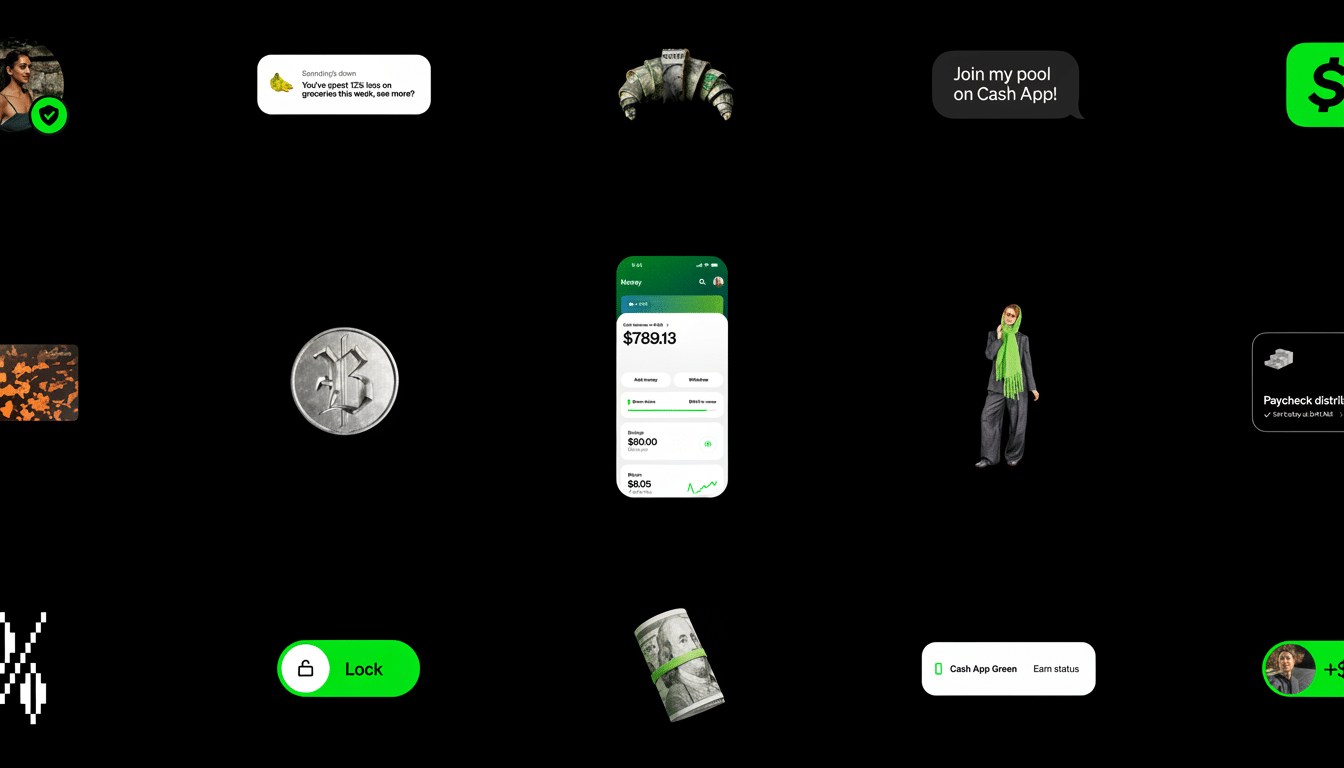

Cash App has unveiled Moneybot, an AI assistant that aims to field everyday questions about your finances and translate account information into actionable advice. It looks like the feature is gradually rolling out to select users and will see wider availability after some early feedback.

What Moneybot Can Do for Everyday Cash App Users

Moneybot allows people to ask questions about their financial life in plain language and receive succinct answers based on their Cash App activity.

- What Moneybot Can Do for Everyday Cash App Users

- How It Works for Users Seeking Quick Money Insights

- Why Moneybot Matters for Day-to-Day Money Management

- Privacy and Accuracy Questions Around AI Money Assistants

- Where Crypto Fits In Within the Cash App Experience

- Competitive Context And Differentiation

- Rollout Plans and What to Watch as Moneybot Expands

Ask a question like “How do my spending habits differ this month?” and it can make a fast pie chart breakdown by category, flag outliers, and point out recurring charges that tend to be easy to forget.

