The AI data center footprint is crashing head-on against an equally rapid change in how those facilities buy power. Recent research from the International Energy Agency points to record spending on data centers and an explosive rise in power demand. The critical question has ceased to be whether renewables will supplant fossil fuels so much as how much of this boom they can realistically fuel—and how quickly.

The Reality Check on Today’s Clean Power Market Share

On paper, the largest cloud and AI operators already offset most or all of their annual electricity consumption with renewable energy purchases. Google, Microsoft, and Meta report they match exactly or nearly 100 percent of their power use annually through entering into long-term contracts for wind and solar power known as PPAs—or by purchasing renewable energy certificates. But that accounting is not the same thing as running all of the time on clean power. Disclosures and grid data from the companies reveal that hourly carbon-free energy coverage ranges on average from about one-third to about two-thirds, depending on where the company is and what time of year it is.

Green is not the picture outside hyperscale campuses. Based on Uptime Institute surveys, many colocation and enterprise operators do not have a coherent long-term renewable strategy, particularly in newer AI hubs. With the worldwide grid typically having an average of one-third low-carbon generation, the genuine real-time renewable share for all AI loads is materially lower than headline global claims suggest.

Procurement Is Booming, but Grid Bottlenecks Remain

Corporate clean-energy buying continues to break records, according to BloombergNEF, with the hyperscalers leading the charge. The mix is moving away from generic certificates toward 24/7 carbon-free deals that combine wind and solar with storage, geothermal, hydro, and grid services. At scale, Equinix, Digital Realty, and other leading operators are regionalizing PPAs to support hypergrowth campuses.

Even then, interconnection queues and transmission limitations are the gating item. U.S. national lab research indicates that there are gigawatt-scale backlogs and multi-year wait times to interconnect new wind, solar, and storage masses. That delay pushes AI projects to well-provisioned—often fossil-heavy—regions unless developers include both on-site and near-site clean resources and flexible load management from day one.

What Percentage of the Energy Market Can Renewables Cover by 2030

From public commitments, IEA electricity outlooks, and corporate procurement trends, a split decision is coming in:

- Hyperscale AI campuses in mature markets are expected to sustain 80–100% annual renewable matching by 2030 and have hourly carbon-free coverage increase into the 50–80% range in locations with ample wind, solar, and storage (Texas, Midwest, Nordics) or access to hydro and geothermal.

- Globally, including colocation and high-growth AI builders, annual matching could settle at approximately 50–70% if the current pace of procurement stays on track. Without the faster build-out of transmission and deployment of storage, the real-time hourly share could fall well below annual claims.

The key swing variables are location strategy, 24/7 contracting, and access to firm clean power. Policies also count; Europe’s efficiency and reporting rules are being tightened, and Ireland has limited connections to the grid around Dublin; Singapore is opening up new capacity in return for efficient, low-carbon imports. These policy actions push operators toward cleaner portfolios, but they also increase siting complexity.

