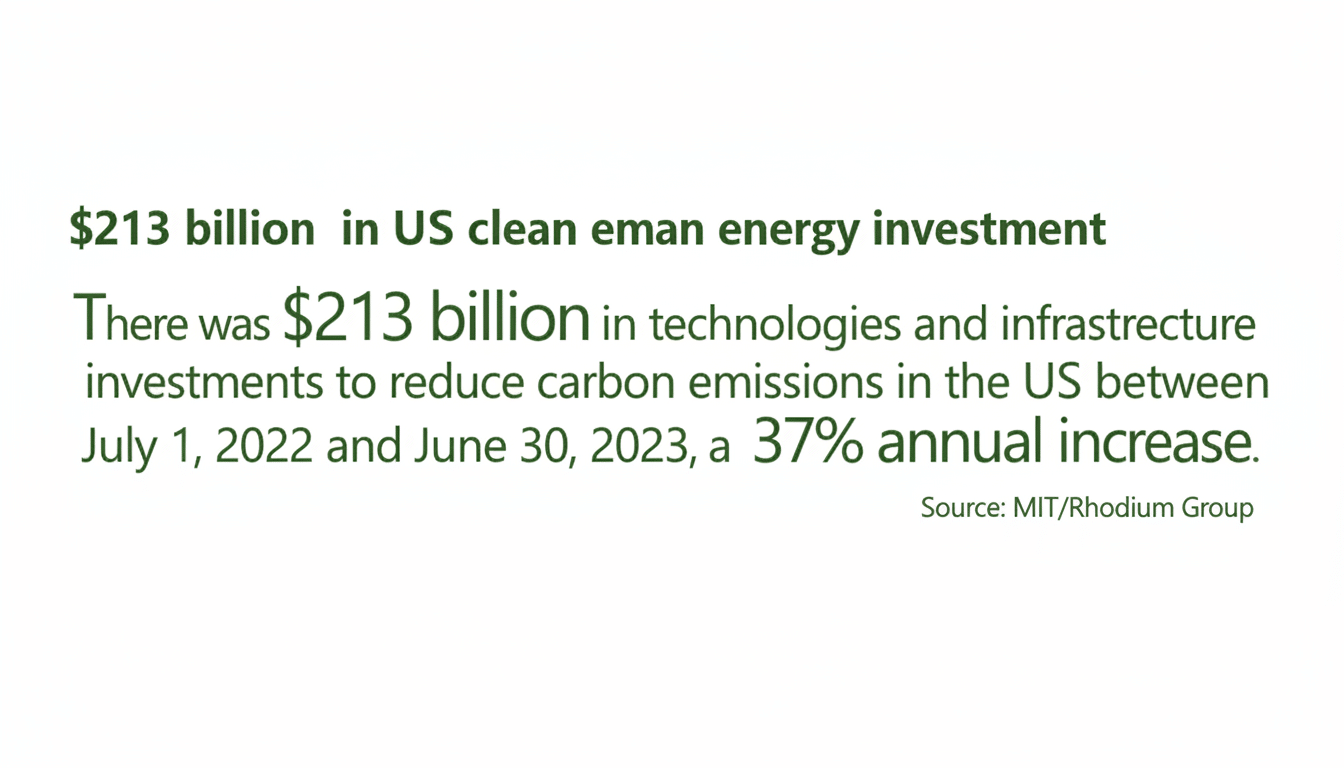

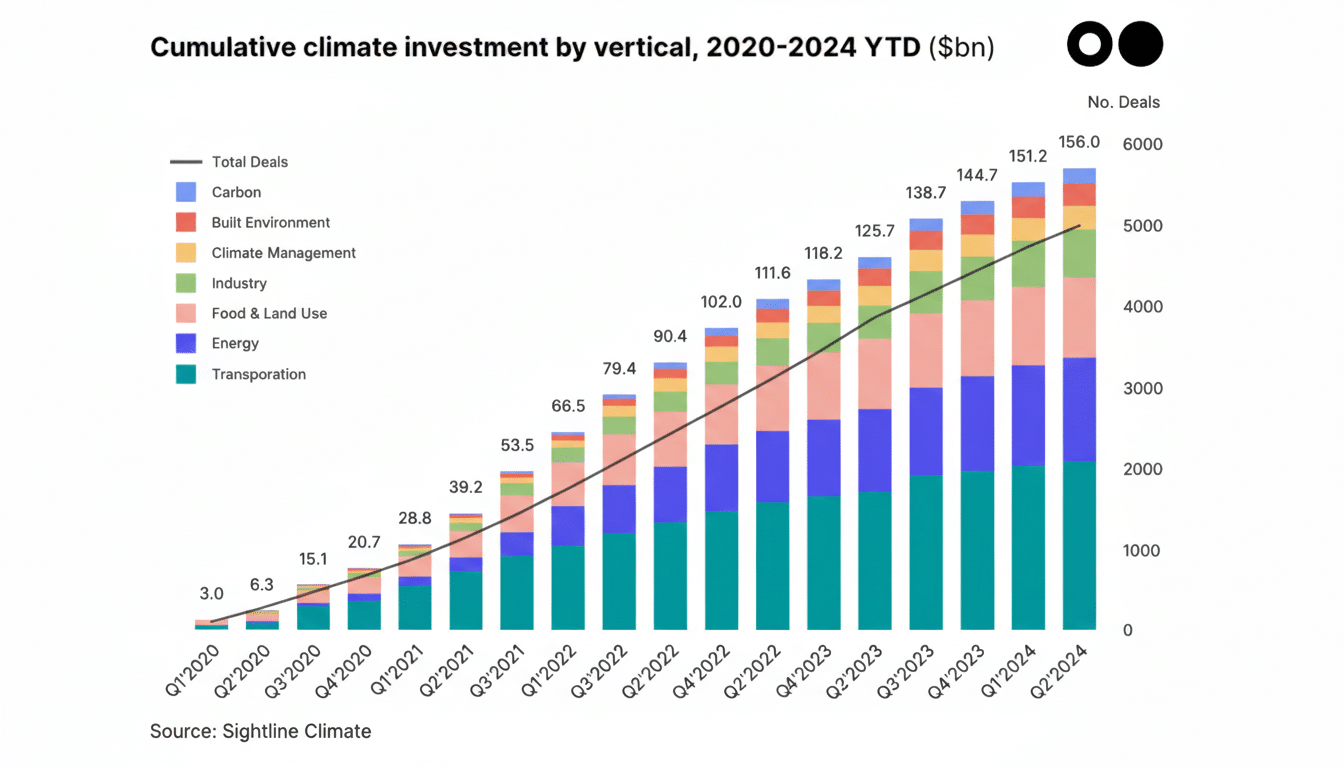

Conventional wisdom has it that climate tech has been in a lull. The data says otherwise. With plunging hardware costs and policies that favor clean energy, as well as corporate demand climbing to record levels, we are at the most appealing time in years to invest in climate technology.

Costs and capital expenditures have been gutted

Clean energy economics have flipped. Lazard’s most recent Levelized Cost of Energy analysis shows utility-scale (so-called “large open access”) solar and onshore wind at or below the price of new gas in many places, even without carbon pricing. Module oversupply has taken solar panel prices to below $0.15 per watt, according to multiple industry trackers, and BloombergNEF says lithium-ion battery pack prices have fallen by roughly 90% since 2010. That capex collapse fundamentally alters project returns across storage, EV infrastructure, and grid-scale renewables.

- Costs and capital expenditures have been gutted

- Policy tailwinds are set across major global markets

- Market demand is bankable with long-term offtake growth

- Valuations favor patient capital amid a market reset

- Execution risk is falling as operations and software mature

- Where the next climate tech breakouts are likely to appear

About 80 percent of new renewable power added globally now undercuts the cheapest new fossil generation, according to an estimate from the International Renewable Energy Agency. For developers and their backers, that means needing to rely less on subsidies to pencil out, shorter payback periods, more bankable pipelines. Put another way: This isn’t the moonshot category of yore — it’s infrastructure with improving margins.

