Volkswagen has dethroned Tesla as Europe’s top-selling electric vehicle maker, snapping up the regional crown on the strength of a broader lineup, deeper dealer reach, and sharp execution. Fresh data from JATO Dynamics shows Volkswagen Group’s battery-electric registrations surging 56% to 274,278, while Tesla declined 27% to 236,357. Across the continent, EV registrations rose 29% to 2,572,491, lifting electric cars to a 19.5% share even as overall vehicle sales barely ticked higher.

The shift underscores how the EV race in Europe is evolving from a single-brand sprint into a multi-segment marathon. Price, product breadth, and production proximity are trumping early-mover advantage as mainstream buyers and corporate fleets scale up electrification.

Volkswagen’s Multi-Brand Muscle Expands EV Market Reach

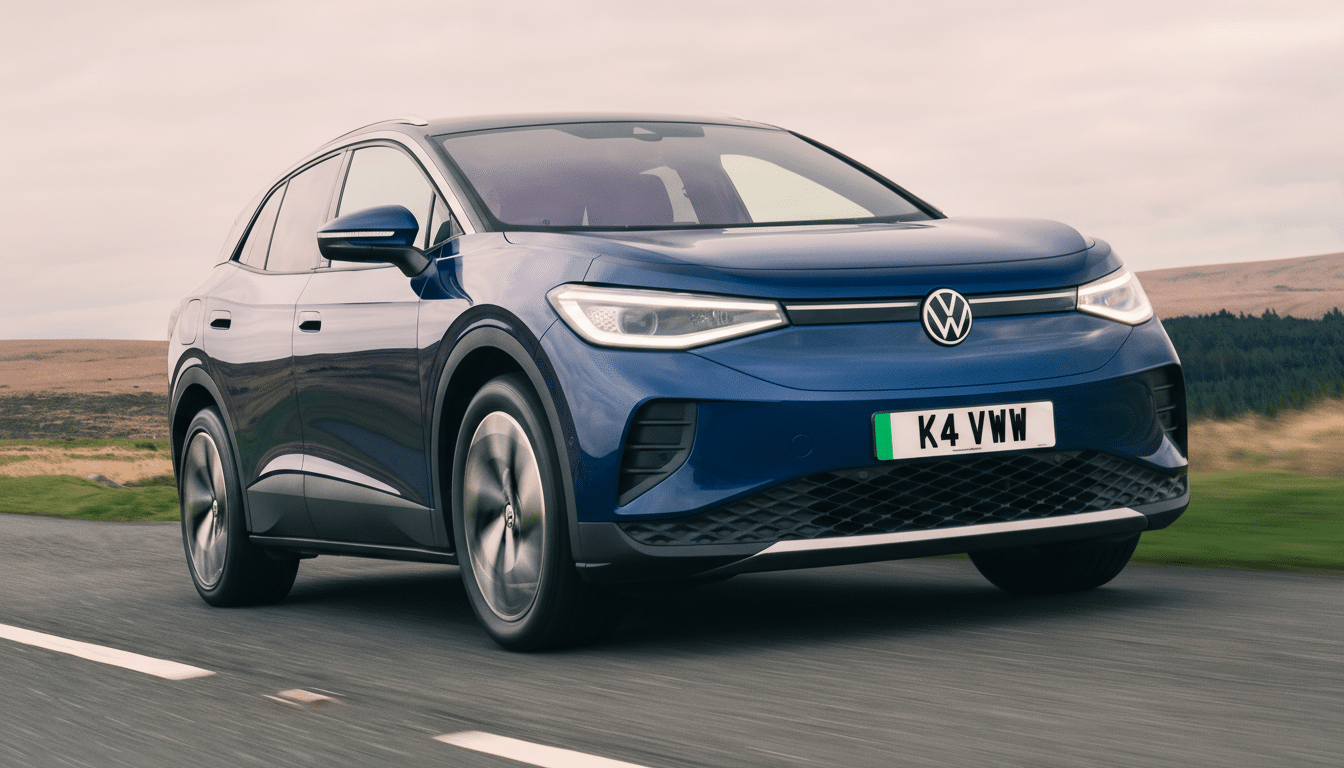

Volkswagen’s win is as much about the group as it is about the badge. JATO’s breakdown shows Škoda taking fourth in the regional BEV rankings with 171,703 units, Audi fifth with 153,845, Cupra 15th with 79,269, and Porsche 21st with 32,715. That spread lets the group cover critical price bands and body styles—from the ID.3 and ID.4 to the Škoda Enyaq, Cupra Born, and Audi Q4 e-tron—capturing both retail buyers and the all-important company-car segment.

Local manufacturing scale and logistics matter, too. With established plants, supplier networks, and a dense dealer footprint across Europe, Volkswagen can compete on delivery times and total cost of ownership. Fleet managers care about uptime, service coverage, and residual values—areas where legacy strengths translate into EV gains.

Tesla Still Holds Europe’s Best-Selling EV with Model Y

Despite ceding the brand leaderboard, Tesla still owns Europe’s single best-selling EV: the Model Y, which notched 149,805 registrations. Even so, its volume fell 28% year over year, while the Model 3 slipped 24% to 85,393. Analysts point to intensifying competition in compact and midsize segments, fewer headline-grabbing price cuts, and a narrower lineup versus rivals that blanket multiple niches.

Tesla isn’t alone in feeling the pressure. Volvo’s EX30, a headline compact entrant, saw registrations drop 37% to 49,110, illustrating how supply dynamics, trims, and incentive changes can swing monthly momentum. In a maturing EV market, freshness and availability are as decisive as brand cachet.

Policy and Pricing Winds Shift as EU Rules and Incentives Evolve

