Tesla’s annual profit fell 46% to $3.8 billion in 2025, underscoring how policy shifts and softer demand reshaped the company’s core automotive business. The drop followed the elimination of federal electric vehicle subsidies by Congress and came as Elon Musk assumed a role in the Trump administration, a combination that weighed on sales and sentiment. Automotive revenue declined 11% year over year, and global deliveries reached 1.63 million, marking a second consecutive annual slide.

Even so, Tesla outpaced Wall Street’s expectations for the quarter and full year, lifting shares in after-hours trading as investors recalibrated around the company’s growing energy and software lines. In its shareholder letter and earnings materials, Tesla cast 2025 as a pivot toward what it calls a “physical AI” model that extends beyond cars into robotics, chips, and grid-scale energy.

Sales Slide and Margin Math as Incentives Fade

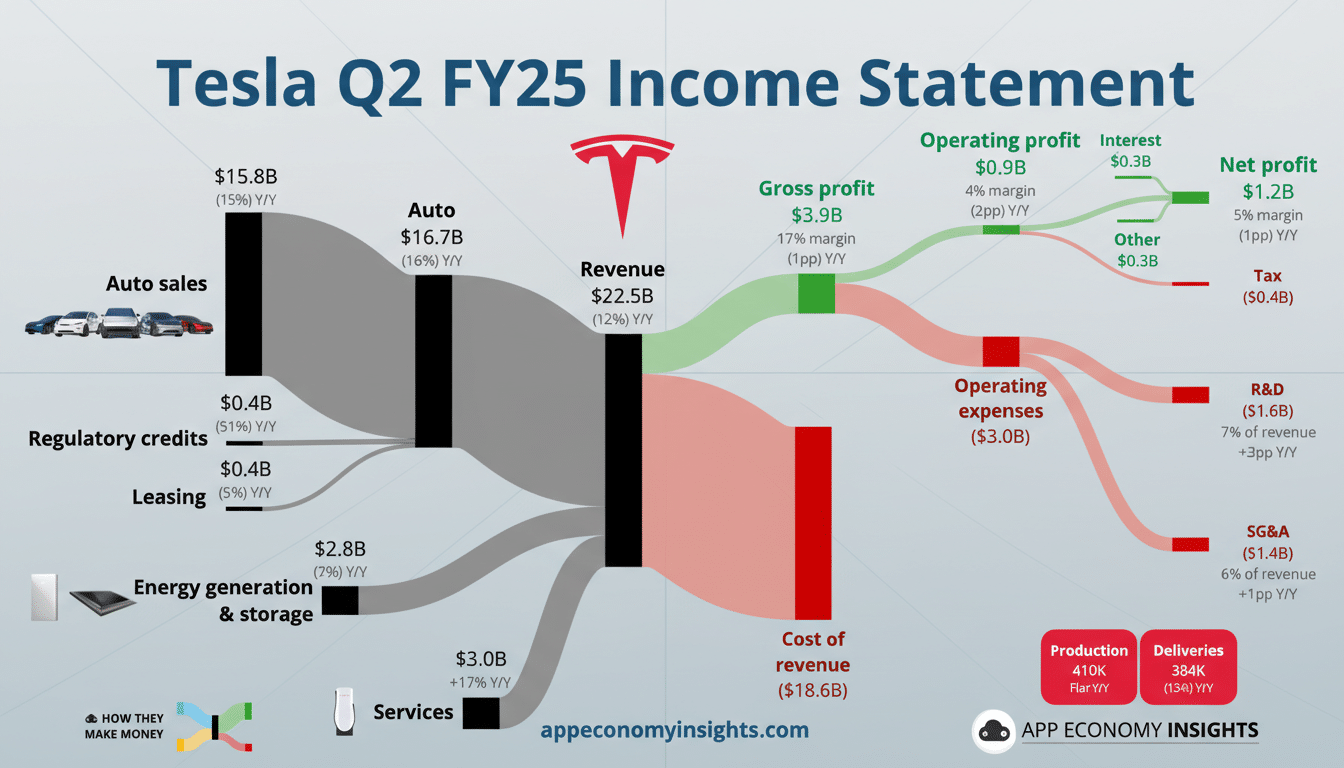

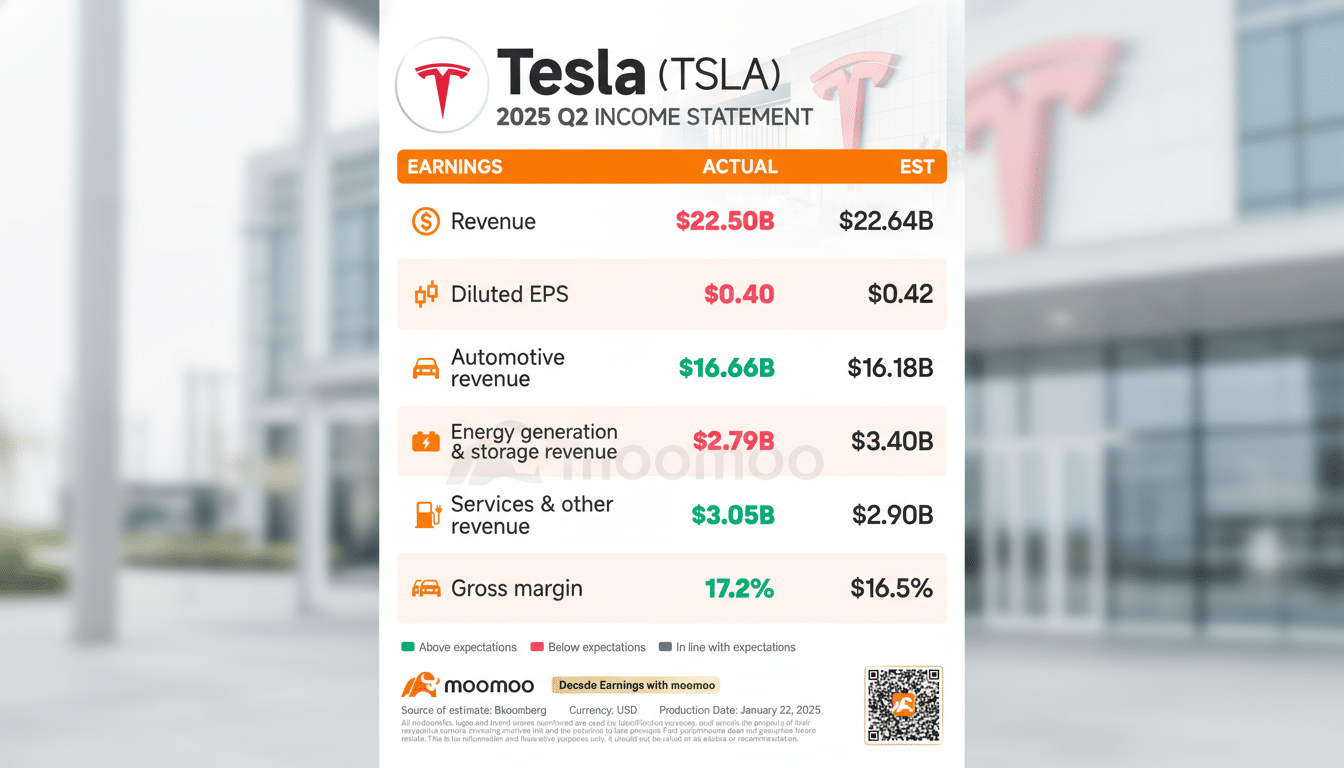

The 1.63 million vehicles shipped in 2025 highlight a notable deceleration from Tesla’s long-touted aspiration of averaging 50% annual growth. The retreat reflects a more challenging U.S. demand backdrop without federal incentives, while heightened competition in key markets has made pricing power harder to sustain. Tesla’s automotive revenue dropped 11%, confirming that volumes and mix both worked against the top line.

One surprise: margins ticked higher versus prior quarters despite the pressure on sales. Management credited a more favorable mix from non-automotive segments and ongoing cost efficiencies. That improvement won’t quiet concerns about the trajectory of the car business, but it shows the margin floor is increasingly supported by energy and services rather than vehicle pricing alone.

Energy and Software Cushion the Blow as Autos Slow

Tesla’s solar and energy storage revenue rose 25% compared with 2024, according to the shareholder letter, underscoring the scale and momentum of its grid battery projects. These deployments provide stickier, long-duration revenue and can be less cyclical than auto sales, a point analysts have emphasized in recent quarters as the energy business matures.

