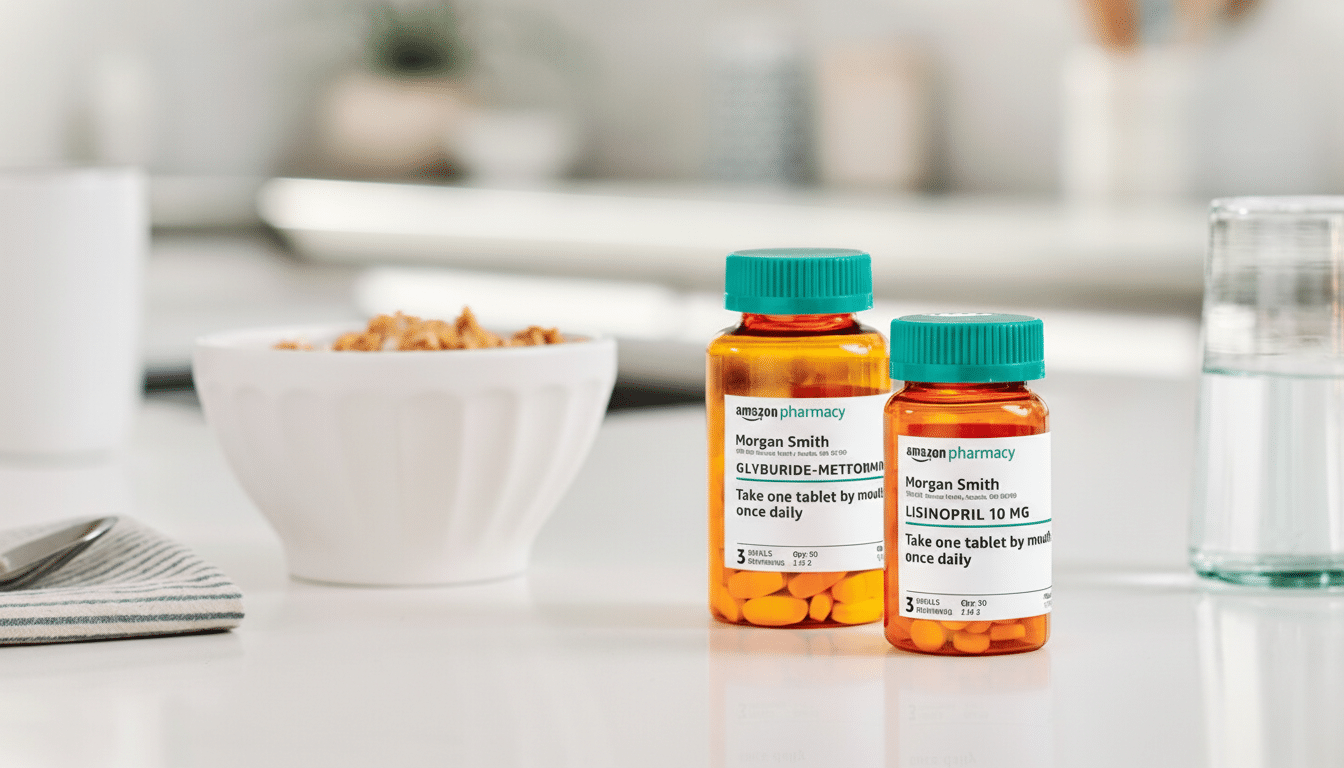

Amazon Pharmacy plans to bring same-day prescription delivery to nearly 4,500 U.S. cities and towns, adding close to 2,000 new communities and expanding into newly served states such as Idaho and Massachusetts. The move significantly widens the company’s healthcare footprint and raises the bar on how quickly patients can start treatment after a prescription is written.

The company frames the rollout as an effort to eliminate trade-offs among speed, cost, and convenience, leaning on its logistics network to compress pharmacy wait times. John Love, vice president of Amazon Pharmacy, said the goal is to remove friction so patients can begin therapy faster, signaling a push to make same-day fulfillment a mainstream expectation rather than a premium perk.

