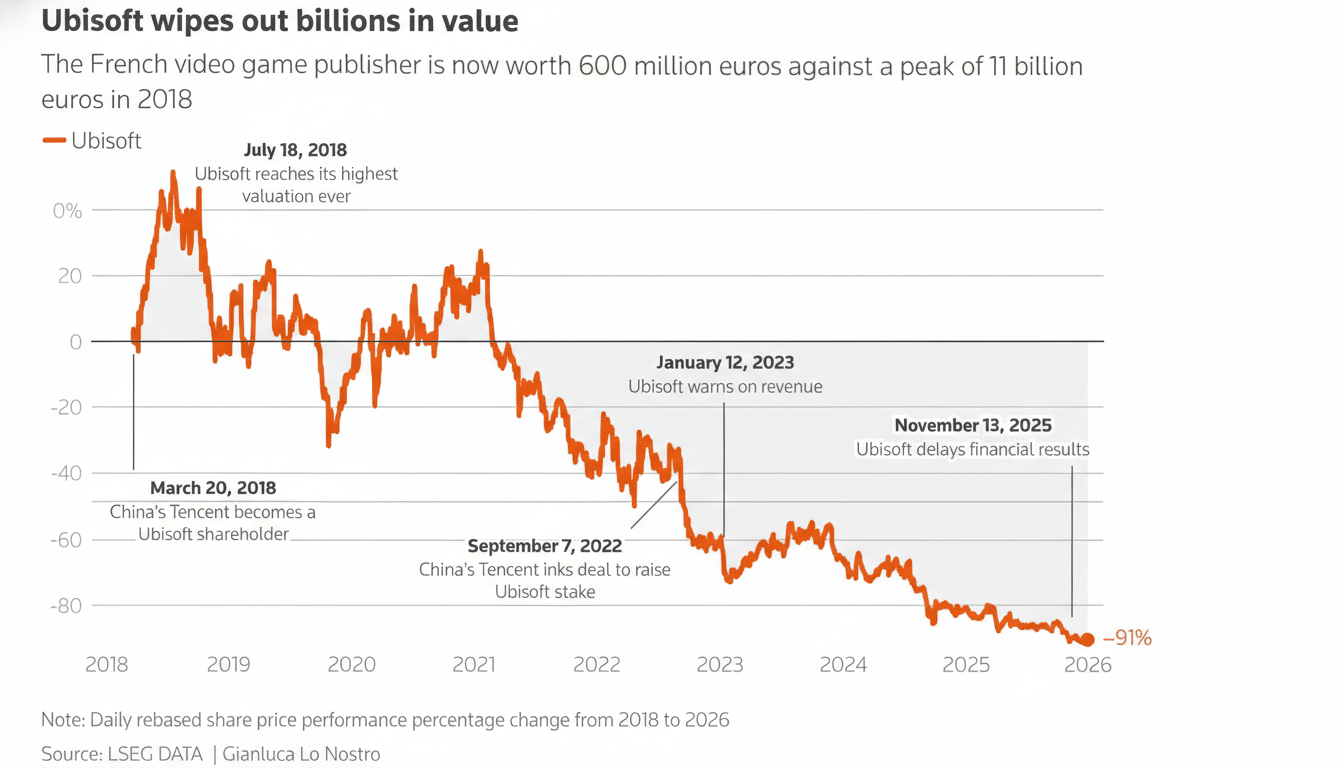

Ubisoft’s stock cratered after the publisher scrapped multiple games and closed studios in a sweeping restructuring, triggering a rapid selloff. The shares fell roughly 34% in early trading and extended losses to about 40% as the day wore on, according to CNBC, as investors questioned the health of the pipeline and the payback on years of big-budget bets.

Market Reaction and What It Signals for Ubisoft

The slide reflects a classic crisis-of-confidence moment: fewer near-term releases, less visibility on future hits, and mounting costs. For a publisher that relies on a handful of tentpole launches to drive cash flow, any contraction in the slate or delay can translate directly into a repricing of risk.

Analysts note that Ubisoft’s volatility has intensified as development timelines lengthen and marketing spends rise, eroding margin predictability. In that context, a wave of cancellations is read as both a hit to revenue potential and a signal of projects failing internal milestones—two red flags for public markets.

What Sparked the Selloff and Studio Closures

The company confirmed it was axing several unannounced titles, shutting multiple studios, and reorganizing teams. Management also emphasized an intent to lean harder on generative AI tools in production, pitching efficiency gains at a time when headcount and content demands have grown.

One high-profile casualty dominated headlines: the Prince of Persia: The Sands of Time remake. First revealed with an early target window then repeatedly delayed, the project’s cancellation became a shorthand for broader execution struggles—shifting scopes, rework, and the challenge of resurrecting a classic without compromising quality.

The restructuring landed alongside news of closures in places like Halifax and Stockholm. Labor advocates in Canada criticized the Halifax shutdown as union-busting, underscoring a separate risk for Ubisoft: morale and retention at a time when experienced developers are scarce and expensive.

The Cost Of Big Franchises And Longer Timelines

Ubisoft helped define modern open-world design, but the economics have shifted. AAA budgets across the industry now commonly reach into the hundreds of millions when factoring in staffing, technology, prolonged testing, and multi-platform marketing, as reported by outlets like Bloomberg and Reuters. Longer cycles concentrate risk: one slip reverberates through bookings, live-service monetization, and investor guidance.

Flagship series such as Assassin’s Creed now involve global studio coordination and sprawling content plans. When new IP underperforms or remakes stumble, sunk costs mount and the opportunity cost is severe. This dynamic has driven restructurings across the sector—see Embracer Group’s extensive portfolio cuts and Take-Two’s periodic pruning—as publishers refocus on fewer, bigger, safer bets.

AI Bet Meets Skeptical Market and Workforce Concerns

Doubling down on generative AI is pitched as a pathway to faster asset creation and more reactive worlds. It may streamline repetitive tasks and help with prototyping, but it is not a quick fix for design bottlenecks, creative direction, or quality assurance. Investors, wary of hype cycles, are waiting for measurable throughput gains—shorter dev times, fewer delays, and consistent hit rates—before awarding premium multiples.

There are also reputational and workforce questions. Developers and unions have raised concerns around credit, originality, and job security when AI is introduced without clear guardrails. If adoption fuels friction or talent flight, any productivity lift could be offset by lost institutional knowledge.

What to Watch Next for Ubisoft’s Reset and Outlook

Guidance will be critical. Investors want clarity on the trimmed roadmap, tangible cost reductions, and the cadence of near-term releases capable of stabilizing bookings. Commentary on headcount, studio footprint, and capitalized development will help test whether the reset aligns resources with realistic targets.

Equally important is brand momentum. With the slate narrowed, execution on core franchises becomes paramount—steady post-launch support, fewer slips, and clear value propositions for players. If Ubisoft can pair a leaner portfolio with timely, polished releases, the current drawdown may mark a painful but necessary inflection. If delays and cancellations persist, the market will keep discounting the story.

For now, the 40% plunge is a blunt verdict: the street is demanding proof that Ubisoft’s pipeline, processes, and strategy can turn ambition into reliable outcomes. The next milestones—earnings, pipeline updates, and production wins—will determine whether confidence returns.