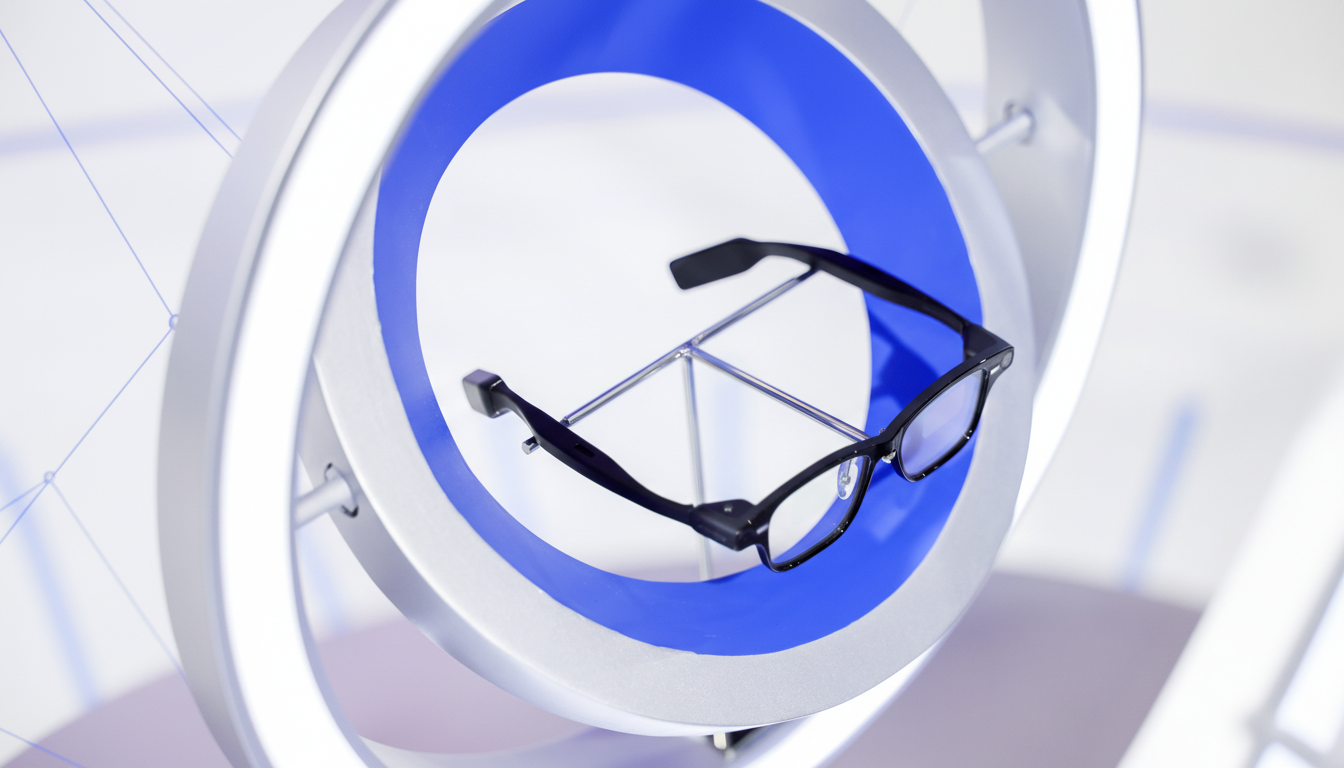

Alibaba’s latest in tech luminaries is the Quark AI Glasses, which it has now opened preorders for and billed as a direct competitor to Meta’s Ray-Ban devices. The pitch is straightforward: mix a powerful on-demand AI assistant with seamless integration across Alibaba’s services to make everyday tasks faster and more contextual — all without the hassle of staring at a smartphone.

What comes with the Quark AI Glasses at launch

At the heart of it all is Alibaba’s Qwen, its large language model, which the company says has been downloaded over 400 million times and generated over 140,000 derivative models. That matters because smart glasses sink or swim based on how quickly, helpfully, and consistently they respond; a good model has the ability to turn spoken prompts into actions, translations, summaries, or recommendations in real time.

