Waymo is closing in on a massive $16 billion capital infusion that would value the autonomous ride-hailing leader at about $110 billion, according to the Financial Times. More than 75% of the round is expected to come from its parent Alphabet, with new backers including Dragoneer, Sequoia Capital, and DST Global, and continued participation from Andreessen Horowitz and Abu Dhabi’s Mubadala, the outlet reported.

If finalized, the deal would mark one of the largest private financings for a U.S. mobility company and a striking re-rate for a business still in the early innings of commercial scale. It also signals rising investor conviction that robotaxis are graduating from research projects to infrastructure-like services with long-term cash flow potential.

Why a war chest now: scaling, safety, and operations

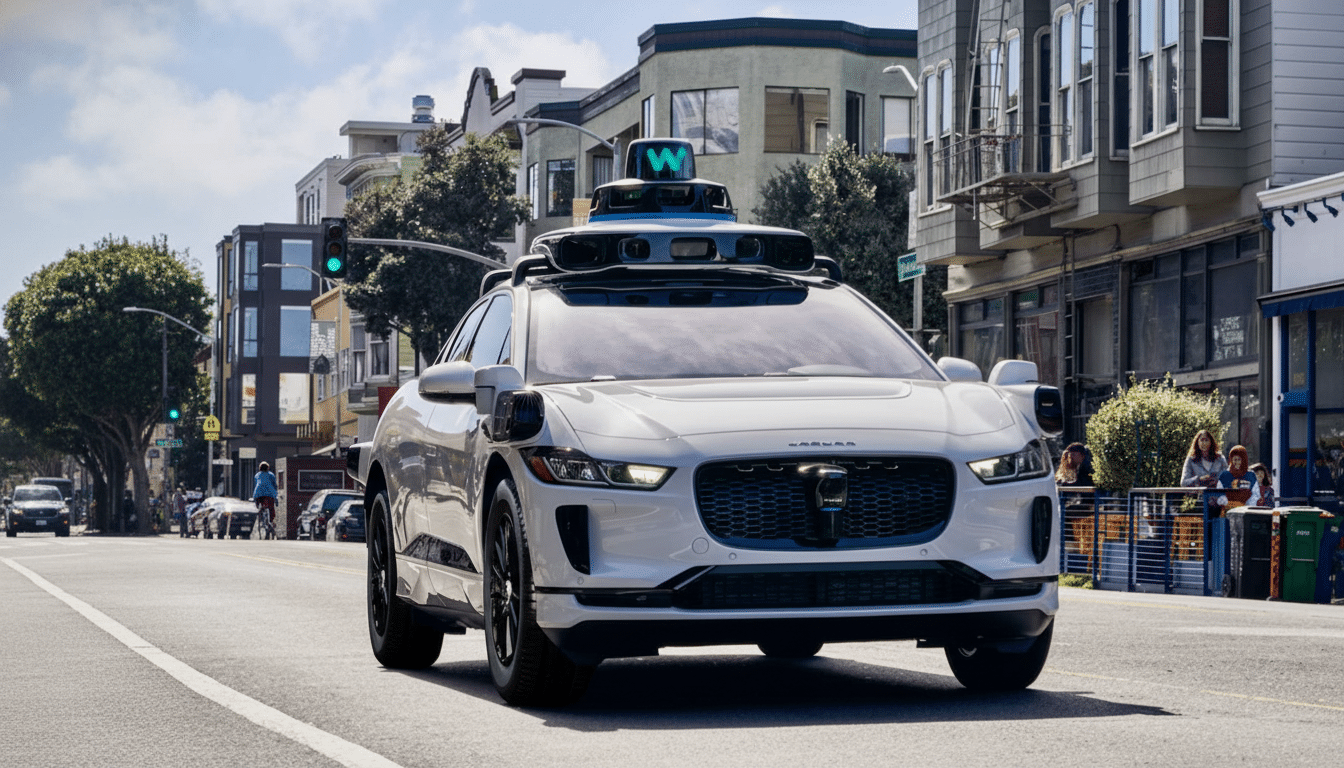

Autonomous ride-hailing is capital hungry. Scaling a driverless network requires dense city-by-city deployment, continuous safety validation, high-performance compute for training and inference, and meticulous operations—from fleet maintenance to remote assistance. Waymo has been expanding quickly, recently adding Miami to a growing map that already includes Phoenix, San Francisco, Los Angeles and other test corridors.

