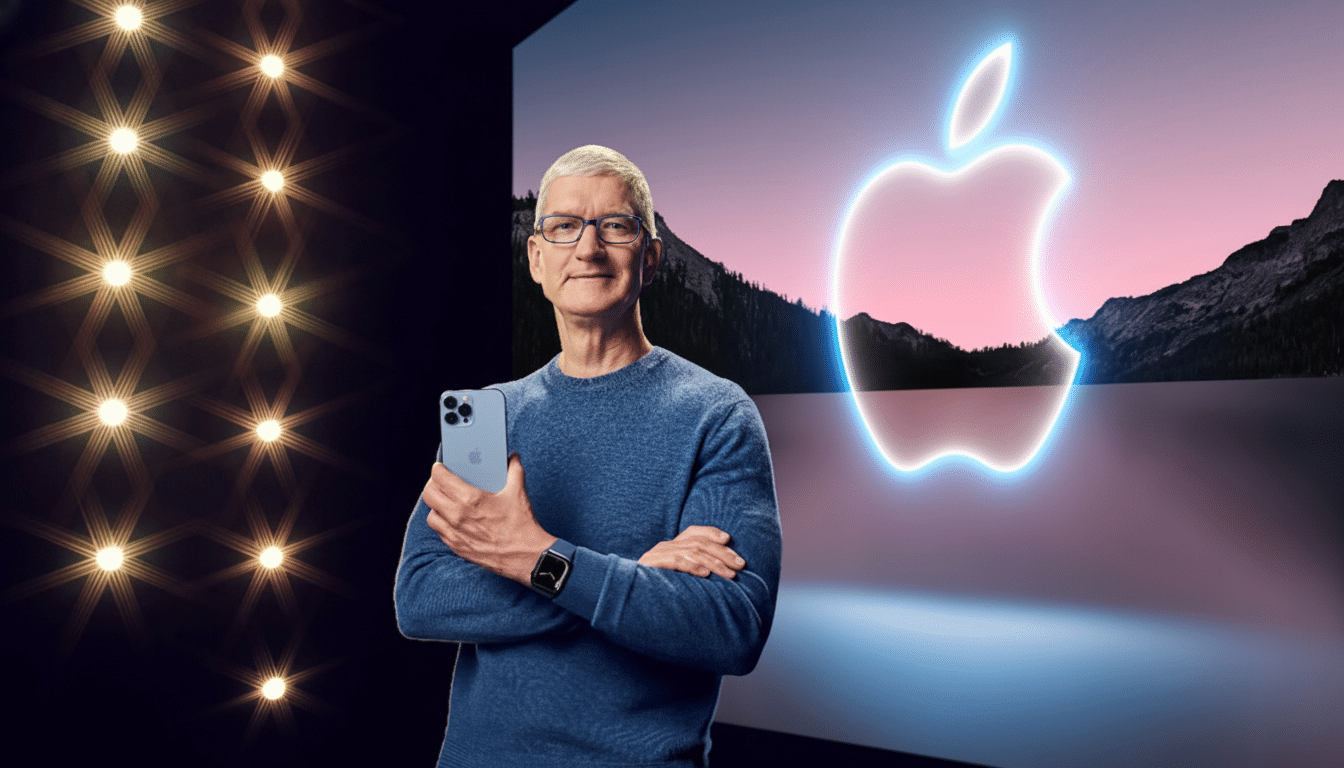

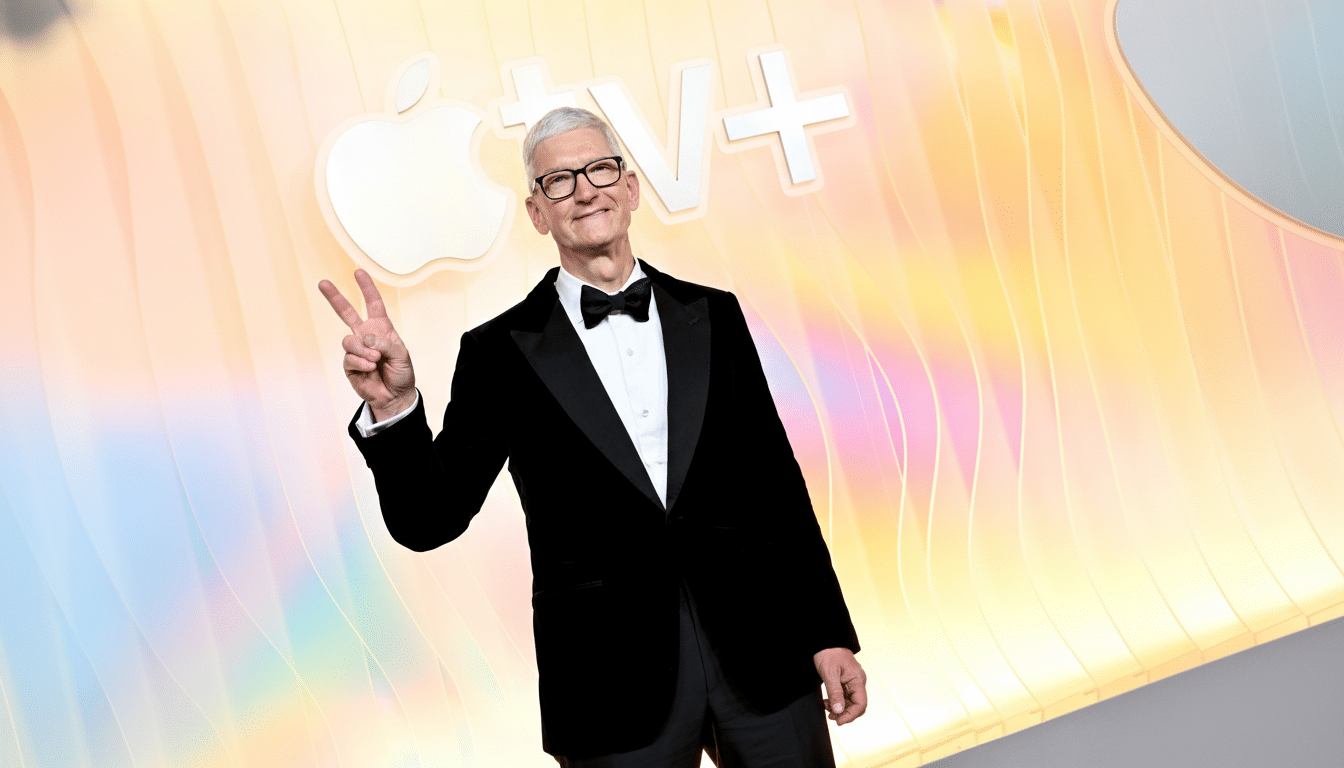

Apple is speeding up CEO succession planning, according to the Financial Times, with management getting ready for the chance that Tim Cook could pass the baton following the next earnings. It hasn’t made a final decision, but the company is working out a timeline that would fend off disruption ahead of marquee product and developer milestones. Hardware chief John Ternus is the top internal candidate to succeed him, according to people familiar with the matter.

Signs of a Managed Transition Emerging at Apple

Apple’s board has long signaled a distaste for disruption and an affinity for quietly steering the ship toward steady continuity. That ethos drove the Steve Jobs-to-Cook transition, and it seems to underpin the current process. It would allow room for the next chief to get their priorities in place before the developer cycle spins up, stabilizing teams and partners around one roadmap.

Boards usually map out multi-track scenarios, corporate governors like Spencer Stuart point out, to have bench depth and optionality. The planning reported could mean that Apple is far enough along past the theoretical to contingency design: communication cadence, role assignment, and near-term operating goals.

The Shortlist Inside Apple for Future Leadership

John Ternus, the senior vice president of hardware engineering, has led iPhone, iPad, and Mac hardware engineering—where he played a major role in each architecture transition—for more than a decade. That change reduced reliance on third-party chip roadmaps and honed Apple’s differentiation in performance-per-watt, a margin—and experience—advantage any new CEO would covet.

Chief Operating Officer Jeff Williams is still a viable candidate. He has steered supply chain, health initiatives such as Apple Watch, and major operations pivots. His background fits the company’s culture of disciplined execution—though the FT’s reporting seems to lean towards Ternus as the inside favorite.

Other top leaders are on the bench. The most visible executive is software lead Craig Federighi, a linchpin of platform strategy. The services division, run by Eddy Cue, spans media, payments, and the cloud. AI leader John Giannandrea paves the way for on-device intelligence. Investor continuity comes from CFO Luca Maestri. But Apple also has a history of promoting leaders with broad product remits and operational control—both of which play into Ternus’s hand.

The Strategic Backdrop Facing Apple’s Next Chief

The next chief executive will take over an organization at a crossroads. Under Cook, Apple grew into a more than $4 trillion company from a market value of around $350 billion, propelled by the resilience of the iPhone, the takeoff of wearables, and a services flywheel with fat gross margins. Services, according to company filings, have since become a meaningful portion of revenue and provided Apple with a more diversified earnings base.