The assistant can also make contextual suggestions like setting aside an amount toward a savings goal, splitting the amount of a recent restaurant tab, retrieving a crypto balance, or sending a payment reminder. That’s because it is meant to learn from each person’s behavior over time, personalizing nudges and next steps based on spending patterns, income, bills, and card use.

How It Works for Users Seeking Quick Money Insights

While there are a number of static dashboards, Moneybot intends to reduce the work in finding those insights buried within lists of transactions. Users can prompt questions such as “What are my top three repeat subscriptions?” or “How much did I pay for groceries last week?” and get back fast, human-readable answers including transactions that matter to you and totals.

Analysis alone cannot bridge the gap to action. After you’ve gotten a sense of where your cash is going, it might nudge you to automate a transfer into savings, set or adjust a goal (say, spending money for next week), or remind someone who owes you money. According to Cash App, the idea is to translate raw data into action steps that can actually lead to better day-to-day money management — and prevent users from squinting at charts on their own.

Why Moneybot Matters for Day-to-Day Money Management

Until now, personal finance tools have required users to create budgets and rules themselves. Moneybot turns the model on its head by meeting people where they are: asking questions in plain language and receiving answers in a matter of seconds. If anything, a single concise assistant that has an understanding of users’ complete activity could reduce the cognitive overhead of keeping track of cash flow, recurring bills, and short-term goals for Cash App’s large user base of card holders, P2P payers, and crypto enthusiasts.

The rest of the industry is already heading in this direction. Bank of America’s Erica and Capital One’s Eno proved that virtual assistants can scale routine support, as well as surface helpful insights — with Erica alone handling more than a billion interactions at the bank. Moneybot takes that playbook one step further in the super-app age, where recommendations can directly lead to payments, savings moves, or balance checks within the same interface.

Privacy and Accuracy Questions Around AI Money Assistants

AI within banking apps also brings up all-too-familiar questions around data use, transparency, and error management. Cash App said that Moneybot adjusts to individual customers’ behavior, but it’s going to have to provide straightforward controls over what the bot uses for personalization and how recommendations are made in order to feel trustworthy. With AI, there’s a need for guardrails around hallucinations and edge cases — particularly when suggestions include borrowing, savings rates, or crypto actions.

Regulators have indicated interest in the space. The Consumer Financial Protection Bureau has cautioned that automated chat systems must provide accurate information and not be a barrier to humans when they are needed. Look for a blog post from Cash App that describes how Moneybot finds answers based on your own records, how to move to a person, and what the assistant can’t tell you (opinions), versus what it can.

Where Crypto Fits In Within the Cash App Experience

With Cash App offering Bitcoin and integrating with Lightning Network for quick money transfers, Moneybot can help users keep track of all crypto-related activity in addition to regular spending.

For instance, the assistant can bring up a Bitcoin payment you recently made in USD, or advise that you check your balance before performing a transfer. The offering is a consolidated view, not a disjointed crypto dashboard.

Competitive Context And Differentiation

One-stop-shop finance apps with budgeting and alerts are a dime a dozen now — few with peer-to-peer payments, card spend, savings, and crypto in one data set with a conversational layer on top. That’s the breadth Cash App has to leverage: If Moneybot is appropriately accurate and snappy, it can collapse multiple app experiences into a single chat thread — from “What bills are due next week?” to “Transfer $25 to savings every Friday.”

The risk is a flip side of the promise: A general assistant needs to be dependably right in many cases. Its success will depend on coverage of real-world money questions, transparent citations to underlying transactions, and frictionless one-tap actions that accompany each answer.

Rollout Plans and What to Watch as Moneybot Expands

Moneybot is available to a group of users at launch but will become accessible to everyone after testing. Early areas of focus include spending trends, income summaries, recurring charges, and smart prompts that are connected to common actions — like splitting a bill or requesting payment.

Key signals to watch:

- How fast Cash App expands coverage to more nuanced queries.

- Whether the assistant can predict issues like overdraft risk before they crop up.

- How well it communicates the “why” behind each action.

If those pieces fall into place, Moneybot could help make conversational money management a default activity for millions of Cash App users.