Tesla’s energy storage arm is now the company’s fastest-growing business, and the numbers show why. Record deployments, expanding margins, and a wave of utility-scale deals helped turn a shaky overall earnings picture into a sturdier one, signaling a shift in where Tesla’s future growth might come from.

Storage Now Drives More Profit Momentum Ahead

In its latest annual report to the SEC, Tesla disclosed 46.7 gigawatt-hours of storage deployments, up 48% from the prior year. Storage and energy generation revenue rose 26.5% to $12.8 billion, and the segment posted a 29.8% gross margin — nearly double what the automotive business earned over the same period.

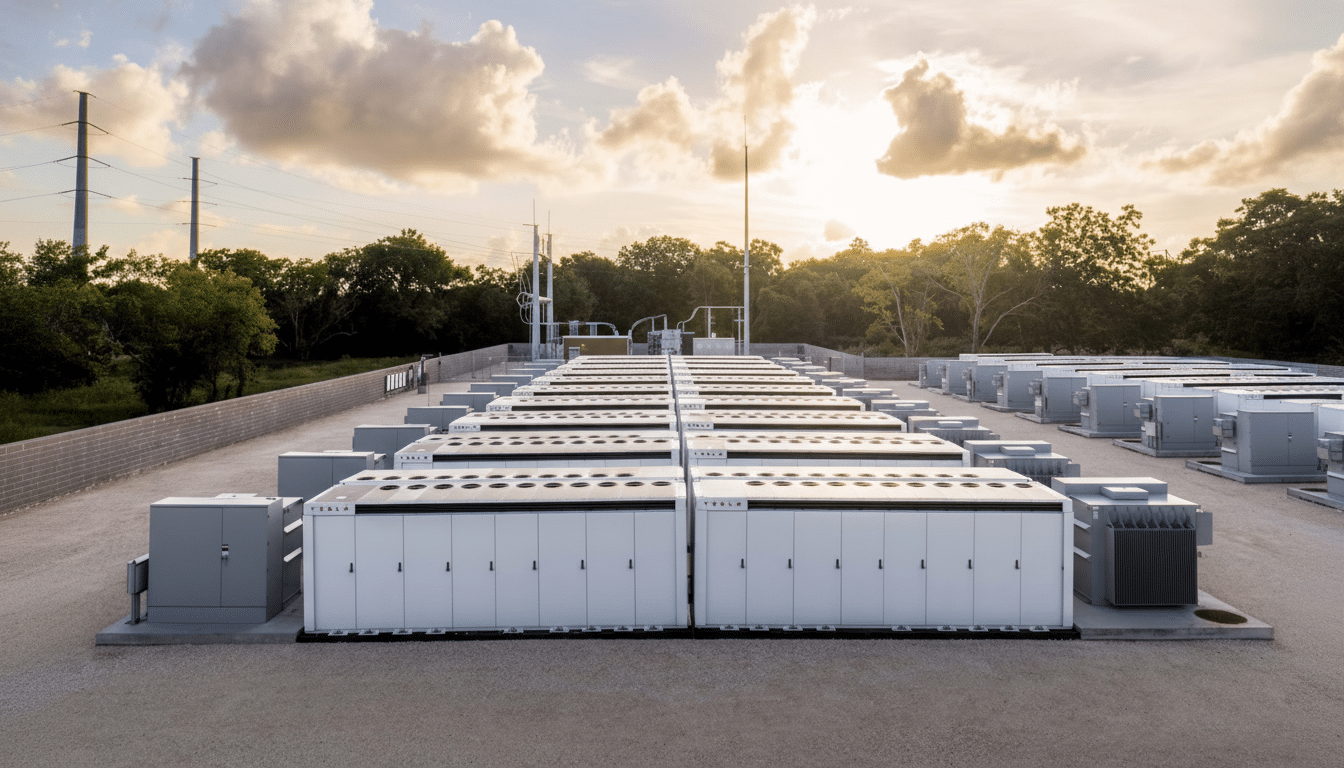

Large, stationary systems did the heavy lifting. Megapack projects contributed $1.1 billion to the segment’s $3.8 billion in gross profit, underscoring how utility-scale installations are becoming a cornerstone of Tesla’s earnings mix. The Powerwall and solar businesses added breadth, but it’s the grid-scale batteries that are setting the pace.

The takeaway is straightforward: storage is not only growing faster than vehicles, it’s growing more profitably. That dynamic matters as EV pricing remains competitive and volume growth becomes less predictable.

Data Centers And Utilities Fuel A New Order Book

Big projects are adding a second tailwind through accounting. Tesla said it expects to recognize $4.96 billion in deferred revenue this year from storage contracts already underway. Because these projects are milestone-based, a strong backlog can translate into stepwise revenue recognition as sites hit completion targets.

The demand behind that backlog is clear. Utilities need batteries to balance variable renewables and bolster reliability. Data center operators — particularly those building AI infrastructure — are hunting for capacity, grid stability, and peak shaving. Tesla’s Megapack has become a standard option on shortlists, competing in the same procurement cycles as products from Fluence, Wärtsilä, BYD, and CATL.

Real-world deployments highlight the trend. Massive battery sites in California’s CAISO territory and Australia’s National Electricity Market have shown how fast-responding storage dampens price spikes and improves resilience. Tesla’s Autobidder software, frequently paired with these assets, helps optimize dispatch and monetize ancillary services, adding a software layer to the hardware sale.

Pricing Pressure Meets Policy Wild Cards Ahead

Not all arrows point up. Tesla noted that the average selling price of Megapack fell, a sign of intensifying competition and buyer sophistication. While volume gains offset some of that pressure, a lower ASP narrows room for error on execution and supply chain costs.

Policy is another swing factor. The One Big Beautiful Bill Act phases out tax credits for residential storage, potentially softening Powerwall demand, while commercial incentives for large-scale systems continue. At the same time, tariffs and sourcing provisions could lift battery cell costs. Navigating these crosscurrents will determine how much of today’s margin advantage is durable.

Still, Tesla’s scale matters. Vertical integration at its Megapack factory and the shift toward lithium iron phosphate chemistries help stabilize costs and reduce exposure to volatile metals pricing. Industry trackers like BloombergNEF and the International Energy Agency expect multi-year growth in grid-scale storage, and scale tends to favor the players already shipping at volume.

What This Strategic Shift Means For Tesla

Energy storage is evolving from a side business into a second pillar. It provides a counterweight to the ups and downs of the vehicle market, expands Tesla’s relationships with utilities and data center operators, and opens recurring opportunities in operations, maintenance, and software optimization over the life of the assets.

If Tesla maintains execution on megaproject delivery and continues to convert its deferred revenue into completed milestones, storage could carry a larger share of the company’s growth and profit mix. The message from the latest filings is unmistakable: the battery business is no longer a supporting act — it’s the segment setting the pace.