The carrier that made its name ripping up wireless norms has sunk into the same playbook it broke. With price increases, app-first service and familiar fees slowly re-emerging, the space T-Mobile left behind is now wide open. The open question is whether any carrier has the appetite to wear the Uncarrier crown anymore — a surprise contender could be Verizon of all places.

Why The Uncarrier Crown Is For The Taking

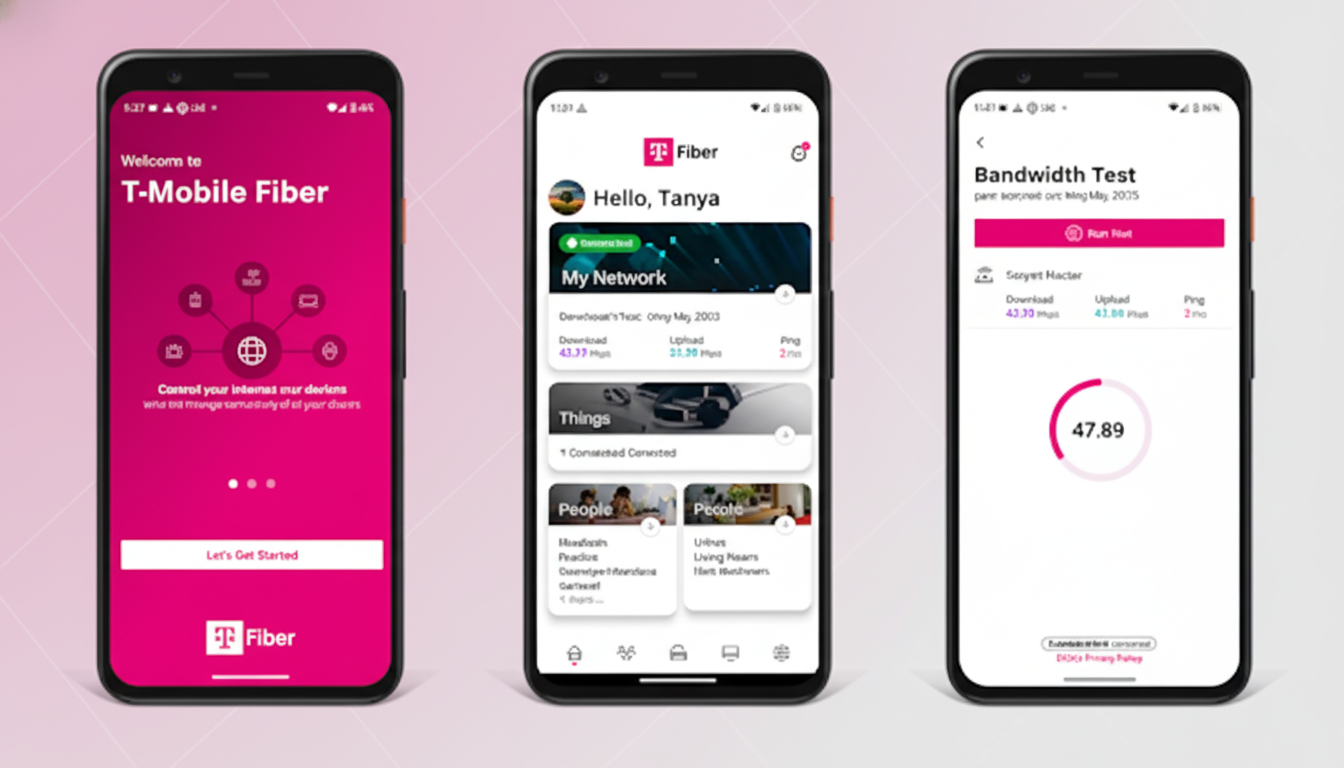

For years, disruption was attacking customer pain points head-on: simpler bills, no taxes or fees, no contracts and perks that actually mattered. That insurgent energy has faded. AT&T has been dedicating its energies to expanding fiber and engineering the network, not consumer showmanship. T-Mobile is working a digital-first game plan that pushes support through its app and reduces in-store touch points. The net effect is an industry with less friction against inertia and more room for nickel-and-diming.

Consumers have noticed. Independent testing from firms such as Opensignal and RootMetrics suggests network parity has closed in 5G, scrubbing off Verizon’s old “best network” halo while dulling others’ excuses for charging extra. Meanwhile, customer satisfaction surveys from J.D. Power and the American Customer Satisfaction Index have singled out annoyances surrounding fees, plan complexity and service automation industrywide.

