The data center spent years in the background — functional and largely unnoticed other than as an essential public building like a central library or post office. That all began to change as artificial intelligence supercharged the demand for compute. Server farms have taken center stage in corporate boardrooms and city halls, utility hearings and neighborhood meetings, stripping away the more boring trappings of modern capitalism to reveal dynamics that are usually hidden.

AI Spending Makes Server Farms Front-Page News

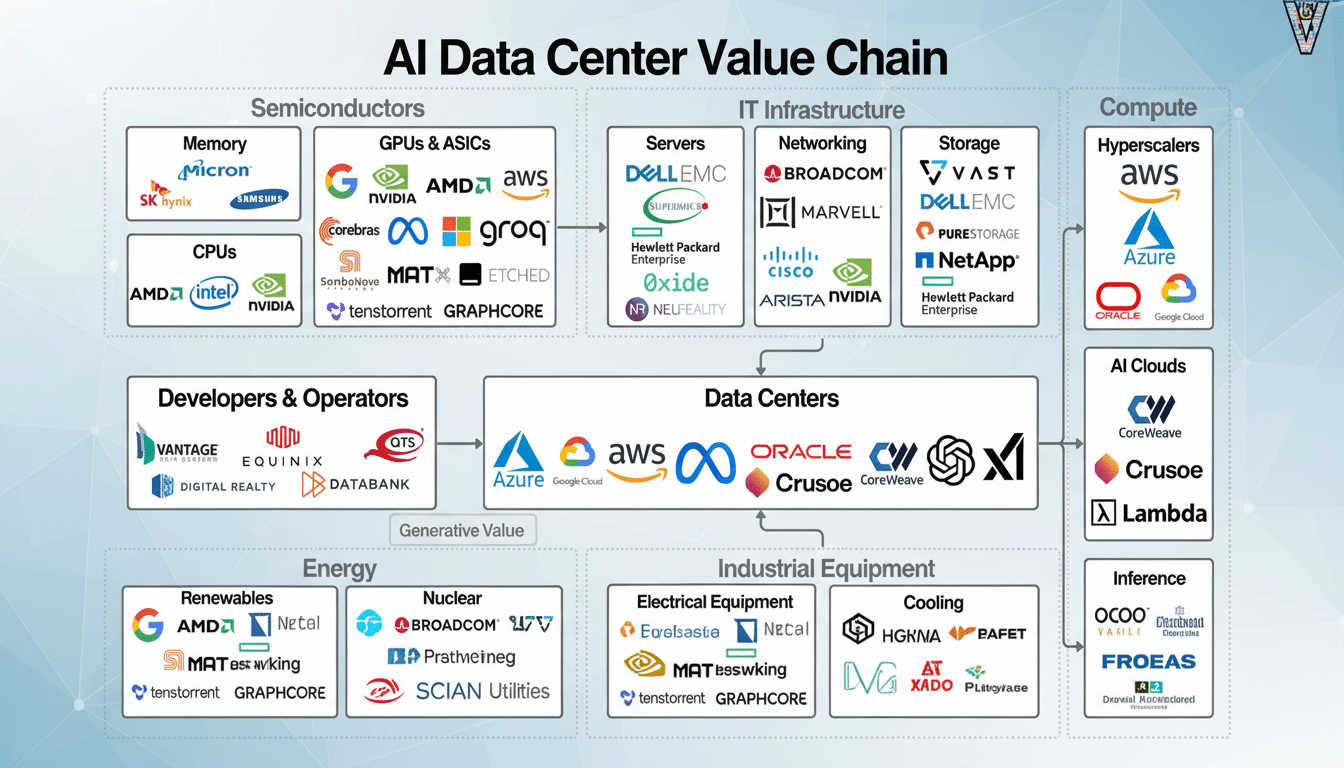

Hyperscalers have unleashed record capital spending on AI infrastructure, a lot of which is landing in new and expanded data centers. Company earnings calls signal tens of billions of dollars each quarter heading into campuses and power-hungry GPU clusters. The number of hyperscale data centers worldwide has passed 1,000 according to Synergy Research in a milestone that illustrates how fast the supply has raced to keep up with demand.

