Adult content creators are again finding their bank accounts shuttered and payment links severed, a trend that increasingly sweeps up other lawful businesses too. As financial firms recalibrate “risk,” creators and companies say the goalposts keep moving and the consequences are immediate: missed rent, stalled payroll, and lost customers.

How The Payment Stack Quietly Sets The Rules

When money moves online, it passes through a layered pipeline: platform marketplaces, payment processors, card networks, and banks on both sides of a transaction. Any link can refuse service, effectively cutting off revenue. Because terms of service and risk controls are mostly private and discretionary, a single “no” can become a hard stop for an entire livelihood.

- How The Payment Stack Quietly Sets The Rules

- Adult Platforms Face Shifting Lines in Payments

- Beyond Porn, Spillover Across Sectors Is Real

- Chargebacks Are The Rationale Data Is The Question

- Regulators Push Back But Ambiguity Remains

- The Human Cost and the Workarounds Creators Use

- What to Watch Next in Payments and Platform Policies

Card networks maintain broad brand-protection clauses, processors enforce prohibited-business lists that often go further than network rules, and banks apply their own anti-money-laundering and reputation screens. The result is a diffuse system of vetoes that rarely provides clear appeal or transparency.

Adult Platforms Face Shifting Lines in Payments

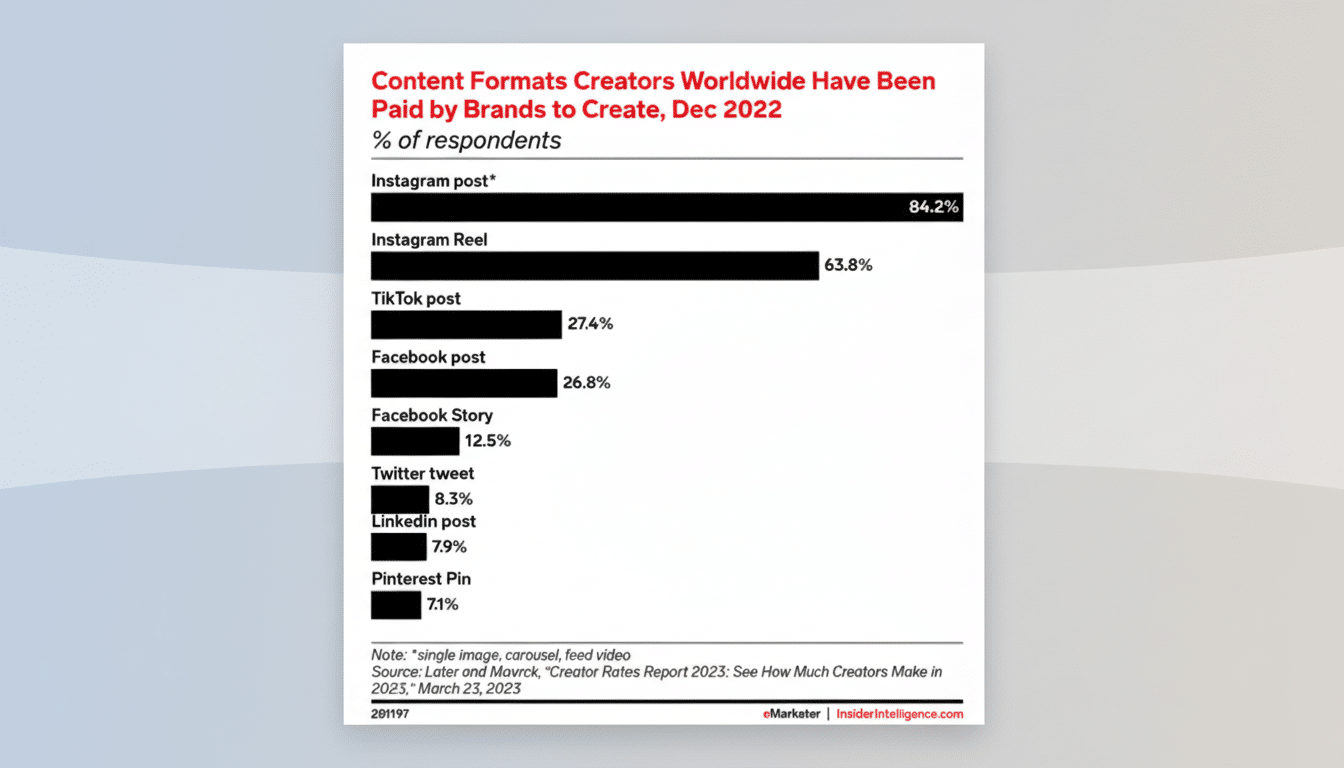

Adult creators say they are still the canaries in the coal mine. Marketplace operators report receiving contradictory guidance from processors and banks, prompting sudden policy changes or blanket bans that ripple down to individual accounts. Researchers at Dalhousie University who study platform governance note that vague standards and brand-safety language give gatekeepers wide latitude to act without public explanation.

