President Trump said the United States would allow Nvidia, the semiconductor giant, to sell its H200 artificial intelligence accelerators to approved customers in China — with the federal government taking 25 percent of the revenue. The deal, which was announced on Truth Social and is subject to finalization by the Commerce Department, explicitly excludes Nvidia’s newer Blackwell (Oyster) as well as yet-to-be-launched Rubin platforms. It is anticipated to include AMD and Intel, and other chipmakers on similar conditions.

What the Nvidia H200 sales plan to China actually includes

Under Trump’s plan, shipments of H200 systems could proceed to pre-vetted buyers “under conditions for national security continuing to be strong,” including the 25 percent slice of proceeds as a means of shoring up U.S. jobs and manufacturing, according to Trump. The Department of Commerce is likely to describe licensing, end-use checks, and compliance procedures that closely parallel — but significantly alter — current AI export controls.

- What the Nvidia H200 sales plan to China actually includes

- Which AI chips are included and which are excluded under the plan

- Why a 25% revenue take matters for this policy

- Ramifications For Nvidia, AMD, Intel, And China

- Compliance, export controls, and key risks to monitor

- What to watch next as the Commerce rules take shape

The framework represents a step away from an outright ban and toward a regulated commercial route, supported by revenue sharing. It aims to curb gray-market leakage of servers and maintain leverage over which organizations in China can gain access to U.S. compute. The White House has so far given no indication that it would make changes to entity lists or restrictions on the broader enforcement of AI chip rules laid out by the Commerce Department’s Bureau of Industry and Security.