Regulation remains a moving target. The European Union has softened its all-electric end-state, leaving space for plug-in hybrids and certain combustion technologies under specific conditions. That nuance matters: it influences automaker compliance strategies, model cycles, and the speed at which fleets transition.

At the same time, charging build-out is accelerating under Europe’s alternative-fuels framework, improving long-distance confidence and lowering total ownership costs for high-mileage users. With overall vehicle sales up just 2.2% in JATO’s tally, electrics are taking share from within the market rather than riding a broader boom—raising the stakes on pricing discipline and cost control.

Global Context and What to Watch in Europe’s EV Competition

Europe’s surge sits alongside rapid electrification in China, where Rho Motion reports 6.5 million EVs sold over a recent twelve-month window and a 29% year-to-date increase within that span. The global backdrop matters for Europe’s pricing: Chinese brands are pushing aggressively on value, while European and U.S. players juggle margins, content, and local policies to stay competitive.

Tesla, for its part, is leaning more heavily on software and services to diversify revenue. The company has removed complimentary Autopilot capabilities from new vehicles and is steering customers toward a $99 per month Full Self-Driving subscription. It is also advancing robotaxi pilots in additional U.S. cities following new regulatory clearances—moves that could reshape its profit model even if vehicle unit growth moderates.

Volkswagen’s next phase hinges on cost-down platforms and high-volume small cars. The group is preparing a sub-€25,000 EV aimed at mainstream adoption while refining software and energy management across its brands. If it pairs lower prices with robust charging partnerships and over-the-air feature upgrades, it can lock in gains as incentives taper and buyers get choosier.

The Bottom Line: Scale and Smart Pricing Will Shape EV Winners

Europe’s EV market is no longer a one-brand story. Volkswagen ascended by meeting buyers where they are on price, body style, and availability—across multiple nameplates—while Tesla’s volume concentrated in fewer models faced heavier crossfire. With EV share now at 19.5% and rising, the winners will be those that blend scale manufacturing, smart pricing, strong software, and a seamless charging experience. For now, the continent’s EV crown sits in Wolfsburg’s trophy case.