A popular AI investing assistant tagged as “ChatGPT for stocks” is now available for just under $60, a price that has attracted attention among new traders and busy investors seeking quicker, data-driven research without a high learning curve. The offer is for a lifetime subscription to Sterling Stock Picker, a software platform that utilizes machine learning to aggregate market data into real-world English prompts such as buy, sell, hold, or avoid.

With an extra $5.19 checkout code, it brings the price to $55.19, down from our typical deal price for a similar lifetime subscription at around $69.95 and an MSRP of $486; that’s about 89% off MSRP. The lifetime license does not come with any monthly, recurring fees.

What Sterling Stock Picker aims to offer

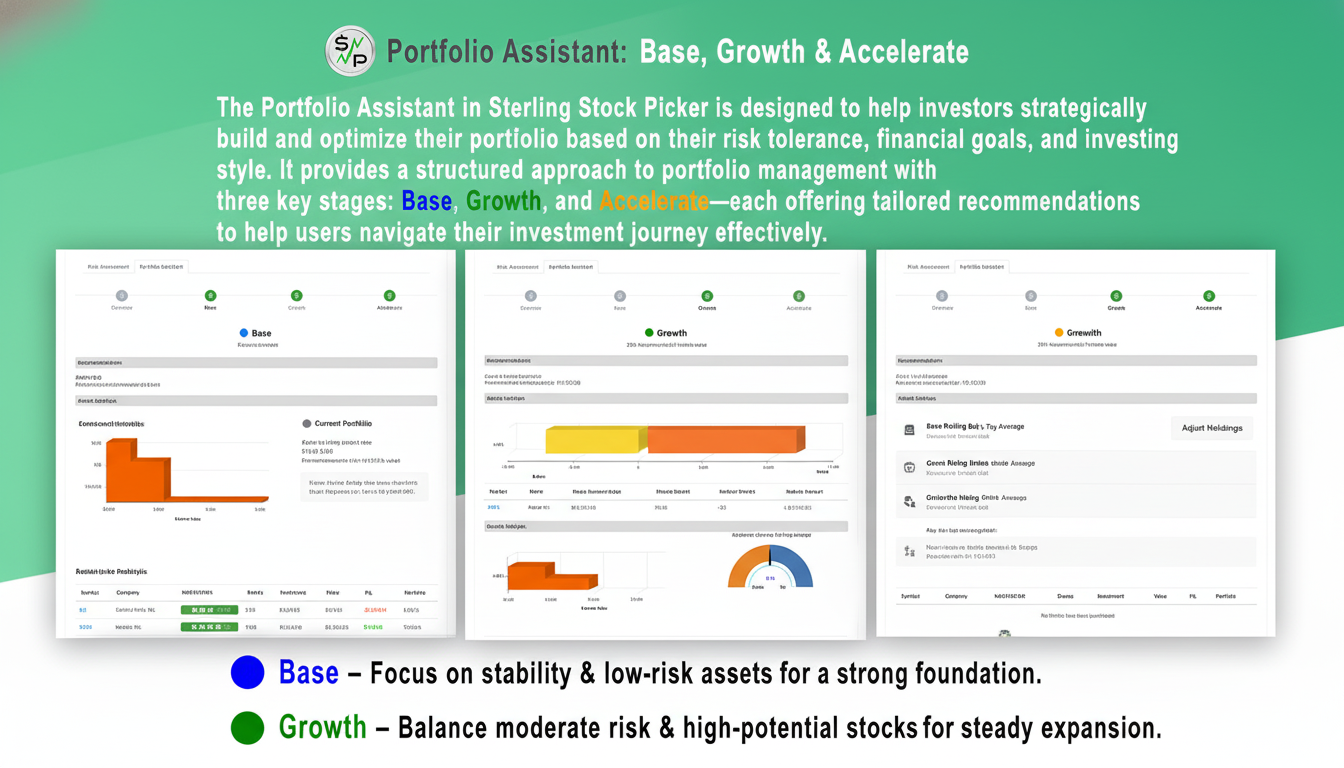

The package includes real-time market study, watchlist tracking, and a “Done-For-You” portfolio creator that adjusts allocations to a person’s goals and risk appetite. For those seeking guardrails, ongoing ideas urge investors to keep their portfolios anchored to a stated plan rather than react to the latest news. Sterling’s core engine compresses essentials and dynamic signals into a simple “North Star” panel designed to minimize decision friction. An AI coach known as Finley, created at OpenAI, can answer questions in regular speech, bring forward the correct metric, and describe why a stock may fit or fail a user’s criteria. The intention is not to predict the next price move; it is to keep due diligence simpler and clearer.

- Real-time market analysis and watchlist tracking

- “Done-For-You” portfolio creator aligned to goals and risk

- “North Star” panel to reduce decision friction

- Finley AI coach to surface metrics and explain fit

Think of it as an intelligent layer between a basic stock screener and a full-service advisor: It automates repetitive research and contextualizes signals but stops short of taking the final call. For self-directed investors trying to force-rank conflicting analyst notes, this framing can help differentiate the signal from the noise. New investors will get the most obvious lift: fewer jargon-heavy hurdles and clearer next steps. Reduce endless searches and get professional scrutiny behind a stock idea in minutes, saving in-depth dives for high-conviction arguments.

Even lifelong investors can then use the platform to manage their satellite allocations without reimagining their core strategy. The portfolio builder can be particularly effective in mapping risks. Instead of guessing how much to put in each basket, customers can start with a model based on their risk capacity and then develop a comfort level. This aligns with investor nonprofit education tutorials designed to encourage diversification and protection rather than frequent trading.

AI can increase the speed of research, but it is not a crystal ball. The S&P Dow Jones Indices’ SPIVA report often shows that only about 20% of large funds outperform their benchmarks over a ten-year period. Data like these make it clear that even experts have limited ability to beat the market. Tools like these can help, but the effect depends on self-awareness, fees, and time horizon.

Caveats, alternatives, and realistic expectations

Claiming, “Over 1 million trades later, the MAX Wealth Daily system has delivered an average gain of 248% every 40 days,” is an unequivocal performance promise that no one should consider worth a single cent of the cost of admission. Regulators and industry groups, such as the SEC’s Office of Investor Education and FINRA, have called for caution in the use of AI-powered stock tips. The key is whether the tool provides adequate explanation and underlying data, not performance guarantees. Sterling does away with the guarantees in favor of transparent signals and coaching, and that’s the proper stance for this type of software.

Comparing alternatives is also a good idea. Quant platforms like Seeking Alpha’s factor grades, charting suites such as TradingView, and automation tools aimed at active traders are all vying for your attention. Sterling’s conversational guidance and portfolio builder are unique to everyday investors who want guardrails but don’t want to take the robo-advisor route.

- Seeking Alpha’s factor grades and quant screens

- TradingView charting and technical analysis tools

- Automation platforms for active traders

A lifetime license to an AI investing assistant for less than $60 is almost one-of-a-kind and a modest entry point. If you’ve wondered about AI-driven stock analysis but have been hesitant to subscribe to more services, this one-time opportunity makes it simple to test-drive it on your watchlist. Pair it with a solid investment plan, a diverse portfolio, and realistic expectations, as always.