Which AI chips are included and which are excluded under the plan

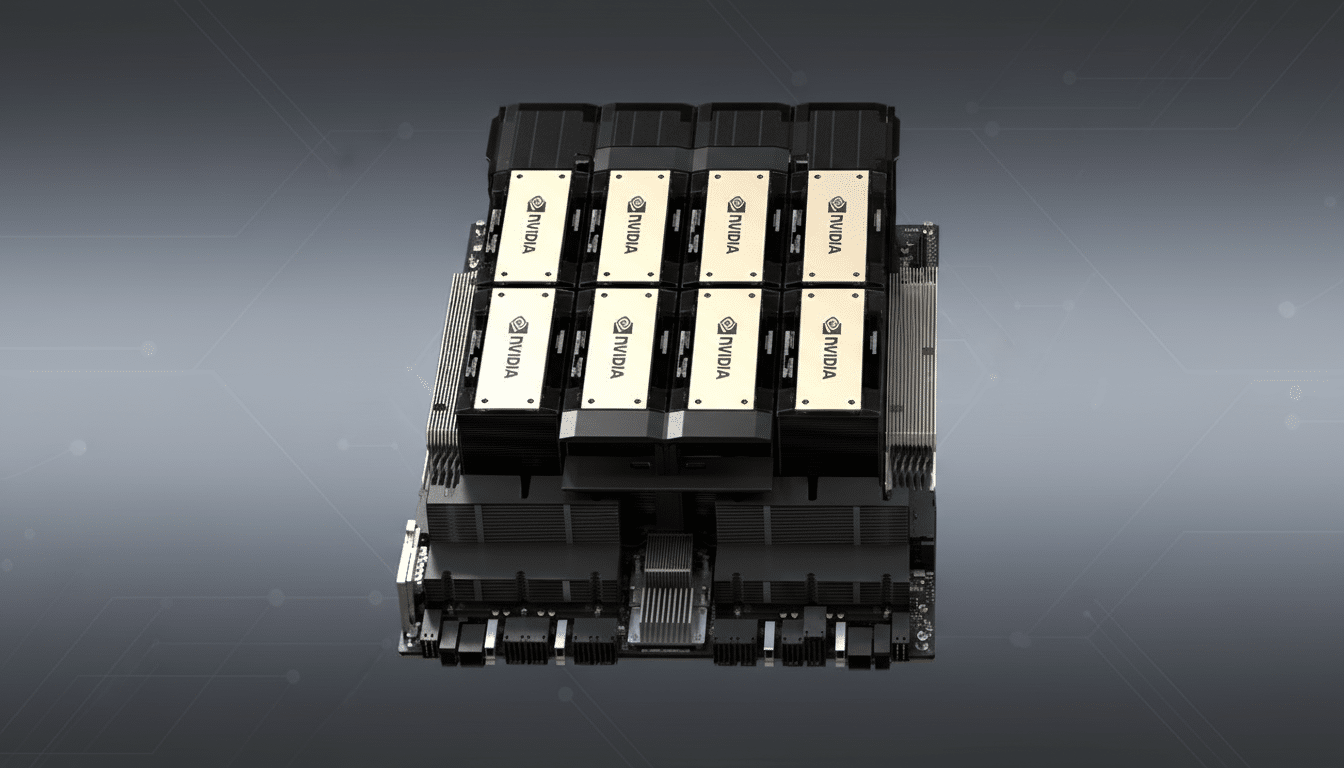

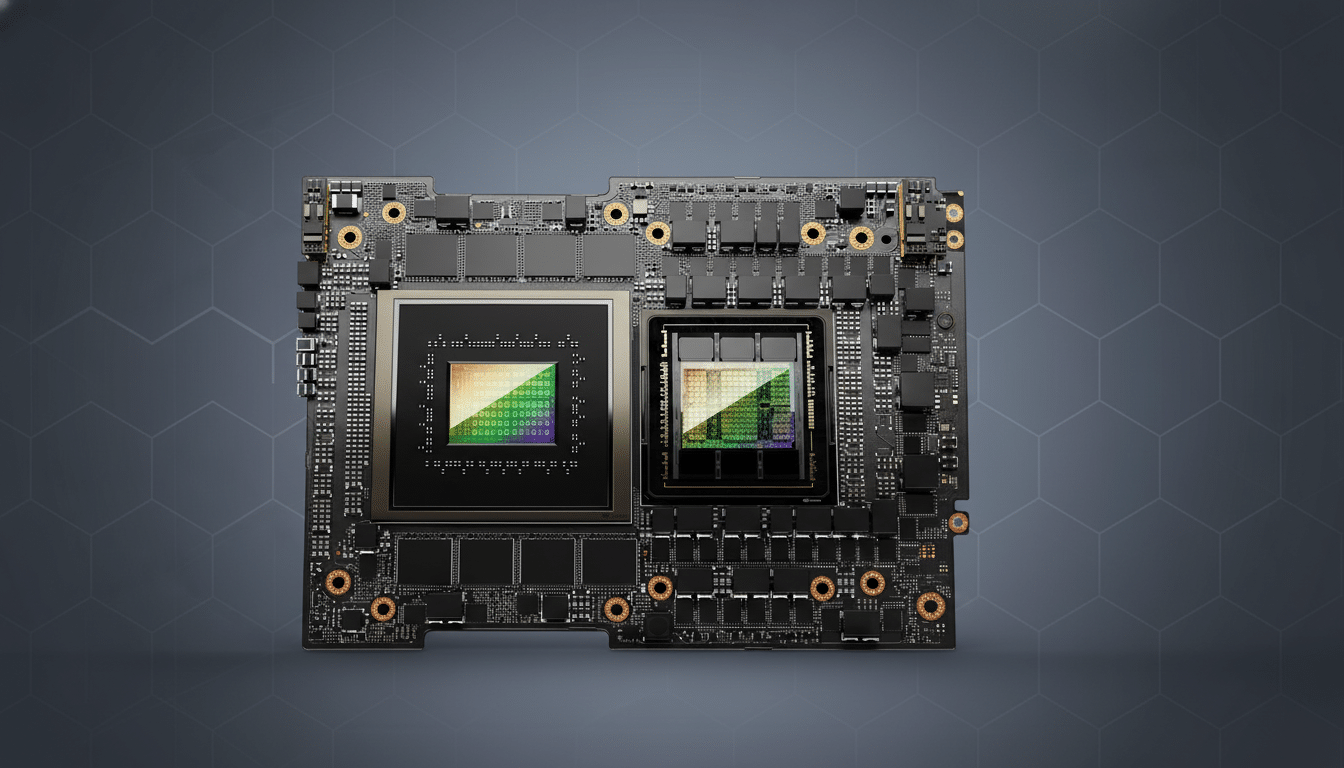

The H200 is a Hopper-generation GPU built on a 4nm process with high-bandwidth HBM3E memory — 141GB in the top-end configurations — intended specifically to accelerate large-scale training and inference, serving as part of what Nvidia calls its “Holodeck” architecture.

