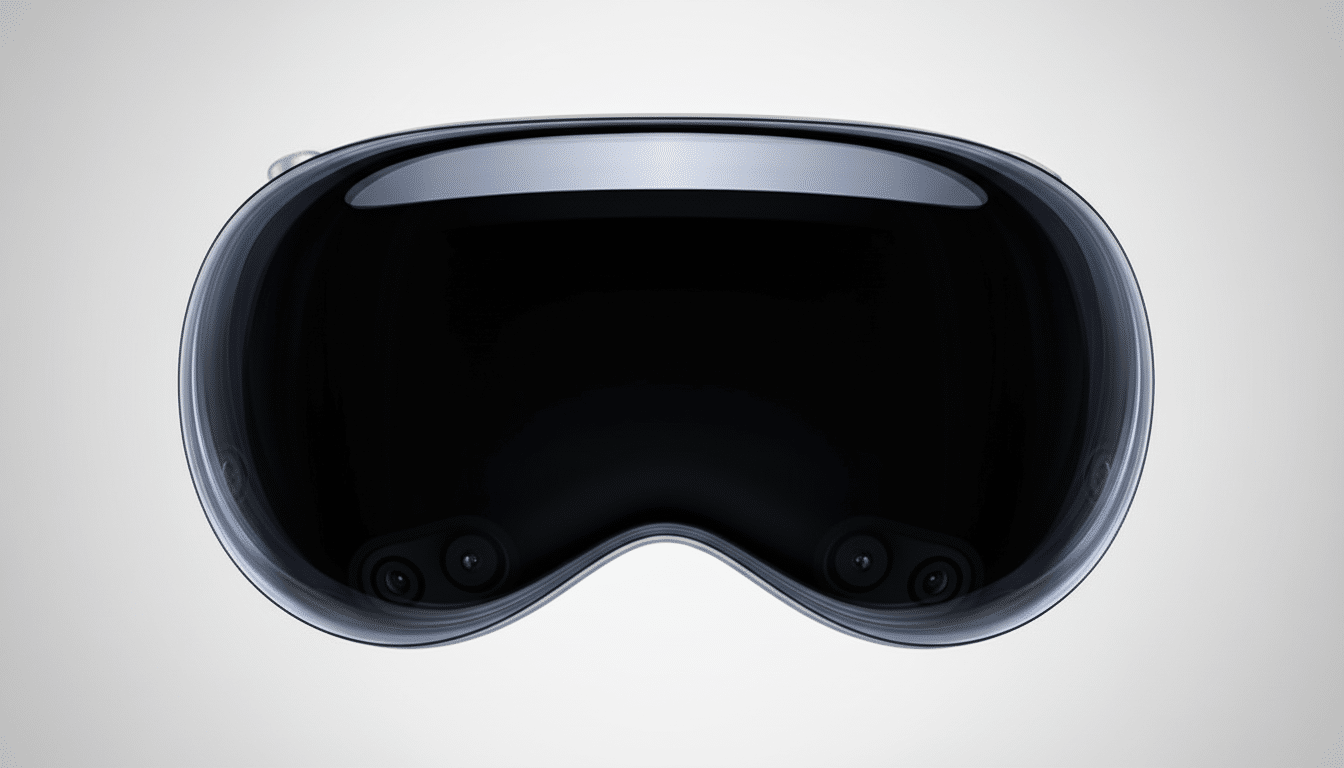

Apple has scaled down production of its Vision Pro headset after a tepid quarter of sales, an abrupt about-face for the company’s most ambitious new product in years and a wake-up call for the wider AR/VR space. The latest holiday season, International Data Corporation estimates, saw around 4,500 of the units shipped across the world, highlighting how a device costing $3,499 and without any killer application can have difficulty finding success with consumers at large.

A Premium Device in Search of a Mass Market

The early momentum of the Vision Pro has waned for have-you-heard-this-one-before reasons: high cost, trade-offs in comfort and a still-unclear value proposition. While the headset displays gorgeous micro‑OLED visuals and accurate hand and eye tracking, consumers have yet to be sold on replacing a laptop, TV, or even a tablet for day-to-day needs. In return, developers have released well-produced demos but few apps that you want to use every day.

