Apple is reportedly reshuffling its iPhone launch playbook, steering resources toward a debut iPhone Fold and the premium iPhone lineup while pushing the base iPhone 18 into a later window. The shift, first detailed by Nikkei Asia and echoed by long-time Apple analyst Ming-Chi Kuo, suggests the company is concentrating on higher-margin models amid supply constraints and a race to define the foldable category on its own terms.

What the report says about Apple’s revised iPhone plans

Nikkei Asia reports that Apple’s next iPhone cycle could spotlight two Pro-tier devices alongside a foldable iPhone, with the standard iPhone 18 slipping beyond the traditional fall cadence. Kuo has floated a similar roadmap, framing the move as a resource optimization choice rather than a strategic retreat from mainstream buyers.

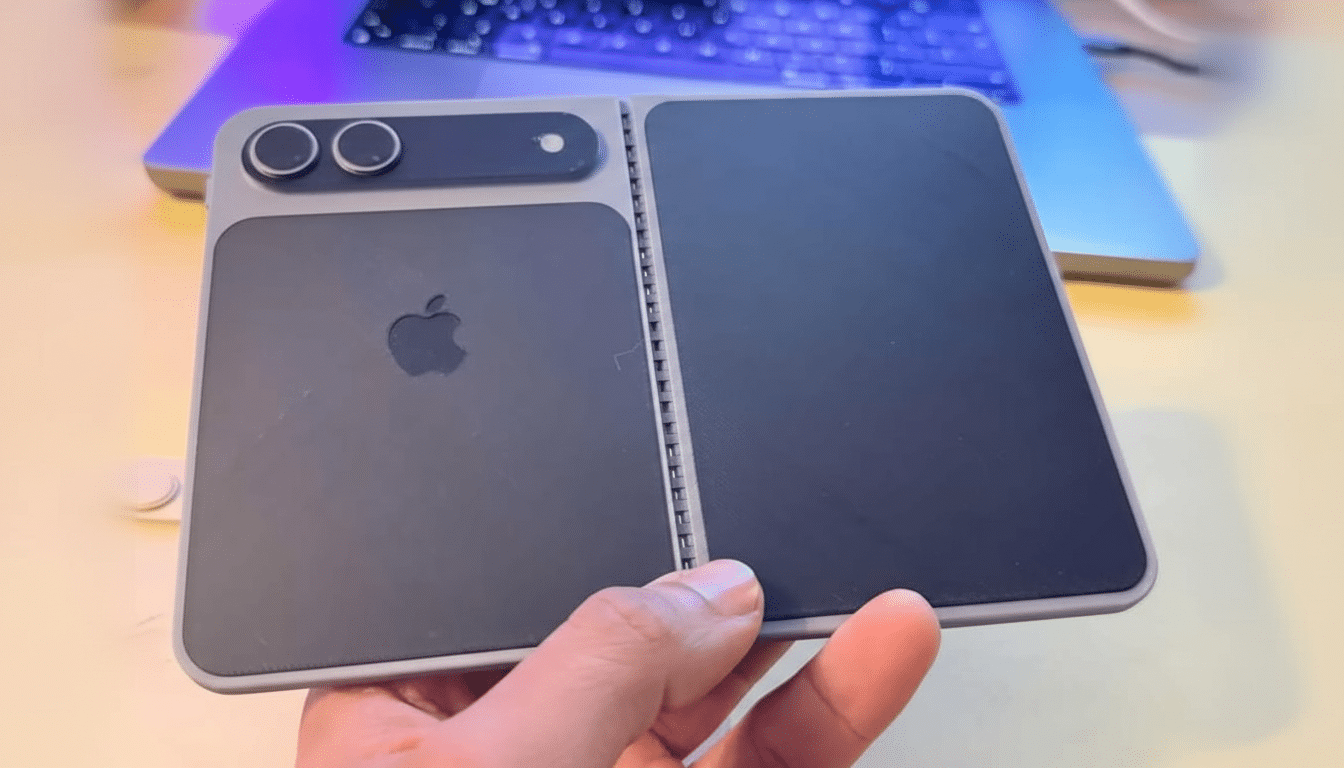

If accurate, this would be one of Apple’s more pronounced lineup pivots in recent memory. The company has tweaked rollouts before—most notably staggering certain models by weeks—yet deprioritizing the base model to clear the runway for a foldable would signal a major bet on a new form factor.

Why Apple might shift resources toward premium models

Memory remains the choke point. TrendForce has tracked tight DRAM supply as chipmakers pour capacity into high-bandwidth memory for AI servers, lifting contract prices by double digits across recent quarters. When parts are scarce, Apple historically leans into devices with higher average selling prices and stronger per-unit profitability, which supports the case for prioritizing Pro models and a halo foldable.

There’s also a marketing logic. A foldable iPhone would be Apple’s first new iPhone form factor in years. Launching it alongside Pro models concentrates attention at the top of the range, where Apple’s customer base has gravitated. Industry estimates from firms such as Morgan Stanley have placed Apple’s iPhone ASP above $900 in recent cycles, reflecting a consumer shift toward premium tiers even as unit growth flattens.

The foldable factor and Apple’s durability priorities

Building a foldable that meets Apple’s durability and reliability targets is nontrivial. Display Supply Chain Consultants has chronicled the industry’s yield challenges around ultra-thin glass, hinge mechanisms, and crease visibility—areas Apple is known to scrutinize. Suppliers like Samsung Display and LG Display have the maturity to support high-volume OLED foldable panels, but ramping to Apple’s scale and standards takes time.

Analysts at Counterpoint Research say global foldable shipments have approached 20 million units annually, still a sliver of the broader smartphone market but growing. Apple’s entry could redefine expectations for battery longevity, dust and water resistance, and software continuity between folded and unfolded states—areas where early adopters have accepted trade-offs that Apple is likely unwilling to make.

Implications for the base iPhone 18 if its launch slips

A delayed base model would shift the upgrade spotlight toward the Pro line and the foldable, potentially raising the near-term iPhone revenue mix. Carriers and retailers could respond by amplifying trade-in credits and installment deals around the pricier devices, reinforcing Apple’s premium skew. For cost-conscious buyers, it likely means a longer shelf life for the current standard model and more aggressive pricing on prior-generation units.

From a development standpoint, a staggered launch could also give Apple extra runway to tune modem performance, camera pipelines, or AI features on the base iPhone 18 without the usual synchronized ship date pressure. Apple has used staggered ramps before to smooth supply or finish software polish; applying that playbook to an entire base model would be a larger-scale version of the same idea.

What to watch next in Apple’s possible iPhone reshuffle

Supply chain breadcrumbs will be telling. Look for reports of panel orders at Samsung Display or LG Display specific to foldable sizes, hinge component volumes from established mechanism suppliers, and indications of increased UTG capacity. On the software side, developer builds that showcase adaptive layouts or new multitasking behaviors would hint at how Apple intends to leverage the larger canvas of a foldable.

Until Apple confirms its plans, the reporting paints a coherent picture: tight memory supply, an appetite for margin defense, and the strategic value of a splashy foldable debut align to sideline the base iPhone 18 temporarily. If the plan holds, the next iPhone cycle will be defined more by what folds than by what’s familiar.