If you feel like your Verizon autopay date just keeps moving either forward or back, well, it’s not in your head. Billing windows can slide around by a few days from one month to the next, and tiny adjustments to your account can push that window a little further. For anyone who budgets by the paycheck, those swings can upend things. The good news is that there’s an easy solution and a handful of habits you can adopt to prevent future surprises.

Why Your Autopay Draft Date Shifts Month to Month

Autopay usually processes a few days before your scheduled due date to allow banks time to settle the transaction. When weekends or federal holidays fall within that window, the Automated Clearing House timetable moves accordingly, so drafts can occur earlier or later. According to Nacha, which administers the ACH network, non-business days delay settlement until the next banking day, which may change the pull date you notice.

Account changes can be an even greater driver. When a line or device is added, when switching plans, or if you redeem a promotion, that can cause proration and even some hidden billing cycle shuffling. That change may only be one or two days at first, but can compound with weekend and holiday effects. One Verizon family reported that their autopay has slid from the 23rd to the 17th, and is now on the 14th after they added a new line during back-to-back weekends.

Payment method tweaks also matter. A card on file expiring, transitioning from bank account to a card, or an initial failure can reset processing logic and retry windows. Even the calendar matters. Because months are lumpy, a fixed deadline does not produce a fixed draft date.

These shifts can be painful for families that run a tight budget. Consumer advocates and the Consumer Financial Protection Bureau have warned that capricious timing of payments is a staple of overdraft fees. Given that about 60% of U.S. consumers live paycheck to paycheck, according to research by LendingClub, a draft like this hitting a few days early can set off repercussions all the way down the line.

Fastest Way to Recenter Your Draft Date and Billing Cycle

In most instances, Verizon customers can move their bill due date once every 12 months. It’s the cleanest way to reset your autopay window around a time of the month that actually makes sense for your cash flow.