What the Amazon Pharmacy expansion covers across the U.S.

The expanded network is expected to reach a broad mix of major metros, suburbs, and smaller towns, with availability ramping as local pharmacy operations, courier capacity, and ordering cutoffs come online. Amazon says the scope spans both new geographies and deeper coverage in cities it already serves.

Eligibility for same-day delivery will hinge on medication type, stock levels, prescriber verification, and state rules. Controlled substances carry additional federal and state restrictions that can limit delivery, and temperature-sensitive therapies require specialized packaging and handling that may affect turnaround times.

Customers can typically use insurance or opt for cash pricing, and generics are a central part of the formula. More than 9 in 10 prescriptions filled in the U.S. are generics, according to the Food and Drug Administration, making rapid access and predictable pricing especially important for commonplace treatments.

How Amazon Is Building Its Pharmacy Footprint

Amazon’s pharmacy strategy has been building for years. The company acquired PillPack, a mail-order pharmacy that pre-sorts medications by dose, for $753 million in 2018 and launched Amazon Pharmacy in 2020 to provide nationwide home delivery. In 2023, it introduced RxPass, giving U.S. Prime members access to many commonly used generics for a flat $5 monthly fee, though it excludes certain medications and isn’t available to patients with government insurance.

Amazon has also been knitting pharmacy services into its broader care ecosystem. At One Medical clinics, in-office kiosks operated by Amazon Pharmacy let patients pick up some prescriptions right after their visit. That blend of point-of-care dispensing, mail-order convenience, and now same-day courier delivery is designed to reduce the handoffs that often cause delays.

Why prescription delivery speed matters for patients’ care

Faster fulfillment is not just a convenience feature; it can influence outcomes. Research cited by the Centers for Disease Control and Prevention and the National Academies has long linked medication nonadherence to avoidable medical costs estimated in the $100B–$300B range annually. Closing the gap between prescription and first dose can help reduce drop-off, particularly after acute diagnoses when motivation is highest but logistics can still derail follow-through.

For chronic conditions like hypertension, diabetes, or asthma, quick initial fills and smooth refills are tied to better persistence. IQVIA analyses have associated convenience factors with higher adherence, suggesting that same-day delivery could be especially impactful for patients with mobility challenges, caregivers juggling multiple therapies, or those who live far from brick-and-mortar pharmacies.

Competitive landscape and policy context for pharmacy delivery

Amazon’s push lands in a market where incumbents have also accelerated. CVS and Walgreens both offer same-day delivery in many areas, often via partnerships with DoorDash or Uber, while Walmart and regional chains are expanding courier options. Startups like Capsule focus on white-glove, courier-based service in select cities. Amazon’s differentiator is the scale of its fulfillment and routing infrastructure, paired with a growing primary care presence through One Medical.

Even with faster logistics, pharmacy care still runs through complex benefit designs. Pharmacy benefit managers and insurers influence out-of-pocket costs, preferred drugs, and dispensing channels, while prior authorization and step-therapy rules can slow fills regardless of delivery speed. Amazon, like peers, must also maintain pharmacist counseling access, electronic prescribing safeguards, and state-by-state licensure compliance.

On the safety front, the company will be judged on accuracy, privacy, and cold-chain reliability. HIPAA standards, tamper-evident packaging, and temperature controls aligned with United States Pharmacopeia guidance are table stakes. As same-day volumes grow, maintaining clinical oversight—such as verifying interactions and ensuring patients can reach a pharmacist—will be as critical as meeting delivery promises.

What to watch next as Amazon Pharmacy scales same-day delivery

Key indicators of success will include the share of orders delivered the same day, refill retention, patient satisfaction, and how far coverage extends beyond dense urban cores. Expect Amazon to test deeper clinical integrations—think streamlined prior authorizations, synchronized refills, and tighter links with telehealth—while independents and chains differentiate with clinical services and local relationships.

If execution matches ambition across roughly 4,500 locales, Amazon will have normalized near-instant pharmacy delivery for a large slice of the country, resetting expectations for how and when patients get their medications—and pushing the entire industry to move faster.