Verizon plans to relax a controversial rule that can keep fully paid smartphones locked for 35 days if customers clear their device balance online or in the app. The carrier says it will introduce additional payment authorization on its website to enable faster unlocks when people pay off phones ahead of schedule, addressing one of the policy’s biggest pain points.

The change won’t erase Verizon’s broader fraud controls, but it signals a shift after consumer pushback and industry scrutiny. Ars Technica first highlighted the delay, and a Verizon spokesperson confirmed the forthcoming tweak, noting details will roll out in the coming weeks.

- What Is Changing in Verizon’s Early Unlock Policy Online

- Why the 35-Day Unlock Hold Exists and How It Works

- How the Unlock Hold and Policy Changes Affect Customers

- How Verizon’s Unlock Policy Compares With AT&T and T-Mobile

- What You Can Do Now to Get an Immediate Device Unlock

- Bottom Line on Verizon’s Planned Change to Unlock Delays

What Is Changing in Verizon’s Early Unlock Policy Online

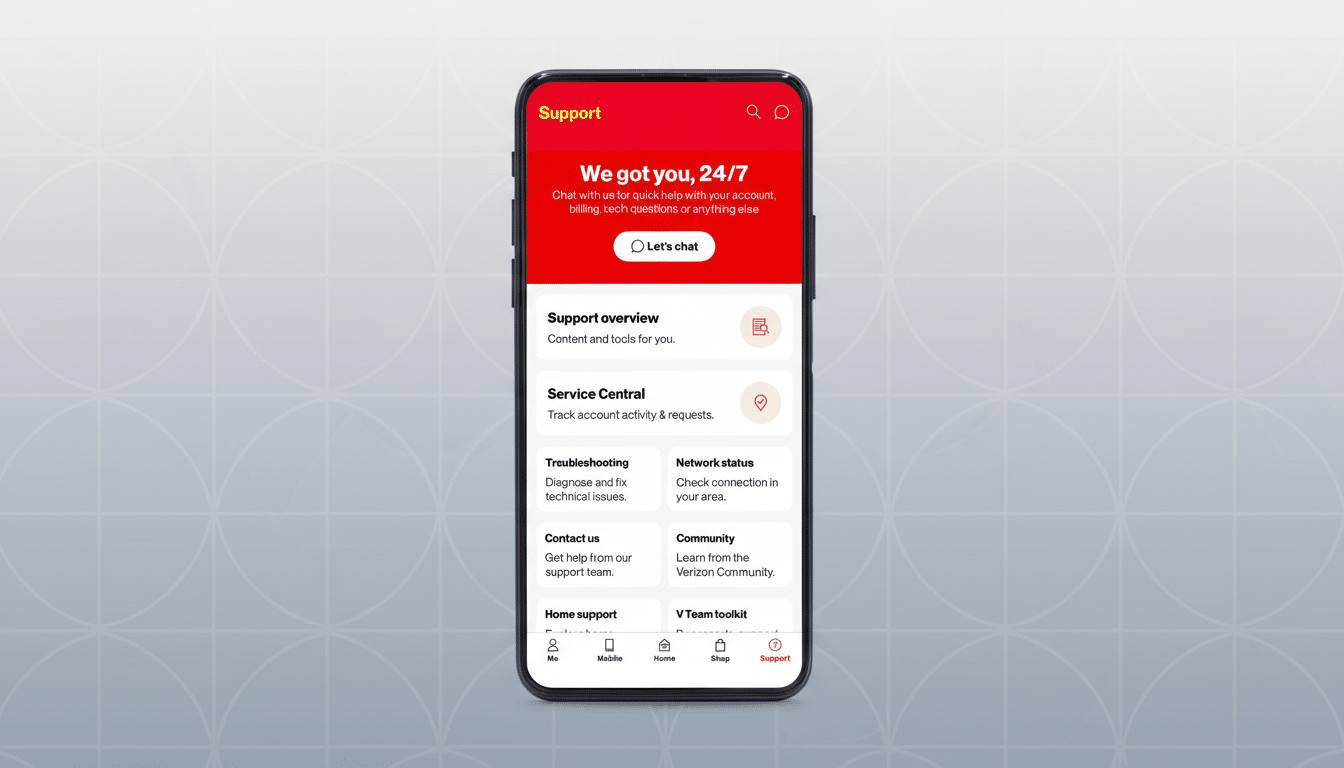

Today, many early-payoff transactions done online, in the My Verizon app, by phone, or at authorized retailers trigger a 35-day wait before the device unlocks. Verizon says that window allows time to verify payments and weed out fraud, particularly purchases made with gift cards. The lone instant workaround has been to visit a Verizon company-owned store and use a “secure” in-person payment method such as an EMV chip card, tap-to-pay via Apple Pay or Google Pay, or cash.

Verizon now plans to add extra authentication for credit-card payments made on its website so that legitimate early payoffs can be unlocked sooner, without a store visit. The company has not specified whether gift-card transactions will still face the 35-day hold or how the new authorization step will appear to customers, but it’s framed as a targeted change rather than a full policy rewrite.

Why the 35-Day Unlock Hold Exists and How It Works

Carriers face a persistent problem: people acquiring devices on payment plans with stolen or disputed funds, then unlocking and reselling the phones quickly. Credit-card chargebacks and fraud disputes can surface weeks after a transaction, and a 35-day buffer generally pushes an unlock past at least one billing cycle. In-person EMV and NFC transactions shift more liability onto the card issuer and processor, which is why those methods have been the exception to the delay.

That risk calculus intensified after a recent FCC decision let Verizon relax an earlier commitment tied to unlocking timelines. While Verizon still publicly commits to unlocking devices after a standard initial lock period, its early-payoff hold goes further than what rivals document, according to public FAQs and analyst commentary.

