Luminar’s long-promised collaboration with Volvo was going to be the venture that validated automotive lidar at scale. Instead, as court filings now reveal, it proved to be the company’s downfall: a long chain of missed milestones, slashed volumes and liquidity that collapsed into Chapter 11.

How a Star Deal Became a Liability for Luminar

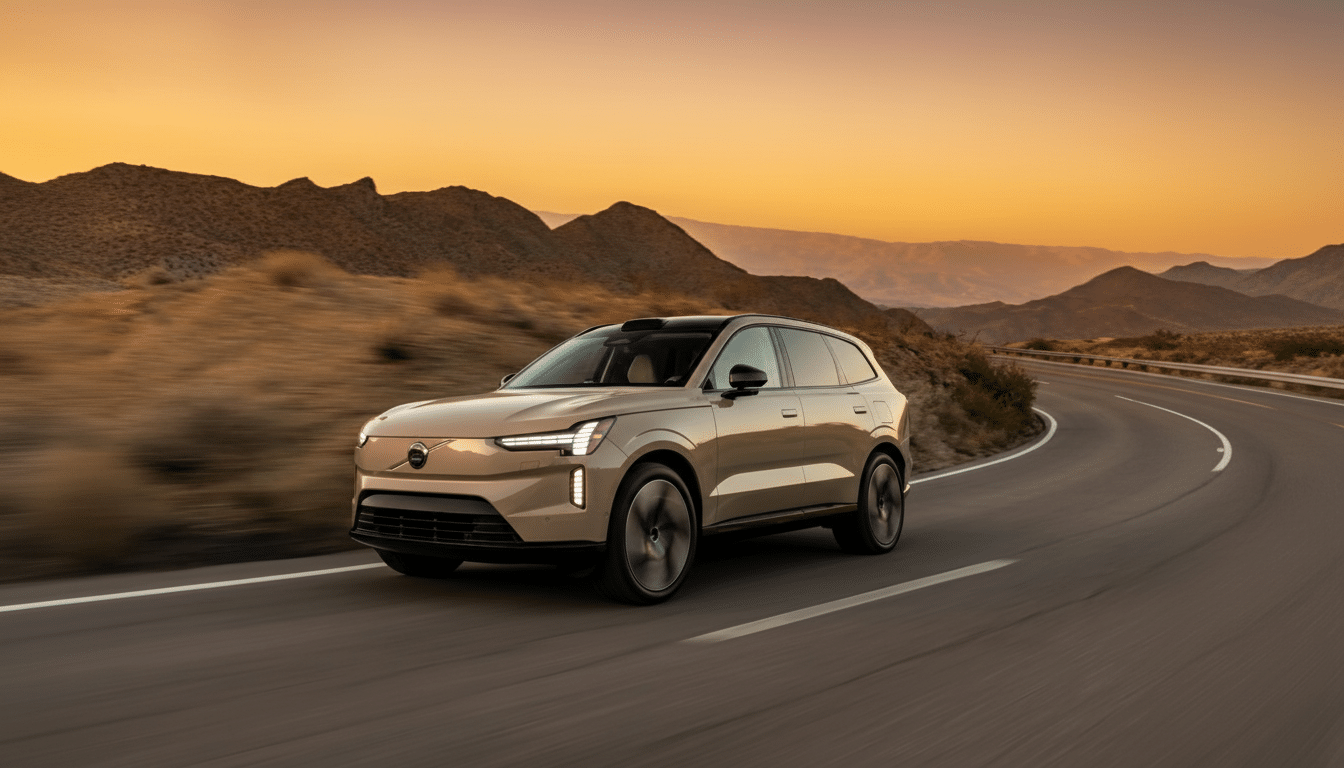

Luminar heavily built to meet Volvo’s growing predictions, Chief Restructuring Officer Robin Chiu said in a statement. The lidar maker expanded a factory in Monterrey, Mexico and invested almost $200 million in tooling up its Iris sensor for Volvo’s EX90 SUV, making a bet that lifetime volumes — eventually boosted to an estimated 1.1 million units — would come through.

