Anthropic has signed up another blue-chip customer to its customer roster, targeting one of the world’s most highly regulated industries for its range of large language models. The deal widens the breadth of Anthropic’s reach in financial services and demonstrates how insurers are transitioning from pilots to production-grade AI implementations.

A Strategic Win in Highly Regulated Insurance

For a global insurer like Allianz with a big business in Europe, the use of AI also faces greater scrutiny. As an E.U.-based entity, Allianz is subject to that body’s data protection rules and pending AI-specific requirements: Its people want traceability, and human oversight is nonnegotiable. That context is what makes this deal interesting: it’s not about model access exclusively, but instead on governance, auditability and safe-by-design workflows.

- A Strategic Win in Highly Regulated Insurance

- What the Allianz Deal Comes With for Enterprises

- How Insurers Are Likely to Use It Across Operations

- Anthropic’s Enterprise Momentum Builds With Alliances

- Rivals Increase Their Enterprise Offerings

- Why It Matters for Carriers in Regulated Markets

- What to Watch Next as the Allianz Deal Rolls Out

What the Allianz Deal Comes With for Enterprises

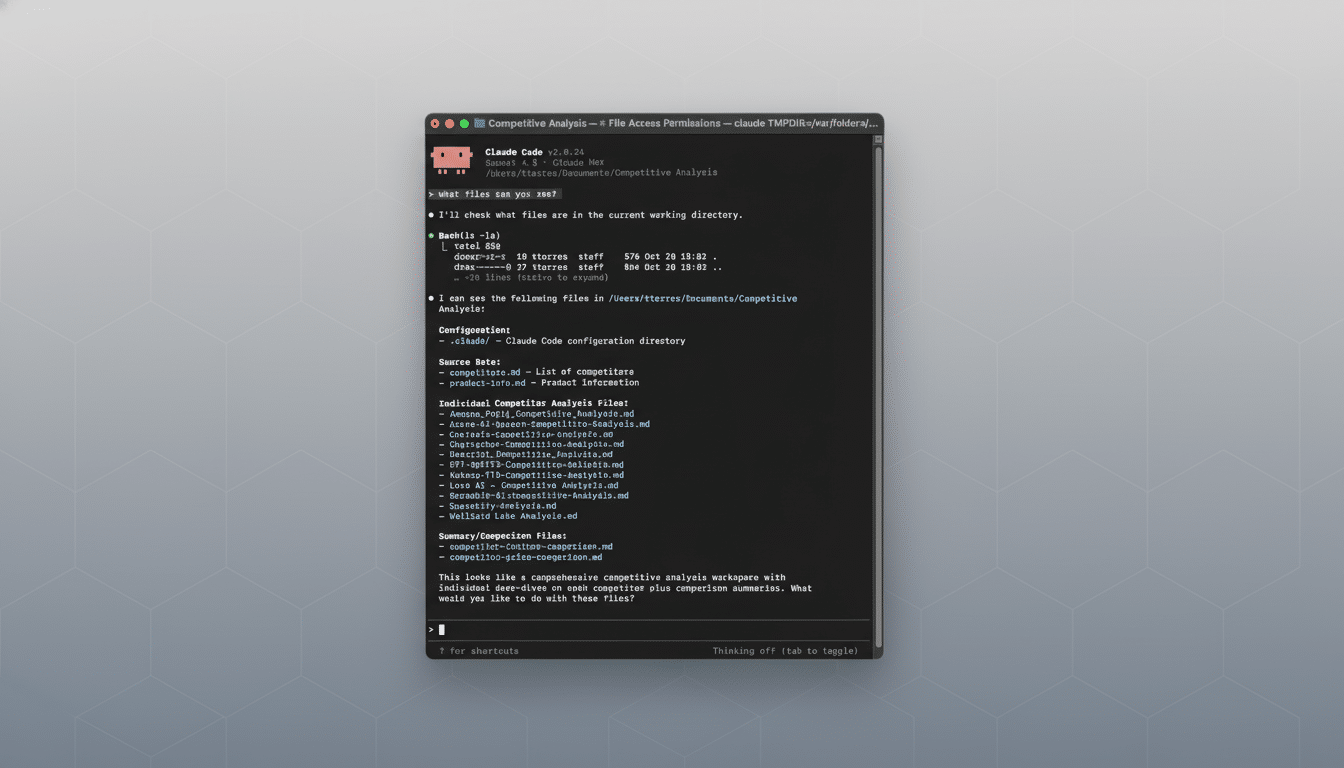

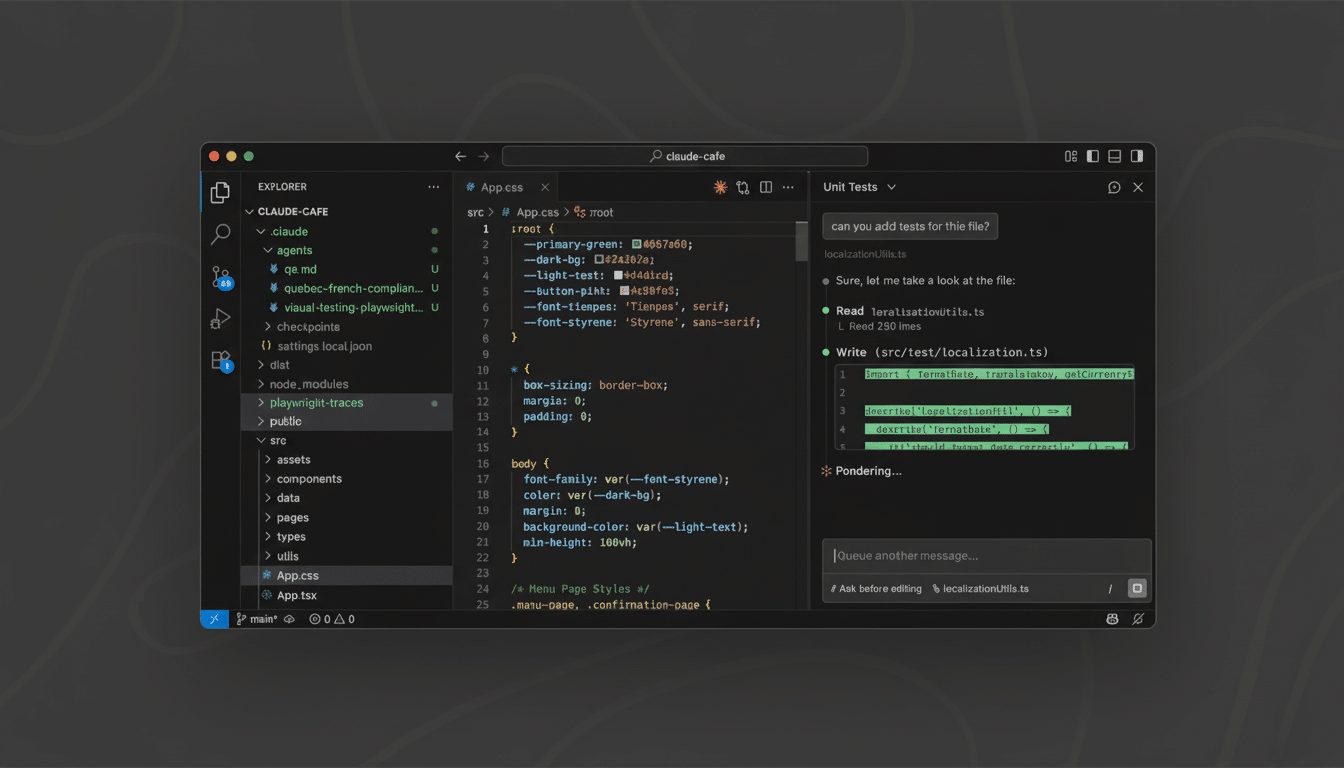

The collaboration spans three pillars. First among this bounty, Allianz employees will have access to Claude Code, a product based on Anthropic’s AI-aided coding environment built for speed and error reduction in development. Second, the companies will jointly develop tailored AI agents able to execute multistep workflows with a human in the loop—as a key control for underwriting, claims and compliance processes that demand review and sign-off.

