Wall Street analysts say AMD has identified a novel way to win an enormous AI customer without paying upfront cash or discounting list price: Use its own rising stock to underwrite the deal. The expanded partnership with OpenAI, the chipmaker says, rests on stock warrants that would allow the AI lab to potentially pay for billions of dollars of Instinct GPUs with proceeds earned from AMD shares themselves.

How The Warrant-For-Compute Model Works

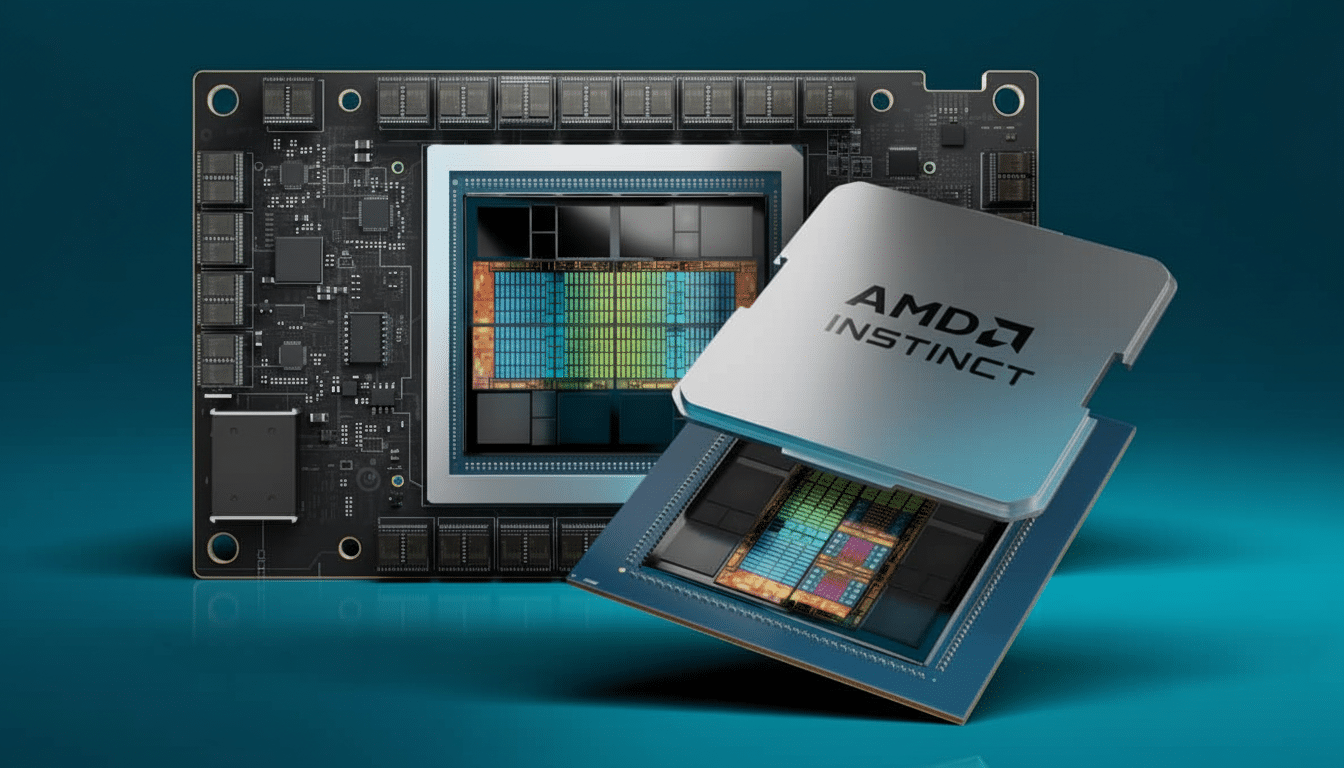

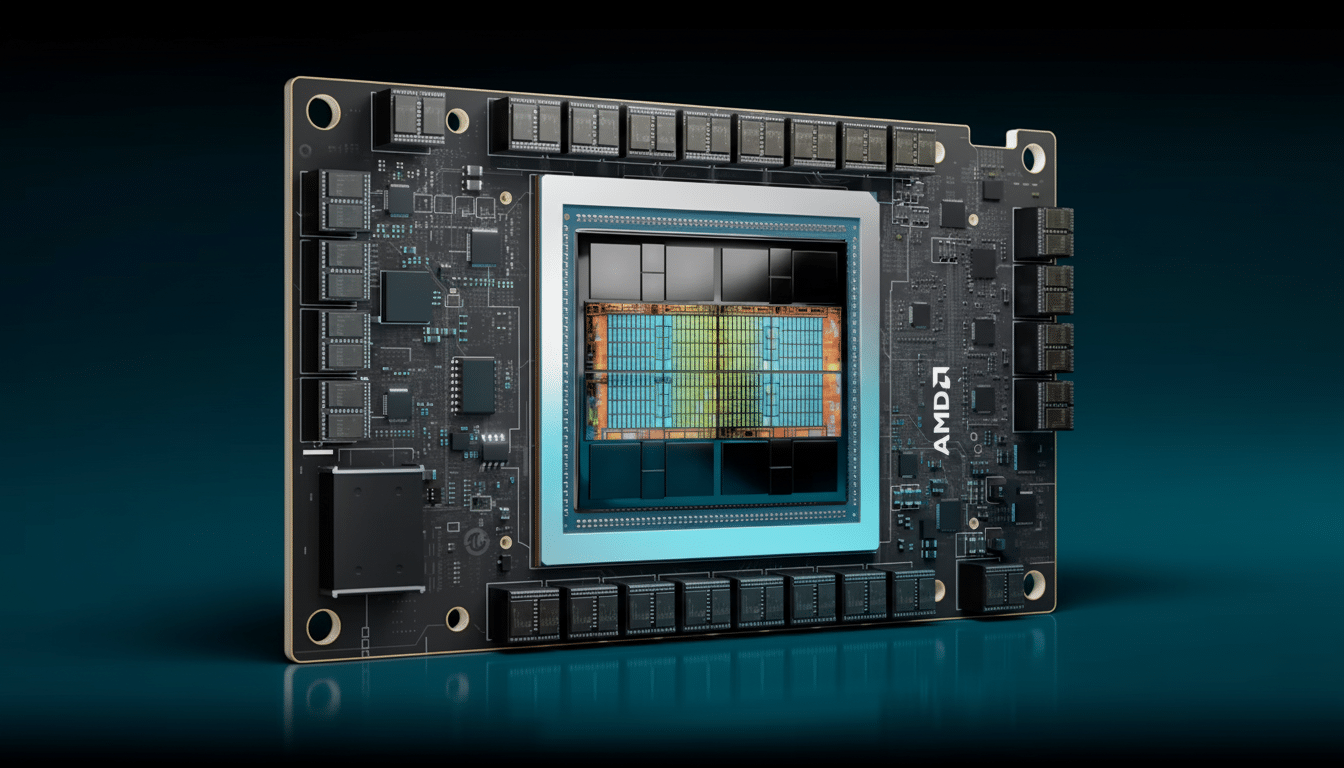

As part of the deal, OpenAI will aid in development and optimization of AMD’s Instinct portfolio, and has committed to purchasing “up to” 6 gigawatts of compute over multiple years from AMD. Instead of relying on its own cash, OpenAI ended up with warrants to buy as many as 160 million shares of AMD over time that vest in chunks related to operational goals and ambitious long-term stock price targets laid out by AMD.

One of the targets lies at the high end: Warrants in the last tranche need AMD shares to trade for $600, or near a $1 trillion market capitalization. Ahead of the announcement, AMD’s shares were trading around $165; they shot up to roughly $214 by the end of the first trading day after the news, suggesting investors’ willingness to fund that bet with higher valuations on its equity.

UBS semiconductor analyst Timothy Arcuri did the math: if OpenAI hits its technology and deployment targets, and holds shares until they are fully vested, the stake could be valued at approximately $100 billion at the highest price thresholds. More likely, he says, OpenAI will sell stock along the way to pay AMD’s invoices as they come due—transforming AMD equity into some sort of revolving customer credit line.

Why It’s Investors Who Ultimately Foot the Bill

The mechanism is a transfer of funding from OpenAI’s P&L to AMD’s capital stack. If AMD stock keeps rising, the value of warrants becomes a method of funding GPU acquisition. Existing shareholders pay out the difference in dilution when warrants are exercised and, arguably, any incremental multiple expansion that the market prices in to account for the OpenAI win.

Put another way — and to the extent that investors continue bidding up the shares — they are underwriting OpenAI’s buildout. That might sound circular, but it’s far from unheard of in capital-intensive tech cycles; equity-financed customer incentives have been otherworldly features that emerged time and again during networking, cloud, and telecom booms when vendors seek to rapidly seed an ecosystem.

What AMD Gains Beyond Cash in the OpenAI Deal

The potential strategic upside — for AMD, that is — is huge. An OpenAI endorsement positions Instinct GPUs as a viable alternative to Nvidia at the highest end of AI training and inference workloads. That validation provides leverage with hyperscalers and enterprise clouds who already buy AMD’s Epyc CPUs, potentially greasing cross-sell paths for full CPU–GPU racks and co-optimized software stacks.

