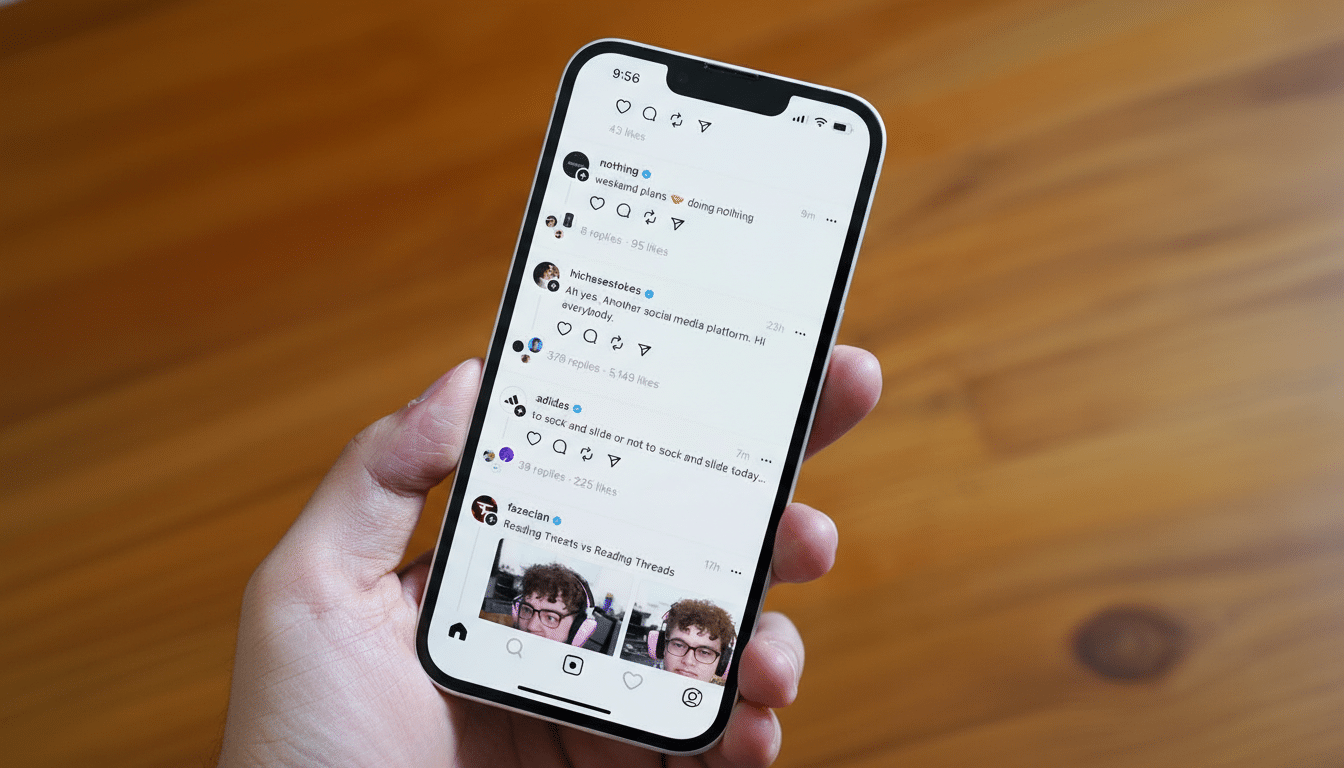

Meta’s Threads has nudged past X on daily mobile usage, according to new estimates from market intelligence firm Similarweb, signaling a meaningful shift in the social media pecking order on smartphones. The report pegs Threads at roughly 141.5 million daily active users on iOS and Android, compared with about 125 million for X, reflecting months of steady gains for Meta’s text-first app.

What the data shows about Threads’ daily mobile rise

Similarweb’s findings point to a sustained climb in Threads’ daily mobile engagement rather than a short-lived spike. The firm previously flagged a 127.8% year-over-year surge in Threads’ mobile audience growth, highlighting momentum that predates recent controversies surrounding X. Meta has also disclosed that Threads surpassed 400 million monthly active users and later reported 150 million daily active users, underscoring the platform’s ability to convert curiosity into habitual use.

