Workday said its chief executive Carl Eschenbach has stepped down and left the board, and co-founder Aneel Bhusri is returning to the top job. The move puts a seasoned product leader back in charge as the enterprise applications company sharpens its strategy around artificial intelligence and an increasingly competitive market for HR and finance software.

Why Workday Is Rewinding To Its Founder Aneel Bhusri

Bhusri, who steered Workday for more than a decade and helped define its cloud-first approach to human capital management and financials, is widely associated with the company’s product discipline and customer-first culture. Bringing him back suggests the board wants tighter alignment between AI investments and core workflows like payroll, talent, planning, and close-to-report processes—areas where Workday differentiates on usability and configuration at large scale.

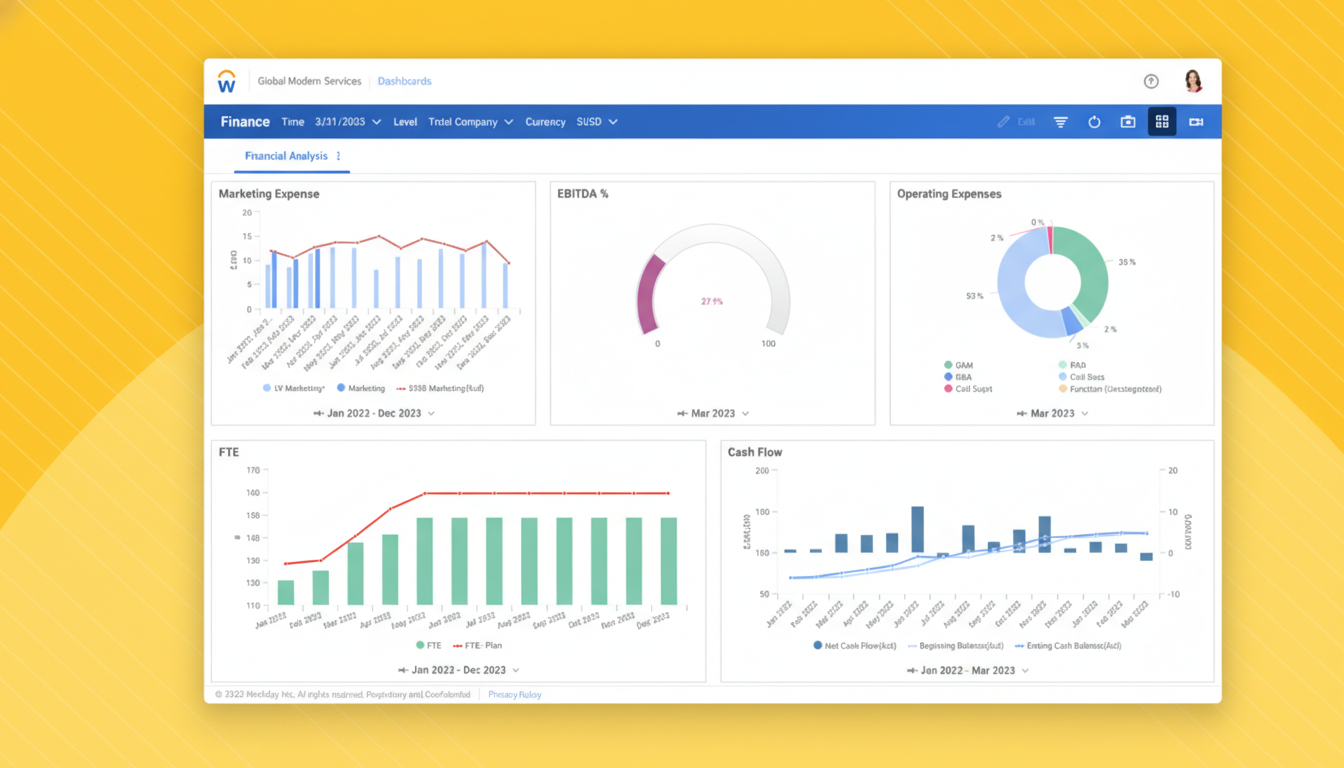

Workday’s history shows a preference for founder-led inflection points. Under Bhusri, the company integrated major bets such as the Adaptive Insights acquisition, extending beyond transactional HR systems into planning and analytics. The latest pivot is larger: embedding predictive and generative AI into the tasks managers, controllers, and HR leaders perform daily, while preserving the trust and compliance posture demanded by global enterprises.

AI Strategy Moves To The Fore At Workday

Workday has been rolling out AI that drafts job descriptions, summarizes performance feedback, flags anomalies in expenses and journal entries, and infers worker skills from activity data. The company has also curated an AI marketplace and model strategy designed to let customers benefit from foundation models while keeping proprietary data governed inside Workday’s security envelope. The message from leadership is clear: AI is not an add-on—it has to be native to the suite.

Competitors are moving quickly too. Oracle and SAP are building copilots into their ERP stacks, ServiceNow is automating service workflows, and Salesforce continues to expand Einstein across CRM. Gartner continues to place Workday in the Leaders quadrant for cloud HCM for large enterprises, but maintaining that position will depend on how convincingly its AI translates into lower cost to serve, faster hiring, better retention, and more accurate forecasting.

What The Change Means For Customers And Investors

For customers, a founder’s return often signals prioritization of product coherence and delivery cadence over broader diversification. Expect Workday to focus on high-impact AI features within HCM and finance, tighter integrations with Adaptive Planning, and stronger admin controls around model transparency and auditability—areas procurement and compliance teams probe heavily in RFPs.

For investors, founder-led transitions in enterprise software can reduce strategic drift and clarify capital allocation. In Workday’s case, watch for updates on AI monetization (bundled versus premium capabilities), operating margin trajectory as automation scales, and progress in regulated sectors where data residency and explainability are gating factors. Industry analysts from firms such as IDC have noted that AI-enabled enterprise apps are sustaining double-digit growth as buyers prioritize measurable productivity gains over experimental pilots.

Eschenbach’s Tenure In Brief At Workday, A Recap

Eschenbach, a former VMware executive and Sequoia Capital partner, joined Workday as co-CEO before becoming sole CEO. He presided over an operating reset that included a workforce reduction of 8.5%—about 1,750 roles—as Workday rebalanced skills and investment toward AI-heavy initiatives and go-to-market focus. While the company did not detail reasons for his exit, his departure from both the CEO role and the board points to a clean handoff rather than a prolonged transition.

Key Metrics And Market Context For Workday

Workday’s annual revenue has surpassed $7 billion, with subscription revenue growing in the high teens according to recent earnings filings. The company regularly cites customer satisfaction above 95%, a critical moat in an industry where switching core HR and finance systems can take years and span tens of thousands of employees.

Workday’s footprint across education, healthcare, and the public sector gives it a diverse base, but also places a premium on security, data privacy, and uptime. As AI spreads from pilots to production, those same customers will expect model-level guardrails, clear data lineage, and audit-ready logs—features that can make or break competitive evaluations against incumbents like SAP and Oracle.

What To Watch Next For Workday Customers

Look for Bhusri to articulate a tighter AI product roadmap, including where Workday will build natively versus partner, and how usage-based pricing or premium tiers could apply. Signals to track include acceleration in net new core HCM and financials wins, attach rates for planning and analytics, and evidence that AI features are shortening close cycles, improving talent mobility, or reducing support tickets at scale.

Founder returns are ultimately judged by execution. With market leaders racing to operationalize AI across back-office work, Workday’s bet is that putting a product-centric co-founder back in the CEO seat will speed decisions, align the roadmap, and keep its enterprise credibility intact.