Even mainstream platforms have trimmed or de-indexed adult content following pressure tied to payments. In past dustups, storefronts cited card brands or processors for tightening the spigot, while card brands publicly denied orchestrating the changes—illustrating how accountability disperses across the chain.

Beyond Porn, Spillover Across Sectors Is Real

What started with adult content now touches other sectors tagged as “high risk,” including firearms, tobacco, certain crypto businesses, and even some oil and gas vendors. Trade groups for these industries have protested account closures and service denials as politically motivated de-risking rather than case-by-case compliance decisions. High-profile account closures in the UK and the US—some later reversed—have reinforced fears that subjective reputation screens trump objective risk analysis.

The Free Speech Coalition, which represents the legal adult industry, has urged US lawmakers to establish due process, ban wholesale blacklists, and require individualized risk assessments. Similar concerns have surfaced from firearms and crypto organizations, which argue that lawful businesses are being boxed out of essential financial infrastructure.

Chargebacks Are The Rationale Data Is The Question

Payment companies frequently cite chargebacks to justify refusing adult accounts. But researchers at the University of Toronto say hard evidence that adult creators have systematically higher chargebacks is thin, especially as fraud tools grow more sophisticated. The Nilson Report estimates that card-not-present transactions account for more than 70% of global card-fraud losses, a cross-industry problem not unique to adult content.

Card brands tout AI-driven fraud controls and data-sharing arrangements that already flag outlier merchants. If those systems can isolate bad actors, creators ask, why are entire categories still blocked? For many, the answer appears to be brand risk, not fraud risk—a distinction that leaves lawful content at the mercy of opaque standards.

