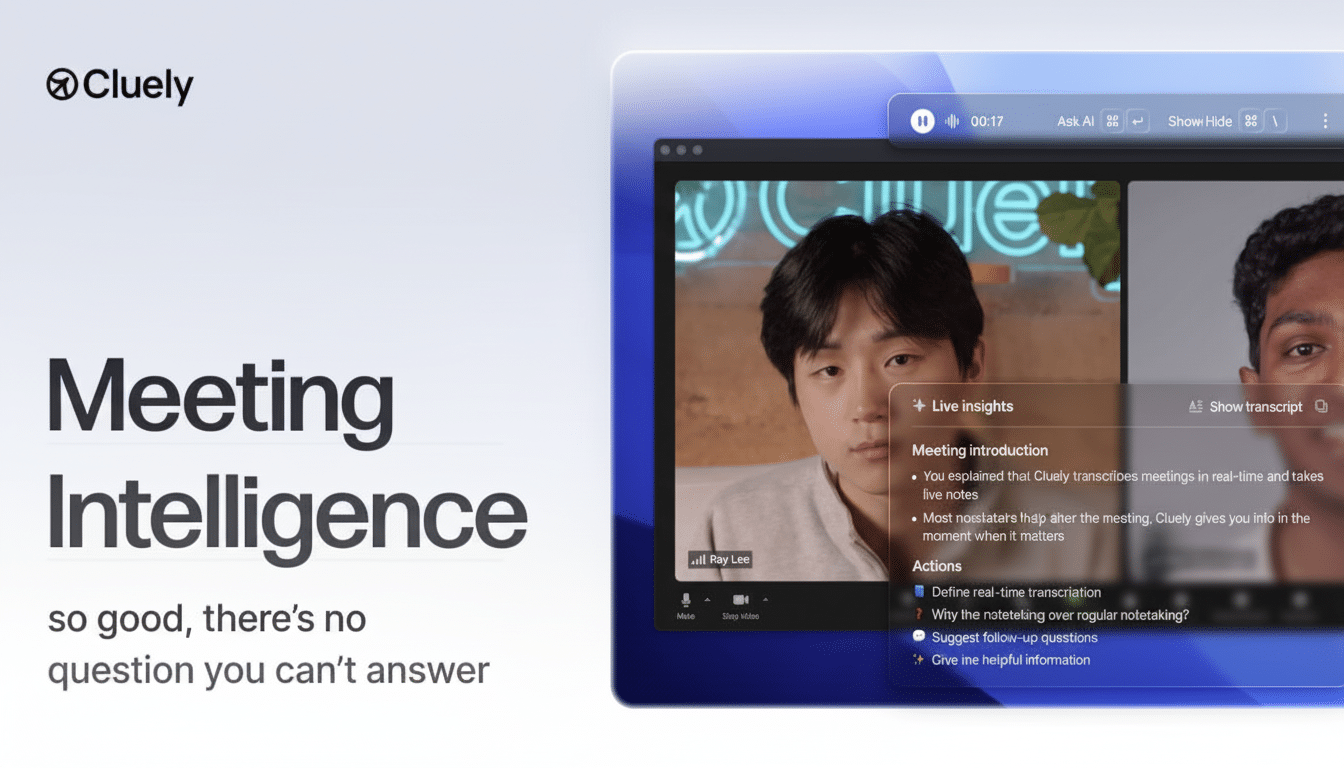

Roy Lee is rebooting the story of his startup Cluely to reflect a move from getting attention to rolling ideas out. Once the founder of viral moments, he now says loud buzz can open doors but not keep customers in the room—which rings particularly true as Cluely repositions its product around an AI assistant for meetings.

Lee’s trajectory has been anything but stealthy. First he made headlines for building a tool to help candidates game coding interviews and then rode the wave of controversy with Cluely’s early “cheat on everything” positioning. The stunts created huge awareness and drew in funnel-filling, generating news that helped the company raise a reported $15 million Series A from Andreessen Horowitz, but now Lee admits brand heat alone doesn’t drive long-term revenue or retention.