Here in the United States, we can quantify the construction boom. Outlays associated with data center projects have more than tripled since 2021, according to construction data from the U.S. Census Bureau, remaking industrial real estate from Northern Virginia to Central Texas. Brokers who only a few years ago were jockeying over warehouse space now speak in megawatts, liquid cooling and substation lead times.

Power, Water and Permits Are Now the Bottleneck

The grid is the new bottleneck. The International Energy Agency projects that global electricity demand from data centers could double mid-decade, driven by AI training and inference. In the United States, utility planners in fast-growing areas are sounding the alarm that multi-gigawatt load requests associated with data centers are coming multiple years ahead of when they can build the needed transmission.

Examples abound. Dominion Energy’s planning filings in the state of Virginia highlight unprecedented data center-driven load growth in “Data Center Alley.” In Santa Clara, Silicon Valley Power has temporarily restricted new large connections as capacity dwindles. According to Mr. Reynolds, data centers already represent up to one fifth of the country’s electricity use, leading to tightened connection rules. And Lawrence Berkeley National Laboratory points out that the nation’s interconnection queues have expanded to thousands of gigawatts of generation and storage, which underlies the broader infrastructure squeeze.

Water is making its way up the agenda, too. Heat-intensive AI racks send operators running toward liquid cooling and shine a light on water use in arid regions. The tussle that took place over Google’s operations in The Dalles, Ore., was a prelude: Communities want to know more about water rights, reuse and seasonal operations — and regulators are listening.

Local Backlash Becomes a Broader Policy Fight

Resistance has organized as the campuses grow and impose more into neighborhoods. Years of public hearings, protests and lawsuits surrounded the Prince William County “Digital Gateway” in Virginia. And in the water-stressed communities of the Southwest, they have pushed for moratoriums and more stringent environmental reviews. Utility commissions in states including Virginia and Georgia have received testimony from the public associating higher bills with demand for data centers and new generation.

Advocacy groups offer various lenses through which to view the conflict: land use, noise, backup emissions from diesel generators, water and the climate implications of a digital footprint that is expanding at breakneck pace. Industry groups respond with jobs, tax revenue and investments in clean energy. The trade-off has already become an issue in some local races, indicating just how mainstream the data center debate has grown.

