Tesla has obtained a Transportation Network Company permit from Arizona regulators, which clears the last regulatory barrier to start charging for rides in the state. The approval places Arizona at the vanguard for Tesla’s long-awaited robotaxi service and in one of the most competitive autonomous markets in the U.S.

What the Arizona permit actually allows Tesla to do

Arizona’s regulations distinguish between the testing of self-driving cars and commercial ride-hailing. Companies have to self-certify to ADOT to attempt testing both with and without someone behind the wheel, along with obtaining a ride-hailing license similar to what Uber or Lyft operate under before they can accept fares. Tesla already finished the self-certification process and has a broader TNC permit that would let it run a paid robotaxi service when it’s closer to being ready.

- What the Arizona permit actually allows Tesla to do

- Arizona’s robotaxi head start and market readiness

- How Tesla will probably roll out service in Arizona

- Tesla’s different technical bet compared with rivals

- What riders should expect from Tesla robotaxi rides

- What comes next as Tesla prepares Arizona operations

The permit wasn’t an automatic green light for fully driverless service to be offered across the entire state. It lets Tesla offer paid rides in Arizona under the TNC obligations of at least insurance, incident reporting, and complying with local traffic laws, but also should allow for staged rollouts, geofenced areas, and safety operators as necessary.

Arizona’s robotaxi head start and market readiness

Arizona has spent years growing its capacity to have machines run themselves by statute, by permit, and in a relatively predictable climate, which helps machine perception and mapping. The Alphabet-owned operator Waymo has been running paid driverless rides in the Phoenix metro since 2018, and it now covers about 315 square miles of the region; that’s the kind of scale that Arizona’s framework can enable.

The state approach, open to testing yet with a fare-collection step that is another matter, has made the Phoenix region something of a harbinger for robotaxi economics. By adding itself to the list of approved ride-hailing firms, Tesla is arriving at a market with expectations set by years of driverless service that includes dedicated pickup areas for people to enter and leave, as well as airport systems and city coordination.