From Shock Marketing to a Product-First Focus

Cluely swung widely, pitching a Swiss Army knife that could whisper answers across sales, support, and tutoring. Its most recent focus has been to become an AI note taker for meetings, highlighting tools like summaries and action item tracking that it says push actions into email. The action hints at a more refined ideal customer profile and an effort to demonstrate crystalline time-to-value.

Lee has swung the pendulum toward the side of opacity when it comes to go-to-market details, and won’t share revenue or cohort metrics—a significant departure from the “show everything” playbook seen in the AI boom. The subtext will be no stranger to founders: Virality is a trial, not a trophy. The only thing that matters is if users arrive back every week, if they convert to paid, and if they expand within accounts.

A Bullish Meeting AI Market Pushes The Envelope

Cluely’s shiny new lane is filled with incumbents and bundles of platforms. Otter.ai, Fireflies.ai, Avoma, Supernormal, and Fathom have spent years optimizing transcription, action items, and CRM syncs. In the meantime, Microsoft bakes Copilot into Teams; Google lathers Gemini into Workspace; and Zoom serves up AI Companion—all raising the bar on expectations around note-taking being accurate, secure, and a native part of the environment.

It’s a headwind for independent tools, that trend of bundling. Gartner predicts that generative AI will be adopted more quickly for enterprise software, and platform providers are racing to make “good enough” AI a standard feature. To succeed, stand-alone apps have to beat out on accuracy, privacy, and results—as in less hallucinating, enterprise-proof compliance, and measured uplift for pipelines or CSAT.

Why Attention Alone Does Not Translate Into Retention

The growth math is unforgiving. OpenView’s product benchmarks have always indicated that the free-to-paid conversion rate for self-serve tools lands in the low single digits—typically around 2–5%. KeyBanc’s annual SaaS survey has a median gross dollar-based retention at about 90%, with net dollar-based retention of around 105–110% for steady cloud companies. Or put another way, to turn viral spikes into a business, start-ups need to be able to convert and retain customers at scale—even if customer acquisition costs go up.

Recent history underscores the point. Clubhouse racked up eye-popping sign-ups but had trouble maintaining engagement after the novelty wore off and platform features closed in. In contrast, products like Notion and Figma sold compounding retention through collaboration, templates, and ecosystems; Slack’s bottoms-up growth was a masterclass in embedding within the daily flow of work. In revtech, Gong and Chorus (ZoomInfo) took seats by correlating insights to recorded business outcomes.

Why Lee’s Revenue Silence Matters for Cluely

Lee now says he’s no longer releasing financials—a contrary position to a recent trend of fast-growing AI startups heralding ARR and month-over-month gains. The reluctance is understandable: public numbers lead to comparison traps, and early revenue can be lumpy. Investors are increasingly attracted to durability metrics: retention by cohort, expansion in seats, payback under 12 months, and evidence that AI-powered features drive repeatable productivity gains.

Yet, transparency has become a signaling engine in AI. Companies like a16z have publicly defended this position, saying attention can be turned into revenue when onboarding is crisp and the product eliminates drudgery in minutes as opposed to weeks. Generative AI, McKinsey has estimated, could deliver trillions in value when applied to high-friction workflows. Meeting automation fits that thesis, but only if it works and teams feel the lift in follow-through, not just the wow of a demo.

What Cluely Will Need to Prove Next to Win Buyers

To support the pivot, Cluely requires evidence that its assistant is more than just a summarizer.

Buyers will seek out higher action completion rates, faster sales cycles delivered by immediate follow-ups, and fewer support escalations due to clarity on what the next step is. “CRM and ticketing integrations, SOC 2 compliance, and role-based controls will be table stakes for bigger customers.”

Just as important is creating a defensible wedge. That could mean by function—sales, success, or education, for example—where domain models can be trained and outcomes measured. Or it might involve concentrating on consumer-first polish that graduates to team plans, a strategy that’s succeeded for products with strong personal utility. Pricing needs to reflect the new normal: with AI assistance increasingly commoditized, stand-alone products need to deliver ROI fast.

Lee’s acknowledgment of virality as insufficient is more a reality check coursing through AI software than a retreat. Attention powers the trial; retention fuels the map. The next chapter of Cluely, far from being translated into views, is that of cohorts that cling, expand, and vouch for the assistant—making sure every meeting becomes decisions made and work advanced.