UBS argues that the deal has the potential to double AMD’s AI accelerator share into high tens, a path toward which could be close to 30% over time if execution holds and supply ramps. The 6-gigawatt promise (the equivalent of multiple large data center campuses) also serves to rationalize long-term capacity plans and investments in advanced packaging.

The critical issue is that AMD does not set a price negotiation precedent at the die level. In financing the relationship with equity, it keeps list pricing in place while getting to keep the marketing value of having OpenAI running on Instinct — and making that value all the larger if performance and availability both live up to expectations.

Dilution and Accounting Considerations for the Deal

Warrants for 160 million shares present a potentially significant dilution — about a tenth of AMD’s recent share count if entirely exercised, according to the company’s filings. The compromise is that dilution only occurs once the equity value has appreciated significantly, and chances are the business scales along with it.

The treatment on the income statement depends on structure. Under US GAAP (ASC 606), consideration to a customer may reduce the amount of recognized revenue unless it receives separate goods or services. The near-term P&L impact is likely to be small relative to the strategic and capacity benefits, with most of the risk moving into the equity line via potential dilution rather than margin squeeze.

How the Strategy Compares With Rival Nvidia

Nvidia, too, has been funding AI’s expansion — most notably with a big investment fund tied to OpenAI and other ecosystem bets. The distinction is direction: Nvidia has made moves that get it ownership stakes in AI platforms, while AMD’s setup gives OpenAI a stake in AMD. The two are locked in demand generators and software lock-ins; AMD’s is just, instead of cash, paid for with some of its future equity value.

What to Watch Next as AMD and OpenAI Execute

Three checkpoints will determine if this virtuous circle sustains: the pace at which Instinct GPUs achieve performance and deployment milestones from OpenAI, the range of follow-on wins with large clouds and enterprises, and how warrant exercises and share sales filter through AMD’s cap table.

Monitor new disclosures in the company’s filings with the Securities and Exchange Commission as well as commentary from sell-side research at UBS and its peers on accelerator share, pricing, and supply. Or, if AMD hits its roadmap and the market rewards it with higher multiples, the company will have achieved a rare thing in semiconductors: letting equity appreciation bankroll a multibillion-dollar customer while speeding up its climb into the league of AI big dogs.