AT&T and Verizon are working to neutralize T-Mobile’s latest customer grab, limiting the carrier’s new “Switching Made Easy” feature within the T-Life app and taking their fight to court. AT&T is suing over what it claims was T-Mobile’s improper scraping of customer account information, and both carriers are reportedly blocking log-ins attempted from T-Mobile’s own app. T-Mobile says that the tool works with customer permission and is intended to help switchers cut through red tape.

What T-Mobile’s tool does for wireless switchers

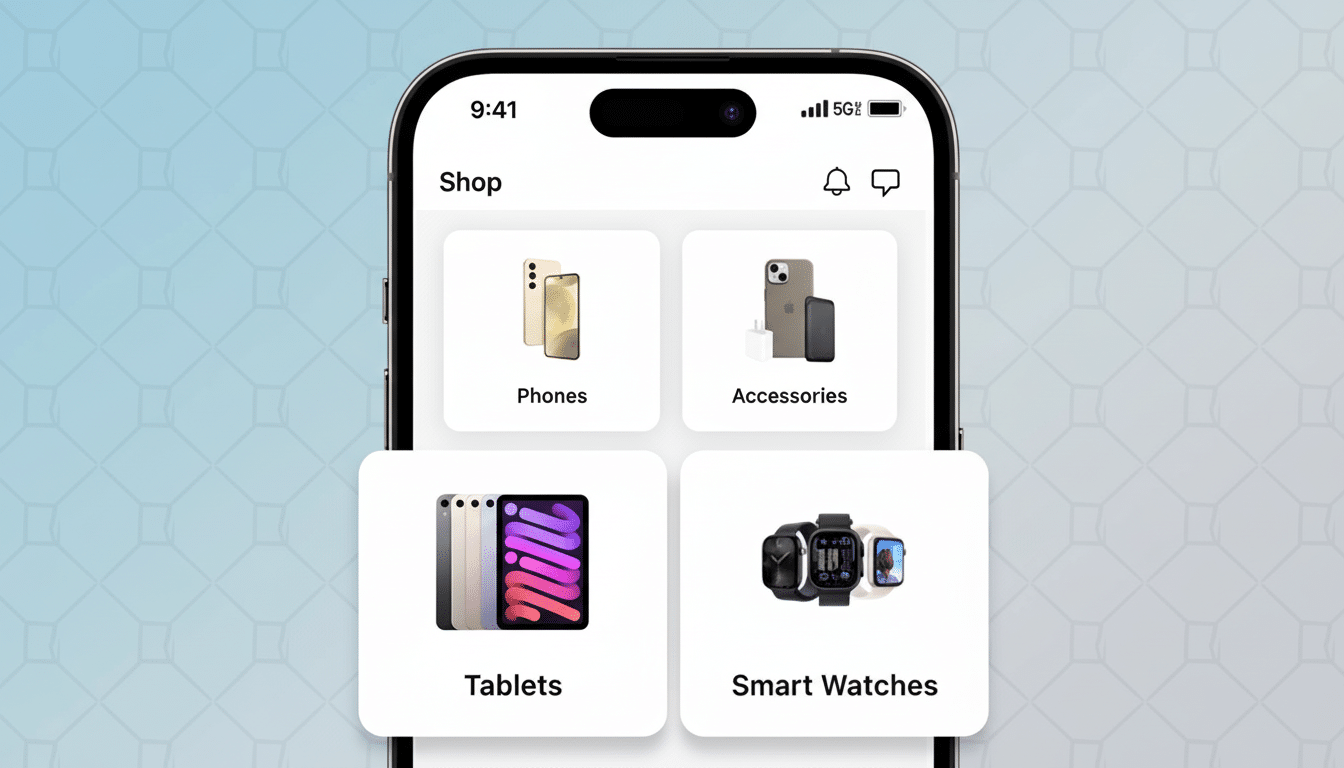

Switching Made Easy is an artificial-intelligence-powered guide that comes built into T-Mobile’s T-Life app. Analyzing an existing AT&T or Verizon account (with user permission), it mirrors current lines, promos, and device financing and recommends a comparable T-Mobile plan. The goal is to put plan math into plain language and save you the time and anxiety associated with porting numbers, especially during this eSIM age when activation can be almost instantaneous.

