Microsoft is outlaying $15.2 billion for four years of commitments to the United Arab Emirates, bringing leading-edge Nvidia chips into the Gulf to position the nation as a prototype of how Washington’s alliances, partnerships, and security networks will govern AI exports. The comprehensive package of computing expansion, training, and authorization gives a foundation from which Abu Dhabi can be a regional hub for American artificial intelligence computing capability and standards.

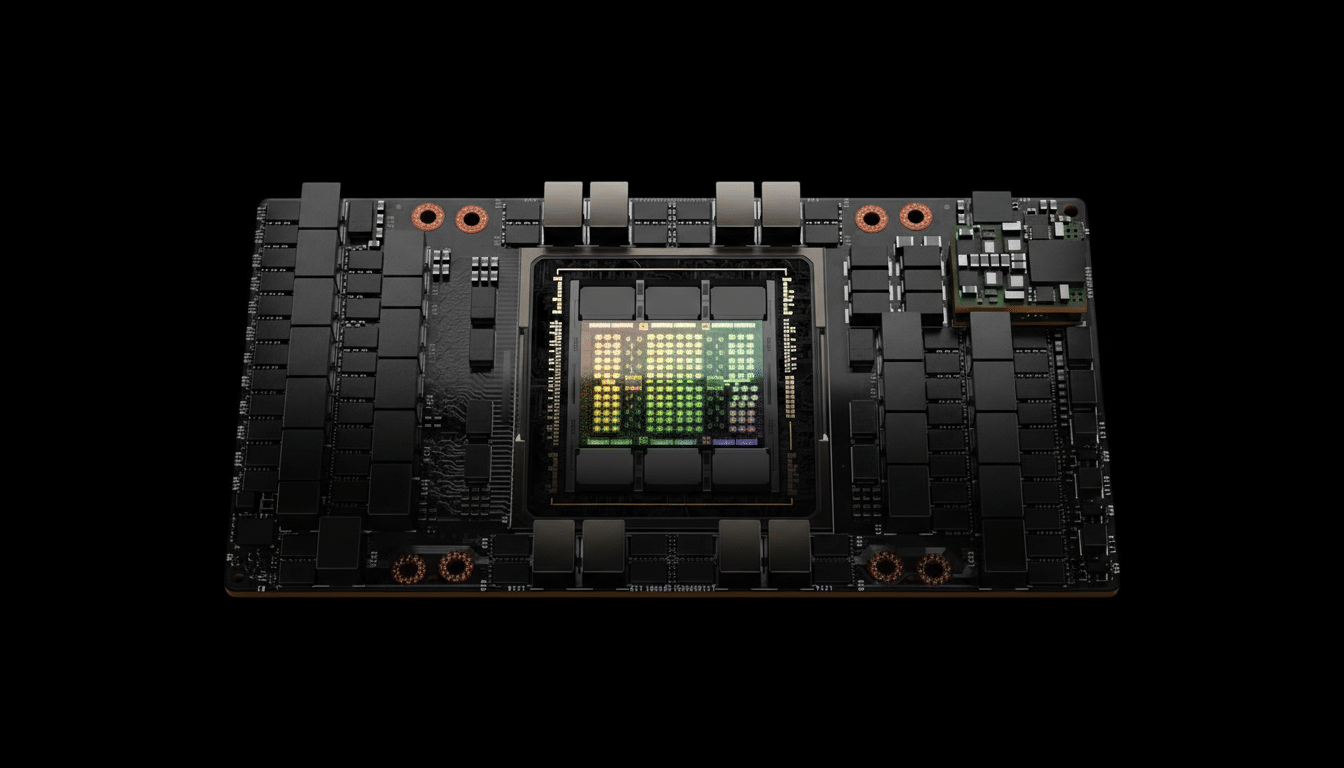

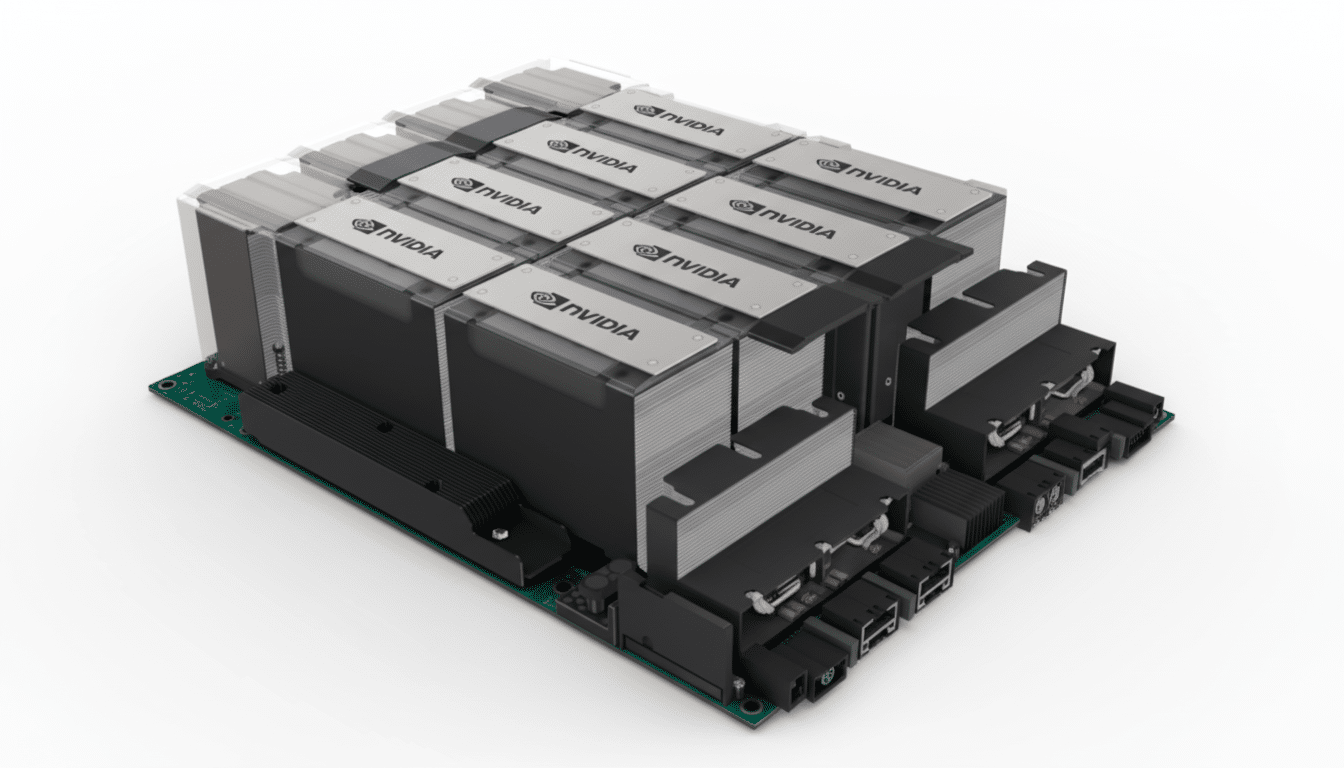

At the heart of the arrangement is a U.S. Commerce Department permit allowing Microsoft to transfer advanced Nvidia GPUs to the UAE, an equipment segment that has been subject to strict export controls. Microsoft reveals it complied with heightened cybersecurity and national security requirements to secure the authorization. This enabled shipments consisting of H100 and H200 series processors, providing an equivalent to roughly 21,500 Nvidia A100 GPUs inside the state.

The license resolves a bottleneck to full-scale artificial intelligence compute in the Gulf, where capital spending alone cannot ease availability constraints on top-tier chips. It also serves as a precedent for American action; the U.S. is applying a trustworthy-partner model in practice, allowing authorized awardees to gain admittance to cutting-edge American technologies while limiting piracy and misuse through strict protective conditions.

Two-phase $15.2B plan pairs data centers with training

In short, Microsoft’s investment is not merely about racks of silicon. The corporation is coupling data center expansions with a broad talent program, promising to train one million UAE residents by 2027 and dubbing Abu Dhabi a hub for AI research and model development. The company says the installed compute will power models from OpenAI, Anthropic, and open-source communities, in addition to its own portfolio.

The spending takes place in two phases. From 2023 until the end of 2025, Microsoft will have deployed just over $7.3 billion in the UAE, over $4.6 billion of which comprises data center capital and a $1.5 billion equity investment in G42, the country’s sovereign AI company. A second tranche of $7.9 billion through 2029 includes about $5.5 billion in ongoing infrastructure capex, underpinning the multi-site footprint that is designed for high-density training and inference workloads.

The plan revives long-held dreams of a major AI campus in Abu Dhabi, the end effect of chip-export curbs. With license terms in place, Microsoft is teasing further announcements around infrastructure, developer services, and governance tooling tailored for sensitive industries. Washington’s say as buyer is an effort to form the global AI stack through export licenses, compliance duties, and governing standards instead of a disregard policy. Alongside guardrails, such as secure enclaves, tightly controlled access, audit rights, and data-residency prerequisites, this can meaningfully diminish leak risks while keeping up commercial momentum.

