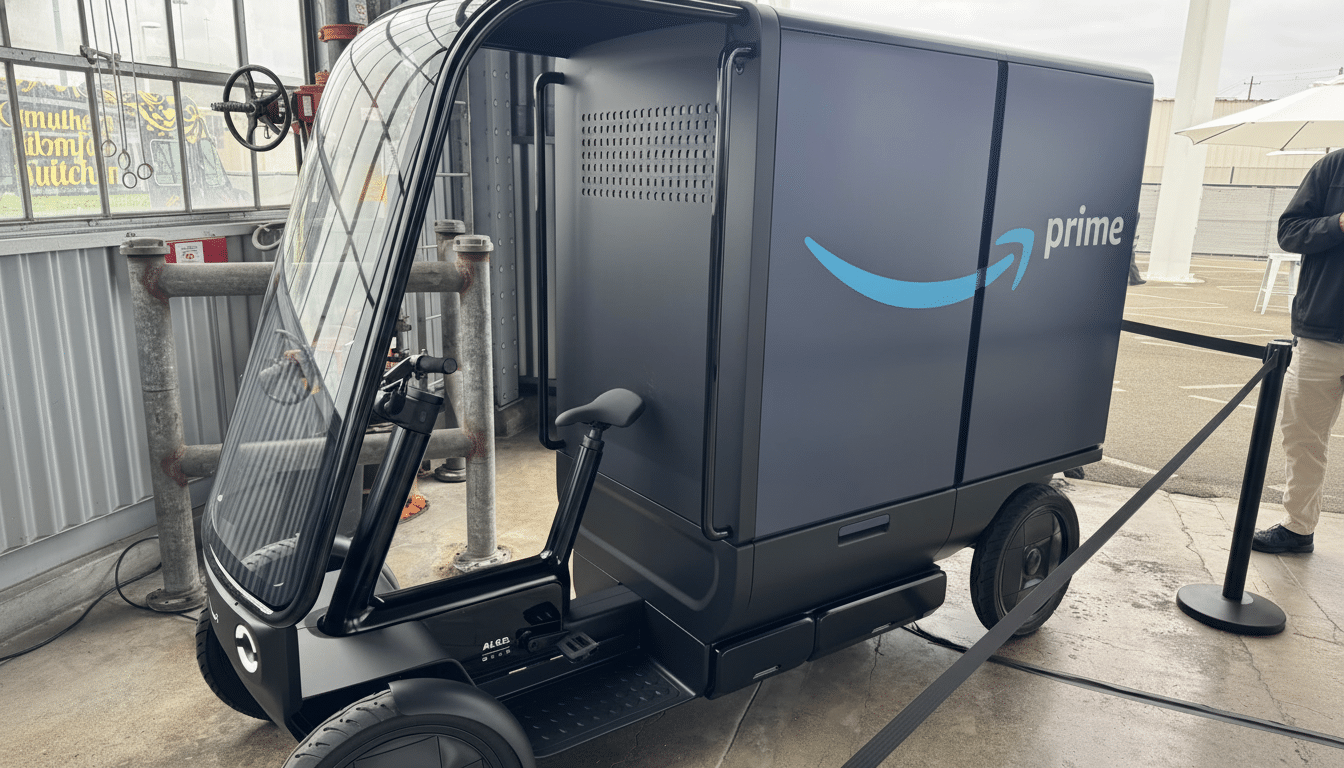

Amazon has made a multi-year deal to buy thousands of pedal-assist e-cargo bikes from Also, the micromobility startup that came out of Rivian, as part of the retailer’s push to make its delivery fleet clean and sustainable, Amazon announced Tuesday. The four-wheeled TM-Qs forecast a payload north of 400 pounds packed into something that’s narrow enough to roll through bike lanes, marrying van-like capacity with bicycle agility.

The companies intend to customize the vehicles for operations in the United States and Europe, including software and hardware designed around Amazon’s routing, safety and charging requirements. Even apart from the scale, what distinguishes Also is an intimate knowledge of supply chains: Rivian, an investor in the startup, has already provided more than 25,000 electric delivery vans to Amazon and therefore a clear view on high-utilization requirements for parcel van fleets.

