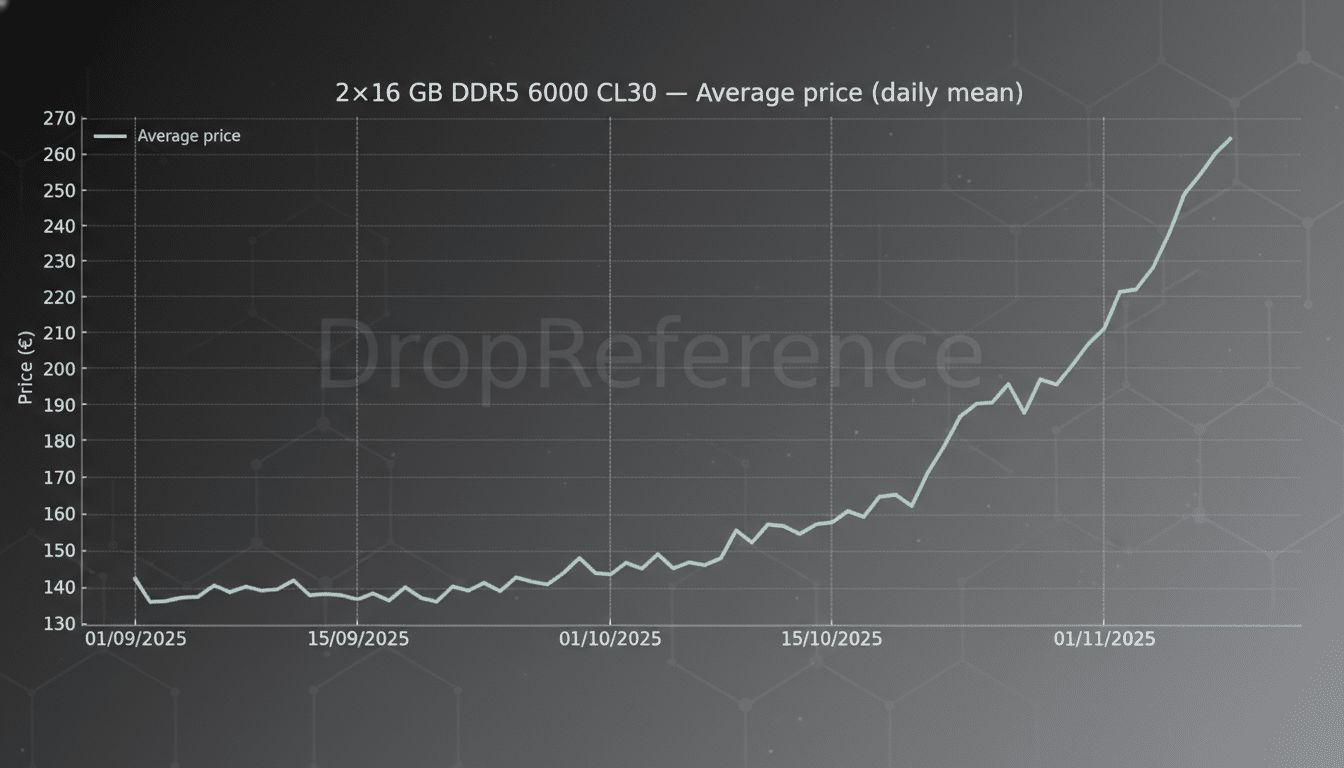

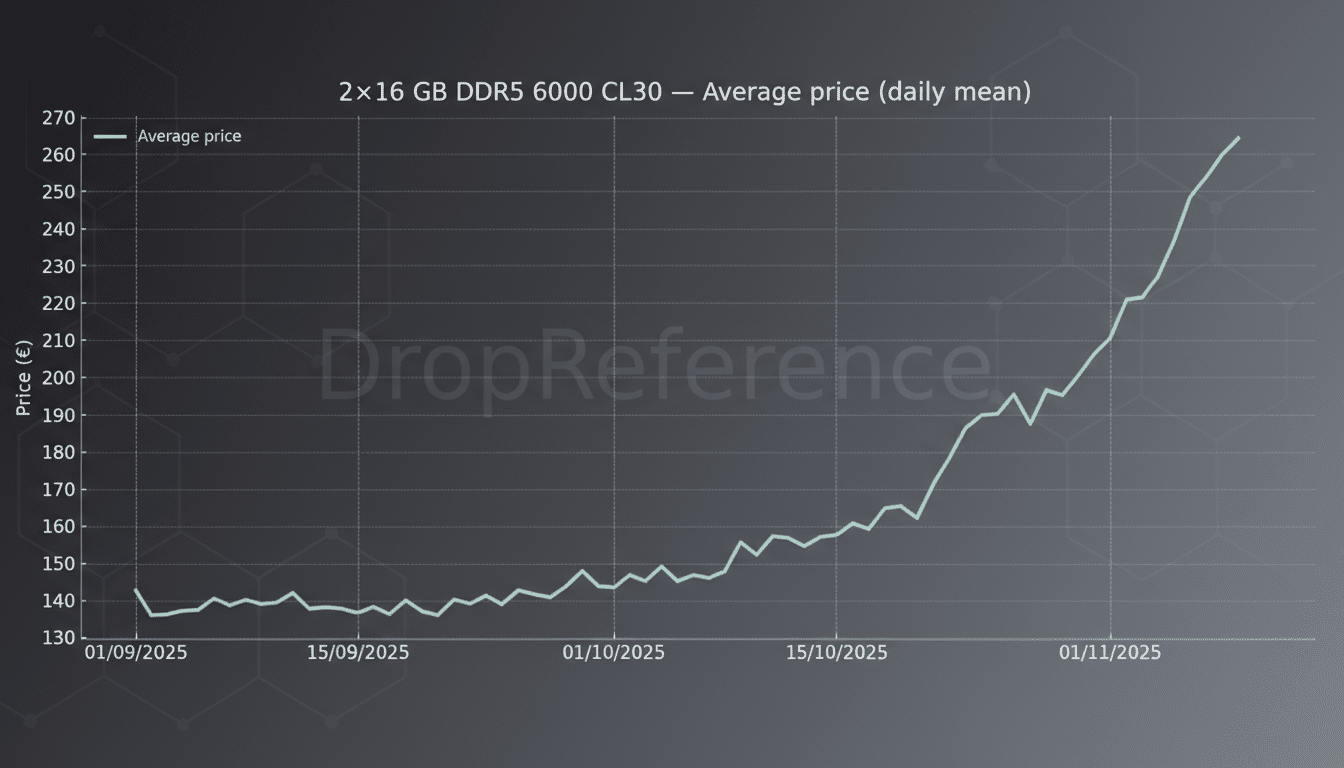

DDR5 memory pricing in Germany has finally hit a flat patch. After months of sharp increases, the retail market has settled, with most popular kits holding their ground and a few notable outliers edging lower. The reprieve is real, but the bigger question hanging over the PC component channel is whether this calm can survive the next supply squeeze.

Price tracking by 3DCenter shows the average sticker for mainstream DDR5 kits barely moved in recent weeks. Some models even dipped, including a 64GB 6,000 MT/s kit that slid from 699 euros to 596 euros, trimming nearly 15% off its peak. That’s a welcome change for builders who watched higher-speed, higher-capacity kits jump by triple-digit euros as supply tightened.

What The Latest DDR5 Price Tracking Shows In Germany

The German retail basket now reflects a plateau across 16GB and 32GB kits at 5,200 MT/s and above, while flagship bins remain volatile. According to 3DCenter’s running index, a handful of products still saw upticks of up to 10%, but the overall average was essentially unchanged. Put simply: the surge has stalled, but the ceiling didn’t crack.

Anecdotally, system integrators and DIY forums report improved day-to-day availability on popular 6,000–6,400 MT/s CL30–36 kits, with intermittent promos reappearing at major German e-tailers. The stabilization is most visible in configurations sweet-spotting gaming and creator builds—32GB at 6,000 MT/s—while ultra-fast or RGB-heavy kits still swing more widely.

Why Prices Paused Instead Of Falling Further

Three forces are helping hold the line. First, channel inventory has normalized after earlier shortages that pushed spot buys higher. Retailers appear to have secured enough volume to avoid constant repricing, and vendors are selectively using rebates to keep key SKUs attractive.

Second, demand in the DIY segment cooled after a rush of upgrades tied to new CPU platforms, taking some heat off day-to-day DRAM turns. When carts are lighter, price wars return—at least for a while. Third, currency and logistics pressures are less acute than during the last spike, giving distributors a little room to maneuver.

The Risks That Could Rekindle DDR5 Price Increases