AI is the big swing. Apple has emphasized privacy-first, on-device intelligence as a differentiator from cloud-first rivals. The trick is to ship features that feel magical and essential while protecting performance, battery life, and trust. To what extent Apple will rely on outside model providers versus developing internally will be an early test for any successor.

Geopolitics and the idea of diversifying supply chains are also on the minds of many. Apple has scaled up manufacturing footprints in India and Vietnam, a hedge against concentration risk. Simultaneously, legal threats to platforms and app stores remain present around the world with legal decisions shaping margins and distribution. A recent $634 million jury award in a medical-sensor patent case underlines that litigation remains a material variable.

Cook’s Legacy and the High Bar for His Successor

Cook’s era will be known as a time of world-class operations, the world’s biggest capital-return program, and Apple essentially turning into an ecosystem of services and devices with a huge installed base. Adding an Apple Silicon migration, muscular buybacks approved in company releases, and product life cycle enhancements into operational excellence to industrial strength reminds shareholders they could be repaid.

That sets a high bar. The next chief executive must sustain cash generation while rekindling category expansion—be it in spatial computing, health, or AI-native experiences—without diluting Apple’s brand promise. The delicate dance between courageous wagers and clinical execution will come to define the post-Cook era.

What Investors Should Watch as Apple Plans Succession

- Signs that Arena and Ganatra have been elevated to roles with increased responsibility: Ternus being put in the spotlight more in public; cross-functional responsibilities going deeper into paperspace; or reorganizations clustering hardware, AI, and platform teams under a more centralized operating model.

- A shift in language with regard to investor communications that indicates not just annual product cycles but a multiyear AI and silicon roadmap.

- Capital allocation. A continuation of buybacks and dividends would reassure the markets, but targeted M&A in AI or health might signal something of a strategic signature for the new chief. Ultimately, keep an eye on board composition and committee leadership—subtle changes to the governance process can be precursors to C-suite news.

Whether the transition comes now or later, Apple seems to be setting up a handoff, rather than scrambling to respond. That, more than anything else, hints at how the Tim Cook era ends—when it does—and that it looks like Apple in its prime: planned, product-focused, and pitilessly steady.