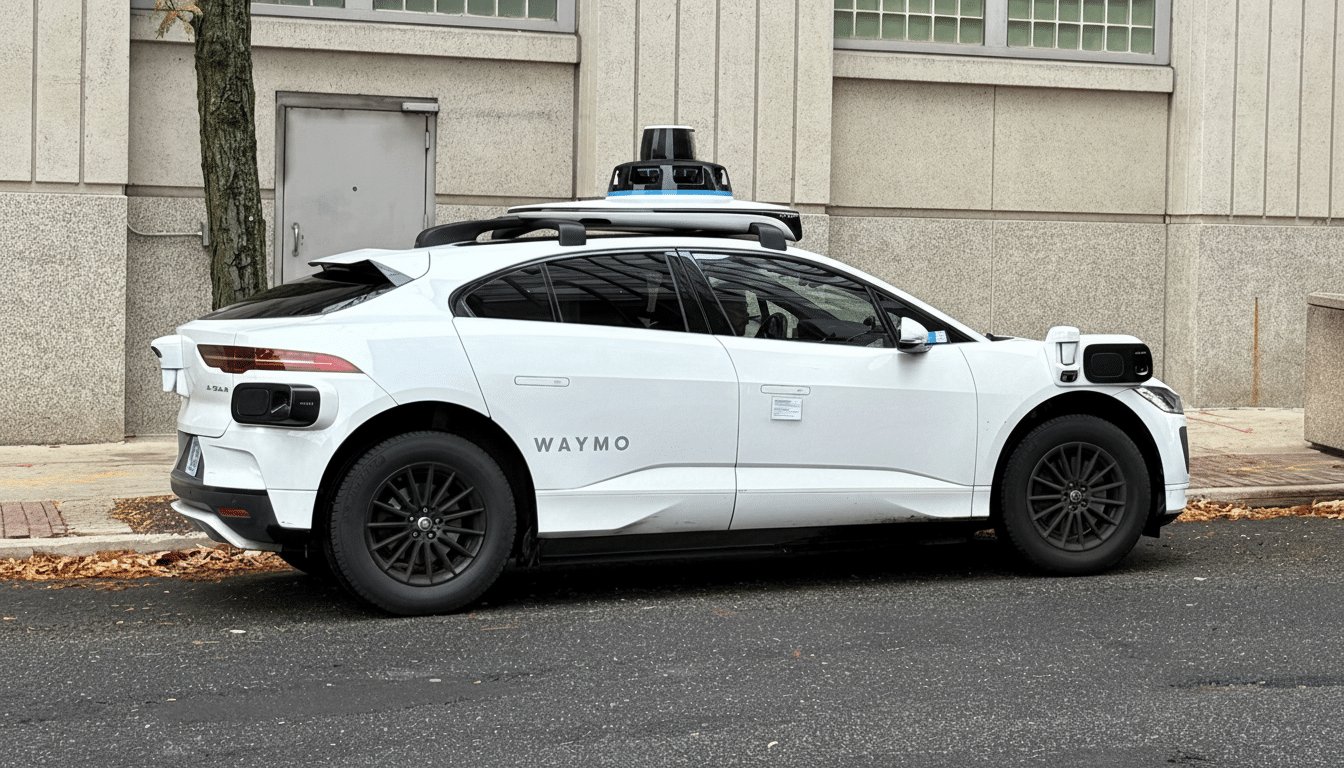

Robotaxis are graduating from science projects to real service maps, and deployment is accelerating. Waymo has begun testing in Philadelphia with a safety monitor, Uber and Avride have turned on a Dallas service that includes an operator behind the wheel, and California regulators have taken steps to clear the way for self-driving trucks on highways. The industry’s foot is down. The question is whether the road — and the public for that matter — are prepared.

Robotaxi Rollouts Reach New Markets Across U.S. Cities

Waymo’s expansion into Philadelphia is the second marquee city on its map, with plans to drive its cars manually to collect data in Baltimore, St. Louis and Pittsburgh. They’re not flashy demos; they are building blocks that increase the operational design domain — the specific streets, weather, construction zones and traffic behaviors an autonomous system must conquer before it can go fully driverless.