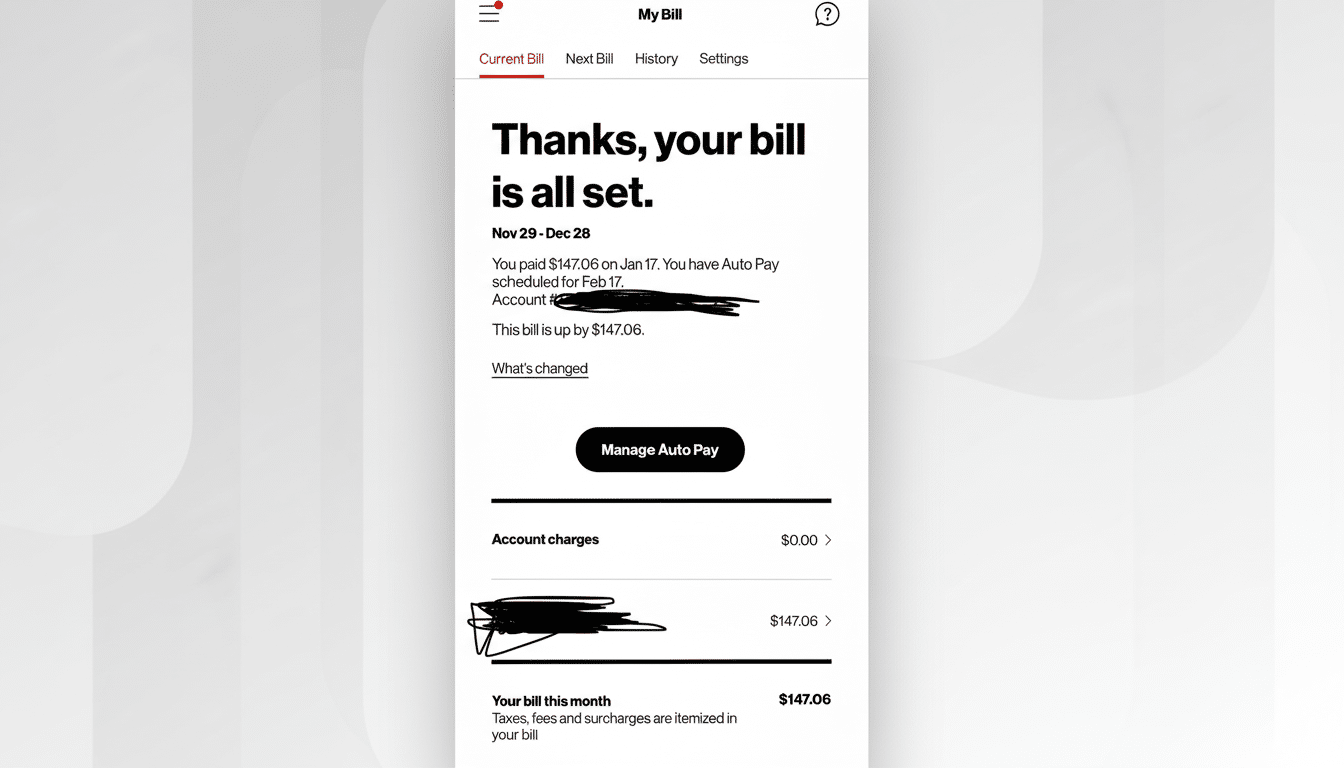

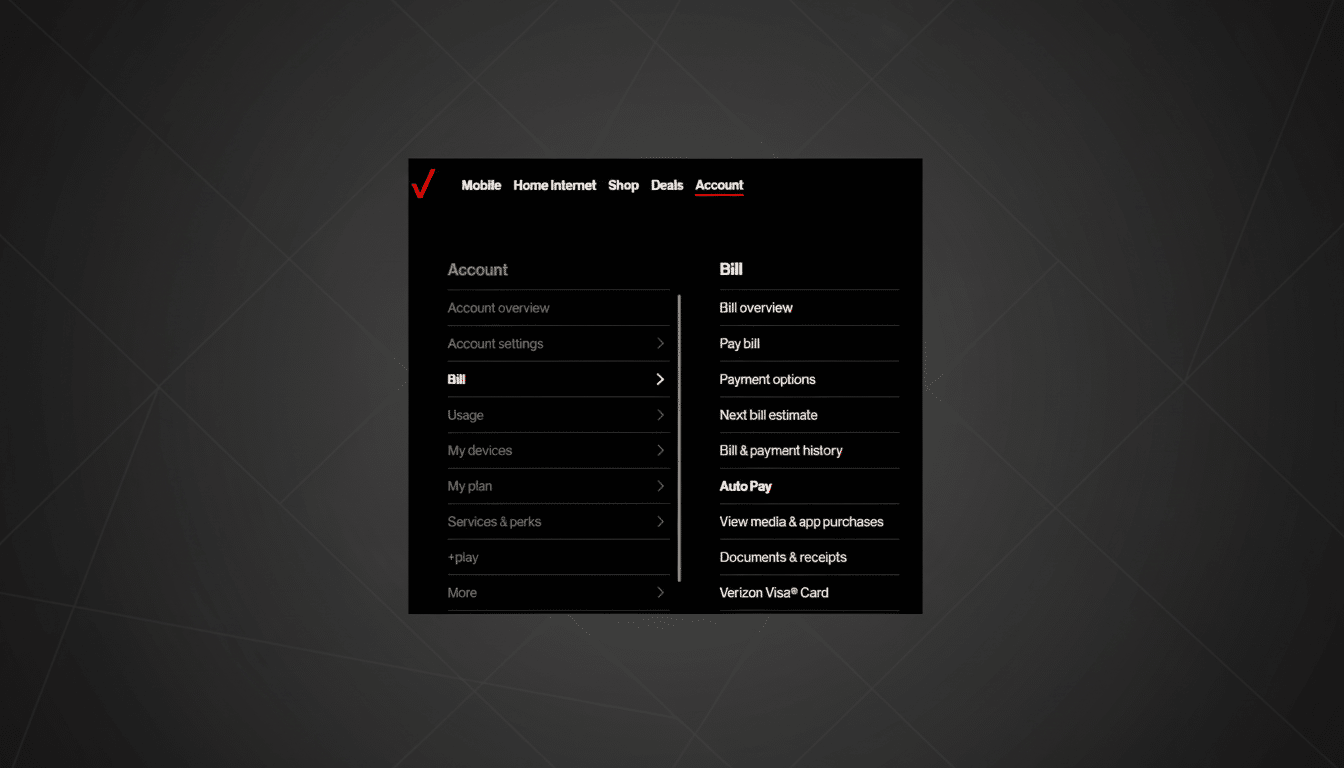

Here’s what to do. Select a target date that corresponds to your pay cycle, but include a few buffer days for weekends and holidays. Call or contact Verizon customer service and explain you want to change your bill due date. You can also initiate this process in the My Verizon app by tapping on Billing, finding due date options, and then verifying with an agent if you need clarification on proration.

Expect a one-time adjustment. Adjusting a due date to synchronize with another biller may also create a shorter or longer billing period, and as such the next bill may appear different. As long as your eligible payment method doesn’t change, your autopay discount should continue. The current discounts at Verizon generally are tied to paying via bank account or debit instead of credit card, so you’ll want to double-check your method before making changes.

After the switch, monitor for the next two cycles. Autopay will still run a few days before the new due date, but the window should be back to where it was (at worst) with your original payment timing. If it starts drifting after future changes to your account, then do the reset if you can.

Pro Tips to Prevent Draft-Date Drift and Overdraft Fees

Make a small buffer in the account with savings linked to it. Drafts usually come in 1–5 days before the due date, so targeting the early edge of the window is safer than exiting toward the close.

Keep your payment method consistent. Switching cards or switching from bank draft to card can reset processing behavior, affect discounts, and change the day you see funds leave your account.

Remember that after a change to your account, you should be careful with nudges in the cycle. Proration, meanwhile, can become a nudge within the cycle if you add a line, finance a device, or move plans. After making any change, verify your next two statements.

Employ mobile alerts overlaid on top of autopay. Create a bank balance alert and schedule a repeating transfer into the bill-pay account, preferably the week before the draft is supposed to happen. Turn on your bank’s low-balance or large-transaction alerts, if available.

How Other Carriers Respond to Due Date Changes

AT&T and T-Mobile both allow customers to request a change in the date their bill is due, though policies differ from provider to provider, as do frequency restrictions (and proration may apply). Many carriers link autopay discounts to debit or bank payments and process drafts a few days before the due date, so the same weekend and holiday dynamics used with credit cards apply here as well. If you’re on an MVNO, due dates are likely well constrained to the activation date, though some offer in-app shift options.

The bottom line is simple. Autopay glide is just good enough — but it doesn’t need to flatline your budget. Re-centering your due date once a year so it coincides with when you’re paid, plus padding to account for banking calendars, can bring back predictability without giving up the discount or convenience.