- What the data shows about Threads’ daily mobile rise

- Mobile momentum versus the web, where X still dominates

- Why Threads is gaining traction with daily mobile users

- Implications for Advertisers and Creators

- The competitive landscape as Threads closes the gap

- What to watch next as Threads and X vie for attention

It’s worth noting the measurement nuances: Similarweb aggregates data from its panels and other sources and is widely used by analysts for directional trends. While specific tallies can differ from internal company metrics, the trajectory is clear—Threads has turned mobile into its home court.

Mobile momentum versus the web, where X still dominates

While Threads leads on phones, X remains dominant on the web. Similarweb estimates X at about 145.4 million daily web visits, whereas Threads draws a fraction of that, around 8.5 million across its domains. The split speaks to product DNA: Threads was built to ride alongside Instagram on mobile, with onboarding and discovery tuned for app-first behavior, while X retains an entrenched desktop audience and a long-standing habit of web-based consumption.

This gap also hints at different usage modes. Threads usage skews toward quick, mobile-native interactions—scroll, react, move on—whereas X still benefits from desktop power users, publishers, and professionals who keep a tab open all day. The platform that narrows this cross-surface divide fastest will have an edge in time spent and ad inventory.

Why Threads is gaining traction with daily mobile users

Three forces are propelling Threads on mobile. First, distribution: Meta has consistently cross-promoted Threads inside Instagram and Facebook, lowering sign-up friction and reminding billions of users that there’s a conversation happening nearby. Second, creators: Meta has prioritized tools and incentives to coax influential voices into posting more often, seeding timelines with content that keeps casual users returning.

Third, rapid iteration: Over the past year, Threads has rolled out features that move it closer to a daily-use network—interest-based communities, stronger content filters, direct messages, long-form text, disappearing posts, and even tests of lightweight games. These features align with mobile behaviors and help shift Threads from a novelty to a habit.

The platform’s tonal positioning matters, too. Threads has leaned into a less combative, more lifestyle-and-culture-forward vibe. For many users, that makes daily posting feel lower stakes, which can drive frequency and retention—two metrics that govern whether a social app graduates from download to daily ritual.

Implications for Advertisers and Creators

Mobile DAU leadership gives Threads a fresh pitch to brands: reach at scale in a brand-safe environment that sits next to Instagram’s proven commerce and creator ecosystems. That contrast sharpens amid ongoing concerns at X, where reports of AI-generated non-consensual imagery tied to the platform’s Grok tool have drawn scrutiny from the California attorney general and regulators in multiple regions. For risk-averse advertisers, perception often moves budgets before policy does.

Creators, meanwhile, are watching two levers—discovery and monetization. Threads’ growing daily base and tighter integration with Instagram improve discovery odds, while Meta’s broader monetization infrastructure can be extended when the timing is right. If payouts and sponsorship tools become more predictable, expect more cross-posting to become primary posting.

The competitive landscape as Threads closes the gap

Similarweb notes that X still leads Threads in the U.S., though the gap is narrowing. Elsewhere, the growth picture tilts in Threads’ favor as Instagram distribution compounds. Alternative networks continue to jostle for attention—Bluesky, for example, has seen a bump in installs during X’s rough patches—but the mobile scale now accruing to Threads raises the bar for challengers that lack a built-in funnel.

What to watch next as Threads and X vie for attention

The key questions now are durability and depth. Can Threads translate mobile DAUs into longer sessions and more creators earning a living? Will it close the web gap with X without diluting its mobile strengths? And as the product tests gaming and other engagement hooks, can it grow while keeping feeds healthy enough for blue-chip advertisers?

For X, the path forward likely runs through rebuilding trust with marketers, clarifying content policies, and leaning into its web and real-time strengths. For Threads, the mandate is to keep shipping, keep creators posting, and keep the Instagram flywheel spinning. On mobile, at least, that formula is working—and the leaderboard reflects it.