None of this means the risk is gone. Analysts at TrendForce, which tracks DRAM contract and spot pricing, have repeatedly warned that wafer capacity is being pulled toward high-bandwidth memory and premium mobile parts. When foundries prioritize those lines, commodity DDR5 can tighten quickly, lifting average selling prices.

There is also a timing gap to watch: retail tags reflect the channel’s current inventory, but upstream contract prices often move first and filter down later. 3DCenter notes this lag can mask looming hikes. If suppliers keep production disciplined to protect margins, the next leg could be up rather than down.

On the demand side, servers remain a wild card. AI and memory-hungry enterprise deployments prefer higher-capacity DDR5 RDIMMs, but spillover affects the whole DRAM stack. Any renewed rush from data center buyers can pinch supply for consumer DIMMs and push German retail prices higher again.

What It Means For PC Builders And OEMs In Germany

For DIY shoppers, this window is an opportunity to capture mainstream performance at tolerable prices. The practical value sweet spot remains 32GB at 6,000 MT/s for modern desktop platforms; if you see pricing near recent lows, the risk of waiting may outweigh the potential savings. For heavy creators, a 64GB kit falling near the 600-euro mark is a notable improvement from peak levels.

OEMs and boutique builders still face a stretched bill of materials. Memory has taken a larger share of total system cost, particularly in laptops, where capacity bumps are non-negotiable. Stabilization helps with quoting and promotion planning, but sustained relief will require broader supply-side easing, not just temporary channel balance.

Outlook For DDR5 Pricing In Germany Over The Next Quarters

The market is pivoting from panic to patience, yet structural pressures haven’t vanished. Micron, SK Hynix, and Samsung have announced capacity expansions, but new fabs take years to ramp and won’t buffer near-term swings. Until additional output arrives—and as long as HBM remains the profit center—DDR5 pricing will likely oscillate in steps rather than trend down smoothly.

Bottom line: German DDR5 prices have stopped climbing and, in selective cases, retreated. Enjoy the breather, but don’t assume it’s permanent. If upstream contracts rise and enterprise demand tightens the screws, retail tags could follow. Savvy buyers should track 3DCenter’s basket, watch retailer promos, and be ready to act when a proven kit hits a genuine low.