Also was born from a Rivian skunkworks along with fresh capital from Eclipse, and continuing connections to Rivian’s technology and manufacturing know-how. That heritage appears in shared parts across the lineup, shorter iteration cycles and pragmatic focus on total cost of ownership for commercial buyers.

Why Cargo Quads Work for the Urban Last Mile

Urban last-mile delivery is as much a congestion and curb-space issue as it is an emissions problem. Pedal-assist quads, being compact, can share bike infrastructure, occupy a mere fraction of a van’s footprint and stage from neighborhood microhubs rather than far-flung depots. Amazon already has more than 70 micromobility hubs set up in cities across the U.S. and Europe, making a natural landing zone for vehicles like the TM-Q.

Independent research backs the shift. A University of Westminster study analyzing real-world courier operations in London discovered that cargo bikes were about 1.6 times faster at delivering goods compared to vans within the dense core, slashing carbon emissions by an estimated 90 percent per drop. “The European Cyclists’ Federation has reached the same conclusion: over half of urban delivery tasks today are technically possible with cargo bikes, especially if we pair them with microhubs and have smart routing.”

The general policy environment is also favorable. From Paris to New York, city authorities around the world are rolling out new cycling routes, broadening low-emission zones and banning double-parking. The International Transport Forum has emphasized that urban freight is a large slice of city traffic and its pollution, so optimizing the size of vehicle for each trip may be one of the most effective interventions.

Inside Also’s TM-Q Platform for Urban Deliveries

Beneath the skin, the TM-Q features a pedal-by-wire drivetrain developed in-house, which provides smooth power-boost delivery without the lurching common to lower-cost systems.

The batteries are meant to be taken off and carried — not installed as they would be inside a vehicle — in keeping with a design that emphasizes speedy, hot-swappable hits at the hub rather than long rests on centralized chargers. Also underway is the building of docking infrastructure so fleet operators can swap modules in seconds and keep their vehicles in service longer.

The control interface revolves around a five-inch circular touchscreen that it shares with Also’s TM-B e-bike and that is used for navigation, security and adjusting performance settings. Fleet software is layered on top, bringing in route assignments, proof-of-delivery workflows and charge-state monitoring. The dimensions of the vehicle are intentionally compact for bike lane access, featuring a cargo topper that effectively converts the quad into a micro-van while maintaining maneuverability.

Also’s modular approach is one of the things that set it apart. And the company is already showing the consumer-facing variants on that same quad platform — replacing the delivery topper with bench seating or open cargo beds, but keeping the drivetrain, controls and battery system all in common. For a new manufacturer, that parts commonality is a cost and serviceability benefit.

Amazon’s Playbook and How Rivals Stack Up

Amazon’s logistics network looks more and more like a combination of assets that are the right size: electric vans for trunk routes, micromobility vehicles for last blocks, neighborhood hubs to stitch it together. The gamble is that pedal-assisted quads can bump stop density-per-hour, cut down on missed deliveries where curb space is limited and shave fuel and maintenance costs in crowded corridors — all while jibing with companies’ environmental goals.

Competitors are running parallel experiments. UPS has trialed the Fernhay eQuad in Europe and the U.S., DHL runs its Cubicycle across several EU cities, and other carriers have launched e-cargo bikes in Manhattan, London, and beyond. What makes Amazon’s move different is the scale and especially the software that it has deeply integrated with fleet software and facilities, which is what tends to decide whether a type of micromobility remains a pilot or graduates to standard kit.

Key Metrics That Will Define Program Success

Three gauges will tell the tale.

- Uptime — swappable batteries and ruggedized drivetrains will need to keep the quad runner flying in all sorts of weather.

- Productivity — density zone parcels per hour and the few hours it takes for a route to be completed need to beat van benchmarks.

- Urban fit — city acceptance, safety outcomes and management of the curb will dictate how broadly quads can deploy.

If Also scales manufacturing efficiently — drawing on Rivian’s supplier relationships and the TM platform it still shares with Ford — the math gets more favorable. If the tens of thousands of pedal-assist cargo quads being added by Amazon are a novelty, it is more so in the sense that it’s actually a further move toward optimizing networks than simply replacing them — with eyes on a future where most short urban drops are made by vehicles sized for the job and streets designed to accommodate them.