How Tesla will probably roll out service in Arizona

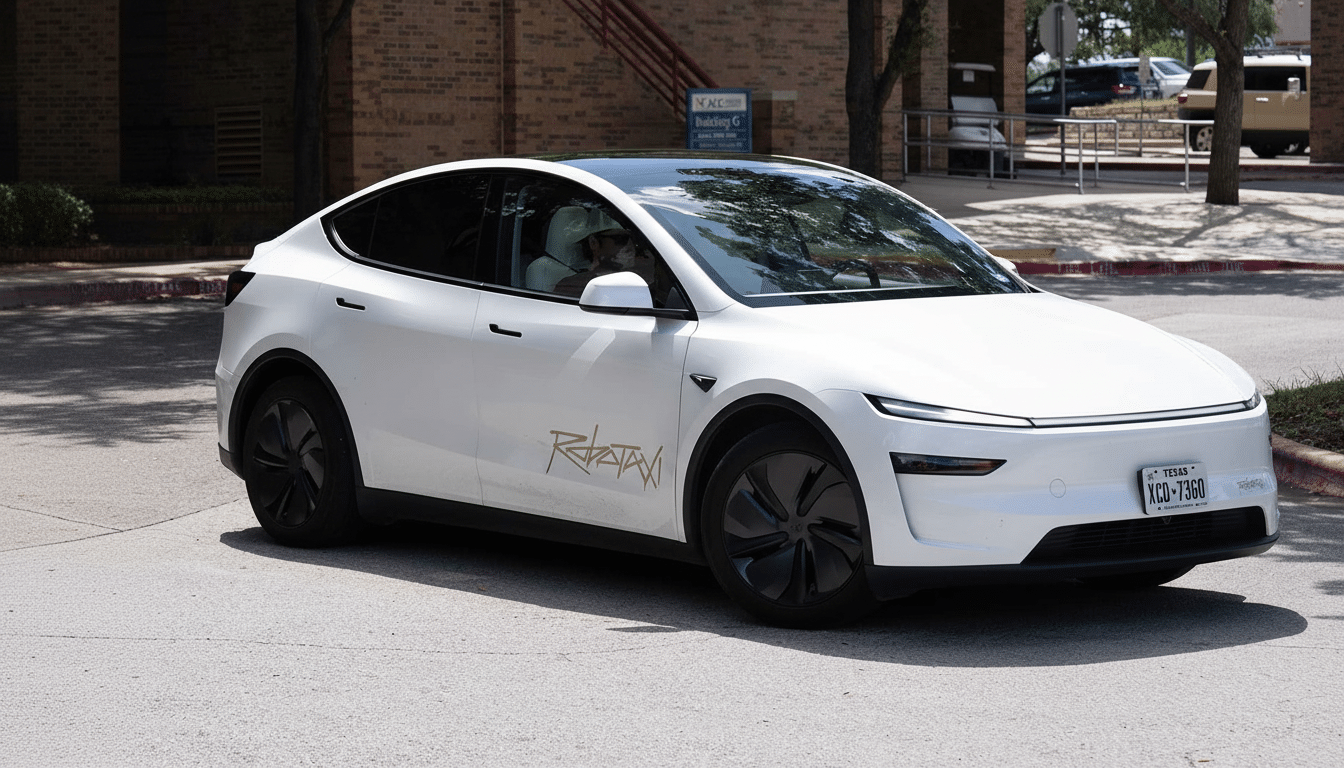

Tesla’s early forays into Arizona will probably be reminiscent of the tentative ones elsewhere. In South Austin, the company has been testing low-speed rides with a human operator behind the wheel. Tesla has been running a charter-style service in California using employees inside Model Ys fitted with its advanced driver-assistance system — which the company calls Full Self-Driving Supervised — but that program is not a commercial robotaxi offering.

In Arizona, look for staggered rollout: defined service areas and operating hours during daylight; proactive use of safety drivers in the early days. Technically, Tesla must close the chasm between its so-called Level 2 driver-supervised system under federal guidelines and an actual driverless service that meets state regulations amid public pressure. It depends on proven abilities to handle local traffic patterns, sound fallback strategies, and quick incident response.