Marketing pullback hasn’t helped. Apple cut digital ad spend on Vision Pro by about 95%, the Financial Times reported, and one sense is that it is hitting the pause button here to check whether the software story sharpens further or hardware becomes lighter and less expensive. That conservatism marks a familiar Apple cadence: step back, iterate quietly and return when the product–market fit has lined up more cleanly.

AR/VR Headwinds Stretch Farther Than Apple

Vision Pro’s fall is part of a larger slowdown. According to Counterpoint Research, shipments of AR/VR headsets dropped 14% in the first half of 2025 as consumer wallets tightened and upgrade cycles lengthened. The market’s two‑tiered split is deepening: the ultra‑premium headsets are just too expensive for casual buyers, while low-cost VR triumphs in gaming value but rarely advances the everyday productivity space.

Price sensitivity is stark. Meta’s Quest line has hit the $250 range at retail, becoming the inexpensive impulse buy of the category. On the other end, high‑end entries like Samsung’s expected Galaxy XR, at around $1,800, are for enthusiasts and professionals, not the mass market. Vision Pro, the most expensive of the lot, has the hardest sell without a single “killer app.”

Supply Chain and Design Limitations Constrain Growth

Even if demand were stronger, production is complicated. Previous reports by Nikkei Asia focused on micro‑OLED yield issues — which are critical for the Vision Pro’s cinematic image quality. Comfort is still a constraint across high‑end headsets, too — weight distribution, heat and reliance on a tethered battery to power everything limit wear time, chipping away at the promise of all‑day mixed reality.

These constraints ripple downstream. A smaller installed base dissuades big developers from making major bets, which in turn cools consumer interest. It’s a classic chicken-and-egg problem that the smartphone era mostly sidestepped because of immediate utility and scale.

The Future: Glasses, Not Goggles, for Everyday AR

Several reports from outlets including Bloomberg and The Information suggest Apple has shifted resources to a project to develop lightweight smart glasses. It is in line with where consumer buzz has been building: camera- and AI-enabled eyewear that provides simple, glanceable utility without the bulk.

Meta’s Ray‑Ban family, which introduced features like live translation, navigation prompts and voice search, demonstrates how a socially acceptable form factor can unlock everyday use. Glasses focus in on micro‑interactions — catching an important message, getting a feed of a baby’s first steps, finding your way around a new city — rather than the macro experiences that some think of when they hear “augmented reality.” The hope is that if Apple can marry on‑device AI with the iconic industrial design it’s so well known for, we could have a far bigger market than premium mixed‑reality goggles can reach right now.

What Apple May Do Next to Reignite Spatial Strategy

Short on breathing room, reducing production is a sensible cost move while refining the road map. Anticipate Apple focusing on three tracks:

- Reduce the bill of materials for a more affordable headset.

- Get glasses research moving faster.

- Seed software that has practical, repeatable value.

That means spatial tools for meetings, design, and training in enterprise environments where return on investment is quantifiable.

Apple can also tap its ecosystem advantage. An iPhone as a spatial camera, spatial video in Photos, and closer continuity between Mac, iPad, and visionOS will effectively lower the “new platform” barrier for developers. Those developer incentives, in the form of funding or discovery boosts and clear guidance on standout use cases, would also help construct the daily workflows Vision Pro is currently lacking.

The AR/VR Outlook Following the Production Cut

Production cutbacks are not an obituary for Vision Pro or spatial computing broadly. They are a sign that adoption will be slow and irregular, with useful wins in limited scenarios coming first: remote assistance, 3D design, medical visualization, and field training. Consumers will probably be introduced to AR through lighter glasses and AI‑first features, while premium headsets grow up for specialized work.

Analysts had estimated first‑year volumes for Vision Pro in the hundreds of thousands; a recent quarter’s roughly 4,500 shipments demonstrate just how steep the road to ubiquity is. But Apple has slogged through slow starts before. If the company is able to manifest its strengths — silicon, design, and ecosystem — into a socially acceptable everyday AR product, this reset could look less like retreat and more like the setup for the form factor that finally breaks out.