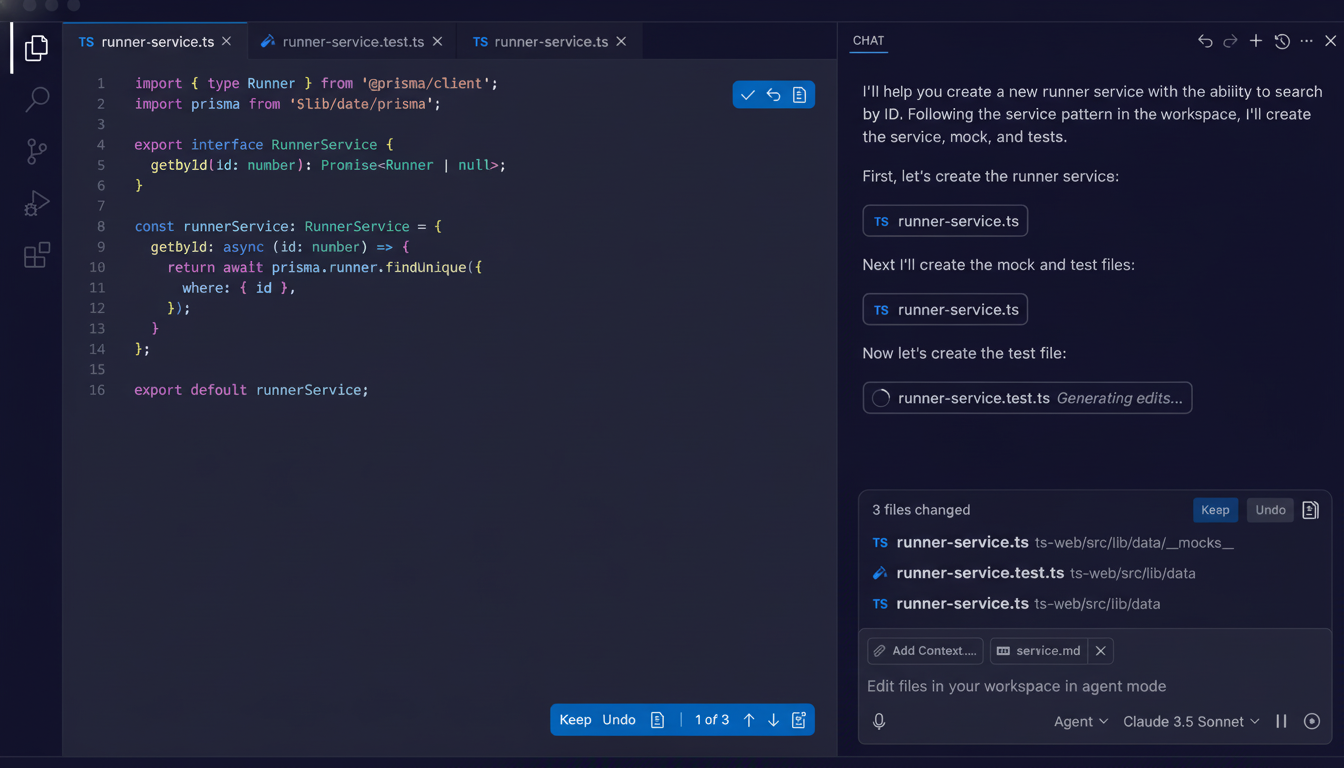

Practical AI is the common thread. GitHub Copilot’s Tim Rogers will explore patterns for agents and copilots in the software development life cycle — eliminating toil, accelerating code reviews, and preserving quality. GitHub has found in controlled studies that developers complete some tasks more quickly with copilots, and Stack Overflow’s latest developer survey finds most engineers are now piloting AI tooling on the job. Anticipate real workflows, not just demos.

Anmol Rastogi, the product lead at Amazon Business, and Microsoft’s Anjali Mann will chart out where agents shine today — customer support, operations, sales enablement — and what will continue to require human oversight. Engineering-first founders from Factory, Fireworks AI (disclosure: we’re pals), and Runlayer will discuss how tech CEOs strike a balance between shipping velocity and scalable org design — a favorite topic of Pinterest’s CTO Matt Madrigal and advisor Meghana Dhar — on creating AI experiences that users actually love.