Verizon’s Opening and Obstacles on the Road Ahead

Verizon is in a strategic reflecting pool few get to swim in. The company’s had postpaid phone losses, an enormous debt load north of $100B and some of its worst satisfaction scores in years. Its network edge is no longer a trump card, and price-first customers now have credible options. And that pressure is just the kind of moment that used to fuel T-Mobile’s reinvention.

Leadership might be the fulcrum. The new chief executive, Dan Schulman, has a consumer brand background as an executive from Virgin Mobile USA and PayPal where loyalty and product culture were core. But he’s hardly an outside presence; his long time on the board of Verizon binds him to actions that have pushed for automation and chatbots over human assistance. All of this means a full-bore reboot isn’t in the cards — but a targeted, customer-first counterpunch is more than possible.

What a True Disruption From Verizon Would Take

A believable 2025 Uncarrier push wouldn’t be a shout-off of ads, it’d prove it really works. Begin by offering both billing transparency and price guarantees that surpass the regulatory pressure on junk fees (not just conceding to it). A commitment like taxes-and-fees-inclusive pricing and a multiyear rate lock would make instant differentiation in the face of creeping surcharges and plan reshuffles.

Revamp device deals so that value comes upfront, reducing the number of 36‑month bill credits and factoring in a trade-in that is real money to customers, not something you hold over their head for three years. Provide quick, human-first support by bringing back in-store expertise and establishing call centers that are answered by trained agents (not bots!). T-Mobile is dialing down the retail experience; Verizon can succeed by doubling up — by making stores feel like service centers, not sales mills.

Apply network strengths where they are useful today. Combine 5G Home Internet with wireless plans in a manner that’s actually free of contracts, and enjoy simple self-installation and easy pauses. Provide richer hotspot buckets and transparent international roaming à la what leaders like Google Fi offer. Ensure unlocking is instant and eSIM switching is easy, so device freedom becomes a feature, not a battle.

Finally, offer perks that people can use. Take a few high-value benefits — premium streaming credits, cloud backup, roadside assist — and instead of bundles that sprawl everywhere, rotate them and let customers exchange them each quarter. This is about relevance, not logo stacking.

Signals to Watch Closely From Big Red in the Months Ahead

There are small signs of tactical disruption.

Moderate Republicans and swing voters in Congress — who are still wary of being savaged by Mr. Trump on Twitter — have become unmoored from the Republican president and his white nationalist talking points, just as he is becoming increasingly unmoored from reality.

In the House hearing room, there are whispers about rank-and-file resistance.

Verizon has experimented with A.I.-powered offers that are priced lower than a competitor’s plans, depending on what a customer is currently spending, and widened programs such as Verizon Access to make bundle offers sweeter. These are tactics, not a strategy. If attrition quickens or churn increases, expect bolder plays: a public-price-lock scheme, an inclusion-of-fees flagship offering and a clear pivot to live assistance.

And there’s a risk that cost-cutting and automation win, continuing the cycle that lost riders in the first place. In the short term, that’s an alluring path. Over a longer time frame, though, the math favors loyalty — because of fewer support contacts and lower churn, but also because people have a better lifetime value when they feel respected. It’s the same equation that once upended the calculus for a different carrier.

The Prepaid Wild Card Shaping Wireless Competition

Here is the twist. The spirit of the Uncarrier, however, arguably didn’t go away; it migrated to prepaid. Visible offers simple, truly unlimited plans at a fraction of the cost of postpaid pricing. US Mobile allows power users to jump networks. Google Fi remains the simplest and most hassle-free service for going overseas, painlessly priced. Metro and its rivals, like Cricket, Total by Verizon and Straight Talk are now household names known for their national ad buys.

This is not an anomaly. GSMA Intelligence has long pegged prepaid at about 70% of total global mobile connections, excluding the U.S., which is a postpaid outlier. The big carriers adjusted by owning the disruptors: Verizon takes ownership of Visible, Total, Straight Talk and TracFone; T-Mobile took on Metro and added Mint; AT&T bought Cricket. That two-tier design allows value hunters to save while postpaid margins continue — but also means the most interesting innovation occurs one rung down the ladder.

Bottom Line: Verizon’s Path to an Uncarrier Revival

Could Verizon steal the Uncarrier mantle? Yes — if it chooses customer trust over short-term automation, and supports that with simple pricing, human advisers and freedom-respecting policies. Where a major player is yet to prove it, the most alive disruption in U.S. wireless continues to be prepaid — and that could very well be the biggest kick in the pants Big Red has had yet to start doing something really different.