And Uber and Avride’s robotaxi service in Dallas also highlights a graduated commercialization model: Start out with a safety driver, track pickup times and passenger satisfaction, then start to strip away human things once confidence has been built. Behind the scenes, success is increasingly measured by operational metrics such as rides per vehicle hour, uptime and rate of remote assistance — the stodgy numbers that determine whether a pilot grows into a business.

Regulators Move in Tandem to Enable Safe Expansion

The California Department of Motor Vehicles issued revised regulations that would allow companies to test and deploy autonomous big rigs on the state’s highways, provided the vehicles weigh at most 90,000 pounds — typically three times the weight of a standard car with a trailer. The heavyweight autonomy use case has always been a compelling one: long, repetitive routes over predictable infrastructure where safety and fuel efficiency gains can be made at scale. Organized labor and safety advocates will remain vigilant about these shifts, but the regulatory message is unmistakable — new experiments are welcome as long as they’re clear-eyed and responsible.

In the end, city governments are the pragmatic gatekeepers. Permits, geofences and cooperation with police and fire departments can widen or strangle service areas. The strongest operators are already seated with first responders to develop incident playbooks, incorporating vehicle-to-everything pilots where possible and adopting more legible rules for construction zones and emergency scenes. When the vehicles encounter daily reality, those details matter more than PR.

Safety Under the Microscope Amid Rising Scrutiny

Federal scrutiny is intensifying. The National Highway Traffic Safety Administration has asked Waymo for more information about its self-driving system and operations after reports by the Austin Independent School District that robotaxis had passed stopped school buses 19 times in violation of Texas law. The agency has already opened an investigation that is concentrating on performance around buses — a high-consequence edge case that calls for cautious, well-defined policy enforcement.

The public mood is also influenced by gut-wrenching occurrences. In New York, a bodega cat named KitKat died when it was hit by a Waymo. New surveillance video reported by The New York Times shows a bystander crouching near the vehicle’s wheel, trying to coax the cat toward him as the car jolted forward. Low-speed perception, occlusion and intent prediction for humans and animals remain some of the most challenging problems in urban autonomy.

Existing safety metrics are imperfect. Disengagement tallies are dependent on the philosophy of testing and do not necessarily reflect actual risk. What regulators and cities want are exposure-adjusted rates — incidents per million autonomous vehicle miles traveled — broken down by scenario types, like school zones or construction sites or emergency scenes or adverse weather. NHTSA’s voluntary standing crash-reporting program for automated driving systems is a start, but standardized third-party-audited benchmarks would more effectively drive marketing away from maturity.

The Business Case Gets Real for Robotaxis and Trucks

Robotaxis need to outcompete human-driven fleets in economics — but with a greater margin of safety. Cutting a driver reduces variable costs, but operators inherit new ones: remote assistance teams, high-bandwidth connectivity, dedicated insurance, and cleaning and maintenance hubs. The S-curve of truck autonomy may return quicker by focusing on well-monitored highways, terminal-to-terminal transfers and regular duty cycles where autonomy leads to fuel reduction & increase in utilization.

Public confidence will determine the speed. A recent reader poll showed that 47.2% believe we’ll see a robotaxi tipping point before the end of the decade, but news of mishaps like those with school buses, pets and in emergency scenes can swiftly alter sentiment. The leaders are pouring money into community engagement, transparent incident reporting and first-responder training — all essential to scale beyond friendly markets.

What to Watch Next in Autonomous Cars and Freight

The key milestones now are specific and measurable: expansion of fully driverless service zones without safety operators; documented performance improvements around schools and construction; lower remote-assist rates; and consistent operation in rain, glare and night.

And on the freight side? Keep an eye out for drivers-out highway pilots, safe on-off ramps to transfer hubs and bold partnerships that bake autonomy into logistics software.

If operators can achieve those outcomes — and reduce rates of incidents while increasing transparency — the accelerator stays down. If not, then anticipate regulators and city partners to tap the brakes until the technology demonstrates it can safely share the road on the public’s terms.