Capital-efficient fundraising and M&A strategies

A number of sessions focus on doing more with less. A tactical workshop on capital efficiency will address how to find your first ideal customer profile, land lighthouse accounts, and fund early growth with revenue — an antidote to dilutive rounds. A hands-on fundraising teardown with a seasoned pitch analyst will emphasize story arc, proof points, data room hygiene, and outreach sequencing.

On the buy side, Aklil Ibssa of Coinbase and Yonas Beshawred of StarSling will share a behind-the-scenes look at M&A readiness — everything from financials to integration planning.

With exit windows in rotation, founders have to prepare months in advance. Family offices also receive their overdue airtime: Members from Paris-Roubaix Group, 5840 Holdings, I.D.I.T. Family Office, and Founders Bay will demystify mandates and the pacing of their diligence. That is important because family offices have become more active in direct venture deals, according to multiple industry surveys.

Corporate venture is also taking off. TDK Ventures president Nicolas Sauvage will discuss how to find the minority of CVCs that move fast yet still add strategic and financial benefit. CB Insights has monitored corporate investors who have had their hands in a large portion of global venture deals over the past handful of years, but it’s been an uneven ride for founders; in this session we aim to separate the signal from the noise.

Turning AI into real-world workflows that deliver

Some of the founder-friendliest content addresses “boring” but profitable workflows. Leaders from tkxel, Quickbase, and Signal will present on how to identify hidden pain points in daily processes and productize them into sticky software with a clear payback. It is the wedge strategy, and it’s the quiet force behind many breakout B2B companies.

Max AI’s Zubair Ahsan, Kindred Ventures’ Kanyi Maqubela, and Assured Health’s Varun Krishnamurthy will discuss post-scribe clinical workflows — from intake and credentialing to billing and care coordination — as providers scale their adoption of AI documentation. Brand and product leaders from EchoHer, Headspace, and Rain Capital will take on authenticity in feeds choked with synthetic content, with strategies for signal, trust, and measurable lift. Get ready for references to fledgling guidance like the NIST AI Risk Management Framework as teams work to balance speed and safety.

From R&D to market in deep tech: a practical playbook

There’s a full treatment of turning frontier science into venture-scale businesses. Founders and investors from Plaid Semiconductors, SirenOpt, Berkeley SkyDeck Fund & T‑Robotics will discuss a translational playbook: validating your markets, sequencing technical milestones, tapping into non-dilutive funding such as SBIR in order to de-risk before chasing big equity rounds. IndieBioSF investors at SOSV will go deeper on biomanufacturing, materials, energy, and health — a focus which seems less big bangy and more trained around cost curves and go-to-market timing.

Frontier risk and infrastructure also come front and center. Daniel Hendrycks from the Center for AI Safety joins us to present on evaluating and red-teaming high-impact systems. On the hardware and power front, Gigascale Capital’s Mike Schroepfer and Panthalassa’s Garth Sheldon-Coulson draw the links between AI’s compute appetite and clean power buildout. The International Energy Agency has sounded the alarm that data center electricity use is skyrocketing, making grid-aware deployment a board-level consideration for new AI-native startups.

Go-to-market storytelling and community building

The narrative becomes an APR-accruing asset this year. SISU founder Jenna Birch teams up with Kleiner Perkins’ Allie Cefalo and Darby PR’s Chantelle Darby to lay out an earned-owned-partner mix that propels a launch without burning cycles. Figure out your agent-product fit. For teams in pursuit of being the first to find it, leading warriors from Maket, Clyx, Blitzscaling Ventures, and Composio will demo live use cases in build tools, real estate, and social — and all the infrastructure decisions that turn novelty into daily utility.

How to get in the room and plan your sessions

These breakouts are first-come, first-served and open to all passholders, making the most tactical rooms likely to fill up soon. Whether you want to learn about shipping agent features, dial in your pitch, prepare for an acquisition, or translate lab work into a fundable plan, the agenda now allows you to plan out your day down to the session.

The thread that runs through the agenda is execution. Whether it’s a GitHub Copilot workflow that shaves down review time, a CVC term sheet that actually aligns incentives, or a deep-tech milestone plan that passes the investor filter, Disrupt’s breakouts are designed for founders who show up with a notebook and walk away with an action item.