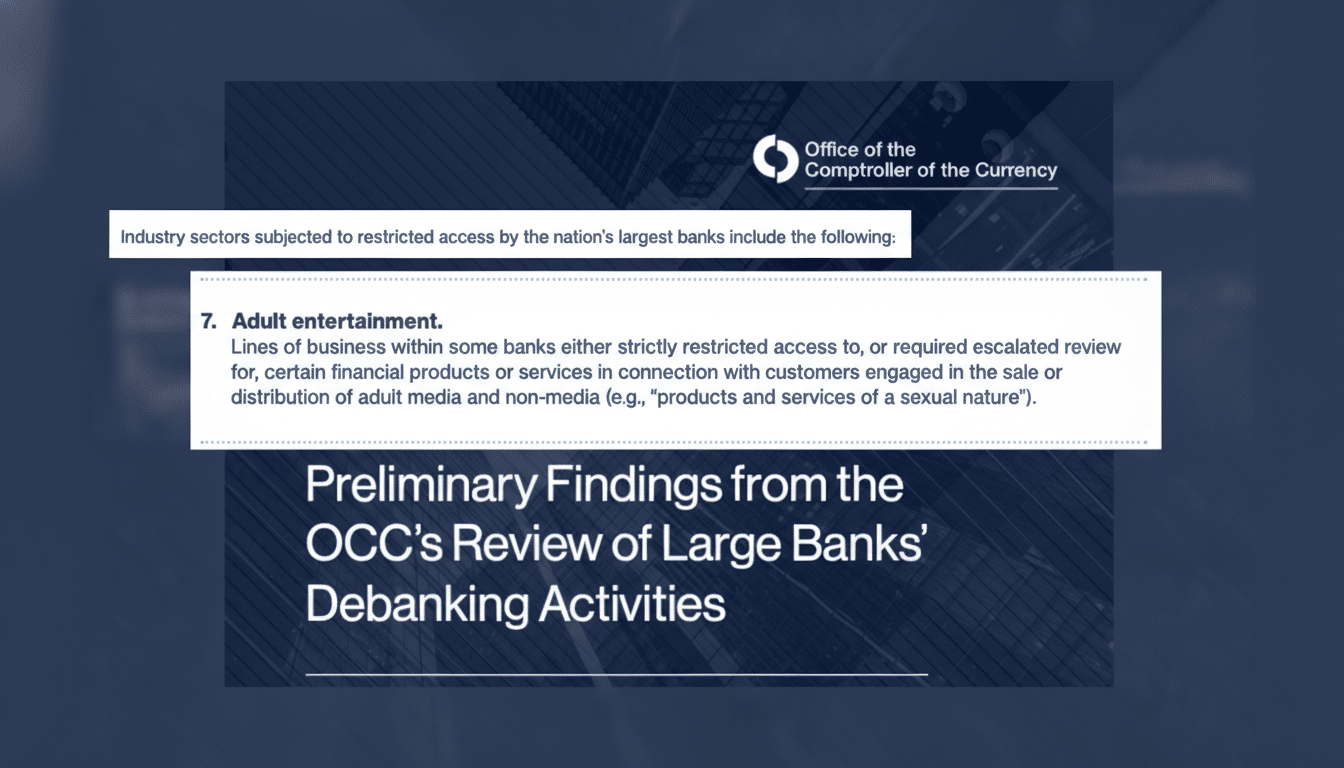

Regulators Push Back But Ambiguity Remains

US bank regulators have moved to distance supervision from “reputational risk” as a compliance metric, and policymakers have pressed agencies to scrutinize politically motivated debanking. Industry participants welcomed the shift, but say it hasn’t filtered down to day-to-day underwriting, which still relies on private policies and conservative risk appetites at card networks, processors, and banks.

Trade associations argue that clearer, technology-neutral standards would curb overreach while preserving anti-money-laundering obligations. Card brands, for their part, stress they don’t micromanage platform content decisions. Caught in the middle, creators and small platforms see a ruleset that is both diffuse and decisive—and nearly impossible to challenge.

The Human Cost and the Workarounds Creators Use

When accounts are shut, creators often migrate to “high-risk” processors that can charge fees well above mainstream rates—sometimes up to 15% compared to the typical 2.9% plus a small fixed fee. Others diversify to multiple processors, adopt instant payout apps, or explore crypto rails. Each workaround brings complexity, compliance hurdles, and new points of failure.

Startups have tried to build creator-led platforms with cooperative governance and tighter verification to reassure banks. Some have succeeded in securing limited banking relationships; many more have struggled once one upstream partner walks away. As a Dalhousie researcher put it, power in the payments stack flows upward: platforms can replace creators, processors can replace platforms, and banks can replace processors—creators cannot replace their bank overnight.

What to Watch Next in Payments and Platform Policies

Key signals will come from enforcement actions, whether regulators require individualized risk assessments in practice, and whether card networks publish clearer content and brand-safety thresholds. If the system rewards sweeping category bans, expect more lawful businesses to be de-risked out of existence. If standards become measurable and appealable, creators across sectors might finally get stable access to the financial plumbing they need to work.