Verizon has quietly tightened its postpaid device unlocking rules, adding a new 35-day waiting period when customers pay off a phone through the Verizon app or via authorized retailers. Unless you clear the balance with specific “secure” payment methods in a Verizon store, that paid-off device won’t unlock right away—an abrupt change that complicates switching carriers or using local SIMs while traveling.

What Changed and Why This Policy Shift Matters

For years, Verizon’s policy was relatively simple: new postpaid phones were locked for 60 days, then unlocked automatically so long as the device wasn’t flagged for fraud. That baseline still exists. The new wrinkle kicks in at payoff time—precisely the moment when many people plan to move a line, sell a device, or pop in an international SIM.

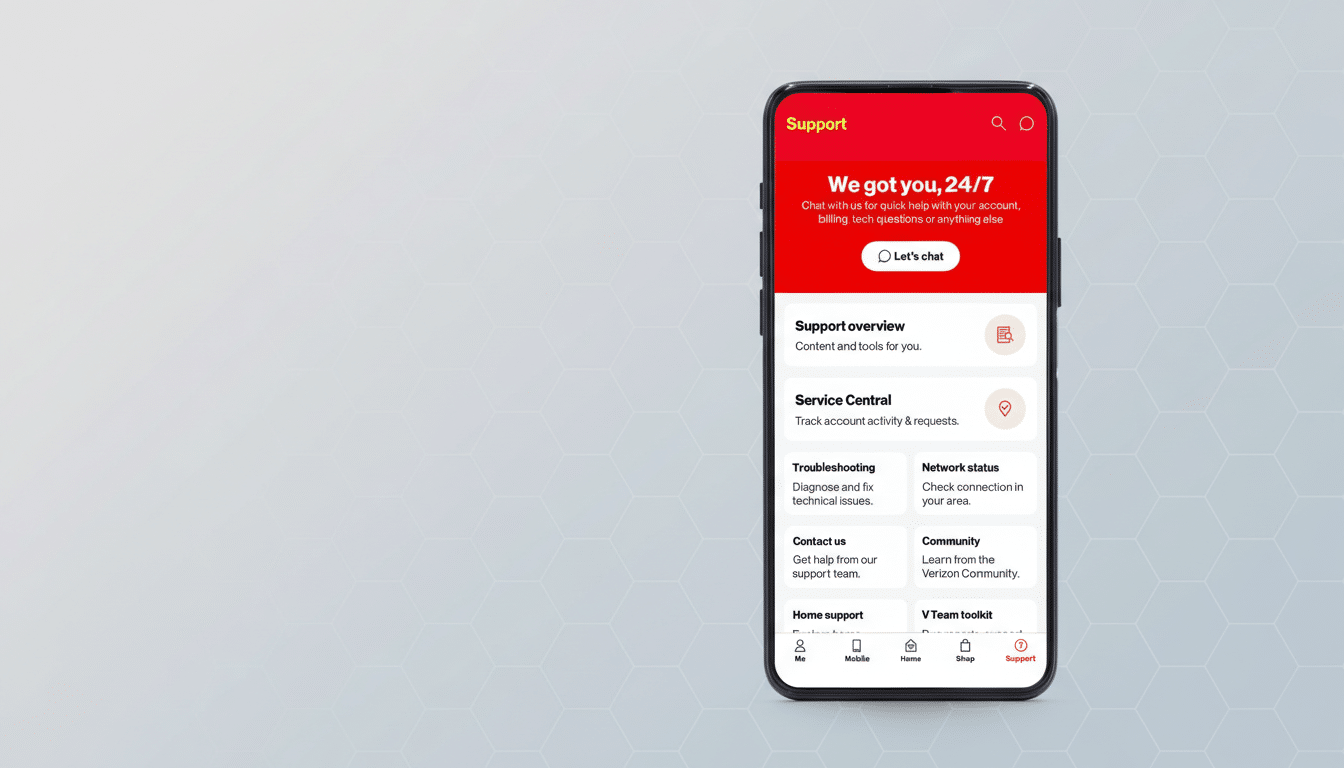

According to Verizon’s updated support materials and reporting from industry outlets, any payoff made through the Verizon app or an authorized retailer can now trigger a 35-day lock before the device fully unlocks. The company frames the policy as a fraud-prevention step; however, it notably offers no public explanation for why app and retailer payments are treated differently than in-store payments.

How the New Waiting Period for Unlocks Works

Verizon says devices will unlock immediately if the remaining balance is paid in a company store using what it calls a “secure” method—cash, a credit card with an EMV chip, or contactless payments. If you pay off the phone online in the Verizon app, or settle up at an authorized retailer, expect a 35-day hold before the unlock completes, even if your account is current and the device isn’t flagged for theft or fraud.

Making matters more contentious, Verizon’s documentation indicates the policy took effect before the public-facing page was updated, suggesting some customers may only learn about the waiting period after they have already paid in full. That kind of retroactive application is drawing sharp criticism in customer forums, where many argue that a paid-off phone should be eligible for immediate unlocking regardless of payment channel.

How Rival Carriers Handle Device Unlock Policies

AT&T and T-Mobile publish unlock criteria that focus on account standing, payment completion, and basic tenure, with requests typically processed within a couple of business days once a device is eligible. By contrast, Verizon’s new rule adds an extra 35 days to certain payoff scenarios, creating a two-tier system that rewards in-store payments and penalizes app or retailer checkouts—even when the same credit card is used.

This isn’t an isolated shift. In a separate move earlier this year, Verizon lengthened the lock period for certain value-branded prepaid devices to a full 365 days, up from a much shorter window previously. Seen together, the changes suggest the carrier is prioritizing anti-fraud controls and customer retention, even if it makes postpaid and prepaid unlocking more cumbersome.

Consumer Impact and the Regulatory Backdrop

Unlocking matters for three big reasons: carrier choice, travel flexibility, and resale value. A paid-off, unlocked phone typically commands higher prices on the secondary market. IDC forecasts the used smartphone market to keep expanding at a healthy clip over the next few years, which makes friction at unlock time more costly to consumers. A 35-day delay can translate into missed sales windows, longer device downtime, or postponed switches to cheaper plans.

Industry-wide, the CTIA Consumer Code commits carriers to unlock eligible devices upon request after obligations are met, generally within a short window. The FCC has encouraged transparent, timely unlocking practices and fields consumer complaints when unlocks stall. Verizon’s policy technically still leads to unlocking, but the extra 35 days—tied to where and how you pay—adds complexity that many customers won’t anticipate.

What You Can Do Now to Avoid Unlocking Delays

- If you need an immediate unlock at payoff, visit a Verizon store and use an EMV chip credit card, contactless payment, or cash. Keep proof of payment.

- If you already paid via the app or an authorized retailer, plan for a 35-day wait. Set calendar reminders and confirm unlock status with support as you approach the end of the window.

- If timelines slip beyond what Verizon states, escalate with customer support. If you believe you meet all criteria yet remain locked, you can also file a complaint with the FCC.

Bottom line: Verizon’s new policy makes the path to an unlocked, paid-off phone more circuitous unless you follow the carrier’s preferred, in-store payment route. That may curb some fraud at the margins, but it also introduces confusion and delays for legitimate customers who simply want the freedom to take their device wherever they choose.