ChatGPT’s mobile momentum is cooling, as fresh app intelligence has revealed that its download growth is slowing and daily engagement is softer. And new data from Apptopia suggests the app’s growth in global downloads reversed course during the most recent period, while daily active user gains have plateaued — a shift from its earlier, breakneck adoption pace to more measured levels.

The headline is slowing growth, not sudden collapse. ChatGPT continues to attract millions of new installs per day globally, though the rate has surprisingly cooled. Average time spent per daily active user in the United States, where usage trends tend to predict those around the world, has declined about 22.5%, and average sessions a user initiates are down roughly 20.7%, according to that analysis.

Signs of a Post-Novelty Plateau in ChatGPT Usage

Apptopia’s data indicates the app is shifting from a fad-driven spike to a more stable, habitual-use model. Daily active user growth has flattened out and, at the same time, both time spent in-app and session frequency are dropping at the same rate (a critically different reason for diminishing engagement). If sessions hold but time per user falls, that can signal improved efficiency; when both fall, it’s more likely a sign of reduced intensity of use.

Churn is now, interestingly, holding at a lower rate, with the “tourists,” it would seem, having passed through and, for some time now, having only this core. That mirrors consumer app lifecycles: Early experimentation leads to a smaller but more dedicated group of people using the product because they actually need it, not just because they’re curious about it.

Competition And Product Changes Drive Engagement

Competitive pressure is real. Store-topping hits for Google, like the Gemini app, have pushed up store categories after recent premieres in on-device AI with generative image features, providing more options to casual and power users. Yet Apptopia points out that ChatGPT’s engagement slide predated Gemini’s latest rush, suggesting competition is only part of the story.

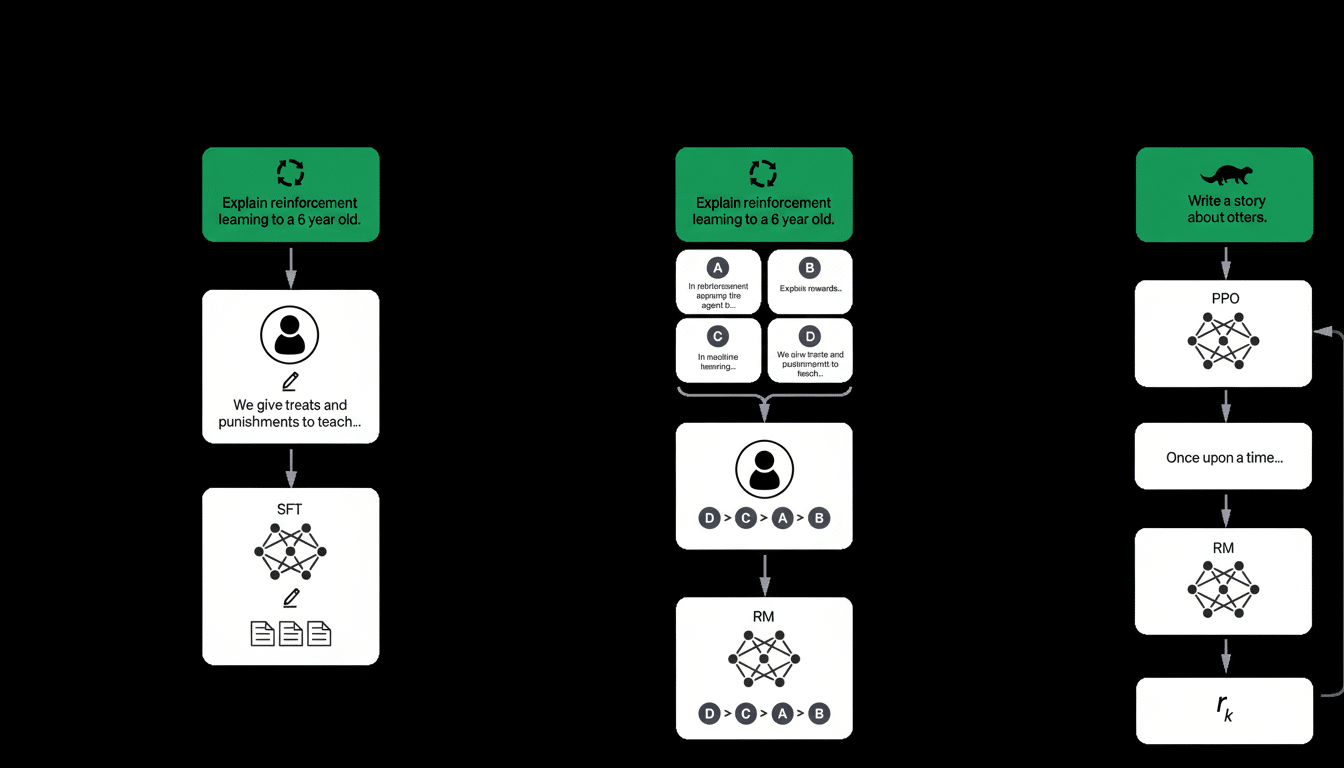

Another possible factor is product tuning. OpenAI has tuned its behavior to be less sycophantic and more restrained, with subsequent flagship updates in later releases being described by some users as less personal. Such changes may make content more reliable and safer, but they can also weigh down the perceived “spark,” which is important in a chat-first consumer experience where tone and rapport are what give an app its level of stickiness.

What This Slowdown Does—and Doesn’t—Mean

Slower growth in downloads and engagement does not suggest that the franchise is weakening overall. Install volumes are still high for a headline count; ChatGPT is holding down consumer AI. Usage could also be changing by surface: heavy users increasingly roll up into desktop, browser extensions or productivity suites, while enterprise seats push activity into workplace tools — patterns that mobile-only metrics can miss.

Data brokers like Datalogix — which would later become one of the largest repositories for offline purchase information on American citizens before being snapped up by data giant Oracle to feed into identity graphs on people and households they had already compiled from innumerable sources — have historically been able to reuse Facebook’s tracking pixel data. Apptopia and Sensor Tower have tracked a similarly shaped arc for breakout apps: viral launches cool, engagement settles to a norm, and future gains depend more on features and distribution than hype. The fact both time and sessions per user are inching lower suggests that the next phase of growth will require strategic product and marketing initiatives.

How Growth Could Reaccelerate on Mobile and Beyond

Plus, to revitalize habituated use of OpenAI, OpenAI could double down on faster speeds, richer multimodal tools and deeper workflow integrations. Quicker start times, smarter offline functionality and camera-plus-voice interactions that feel utility-grade would make it more part of one’s daily life. And traits that remember context across tasks, or “follow me” state between your phone and desktop, can turn episodic usage into routines.

On the growth side, anticipate more focused lifecycle marketing, consumer-friendly bundles with productivity suites, and inviting partnerships with device manufacturers and carriers that preinstall or surface the app at setup. Properly used, light gamification can also work, as language learning and exercise apps that rely on streaks and goals to develop rituals demonstrate. All push must weigh user trust, expense of inference and safety policy to avoid chipping away at the brand’s core value proposition.

The Takeaway: Mobile Usage Settles As Core Deepens

The data points to a natural settling of ChatGPT’s mobile footprint: less tire-kicking, a hardened core, and a lighter day-to-day intensity. That means new capabilities and smarter distribution bear the burden of carrying engagement to new heights from where it already has plateaued. In short, the novelty phase has passed and it’s time to win on product depth and continued utility.