Quark taps into Alibaba’s ecosystem where it makes the most sense on a phone. Navigating takes place on Amap, paying is done through Alipay, shopping and price comparisons are done with the crutch of Taobao while travel planning includes Fliggy’s assistance. The glasses also check off the basics you might expect — voice calls, music streaming, and bidirectional language translation — to compete with more mainstream wearables.

And Alibaba unveiled a new AI Chat Assistant inside the Quark app, along with preorders. It also stretches the glasses experience out onto the phone, allowing users to carry on conversations, ask follow-up questions, and see answers after a hands-free session.

How the Quark AI Glasses compare with Meta’s offerings

It’s been a solid start for Meta’s Ray-Ban series — parent company EssilorLuxottica said the sales were triple its expectations this year — and the latest wave announced at its Meta Connect event brought new models under the second-generation Ray-Ban, Oakley Meta Vanguard, and Meta Display families. Today, Meta’s strengths lie in a camera-first capture model, social sharing, and a product design language that lives between elegance and everyday wearability (and backed by Luxottica frames).

Alibaba’s rival is more utility-focused and even better for users locked into China’s super-app ecosystems. Where Meta focuses on hands-free photos, messaging, and creator features, Quark emphasizes productivity and commerce: visiting a shop; checking prices on Taobao; paying with Alipay; receiving itinerary updates via Fliggy — through speech and gestures and the AI layer. Their approaches are drawn from their own ecosystems: Meta optimizes for social platforms, Alibaba for transactions and services.

One significant unknown is the hardware details. Alibaba has thus far revealed no specifics about its camera sensors, display tech, or battery metrics in its first announcements. That transparency will be important to buyers, a decision to consider based on Meta’s proven industrial design and comfort levels. Yet if AI-assisted help and knowing the stakes are taken into consideration, Qwen’s relative maturity may be enough to tip the balance.

Price, availability, and the broader service ecosystem

Customers in Asia can preorder now through Tmall for 4,699 yuan, or around $659, with shipments launching in December. That puts Quark at a premium to entry-level camera-first smart glasses but in reach for a device that touts deeper service integrations. International availability hasn’t been detailed.

The payment angle merits attention.

- Alipay on glasses possibilities include confirming a hands-free purchase at checkout or while passing through transit.

If it’s implemented with strong authentication and clear privacy controls, it could be an appealing convenience edge — but it will also draw continuous scrutiny from regulators and security researchers.

Why this launch matters for the smart glasses market

As AI gets better, smart glasses transition from novelty to niche utility. According to MarketsandMarkets, the market will increase by a CAGR of 29.4% between 2024 and 2030 to approximately $4.13 billion. The reasons should be pretty obvious: more powerful on-device AI, improved eye and gesture tracking, early AR and MR capabilities filtering their way down into everyday form factors.

In Alibaba’s case, Quark is a major consumer-facing AI product in its portfolio, which has traditionally been more focused on enterprise and cloud. If the glasses can translate voice intention directly into actions across Alibaba’s commerce and travel rails, they could shrink the time between discovery and purchase — that is to say, they might just be able to change human behavior in a way platforms dream of.

What to watch next for Alibaba’s Quark AI Glasses

There are two factors that will define Quark’s traction: performance in the real world and third-party reach. Daily use will be determined by the latency, battery life, and comfort of the spectacles; which services beyond Alibaba’s core ecosystem plug into it will depend on APIs and developer support. In the competitive battle, Meta is seen as having an advantage in terms of visibility on the ground because it can iterate more quickly and has a retail presence, while localized utility could swing buyers in markets where people gravitate to Alibaba’s apps by default.

The rub: Alibaba is not simply responding to Meta — it’s offering a different reason to wear smart glasses. If Quark turns AI into frictionless browsing, shopping, and getting around, it could push the category toward something more utilitarian, practical always-available assistants instead of camera-first companions.