- What T-Mobile’s tool does for wireless switchers

- How AT&T and Verizon are responding to T-Mobile’s tool

- Inside AT&T’s legal argument over T-Mobile’s account access

- T-Mobile’s defense and the market stakes in carrier switching

- What it means for consumers considering a carrier switch

- What to watch next in the carriers’ legal and technical fight

Originally, it involved logging in directly to an opposing account or uploading the most recent bill. All of which is to say that Verizon customers trying to sign on through T-Life were met with access-denied screens, according to internal screenshots and user reports shared with The Mobile Report, while AT&T detection tools identified robo-activity in the app and took steps to block its use altogether.

How AT&T and Verizon are responding to T-Mobile’s tool

According to sources, both carriers are actively blocking T-Life from signing into customer accounts, which effectively neuters the automatic scan. AT&T has gone even further, filing a suit that alleges T-Mobile “repeatedly” altered its bot to avoid detection and extracted more fields than necessary — in some sessions, more than 100 — allegedly under the cover of a normal user session. Verizon has not announced what its technical fixes are, although users claim that T-Life authentications have been blocked.

And in response to AT&T’s pushback, T-Mobile’s app has more frequently asked users to upload a PDF bill or enter details manually rather than logging in directly at AT&T, according to copies of reports reviewed by The Mobile Report. The pivot indicates T-Mobile is keeping the switching flow but steering clear of the automated entry that precipitated the dispute.

Inside AT&T’s legal argument over T-Mobile’s account access

“The unauthorized access and use of the AT&T customer information to engage in fraudulent, abusive, or illegal uses of our services should be enough,” Silberman writes.

AT&T’s complaint alleges T-Mobile broke its terms of service when it used automated tools to sign into customer accounts behind a login wall — potentially implicating state computer access statutes and privacy obligations surrounding customer proprietary network information (CPNI).

The bot attempted to hide its identity, pretending to be a normal user agent in order to evade defenses, claims the filing. AT&T sent a cease-and-desist letter and complained to Apple, explaining that the behavior violates App Store review guidelines related to data collection and impersonation. Apple hasn’t acted publicly.

Attorneys with expertise in internet law say that court decisions in scraping cases typically turn on whether the data is strictly public or gated, and if there are clear, enforceable terms against automated access. But the sticking point here is that T-Mobile says customers start the data-sharing process themselves and consent to it; AT&T argues that doesn’t allow a competitor’s bot to circumvent protections or grab more personal data.

T-Mobile’s defense and the market stakes in carrier switching

T-Mobile says it is streamlining a complicated switch, not siphoning data. The carrier says that customers have always swapped bills or account information to compare plans, and that automating the math is pro-consumer and privacy-protected. The company has relied on switching inducements for years, and still commands the industry’s lead in postpaid net adds by a long shot, as seen in recent earnings disclosures.

Why the urgency? For AT&T and Verizon, the equation is simple: If it’s easier for customers to switch providers, they will do so — and that added port-out volume hurts their churn. Independent surveys from firms such as JD Power and Opensignal conclude a close tie in which network consumers think is best, meaning small onboarding improvements can make a big difference. Blocking automated access slows T-Mobile’s funnel, but also risks looking anti-consumer if it denies the ability for data portability that customers clearly agree to.

What it means for consumers considering a carrier switch

For now, the T-Life experience will be focused more on uploads of bills and manual input, particularly for AT&T accounts. That’s less smooth than the live account scan, but more than sufficient to run apples-to-apples plan comparisons and enable near-instant eSIM activation. If you’re thinking of switching, you should check which fields are shared, read privacy disclosures, and use one-time passwords or billing PDFs rather than sharing longer-term account credentials wherever you can.

What to watch next in the carriers’ legal and technical fight

Crunch points include whether the courts make a ruling on automated access with user consent, and if any action will be taken to enforce App Store policy. Would the intervention of the FCC over data portability and anti-competitive porting friction help? Also look for technical détente: The carriers could work out a narrow, auditable data-sharing schema where allowed plan comparisons can occur without broad scraping. If not, the industry will probably rally around bill-upload workflows and some standardized, permissioned APIs that allow you to (fairly) easily aggregate all your financial activity while still following privacy requirements and platform rules.