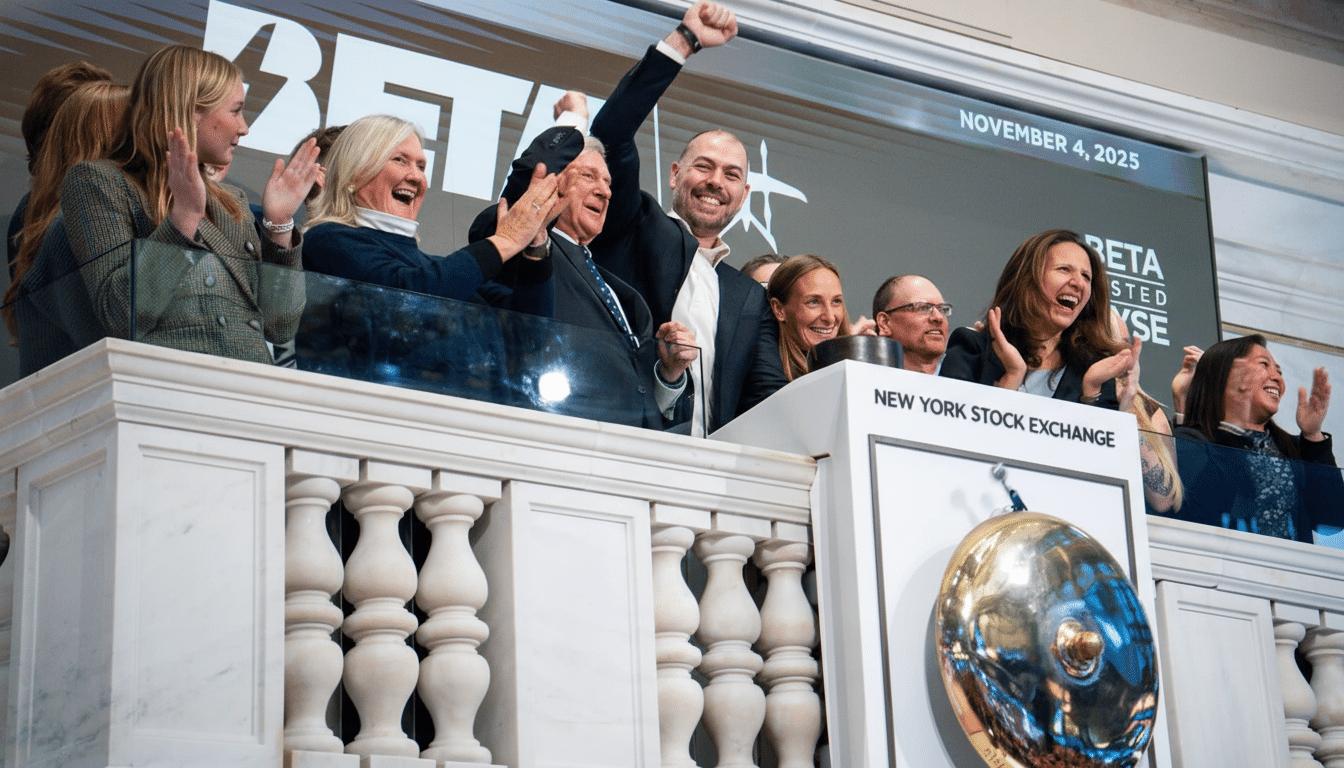

Electric aviation startup Beta Technologies ended its first day of trading on the New York Stock Exchange in a rare zone of positivity for new public hardware companies in the capital‑intensive sector, after securing about $1 billion.

IPO Pricing And First Day Trading On The NYSE

The Vermont company priced its initial public offering at $34 a share, at the high end of an indicated range of $27 to $33, selling 29.9 million shares and raising proceeds of more than $1 billion, as well as garnering a valuation of approximately $7.4 billion. The shares dipped a bit after the opening, but then recovered to close at $36 in another signal of investor appetite for something different in electric aircraft and charging infrastructure.

Pricing above range — combined with a green close — suggests both an oversubscribed book and a market eager to hear stories about near-term revenue alongside clear regulatory milestones.

To put that in context, there have been a number of recent hits among industrial and mobile IPOs so far this year whose day-one gains have been difficult to hold onto; Beta’s finish looks strong for a pre-profit enterprise.

An Atypical Path To The Public Markets For Beta

Founded in 2017 by Kyle Clark, a Harvard-educated former pro hockey player and pilot instructor who serves as CEO, Beta bypassed the usual venture-backed path, cultivating big institutional investors. Investors include Fidelity and Qatar Investment Authority, with strategic backing from Amazon and General Electric, according to disclosures by the company.

The journey of getting to the listing was also not typical. Beta pressed ahead with its offering during a government shutdown period in which U.S. Securities and Exchange Commission guidance permits some registration statements to go effective on their own after 20 days. The company presented the timing as a matter of investor engagement and momentum in diligence.

Two Aircraft Platforms And A Growing Charging Network

Beta’s vision is far bigger than urban air taxis. The company is marketing itself as an aviation OEM with two electric platforms and an energy business designed to feed them. The Alia CX300, an electric conventional takeoff and landing aircraft, is designed to perform regional missions with runway access. The Alia A250, a vertical takeoff and landing electric model, is intended for short hops and space-crunched operations.

Concurrently, Beta is constructing an electric aircraft charging network for its own fleet and third parties. Crucially, Archer Aviation is a charging customer — an indicator that standardized infrastructure might itself become a revenue line for Beta outside of its own deliveries. The dual-track, airframes-plus-energy approach provides the company with extra levers to pull as its certification and adoption timelines adapt.

The Certification Is The Primary Trigger

In the next phase, it depends on regulatory approval from the Federal Aviation Administration. While type certification and operational approvals are still the gating items for commercial service, the agency’s evolving rule sets for electric and powered-lift aircraft will place high value on robust flight-test data, safety cases, and supply chain continuity. Beta has indicated that management resources are shifting back to these milestones now that the listing is over.

Relative to its peers, more focused on eVTOL passenger services, Beta’s eCTOL aircraft designed for regional logistics might provide a nearer-term path to utility with established airport infrastructure and operational experience. If certification follows the conventional sequence, the CX300 may be a bridge to wider eVTOL deployment.

Financial Picture and How the Cash Helps

Beta’s IPO filings reveal a company in its early commercial stages: $15.6 million in revenue through the first half of 2025, about double the same period last year, with a net loss of approximately $183 million over that span. It’s a characteristic profile of frontier aerospace: revenue starts trickling in just as R&D, testing, and tooling costs ramp.

Fresh capital from the offering provides Beta with runway to progress certification, scale manufacturing capabilities, and grow its charging footprint, as well as further solidify commitments with suppliers. Near-term focus points have been set by management on technical readiness and regulatory approvals, which serve as gating factors before meaningful deliveries and margin expansion can be realized.

What To Watch Next As Beta Scales And Seeks Approval

Investors will seek clear signposts: updates on engagement with the FAA, flight-test milestones, expansion of the charging network, and signs that backlogs are turning into contracted revenue. The first trading day delivered a vote of confidence; the enforcement is in execution against a tight certification timeline and disciplined capital return.