Cash App is rolling out payment links, a lightweight way to request or receive money by dropping a hyperlink into a text, email, or social DM. The feature aims to turn conversations into checkout moments, letting people settle tabs or invoice clients without jumping between apps or hunting down a $Cashtag.

What Cash App Payment Links Do Across Social DMs

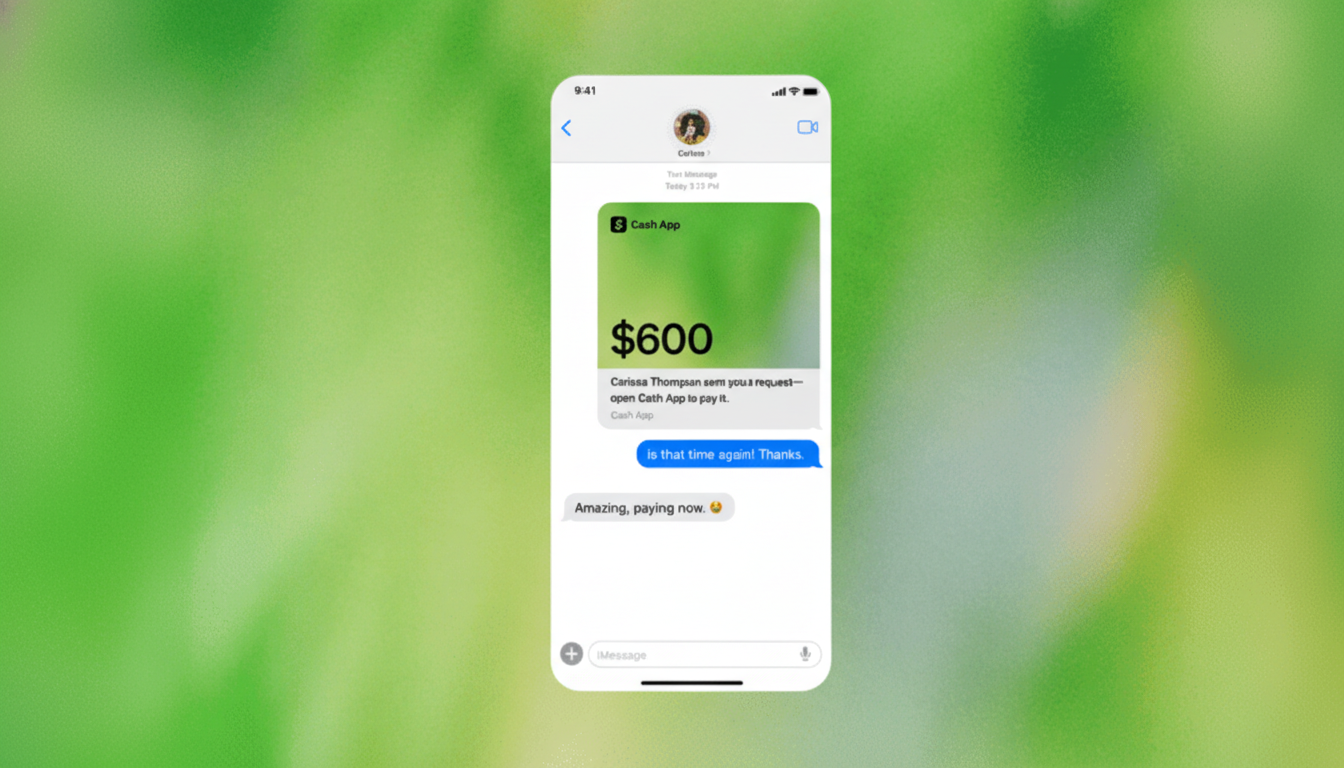

Instead of sending a formal in-app request, users can now generate a shareable link that preloads the amount and context of a transaction. Paste it into Instagram, iMessage, WhatsApp, or a Discord DM, and the recipient can complete payment in a few taps.

- What Cash App Payment Links Do Across Social DMs

- How the New Payment Links Work Inside the Cash App

- Why Direct Messages Are Becoming a Seamless Checkout Channel

- Competitive Context Among PayPal, Stripe, and Others

- Adoption Signals and the Growing Cash App User Base

- Security and Etiquette Considerations for Payment Links

- The Bottom Line on Cash App’s Social Payment Links

Cash App says links support recurring and group payments, a nod to real-world use cases like monthly rent splits, club dues, or ongoing client retainers. The company framed the move as a way to reduce the social friction of payment nudges by letting people add tone and context in the conversation where it’s already happening.

How the New Payment Links Work Inside the Cash App

From the payment tab, enter an amount and details, then choose “share link” instead of adding a recipient. Cash App generates a unique hyperlink you can drop into any channel. The recipient follows the link, sees the prefilled amount and note, and confirms payment through Cash App. If they’re new to the service, they’ll be prompted to sign up before paying.

Because the link carries the context with it, it’s especially handy when you’re collecting from multiple people: one link can be shared widely, and each person can pay their portion with the same flow.

Why Direct Messages Are Becoming a Seamless Checkout Channel

Commerce has been edging into private messaging for years as creators, resellers, and service providers move deals from public feeds to one-on-one threads. Research from eMarketer estimates U.S. social commerce sales surpassed $60 billion recently, reflecting how often discovery and purchase now happen in social channels.

Payment links formalize what many already do: agree on a price in a DM, then scramble for a handle or QR code. With a single link, a photographer can secure a deposit, a tutor can collect weekly fees, or a roommate can square up for utilities—without breaking the conversation flow.

Competitive Context Among PayPal, Stripe, and Others

Cash App’s move lands in a familiar lane. PayPal launched PayPal.Me years ago to give users a personal link for getting paid, while Stripe’s Payment Links power hosted checkouts for small businesses. In the UK, Monzo.me and Revolut have pushed similar link-based flows. The difference here is cultural fit: Cash App’s P2P roots and social-savvy user base make link requests feel native to how people already split costs and pay creators.

It also complements Block’s broader ecosystem. Square sellers already use checkout links and invoices; bringing a flexible link feature to Cash App tightens the loop between casual P2P payments and lightweight commerce.

Adoption Signals and the Growing Cash App User Base

Block has reported more than 50 million monthly active Cash App users in recent investor materials, a scale that can quickly normalize new behaviors. If even a fraction of group paybacks or creator invoices shift to link flows, expect links to show up across community chats, campus groups, and niche marketplaces.

Cash App has been layering on utility, including an AI chatbot for financial guidance and new benefits tied to borrowing and rewards. Payment links extend that utility into the moment of intent—right where people negotiate price, confirm scope, and close the deal.

Security and Etiquette Considerations for Payment Links

Link-based payments are convenient, but they also invite phishing if bad actors spoof requests. Users should verify the sender and description before paying, and consider sending links only to known contacts or within trusted groups. Cash App’s risk and fraud systems operate behind the scenes, but basic hygiene—clear notes, verified identities, and cautious sharing—remains essential.

Etiquette matters, too. Because links live in the thread, senders can add context or humor to soften a request and avoid the passive-aggressive feel of a surprise push notification. That subtle shift—flexibility in tone, timing, and channel—may be the real unlock for getting paid faster.

The Bottom Line on Cash App’s Social Payment Links

By turning a payment request into a portable link, Cash App is meeting users where they already are—inside DMs. It’s a small feature with outsized potential: fewer awkward follow-ups, simpler group collections, and a smoother on-ramp for casual commerce across the social web.