Independent benchmarks published here show Hopper-class parts holding a solid advantage in both performance and energy efficiency over Chinese-produced accelerators, and the CUDA software ecosystem is a big leg up for developers.

Significantly, they do not include either Nvidia’s Blackwell family or its Rubin replacement. It keeps the most advanced U.S. compute out of reach but still facilitates sales of a powerful, last-generation platform. It also skirts the Commerce Department’s new performance-density threshold, which effectively banned earlier China-specific versions such as the H800 and H20. Chinese regulators have also probed those few remaining options, with the Cyberspace Administration of China previously investigating potential security risks.

Why a 25% revenue take matters for this policy

The required 25 percent revenue split is a unique wrinkle in tech trade policy. It aims to capture fiscal value from demand that would otherwise potentially move underground or to non-U.S. suppliers, while keeping an eye on who buys what — and where it winds up. For whatever amount of licensed H200 systems are sold in the U.S. — say, 10 billion USD worth of H200s — that would be 2.5B USD going to the U.S. government before taxes and fees. Actual volume will be a factor of licensing scope, sales price, and Chinese appetite for the older part.

For Nvidia, the thinking goes, it is straightforward math: get paid for inventory and manufacturing capacity with Hopper while keeping Blackwell in hand to service markets lacking extra controls. With China not long ago contributing about 20%–25% of Nvidia’s earnings from its data center efforts — and though that mix has changed thanks to heightened rules — a sanctioned H200 sales line stands to help spark some fresh domestic demand with ready-to-use compliance guardrails.

Ramifications For Nvidia, AMD, Intel, And China

Nvidia has some near-term headroom if HBM3E supply from Micron, SK hynix, and Samsung can be fulfilled in line with resurgent orders. For AMD, such a policy could place its MI300 series under licensure (should it be called upon by the Secretary), and Intel too may find similar roads to market for Gaudi accelerators — subject to Commerce signing off on comparable terms and end-user restrictions.

For China, the decision is a trade-off. H200 gives back stability and compatibility with CUDA for model training and inference — accelerating AI deployments created in the cloud or for enterprise. But dependence on a controlled U.S. channel — one that excludes next-generation Blackwell and Rubin — widens a performance gap. The Chinese government continues to advocate homegrown alternatives and self-sufficiency targets, but many AI teams are still achieving higher productivity and better model outcomes on Nvidia hardware, as per international business press.

Compliance, export controls, and key risks to monitor

Expect strict licensing, end-use regulation, and possibly the revocation of a license for poor behavior. U.S. officials would probably demand:

- Attestations on ultimate beneficiaries and end users

- Assurances the goods will not be used for military or surveillance purposes

- Assurances the goods will not enhance the ability to suppress political dissent

- Reseller and third-party integrator oversight, with auditability

The credibility of the program will rest on enforcement: if smuggling or diversion continues, don’t be surprised if regulators limit eligibility or revoke approvals.

Price dynamics bear watching. A 25 percent skim was seen as potentially compressing vendor margins or being passed on to customers in the form of higher system costs. Should the balance of net price-performance move out too much in one direction, Chinese companies could, with some justification, double down on domestic accelerators despite the software and ecosystem delta. On the other hand, if the channel ends up being predictable and cost-competitive, it might dampen concurrent demand for workarounds.

What to watch next as the Commerce rules take shape

Key touchstones are likely to include the Commerce Department’s formal license criteria, confirmation about which Chinese entities will be considered “approved,” and limits on compute capacity or aggregate cluster size.

- Formal licensing criteria and timelines from the Department of Commerce

- Which Chinese entities qualify as “approved” purchasers

- Any caps on compute capacity, cluster scale, or deployment locations

- Industry feedback from Nvidia, AMD, and Intel on H200 supply and roadmaps

The point is: Washington is experimenting with a new lever — regulated sales at a 25 percent take — rather than binary bans. If it helps to curb illicit flows, protects national security, and captures value for U.S. taxpayers in a way that preserves commercial incentives, it might even become a model for future tech export policy. And if not, keep an eye out for another turn of the regulatory dial.