Policy tailwinds are set across major global markets

Many investors point to policy risk as a reason for waiting. But the larger story is one of policy durability. In the United States, a 10-year phaseout of tax credits for clean power, storage, hydrogen, and advanced manufacturing is reworking investment choices far beyond a single budget cycle. Europe’s Green Deal Industrial Plan; Canada’s investment tax credits program; Japan’s Green Transformation program; and India’s production-linked incentives are constructing a multi-region floor under project economics and supply chains.

The most recent outlook from the International Energy Agency underscores the result: Investment now in clean energy is outpacing fossil investment around the world. Even more dramatically, the IEA’s baseline emissions path today resembles its “optimistic” scenario from a decade ago. Even in its conservative scenarios, the world’s trajectory is flatter and cleaner than expected a few years ago — an inflection that underpins long-lived assets such as those in renewables, transmission, heat pumps, and industrial electrification.

Market demand is bankable with long-term offtake growth

Corporate procurement is underpinning long-term offtake for climate tech. RE100 firms are still signing multi-gigawatt contracts for clean power, heavy industry sectors are securing green molecule supply deals, and hyperscale operators are chasing 24/7 clean energy for AI data centers. As grids creak under pressure, utilities are expediting storage, flexible demand, and virtual power plant contracts empowered by rules such as FERC Order 2222. These are not pilot budgets; they’re multiyear commitments.

Transportation and buildings exert even more pull. Adoption of electric vehicles continues to increase, even in countries where consumer incentives have begun to decline. Shipments of heat pumps have surged by double digits in parts of the country, as efficiency rises and installers grow. The throughline is evident: buyers are no longer dipping their toes in the water (wait, that’s impossible); they’re incorporating climate tech into core operations to cope with cost volatility and comply with and achieve ESG goals.

Valuations favor patient capital amid a market reset

Venture economies broadly cooled in the last cycle, and climate tech was not spared. But that reset is a feature, not a bug, for an investor coming in now. Company valuations have returned to earth, growth equity is scarce, and project finance seeks de-risked assets with contracted cash flows. At the same time, non-grant capital — from government loan guarantees and advance market commitments to vaccine procurement contracts up front — is also offsetting technical risk for hydrogen, sustainable aviation fuel, long-duration storage, and carbon removal.

Think of the public signals: The U.S. Department of Energy is funding regional hydrogen and direct air capture hubs; Europe has approved contracts for difference to span cost gaps in green fuels; and large buyers have coalesced behind more than $1 billion in forward purchases of carbon removal through initiatives like Frontier. Such mechanisms cut the gap between laboratory-scale success and commercial revenue.

Execution risk is falling as operations and software mature

Climate tech bets a decade ago were often science projects. Today, the limiting factors are grid interconnection, siting and permitting, and supply chain challenges — operational headaches that experienced operators can navigate, said Aaron Edelheit, a solar investor with North Light Capital. Now software and AI are front and center: grid orchestration systems, forecasting tools, and market participation technologies aid in “squeezing the sponge” dry by wringing more capacity from existing wires while deferring costly upgrades — a process that increases the value proposition of distributed energy resources and storage.

Manufacturing is also localizing. Battery, solar, and heat pump factories unveiled in both North America and Europe are diversifying supply chains while unlocking domestic incentives, he added. For investors, this means clearer unit economics, faster payback periods, and robustness to market shocks.

Where the next climate tech breakouts are likely to appear

Our near-term favorites are grid software and flexibility markets, DER aggregators, and multi-hour duration storage at utility scale. Industrial decarbonization — electrified heat, process optimization, and low-carbon cement and steel — rests on a huge base of emissions, with growing policy support. Geothermal is also trending as oil and gas drilling tech spills into clean baseload, and durable removal will benefit as compliance and procurement mature.

The question is less a matter of “if” now than “how fast.” IEA scenarios now see a plateau in sight, and in much of the world clean energy is already the cheapest new power. When in doubt, follow the money: Right now, a host of factors have created a special moment — one very attractive to corporate buyers — circulating capital into renewable energy projects. Those investors who take the leap now can enjoy the compounding effects of scale while the market is still repricing.