Operators Race for Efficiency and Clean Power

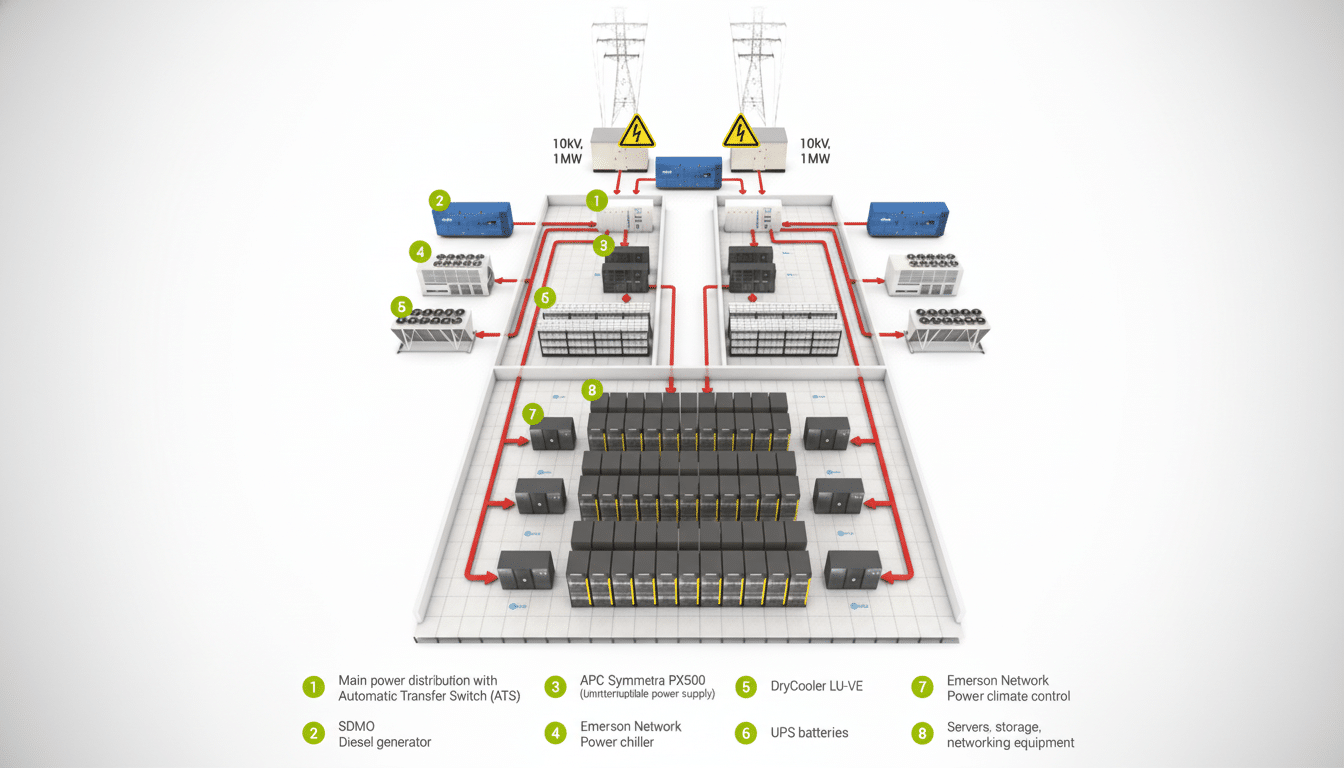

To keep constructing amid community opposition, operators are adjusting designs. Higher-density racks, direct-to-chip liquid cooling and waste heat reuse are transitioning from pilots to practice. At Meta’s Odense campus in Denmark, the company channels surplus heat into district heating. Industrywide PUE has come together toward the low 1.2s at scale, based on Uptime Institute data, and next-gen AI halls are aiming for even lower effective energy overhead.

On the supply side, there is a growing clean energy toolkit. Google’s 24/7 carbon-free effort added enhanced geothermal for Fervo Energy. Microsoft inked nuclear-backed power deals with Constellation and even propped up a nuclear technology team to investigate long-duration, 24/7 solutions. Equinix and others are testing using hydrogen fuel cells for backup instead of diesel. The grid also faces pressure from corporate buyers of power: long-term contracts that guarantee they get to underwrite new transmission and storage.

What to Watch Next in Data Centers and AI Infrastructure

Policy is moving. A new transmission planning rule from the Federal Energy Regulatory Commission seeks to push longer-term grid planning that takes into account big loads like data centers. Cities, in the meantime, are revising zoning to cluster facilities close to appropriate substations and require proposals for noise, water and heat reuse. Look for more “behind-the-meter” generation, like battery storage and in some places gas peakers paired with offsets, as stopgaps to build lines.

Geography will shift. Developers are branching out beyond the familiar hubs to locations where power is cheap and cooler weather can help utilization: The Nordics, Quebec and Ontario, other parts of Spain and Portugal, regions in the United States that have built up their renewable sources. Heat reuse incentives in Europe and North America could nudge the balance toward co-location with district heating.

Finally, AI-era metrics will matter. Look for “tokens per joule” and carbon-aware scheduling to become commonly reported metrics, along with PUE. As the IEA, EPA, and Green Software Foundation demand better accounting, the operators who are able to demonstrate lower total energy and water per unit of work will get permits faster — and likely get capital cheaper.

The upshot: data centers aren’t invisible anymore. They are the human face of the AI economy, remaking power markets, tax bases and local politics. Those who can do so with ever more agility, at a lower cost of energy and water, from cleaner electrons and with social license in communities where the next wave of compute is located — will win.