Third, the collaboration features a mechanism to log all AI interactions such that it leaves an auditable track of prompts, outputs and approvals. That sort of recordkeeping is key to model risk management, consistent with guidance in the NIST AI Risk Management Framework and ISO/IEC 23894, and foreshadows traceability requirements that are projected under the EU AI Act. In real life, it means Allianz can answer regulators’ questions about how AI was used in a claim or policy decision.

How Insurers Are Likely to Use It Across Operations

Early use cases will probably cluster around efficiency and accuracy: summarizing long claim files, composing first-draft correspondence, helping developers modernize legacy systems and aiding fraud teams with pattern analysis. Human-in-the-loop agents might organize tasks, such as triage of claims, extraction of documents and checks against applications, but would retain ultimate control by licensed adjusters.

The logging layer solves a persistent pain point for carriers: demonstrating that outputs generated by AI were reviewed as intended, with bias taken into consideration and data lineage preserved. That’s particularly true when it comes to pricing and underwriting decisions where explainability and fairness reviews are par for the course.

Anthropic’s Enterprise Momentum Builds With Alliances

The Allianz deal was an addition to a string of marquee victories. In the past few months, Anthropic entered a $200 million deal to bring its models to Snowflake’s data cloud ecosystem, announced a multi-year partnership with Accenture and opened up access to the Claude assistant through collaborative partnerships with consulting and technology partners like Deloitte and IBM. That conveyor belt matters: Deloitte itself employs about 500,000 people, presenting Anthropic with an immediate inroad into large-scale enterprise workflows.

Adoption numbers indicate a wider change. The company had 40% share of LLM usage within enterprises and 54% of AI coding among those surveyed in December, an increase from its overall 32% share in July, according to a Menlo Ventures survey. While the methodology caveats abound, the trendline would seem to indicate that at least among developers and knowledge workers there is some sustained traction.

Rivals Increase Their Enterprise Offerings

Competition is intensifying. Google introduced Gemini Enterprise, featuring customers including Klarna, Figma and Virgin Voyages and combining model access with enterprise controls and Workspace integrations. OpenAI’s ChatGPT Enterprise, released earlier this year, is gaining market traction — OpenAI claims it has seen 8x growth in enterprise adoption YoY — but according to industry scuttlebutt the company has been closely monitoring Google’s advances.

On the buyer side, the decision increasingly comes down to security tooling, data isolation, price performance and ease with integration into existing platforms (Microsoft 365, Salesforce, ServiceNow, Snowflake etc.). IDC projections are that global spending on generative AI will exceed $140 billion by 2027, and the victors will be able to turn proofs of concept into quantifiable productivity at scale.

Why It Matters for Carriers in Regulated Markets

Insurance is a high-stakes laboratory for AI. Carriers are under pressure on margins, as inflation in repair and medical costs ratchets up, catastrophe risk moves around and regulatory requirements continue to pile on. Generative AI is said to offer faster cycle times and improved customer communications, so long as it’s used with sound controls. Anthropic’s focus on human-in-the-loop systems and audit logging is squarely aimed at those adoption barriers.

If Allianz can show a dependable return on investment — reduced claims adjustment time, lower handling costs, better developer productivity — peers will follow. The pattern for such deployments will also be likely set by European supervisors and industry bodies such as EIOPA, which have already been promoting strong model governance; tower operations that meet this expectation without penalty on speed should become the template.

What to Watch Next as the Allianz Deal Rolls Out

Key indicators will be rates of employee training on Claude Code, number of agent-enabled workflows put into production and tracked results including accuracy, cycle time and outcomes in audit. The speed at which value will show up on the front lines depends on how signals are integrated with Allianz’s core systems and data platforms.

For Anthropic, the Allianz arrangement is more than just a logo. It is a question of whether safety-forward design and enterprise-grade governance can unlock generative AI at scale in one of the most regulated corners of the global economy.