How the Unlock Hold and Policy Changes Affect Customers

Most subscribers never notice locking rules until they need flexibility: adding a secondary eSIM for travel, switching carriers for a better deal, or keeping service during an outage by popping in a prepaid SIM from another provider. Unlocked phones also make it easier to try emerging services, such as satellite-based roaming partnerships announced by mobile networks.

When a paid-off phone remains locked for 35 days, those options are on hold. That’s why a faster path for verified online payments matters, particularly for customers who can’t easily get to a company-owned store or prefer to settle balances from home.

How Verizon’s Unlock Policy Compares With AT&T and T-Mobile

AT&T and T-Mobile outline unlock eligibility—covering factors like time active on the network and whether a device is fully paid—but do not publicly describe an extra 35-day delay tied specifically to online payoffs. Industry analyst Roger Entner of Recon Analytics has argued that if a phone is paid off, protracted waits feel punitive to legitimate customers, even if they deter bad actors.

The nuance is in the fine print. Paying off a device early can also forfeit remaining monthly bill credits from trade-in promotions at both Verizon and T-Mobile. That’s separate from unlocking but crucial: clearing the balance to unlock sooner might inadvertently cancel credits that were meant to be spread over the life of a contract. Reading the promo terms—and checking your remaining credits—can prevent expensive surprises.

What You Can Do Now to Get an Immediate Device Unlock

If you need an immediate unlock today and you’ve paid off your device early, the most reliable route remains an in-person payoff at a Verizon company-owned store with a chip card, tap-to-pay, or cash. Not all locations are company-owned; look for the designation in Verizon’s store locator to avoid third-party retailers that can still trigger a delay.

Planning ahead helps too. If frequent unlocking matters—say, for international travel—consider buying unlocked directly from manufacturers like Apple or Google, or from major electronics retailers. Many offer installment plans similar to carriers, but the phones arrive unlocked from day one.

Bottom Line on Verizon’s Planned Change to Unlock Delays

Verizon’s upcoming change won’t eliminate all checks, but it should spare legitimate customers from a rigid 35-day wait when they settle balances online with a verified card. It’s a welcome step toward balancing fraud prevention with consumer flexibility. Keep an eye on Verizon’s policy pages for the final details—and think through store payoffs or factory-unlocked purchases if you need maximum freedom right now.