The wager was contingent on Volvo’s software being prepared to access the Iris perception capabilities. It wasn’t. The carmaker delayed the EX90’s deployment to do more software validation, and Luminar says Volvo then slashed projected Iris volumes by 75 percent. Yet despite those warning signs, Volvo allegedly reaffirmed the overall lifetime commitment, which prompted Luminar to continue outspending where it should have stopped to make sense of the higher ceiling.

Then came a decisive blow. Volvo removed lidar as a standard feature on the EX90 and temporarily stopped using it in further models as a cost-management measure, taking the planned lifetime volumes down by about 90 percent, destroying Luminar’s ramp economics, according to Chiu.

Assumptions Versus Orders in Automotive Lidar Supply

The bankruptcy filing highlights a structural risk in advanced automotive supply: suppliers make investments based on “lifetime volume” planning assumptions rather than firm purchase orders. These examples are extremely sensitive to take rates at optional feature launch. Even a small consumer take rate miss can cannibalize unit economics and cash flow when one is serving capital-intensive hardware.

And for lidar, the strain is magnified by automakers’ relentless bill-of-materials targets and a requirement to validate sensors against driver-assistance stacks that shift as they evolve. Lidar hardware may be production-ready many months or years ahead of when the vehicle’s software can realize its advantages, so suppliers risk being caught in delays and redesigns well outside their control.

Collateral Damage Beyond Volvo as Programs Slip Away

As Volvo floundered, other major programs slipped away. Polestar scrapped its inclusion because “the car’s software couldn’t ultimately utilize the features,” Chiu wrote. Mercedes-Benz had also cut its Iris purchase order after Luminar “did not meet ambitious requirements,” ending a second marquee avenue to production. A separate panel on next-generation hardware at Mercedes did not turn into a live program at the time of filing.

Luminar had pinned its identity on automotive rather than chasing nearer-term deployments in defense, robotics or industrial automation that some rivals would use to smooth their revenues. A last-ditch attempt to diversify — underscored by a deal with Caterpillar — could not make up for the scale lost as the flagship car programs unraveled. The leadership vacuum widened when the company’s founder and chief executive, Austin Russell, stepped down in response to a board ethics inquiry.

Cash Burn Meets Reality Amid Contract Dispute With Volvo

With projections dwindling, Luminar slashed expenses aggressively. Blaming the federal government for tightening oversight regimes, a “lack of competitive tariff protection” and an inability to secure a buyer that would have allowed it to survive as a going concern, the company cut its workforce by 20 percent, outsourced more manufacturing and restructured operations, the filings say. It even attempted to sell lidar headed for Volvo into neighboring markets, hoping to recoup sunk costs. The very public dispute with Volvo then only increased the pain by spooking other buyers and partners, squeezing liquidity just as the factory ramp needed cash.

With the relationship completely broken, Luminar announced Volvo was in breach of contract and cut off deliveries. Volvo canceled the deal in response. With its lifeblood gone, Luminar took its case to the courts, seeking approval to sell a semiconductor subsidiary to Quantum Computing, Inc. for $110 million and to hire Jefferies as an investment banker to run a broader sale process of the lidar assets.

Interest surfaced quickly. The company received unsolicited requests, including one from a new AI startup that Russell is involved with, so the technology had value; it was just that the go-to-market strategy hadn’t worked out.

Lessons for the Lidar Race From Luminar’s Bankruptcy

Luminar’s downfall provides a telling case study in concentration risk and timing mismatch. Creating an automotive-grade supply chain before getting hard orders can only be done if a supplier is either well-diversified across OEMs and segments, or shielded by the most robust commercial terms. Luminar had neither. When a customer transitioned from regular fit to optional — and another waltzed out the door — there were no levers of volume for it to pull.

The rest of the lidar industry has already experienced consolidation and a few flameouts, from public peers merging to earlier entrants going bankrupt. First-movers are likely to be those that win across multiple programs, hedge with non-automotive revenue and match hardware roadmaps to software readiness inside the vehicle. But for Luminar, the technology may still have a home under new ownership. But the fact of its bankruptcy signals that in automotive, the space between what’s promised and what’s booked can be the most dangerous territory.