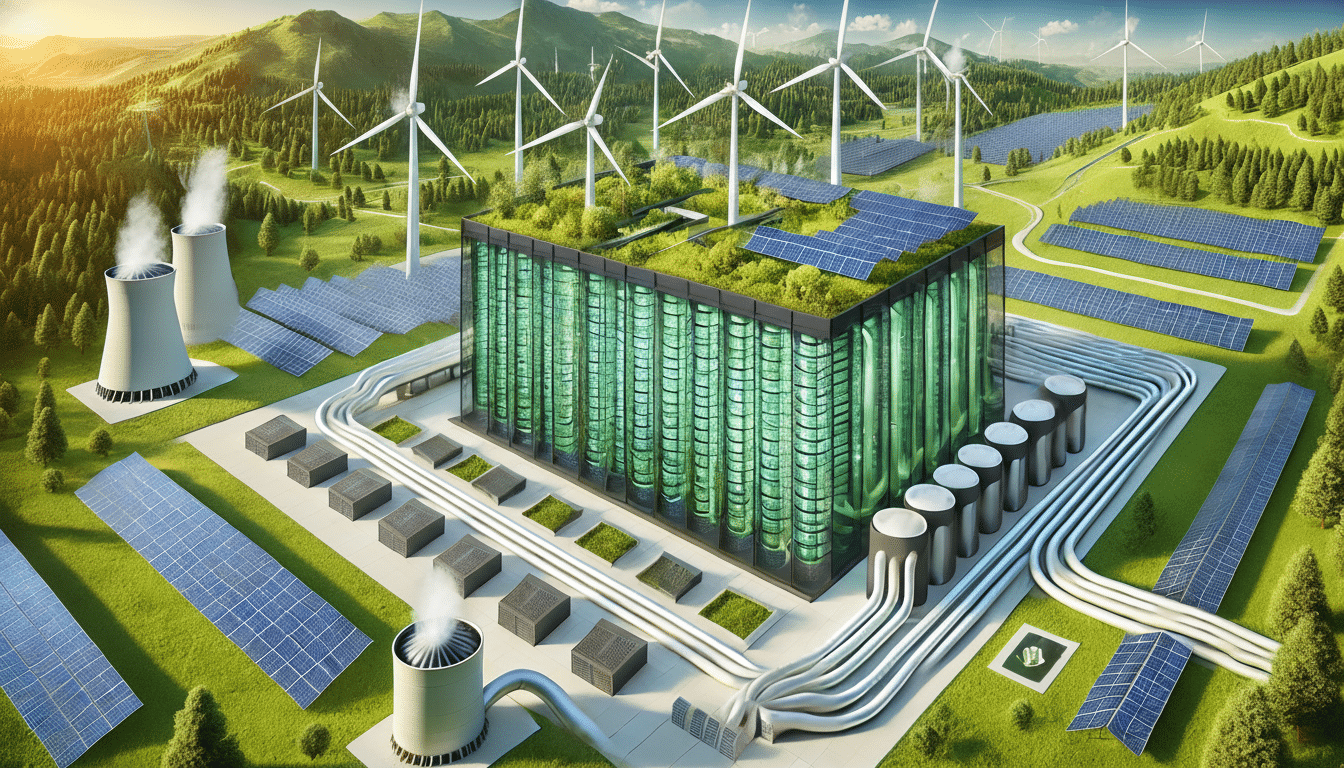

Where the Clean Megawatts Will Be Found

The load served by on-site solar at even a large AI campus is likely to be no more than a sliver, with utility-scale wind and solar, complemented more and more by long-duration storage for days or weeks without the sun or wind as resources allow, doing the heavy lifting. Microsoft has trialed multi-megawatt hydrogen fuel cells as a diesel replacement, while utilities are offering green tariffs, which bring together new renewables with storage and grid services. Nuclear life extensions and uprates, as well as geothermal expansions, can provide reliable, clean baseload where they are available, but small modular reactors probably won’t scale in any significant way this decade.

Software will help. Carbon-aware scheduling—which has already been piloted by leading cloud providers—can move elastic AI training to times when wind and solar power abound, soaking up curtailment and enhancing project economics. Inference workloads, which operate 24/7 in order to fulfill user requests, will nevertheless require firm, clean capacity to help lift the hourly carbon-free share.

Bottom Line on AI Data Centers and Renewable Power

How much of the AI data center boom will depend on renewable power? Today’s best operators can cost-effectively balance approximately 100% of their annual consumption with clean power purchases, while achieving only about 30–70% real-time carbon-free supply at any given location. Top-tier AI campuses in favorable markets should be able to reach 60–90% hourly clean energy by 2030 on average, and the world average closer to 50–70% annually, but much less than that in real time unless grids decarbonize significantly faster. That delta between annual claims and hourly reality will only shrink if procurement, storage, transmission, and firm clean power all expand in tandem.