UAE tilt toward U.S.-aligned compute raises soft-power stakes

The stakes are high. The UAE has developed ties to both U.S. and Chinese technology ecosystems in recent years, and U.S. officials have probed local players to unravel sensitive Chinese dependencies. Microsoft’s $1.5 billion investment in G42, combined with governance and security assurances, is generally perceived as a pivot toward a vetted, U.S.-allied supply chain for compute and models.

Industry commentators emphasize that the agreement is a measure of soft power: if U.S.-licensed AI capacity becomes the region’s default, American principles — from the NIST AI Risk Management Framework to nascent security measures — could set the starting point for vital uses across the Gulf.

Gulf states escalate compute race to lure AI labs and chips

The UAE is locked in rivalry with neighbors to entice AI labs, cloud providers, and chipmakers. Saudi Arabia has invested in research clusters and data infrastructure, and Qatar competes for specialized workloads. Scarce GPU supply has transformed first-mover access into a tactic, not wealth.

Global procurement contracts highlight the scale. Microsoft inked a mandatory $9.7 billion contract with Australia’s IREN for AI cloud capacity the same day, displaying the way hyperscalers interweave energy, land, and hardware contracts over continents to fulfill escalating demand. For the Gulf, plenty of power and purposeful digital blueprints provide a singular blend — if the silicon commodity lands and compliance is preserved.

Over the long term, the business economics could be engaging. A PwC analysis estimates AI might add some $320 billion to Middle East GDP by 2030, with the UAE contributing substantially. Localizing compute and talent is crucial to transforming that forecast into distributable software, sovereign plans, and high-gain services.

What to watch next: three signals for U.S.–UAE AI pact

Three signals will tell us if this becomes a template for U.S. AI diplomacy:

- How rigorously Microsoft, the U.S., and the UAE implement the license safeguards, including third-party audits and effective segmentation of sensitive workloads.

- Whether the promised workforce training in high-tech converts into a durable developer ecosystem that reduces the UAE’s reliance on fly-in expertise.

- If and when regional partners adopt compatible governance frameworks, dramatically reducing friction for cross-border AI services.

For now, Microsoft’s $15.2 billion bet gives the UAE a rare asset in a compute-constrained world and Washington a proving ground for export-control policy that prizes influence as much as interdiction. If the model holds, expect more “licensed corridors” for AI across strategically aligned capitals.