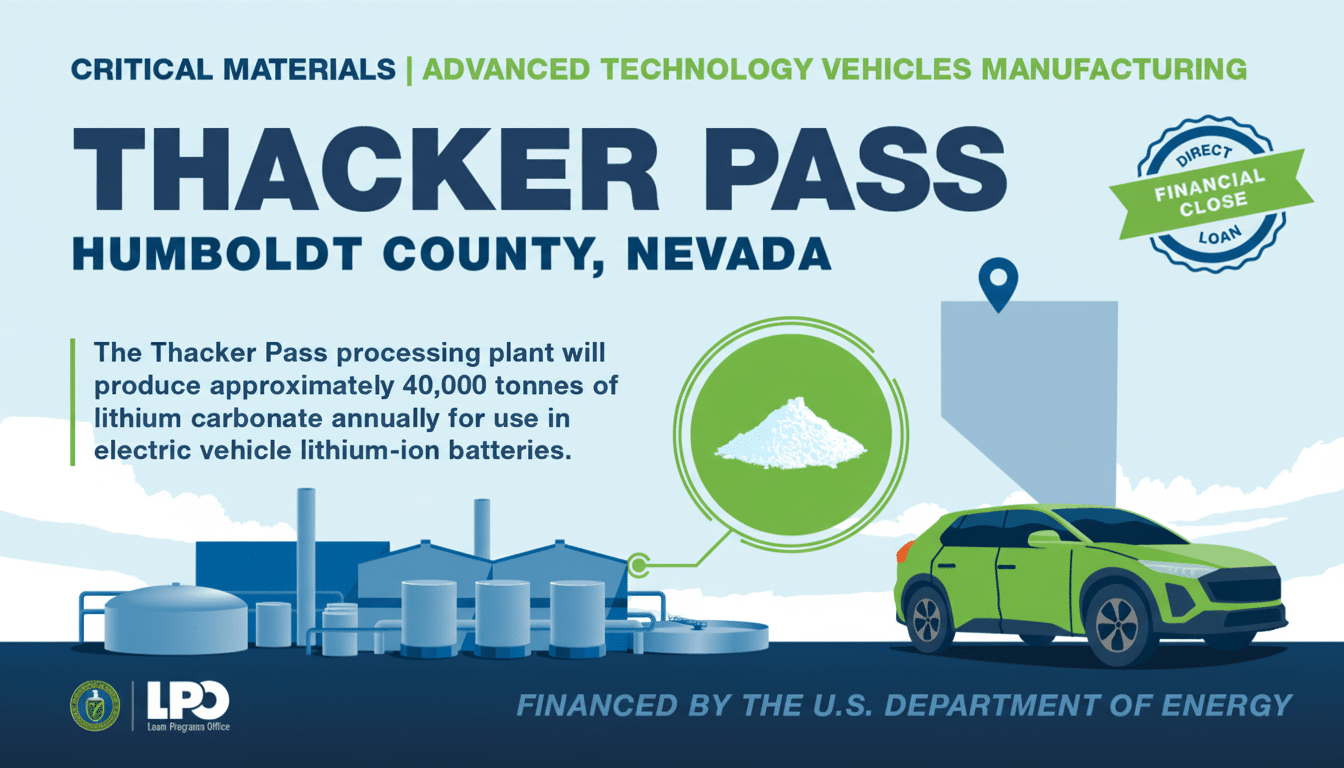

The White House wants up to a 10% stake in Lithium Americas, which is developing the Thacker Pass lithium project in Nevada, as part of an agreement that would change terms of a $2.26 billion Department of Energy loan to the company. The offer, first reported by Reuters, would hand the government a direct stake in a domestic critical-minerals asset that feeds General Motors as part of a long-term deal.

It’s a remarkable twist in U.S. industrial policy: A Republican administration skeptical of a fast, electrified future wants to take a stake in the flagship materials project for electric vehicle makers. Officials have characterized the ask for money as a means to protect taxpayers and capture upside if lithium prices rise, and to make sure that a strategically important mine gets to commercial scale.

An equity-for-relief proposal to reshape DOE loan terms

At stake is a renegotiation of a DOE Loan Programs Office facility that helped fund Thacker Pass, a claystone deposit described by the company as North America’s largest lithium resource. The administration, however, refused to just roll over terms in any renewal, seeking equity instead, a structure hewing to recent federal deals that provided warrants or profit-sharing for recipients of semiconductor and critical-minerals funds.

Those familiar with the talks said GM has also asked the government to backstop its current offtake commitments — in effect, a guaranteed purchase as the mine ramps up. That would transfer the market risk to taxpayers while still retaining an anchor buyer — which is a point of real significance given lithium’s price volatility and mixed messages from the administration on electric-vehicle policy.

