Uber and Lyft, the twin giants of the ride-sharing industry remaining in existence today, will begin testing Baidu Apollo Go robotaxis on London’s streets next year in order to position themselves neck and wheels with Waymo and homegrown startup Wayve within one of the world’s most closely watched urban autonomy testbeds. Pending local approvals, the trials will see Baidu’s electric RT6 vehicles deployed in limited operating domains as the companies accumulate at-scale safety, mapping, and rider-experience data.

What the Pilots Will Look Like on London Streets

It anticipates that early operations will involve safety drivers and deeply geofenced routes, expanding as the system demonstrates its performance. Lyft’s chief executive has indicated a desire to scale up to hundreds of RT6 vehicles over time, if regulatory milestones and operational metrics are satisfied. Uber, which already offers Waymo rides in some U.S. markets, says its London testing window will open during the first half of the year and allow Apollo Go vehicles to be included directly into the established flow of the Uber app.

- What the Pilots Will Look Like on London Streets

- Regulatory Pathway And Safeguards For London Trials

- Why London Is a Hive of Autonomy For Robotaxis

- A Platform Strategy for Robotaxis by Uber, Lyft, Baidu

- What Riders Should Expect From London Robotaxi Pilots

- The Bottom Line on Uber, Lyft and Baidu Robotaxis in London

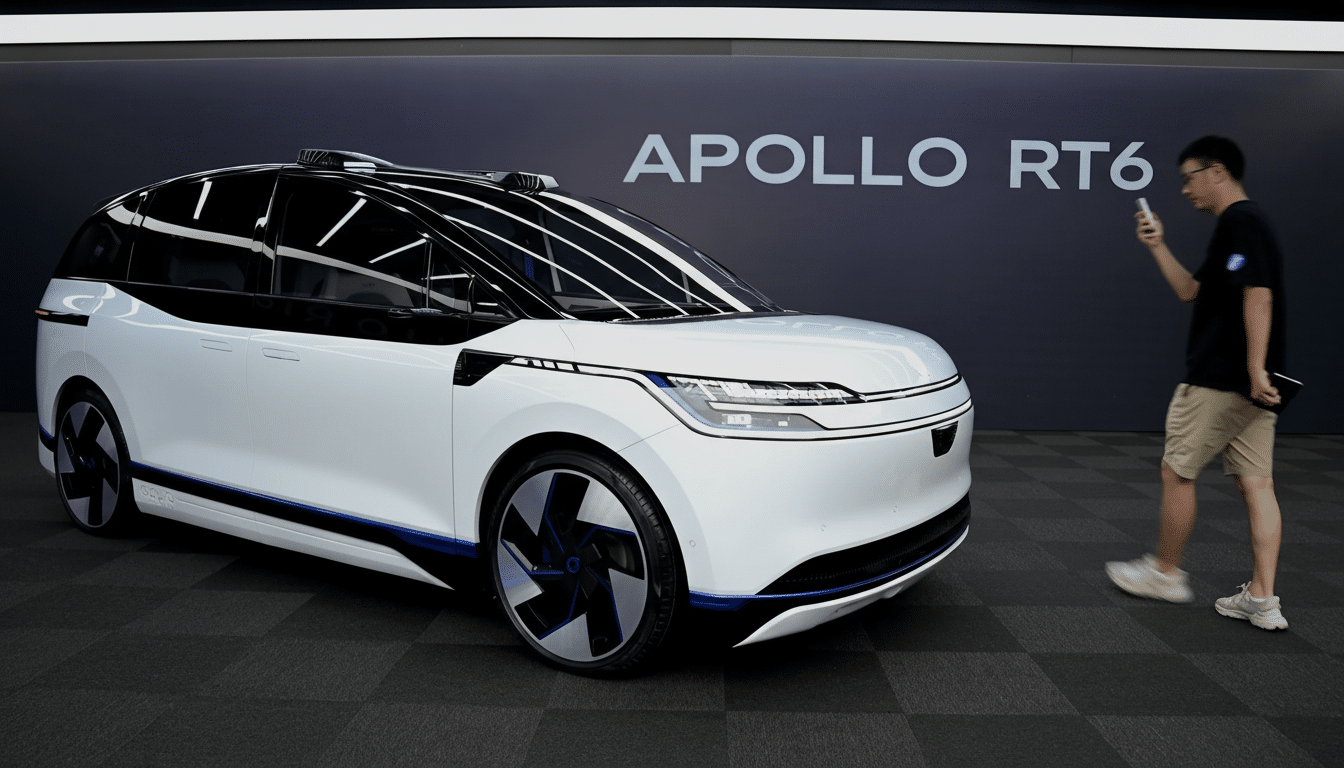

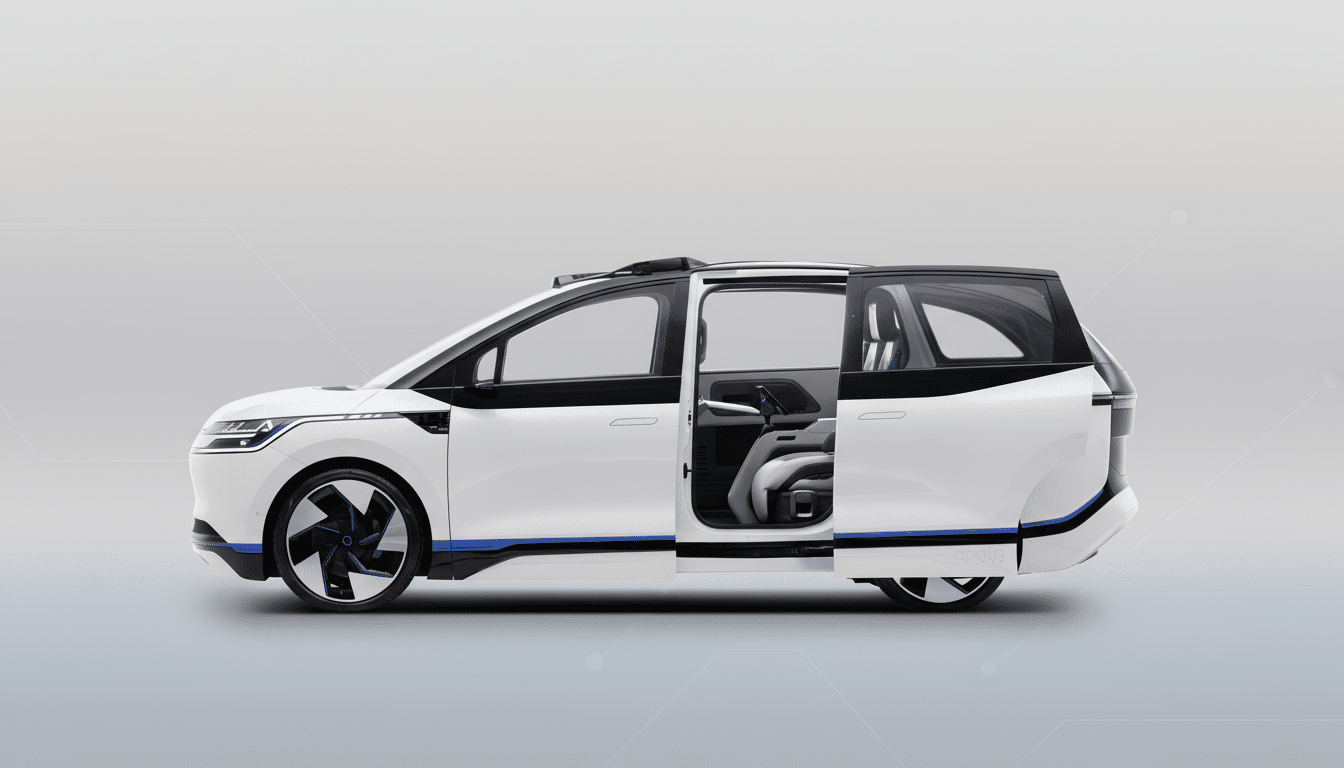

RT6: Baidu’s purpose-built Level 4 robotaxi

Baidu’s RT6 is an entirely new platform for a purpose-built Level 4 robotaxi, which fleets have already been running under the Apollo Go service in China covering several cities. Though it has felt like there’s been much talk of the bill of materials and extreme sensor redundancy with regard to the vehicles, pilots in London will be more about little black numbers on spec sheets and far more about how well they negotiate dense traffic scenarios involving various modes, complicated junctions, and regular lane narrowing. Expect remote assist for edge cases too, with cars that will eventually secure their position and wait safely for human guidance.