Services and other revenue climbed 18% year over year, supported by Full Self-Driving software, Supercharging, insurance, and parts. While FSD remains under regulatory scrutiny in multiple markets, its paid features and subscriptions have become a meaningful contributor to Tesla’s recurring revenue base. Together, energy and services helped stabilize gross margin and kept free cash priorities intact.

AI Bets and New Platforms Signal Tesla’s Next Phase

Tesla disclosed a $2 billion investment in xAI as part of that company’s recent Series E round, signaling deeper alignment between Musk’s AI ambitions and Tesla’s autonomy roadmap. The shareholder letter also highlighted in-house inference chips under development for autonomy and robotics—an effort that, if successful, could reduce dependence on external suppliers and tailor compute to Tesla’s workloads.

On the product front, Tesla reiterated that the long-delayed Semi and the ride-hailing-focused Cybercab are slated to enter production in the first half of the year. The company has begun pilot output at its Texas lithium refinery, a vertical-integration step aimed at cost control and supply security. Tesla also plans to unveil the third-generation Optimus robot, the latest proof point for its “physical AI” narrative.

What to Watch in Tesla’s Next Few Quarters

The end of federal subsidies raises the bar for Tesla’s pricing strategy and product cadence in the U.S., even as state-level incentives and global markets offer partial offsets. With competitors pressing on affordability and features, especially in China and Europe, Tesla’s ability to reinvigorate demand for its aging lineup will be pivotal.

Investors will watch whether energy growth and software attach rates can continue to outpace the slowdown in autos, and whether new platforms—Semi, Cybercab, and Optimus—translate from headlines to measurable revenue. Key indicators in upcoming quarters include delivery trajectory, automotive gross margin excluding credits, storage deployments, and any updates from Tesla’s earnings calls, shareholder letters, and regulatory filings.