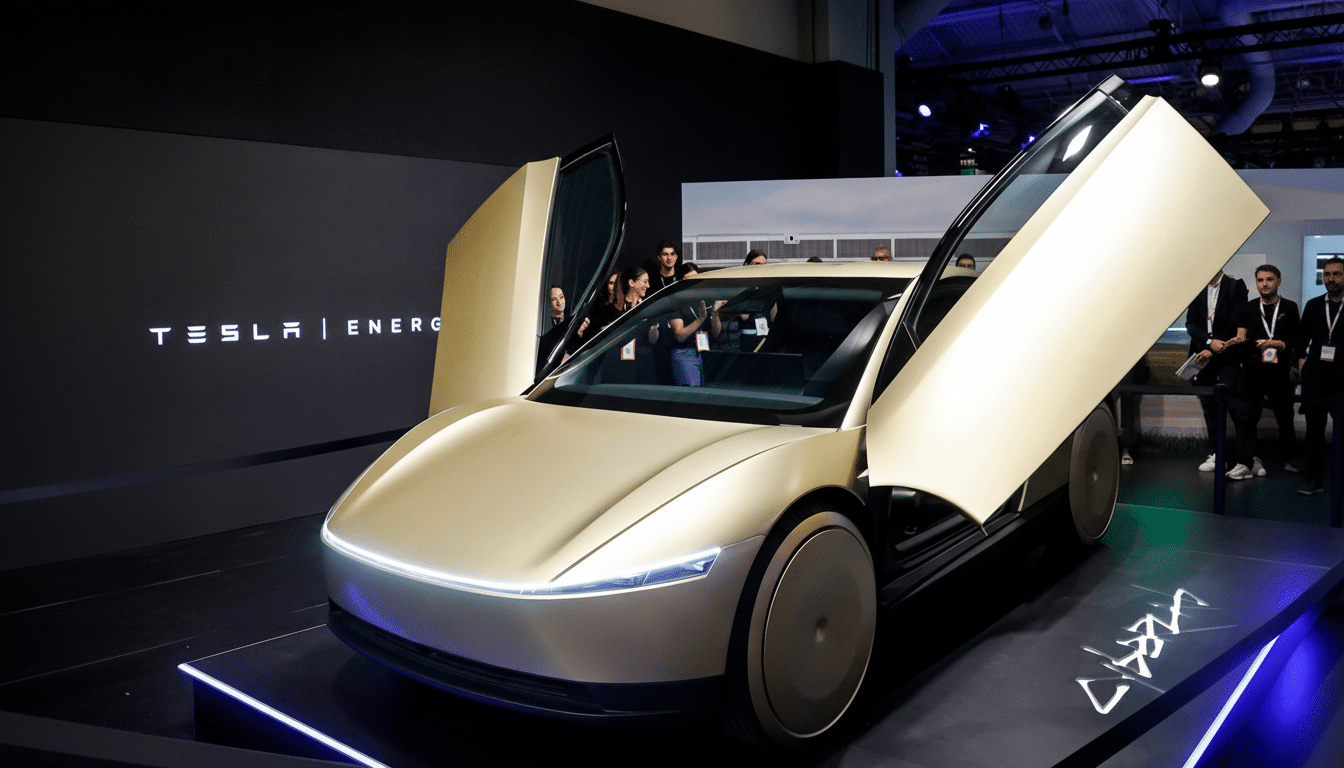

Tesla’s different technical bet compared with rivals

Tesla’s model for autonomy is software- and camera-first, using its installed vehicle base to train neural networks with fleet data. That’s as opposed to operators like Waymo, which has relied on a high-fidelity sensor stack that includes lidar and detailed mapping. The tradeoffs are well understood; Tesla is shooting for scale and cost, if vision-only can reach adequate reliability; sensor-rich stacks prioritize redundancy and perception certainty at potentially higher per-vehicle cost.

Arizona’s competitive environment will prove whether such philosophical differences can deliver high-quality service at reasonable cost, on a large scale.

The metrics that regulators and riders care most about include collision rates, unplanned stops, interactions with emergency vehicles, the ability of riders to assist in edge cases (e.g., construction detours or road closures), and dust storms that obscure perception systems.

What riders should expect from Tesla robotaxi rides

The experience for customers is expected to be conducted through the Tesla app, with standard ride-hailing features — upfront pricing, estimated time of arrival, and in-app support. Pickups may be drawn to clearly marked curb zones that aid autonomous maneuvers. Arizona’s TNC rules have plenty of insurance and incident reporting obligations, and while traditional driver background checks are less relevant when there will be no drivers at all in autonomous cars, companies still would have safety obligations, duties to keep data about rides for some period of time, and assistance to law enforcement.

Accessibility will be an early point of emphasis. In fairness, most Tesla cars currently on the road are themselves not wheelchair-accessible, and providing equitable access will continue to be an obstacle for every robotaxi provider. (Its service animal, in-vehicle cleanliness, and rider aid policies will also need to be crystal clear if it wants riders’ trust.)

What comes next as Tesla prepares Arizona operations

With the TNC permit squared away, it is down to the gating items:

- Define service zones

- Coordinate with cities on pickup rules

- Train support staff

- Scale maintenance and charging to keep cars on the road

ADOT’s framework gives companies the freedom to move fast, but ongoing scale will be a function of safety record and insurance stability — as well as rider adoption.

If Tesla can turn its software-first approach into a reliable driverless service, Arizona may be the place where broader U.S. deployment is first shown to work on a consistent basis. Or else the state’s established market will unmask weaknesses in short order. Either way, a new arrival with a humongous EV footprint and an ambitious autonomy road map will only heat up the competition in America’s most advanced robotaxi corridor.