Regulatory Pathway And Safeguards For London Trials

The UK’s Automated Vehicles Act outlines the high-level regime for authorizing self-driving services, establishing a safety benchmark of “careful and competent” and defining clear lines of responsibility for the authorized self-driving entity. In London, pilots also integrate with Transport for London oversight provisions, such as insurance requirements and data sharing rules; pilot vehicles also interact with the bus lanes and kerb management rule set. The Centre for Connected and Autonomous Vehicles has long promoted controlled trials, but commercial-level deployment will need further assurance arrangements.

Data governance will be scrutinized. The UK’s Information Commissioner’s Office said it would require clear passenger notices, limited personal data collection from in-cabin and external sensors, and strong policies on retention and anonymisation. With Baidu’s involvement, the UK’s National Security and Investment Act may trigger a critical technologies-like review of data flows and supply chain exposure. The companies say the trial’s mapping and telemetry will meet UK legal and security regulations from the National Cyber Security Centre.

Why London Is a Hive of Autonomy For Robotaxis

London presents challenging geometries and unexpected behaviours: its narrow streets, cyclists filtering through traffic, frequent roadworks that can lead to unpredictable behaviour, and rain affecting performance of sensors. Traffic speeds through central areas regularly appear in the single digits, which makes precise low-speed autonomy at a busy kerbside or pick-up/drop-off zone all the more valuable. The city’s Ultra Low Emission Zone additionally tilts the balance toward zero-emission fleets, which lines up with the all-electric robotaxis Uber and Lyft plan to test.

As a testing ground, London provides rich datasets — bus-heavy corridors, sprawling roundabouts, and inconsistent signage — that can refine perception and planning models. The bar is likely to be set even higher with the expected arrival of Waymo vehicles, while Wayve has taken a very different approach to autonomy — end-to-end AI — developed on UK streets. That success would be a sign of resilience that could be applied in other historic European cities with similar impositions.

A Platform Strategy for Robotaxis by Uber, Lyft, Baidu

Both Uber and Lyft have moved away from developing their own self-driving systems in-house to brokering access to multiple autonomy providers. Uber sold the ATG unit and now is pursuing an aggregator model, sewing together partners like Waymo and Baidu. Lyft initially tested autonomous rides on a ride-share platform in Las Vegas and makes a similar platform-fleet move. For Baidu, London provides a marquee international test outside China’s regulatory environment for the service, Apollo Go, which it has operated in several cities and completed millions of rides.

The prize is utilization. Autonomous economics are dependent on empty vehicle productivity — rides per vehicle per day, short deadhead times, and high levels of uptime. Look out for signs that pilots can graduate from safety-driver tests to rider-only service windows, and published incident rates along with insurance structures. UK insurers have previously teamed with AXA and Aviva on autonomy pilots, and although it will be flashy demos making the headlines, their actuarial readouts will matter just as much.

What Riders Should Expect From London Robotaxi Pilots

At launch, rides would likely be restricted to certain neighbourhoods and time windows with clear disclosures in the app and feedback prompts. Prices are generally similar to or slightly lower than those charged for standard rides in order to spur adoption. Look for specified pick-up bays, in-vehicle displays that are impossible to miss, and safety features doubled up, such as external audio cues chiming for pedestrians. Its tracks are widely covered, but if 5G becomes the main course next year, “accessibility will be front and center: operators will need to show that wheelchair-friendly options have really changed their lives — as much as service coverage has become fairer and better, not just cool tech.”

“Transparency in reporting will be a key for public acceptance. Regulators and safety researchers caution that disengagements are a weak proxy for danger; more telling are the severity of incidents, a company’s adherence to rules, and how often remote help is required. If they can demonstrate cool with London’s daily chaos — real diversions because of roadworks, emergency vehicles, and erratic kerbside behaviour that we no longer even notice — trust will grow.”

The Bottom Line on Uber, Lyft and Baidu Robotaxis in London

The tie-up by Uber and Lyft with Baidu, which is to test robotaxi rides in Shanghai, represents a key test for platform-based robotaxi strategies in Europe’s most challenging market. With Waymo and Wayve in the running, London will essentially function as an A/B comparison of strategies — sensor-heavy stacks, end-to-end learning, and aggregator distribution. Less about flashy claims for autonomy, and more about on-street consistent transparency where reliability (not the press release) wins.