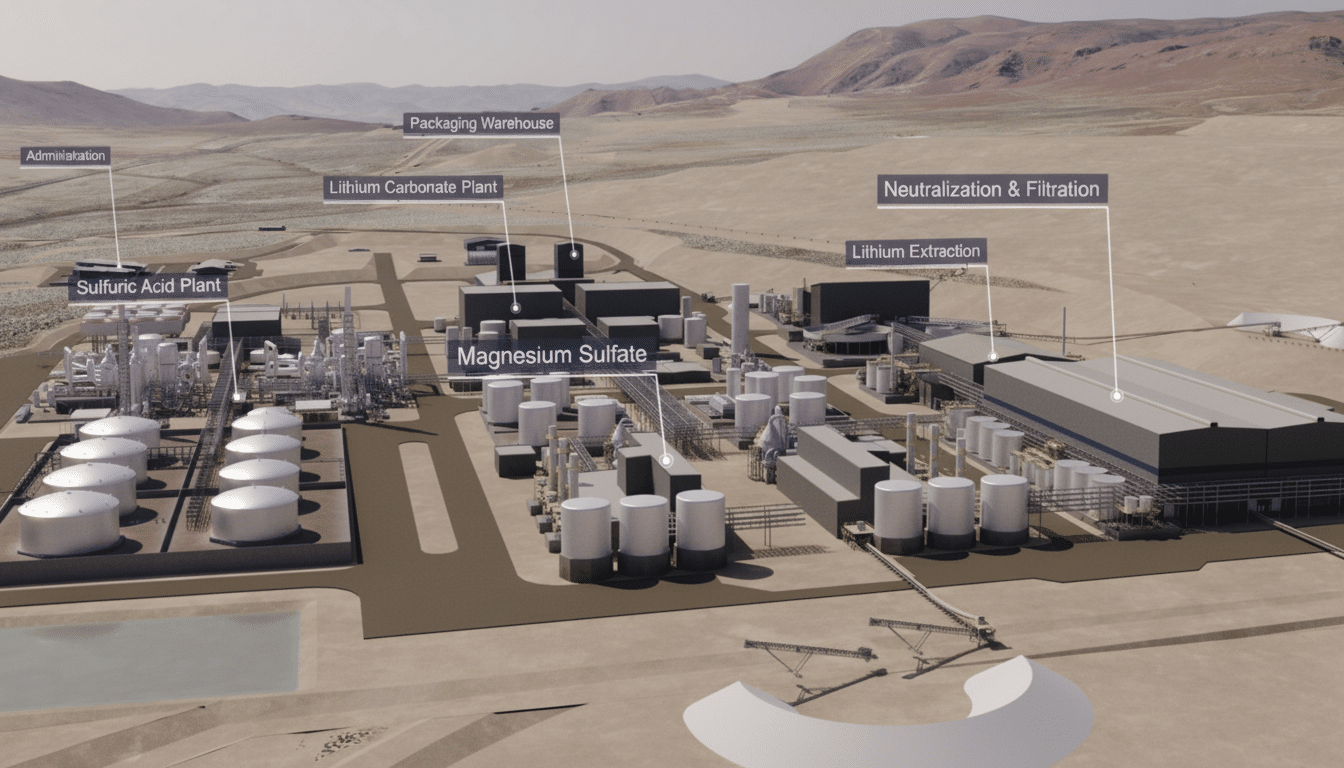

Why Thacker Pass matters for U.S. lithium and EV supply

Thacker Pass is intended to make battery-grade lithium chemicals at a scale that could help enable up to 800,000 electric vehicles per year in its first phase, according to company plans reviewed by investors. If it were ever fully constructed, future phases would leverage significant additional capacity — knocking a big hole in U.S. dependence on overseas supply chains dominated by foreign refining hubs where Canada and other friendly but dependable countries are not principal players.

The United States has just one lithium mine, which produces a modest amount of the metal, at a time when domestic battery plants and electric vehicle factories are coming online at an accelerating clip. U.S. Geological Survey estimates have long identified lithium as a strategic Achilles’ heel–related vulnerability. Developing a large, integrated mine-to-chemicals project in the country would enhance security of supply and logistics, and aid manufacturers in meeting domestic-content requirements that are tied to consumer tax credits.

Thacker Pass is no stranger to controversy. The permitting process had drawn lawsuits from both environmental groups and tribal nations, and construction has been closely monitored. With permits in hand and federal financing secured, however, the project is one of the most advanced large-scale lithium developments on American soil.

GM’s close connections and guarantees of sales

GM plunked down $625 million for about 38% of Lithium Americas’ U.S. business and access to the entire output from the first phase and about a third from the next for around two decades. The volumes in the aggregate would cover battery materials for as many as 1.6 million vehicles over that time frame, offering a keystone supply for the automaker’s Ultium platform.

The federal requirement that GM backstop its offtake would further bind that linkage. For Lithium Americas, it might mean reduced financing costs and a smoother path to full-scale production. For GM, it would secure a predictable supply of domestic material — and in an attractive market, given that spot prices have seesawed — while playing to the carmaker’s strategy of becoming less dependent on non-U.S. sources.

A wider shift in U.S. industrial strategy

The equity ask highlights an increasing willingness in Washington to swap public support for ownership-like potential upside. The Commerce Department has put itself into warrants on some semiconductor awards; the Pentagon structured support deals involving rare earths; and the DOE has been increasingly reliant on loans that are coupled with milestones and covenants meant to avoid one-way bets.

For taxpayers, taking a stake can reduce risks that come with building first-of-its-kind projects as delays, cost inflation and commodity cycles could all potentially eat into returns. For companies, it could bring a more patient capital base — as long as policy objectives and corporate strategy stay in sync.

What to watch next as the Lithium Americas deal evolves

“Key variables would be the eventual structure of any equity instrument, how much GM [guarantees] purchases, as well as ramp timeline and capex profile for the project.” Cash flow will be determined by the price of lithium and refining bottlenecks. As we move through the construction process, community engagement and environmental oversight will continue to be central.

If the deal is executed, it would signify that the administration was willing to use the federal balance sheet not merely as lender and regulator but also as part owner of a strategic supply. For the EV ecosystem, a settled Thacker Pass would be a concrete step toward a homegrown battery materials base — one that automakers, miners and government have a vested interest in making work.