Amazon is working toward prescription vending machines inside One Medical clinics, which would allow patients to walk out of an exam room and immediately pick up medications in the office. The in-office kiosks are being introduced with the support of Amazon Pharmacy and roll out first in Los Angeles and will expand to more markets following the initial launch.

The move further extends Amazon’s gradual push into healthcare, after its acquisition of PillPack, the creation of Amazon Pharmacy and the purchase of primary care provider One Medical. In deploying dispensing tech where care is delivered, Amazon is going after the last mile of medication access — frequently the moment prescriptions go unfilled due to an extra trip, wait or confusion over costs.

How the in-clinic prescription kiosks and pickup work

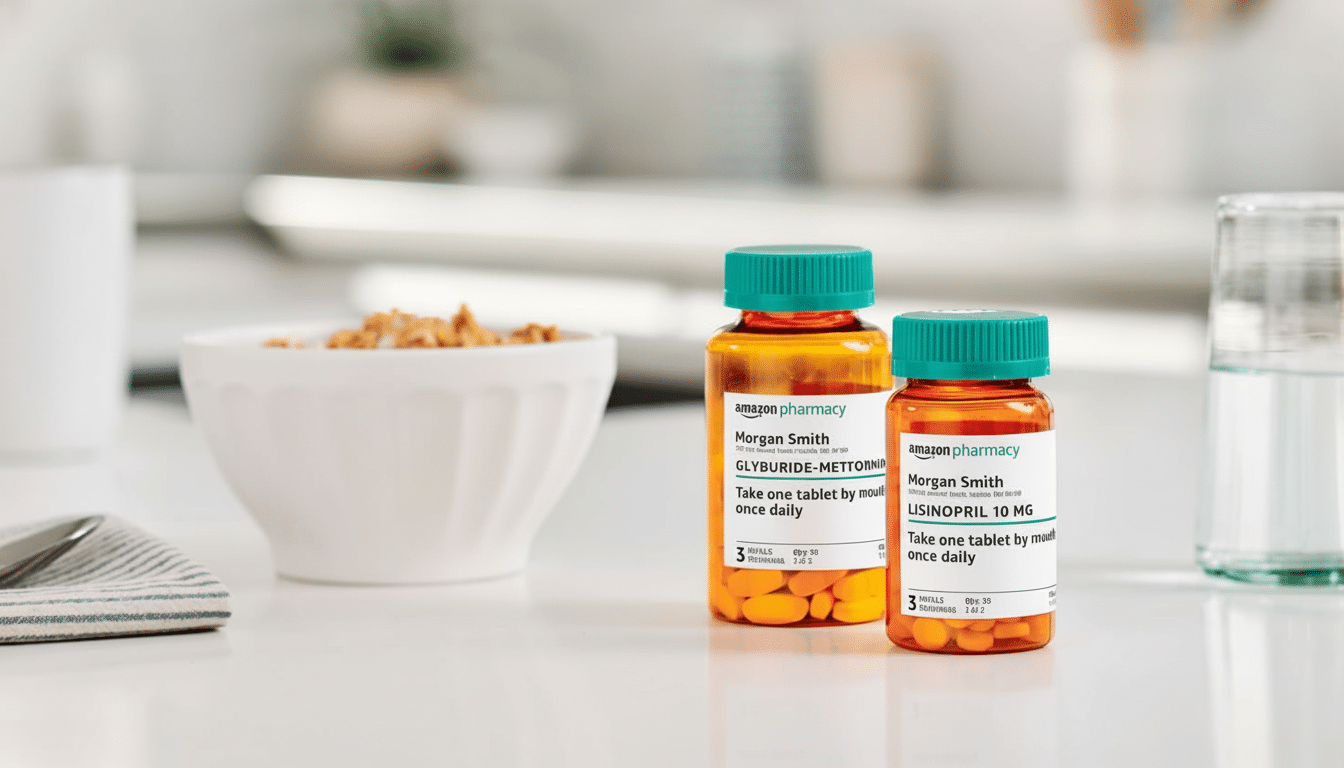

Once a clinician writes an e-prescription, patients can choose to direct it to Amazon Pharmacy for on-site pickup. Checkout occurs in the Amazon app, which displays estimated insurance copays and any available discounts before payment. After processing, a code in the app opens the kiosk compartment for pickup — a process designed to cut wait times down to just a few minutes.

Amazon says it stocks based on prescribing patterns at that clinic, centering around common therapies such as antibiotics for acute infections, inhalers for asthma and first-line drugs for hypertension. Controlled substances and refrigerated drugs will not be available from the machines. Patients can get a consultation and safety check with a licensed pharmacist via video or phone, to maintain clinical oversight without delaying the handoff.

Why convenient in-office pickup can boost access and adherence

Missed first fills are a stubborn issue in U.S. healthcare. Studies cited by the Annals of Internal Medicine and the Centers for Disease Control and Prevention have long estimated that about 20% to 30% of new prescriptions are never filled, a phenomenon that adds costs but doesn’t benefit patients. Initiation generally increases when medications are offered at the point of care, and self-selection decreases because the friction of a separate pharmacy trip evaporates.

Cost transparency is another lever. Kaiser Family Foundation polls have found that about one in four adults has difficulty paying for prescription drugs. By displaying copays and cash prices up front — as well as applying pharmacy discount options directly in the app — Amazon, which is using its vast store of consumer data to determine accurate drug prices, believes it can cut down on surprised reactions at the counter, a common reason patients abandon fills.

Competitive context and evolving regulatory landscape

The timing also dovetails with a shakeout of pharmacies. The National Community Pharmacists Association said that big chains have been shuttering underperforming sites and that independents are facing increasing pressure from the “reimbursement dynamic” and staff shortages. Kiosks in clinics could partly backfill lost neighborhood access, especially for simple prescriptions, but they would likewise create a new brick-and-mortar rival for volume.

Regulatory guardrails remain central. Dispensing protocols, patient counseling and security are subject to state board of pharmacy oversight. And by leaving out controlled substances, Amazon sidesteps much of the Drug Enforcement Administration’s headaches but continues to manage identity verification and tamper-evident packaging, as well as temperature-sensitive shipments at room temperature. E-prescribing and claims processing depend on pre-existing standards, such as NCPDP SCRIPT, while pharmacist consults — provided to patients via remote sessions — also meet state counseling mandates, which the National Association of Boards of Pharmacy notes.

Key metrics and market signals to watch in the rollout next

Early signs will be important: Fill rates compared with traditional pharmacies, average wait times, drug availability and the portion of patients who access pharmacist consults. Regulators and clinicians will closely watch safety metrics — such as dispensing errors, returns and counseling acceptance.

Equally important is payer support. If insurers and pharmacy benefit managers consider point-of-care pickup as reducing total cost of care by enhancing adherence, they may encourage members to use the kiosks or provide discounts on copays. And on the other end, prior authorization delays, out-of-stock items or complex medications that require cold chain and intensive counseling could prevent some patients from using the model.

For Amazon, the key to success will be demonstrating that a few minutes saved at the clinic translates into meaningful increases in medication adherence and patient satisfaction. If the pilot lives up to that promise, the blueprint — clinics first, then eventually more comprehensive sites — could change where and how easily Americans get their prescriptions filled.