That growth exposes both promise and friction. A widely reported San Francisco power outage recently left multiple Waymo vehicles stalled at intersections, underscoring how edge cases—while rare—can ripple across a fleet. Solving for these scenarios is part of the work: more mapping, more simulation, more on-road miles, and more resilience in the autonomy stack. Capital ensures the company can harden systems while keeping up the pace of market launches.

Investor lineup and structure for the massive funding round

Alphabet’s willingness to supply the majority of the round effectively de-risks Waymo’s runway during a critical expansion phase. The addition of Dragoneer, Sequoia, and DST Global brings late-stage and crossover expertise, while repeat commitments from Andreessen Horowitz and Mubadala suggest durable institutional support. Together, this syndicate combines strategic patience with public-market discipline—useful if an eventual listing comes into focus.

Large inside-led rounds can also simplify governance and reduce the distraction of serial fundraising. For a category where scale and reliability are the moat, fewer financing uncertainties mean Waymo can focus on throughput: growing active service zones, increasing vehicle utilization, and compressing response times for riders.

Valuation versus revenue and how investors may be pricing risk

The Financial Times reports that Waymo has more than $350 million in annual recurring revenue. A $110 billion valuation implies a lofty multiple on current sales, but autonomy is often priced on option value: if driverless networks approach city-utility economics, early leaders could command durable margins and defensible market share. Waymo’s prior financing valued the company around $45 billion, making this a substantial step-up that reflects execution progress and a sharper line of sight to scale.

Unit economics remain the fulcrum. Waymo’s fares are broadly comparable to traditional rideshare on many routes, but profitability turns on three levers: fully driverless operations, high vehicle utilization, and declining hardware and compute costs. The company has logged millions of rider-only miles, and as sensor prices fall and on-vehicle AI becomes more efficient, cost per driverless mile should continue to trend down. Fleet management—battery life, maintenance intervals, and depot logistics—will separate efficient operators from the pack.

Market and regulatory backdrop shaping autonomous ride-hailing

The competitive field remains dynamic. General Motors–backed Cruise faced a high-profile reset after safety incidents, while Amazon’s Zoox continues methodical testing. Motional has retooled its capital plan and timelines. These shifts have, at times, left Waymo as the most visibly active service in multiple metros, but momentum in autonomy is non-linear and can change quickly as rivals return to market.

Regulation is evolving in parallel. The California DMV has allowed incremental service expansions, even as the National Highway Traffic Safety Administration has queried incident data across the sector. For operators, transparency on safety performance—collision rates per million miles, disengagement behavior, and response to unusual road conditions—has become as important as growth metrics. Cities are learning in real time how to integrate driverless fleets into traffic operations, curb space, and emergency protocols.

What to watch next as Waymo scales robotaxi operations

Three signals will show whether this raise translates into durable leadership.

- Deployment velocity: the number of fully driverless service zones, not just pilots, and average wait times during peak demand.

- Operating efficiency: improvements in cost per mile, uptime, and remote assist load, ideally reported with consistent methodology.

- Safety and reliability: richer disclosure on incident rates and learnings from edge-case events like outages or severe weather.

Partnerships will matter, too. Expect more coordination with cities and transit agencies, plus expanded collaborations with automakers as purpose-built robotaxi platforms mature. An eventual path to the public markets is plausible if revenue scales alongside clearer unit economics. For now, a $16 billion round—anchored by Alphabet and joined by tier-one investors—would give Waymo the resources to push toward network effects that have long been theorized but rarely achieved in autonomous mobility.